Michigan Elf Form 2015

What is the Michigan Elf Form

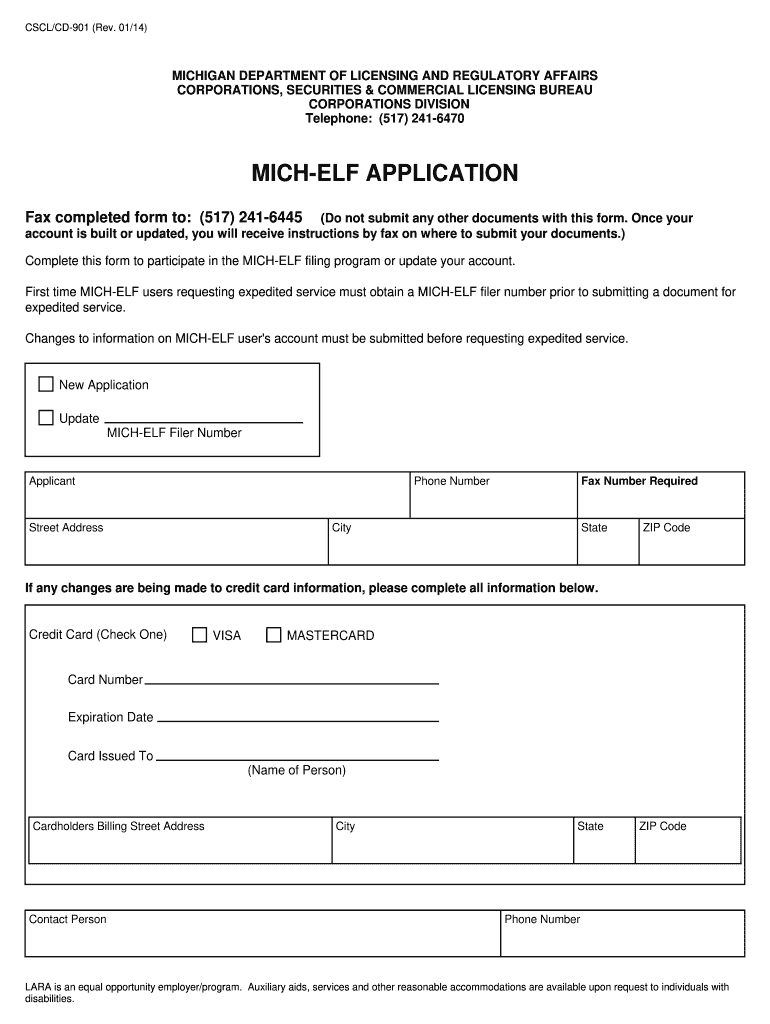

The Michigan Elf Form is a specific document used for reporting certain tax-related information to the state of Michigan. This form is essential for individuals and businesses to ensure compliance with state tax regulations. It is particularly relevant for taxpayers who need to report income, deductions, and credits accurately. Understanding the purpose and requirements of the Michigan Elf Form is crucial for maintaining good standing with state tax authorities.

How to use the Michigan Elf Form

Using the Michigan Elf Form involves several steps to ensure accurate completion and submission. First, gather all necessary financial documents, including income statements and any relevant deductions. Next, fill out the form with precise information, ensuring that all entries are correct and complete. Once the form is filled out, review it for any errors before submission. The form can be submitted electronically or by mail, depending on the preferences of the taxpayer and the requirements set by the state.

Steps to complete the Michigan Elf Form

Completing the Michigan Elf Form requires careful attention to detail. Follow these steps for successful completion:

- Gather all necessary documents, including W-2s, 1099s, and receipts for deductions.

- Fill out personal information, including your name, address, and Social Security number.

- Report all sources of income accurately, ensuring that you include any taxable income.

- List any deductions or credits you are eligible for, following the guidelines provided with the form.

- Double-check all entries for accuracy and completeness.

- Sign and date the form before submission.

Legal use of the Michigan Elf Form

The Michigan Elf Form is legally binding when completed and submitted according to state regulations. To ensure its legal standing, the form must be filled out accurately and submitted by the designated deadlines. Compliance with state tax laws is essential, as failure to do so may result in penalties or legal repercussions. Utilizing a reliable electronic signature solution can further enhance the legal validity of the form.

Key elements of the Michigan Elf Form

Several key elements must be included in the Michigan Elf Form to ensure its validity. These elements include:

- Personal Information: Accurate details about the taxpayer, including name, address, and Social Security number.

- Income Reporting: Comprehensive reporting of all income sources, including wages, dividends, and interest.

- Deductions and Credits: Clear documentation of any deductions or credits claimed, supported by appropriate documentation.

- Signature: A valid signature affirming the accuracy of the information provided on the form.

Filing Deadlines / Important Dates

Filing deadlines for the Michigan Elf Form are crucial for compliance. Typically, the form must be submitted by April fifteenth for individual taxpayers. Businesses may have different deadlines based on their fiscal year. It is important to stay informed about any changes to these deadlines, as late submissions can incur penalties. Marking these dates on a calendar can help ensure timely filing and avoid any issues with the state tax authority.

Quick guide on how to complete michigan elf 2014 form

Effortlessly prepare Michigan Elf Form on any device

Managing documents online has become increasingly popular among businesses and individuals. It offers an ideal eco-friendly substitute for traditional printed and signed papers, as it allows you to access the necessary forms and safely store them online. airSlate SignNow equips you with all the tools you require to quickly create, modify, and eSign your documents without delays. Handle Michigan Elf Form on any platform with the airSlate SignNow apps for Android or iOS, and enhance any document-based workflow today.

How to modify and eSign Michigan Elf Form with ease

- Locate Michigan Elf Form and select Get Form to begin.

- Use the tools we provide to fill out your document.

- Highlight important sections of the documents or obscure sensitive information with tools specifically designed for that purpose by airSlate SignNow.

- Create your signature using the Sign tool, which takes mere seconds and holds the same legal validity as a traditional handwritten signature.

- Verify the details and click on the Done button to save your changes.

- Choose how you would like to send your form: via email, text message (SMS), an invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious searches for forms, or mistakes that require reprinting new copies. airSlate SignNow addresses all your document management needs in just a few clicks from any device of your choice. Modify and eSign Michigan Elf Form to ensure effective communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the michigan elf 2014 form

How to generate an electronic signature for your PDF online

How to generate an electronic signature for your PDF in Google Chrome

The way to generate an electronic signature for signing PDFs in Gmail

The way to generate an electronic signature from your smartphone

How to make an electronic signature for a PDF on iOS

The way to generate an electronic signature for a PDF file on Android

People also ask

-

What is the Michigan Elf Form, and how does it work?

The Michigan Elf Form is a digital document designed to streamline the management of employee leaves in Michigan. With airSlate SignNow, users can easily fill out, sign, and send the form electronically, making the process efficient and hassle-free. This ensures that businesses can maintain clear communication regarding leave requests while adhering to state regulations.

-

How much does it cost to use the Michigan Elf Form with airSlate SignNow?

Using the Michigan Elf Form with airSlate SignNow is part of the overall pricing plans offered by airSlate. These plans are competitively priced to provide businesses with a cost-effective solution for document management. Check our website for specific pricing details and promotional offers for new customers.

-

What features does the Michigan Elf Form offer?

The Michigan Elf Form includes features like customizable templates, easy electronic signatures, and secure document storage. With airSlate SignNow, users can also track the status of submitted forms and set reminders for important deadlines. These features enhance the functionality and ease of use of the Michigan Elf Form.

-

How can the Michigan Elf Form benefit my business?

Utilizing the Michigan Elf Form can signNowly improve your business's leave management process. It minimizes paperwork and reduces delays associated with traditional forms, increasing overall efficiency. By adopting airSlate SignNow, your company can ensure compliance with Michigan's regulations while streamlining internal processes.

-

Is the Michigan Elf Form customizable?

Yes, the Michigan Elf Form can be customized to fit your business's specific needs. With airSlate SignNow, you can modify fields, add logic to the form, and incorporate branding elements to reflect your business identity. This flexibility allows you to create a form that effectively captures the necessary information.

-

Does the Michigan Elf Form integrate with other software?

Absolutely! The Michigan Elf Form can integrate seamlessly with various software solutions like CRM and HR management systems when using airSlate SignNow. These integrations help streamline workflows and ensure that all your essential tools work together to support your business operations.

-

How secure is the Michigan Elf Form on airSlate SignNow?

The Michigan Elf Form on airSlate SignNow utilizes industry-leading security measures to protect your sensitive information. This includes encryption, secure data storage, and compliance with legal standards. By choosing airSlate SignNow, businesses can be confident that their document handling is safe and secure.

Get more for Michigan Elf Form

- Great fun rebate form

- Capago application form

- 3m primary crowns order form printable

- Loganschool wikispaces com file view myers briggs for careers pdf form

- Sd sales tax return state of south dakota state sd form

- Formularios formulario y requerimientos becas grado pdf seescyt gov

- Rental agreement and liability waiver party rental professional form

- Sample contract for fence installation form

Find out other Michigan Elf Form

- Sign Maine Construction Business Letter Template Secure

- Can I Sign Louisiana Construction Letter Of Intent

- How Can I Sign Maryland Construction Business Plan Template

- Can I Sign Maryland Construction Quitclaim Deed

- Sign Minnesota Construction Business Plan Template Mobile

- Sign Construction PPT Mississippi Myself

- Sign North Carolina Construction Affidavit Of Heirship Later

- Sign Oregon Construction Emergency Contact Form Easy

- Sign Rhode Island Construction Business Plan Template Myself

- Sign Vermont Construction Rental Lease Agreement Safe

- Sign Utah Construction Cease And Desist Letter Computer

- Help Me With Sign Utah Construction Cease And Desist Letter

- Sign Wisconsin Construction Purchase Order Template Simple

- Sign Arkansas Doctors LLC Operating Agreement Free

- Sign California Doctors Lease Termination Letter Online

- Sign Iowa Doctors LLC Operating Agreement Online

- Sign Illinois Doctors Affidavit Of Heirship Secure

- Sign Maryland Doctors Quitclaim Deed Later

- How Can I Sign Maryland Doctors Quitclaim Deed

- Can I Sign Missouri Doctors Last Will And Testament