Nebraska Form 521 2013

What is the Nebraska Form 521

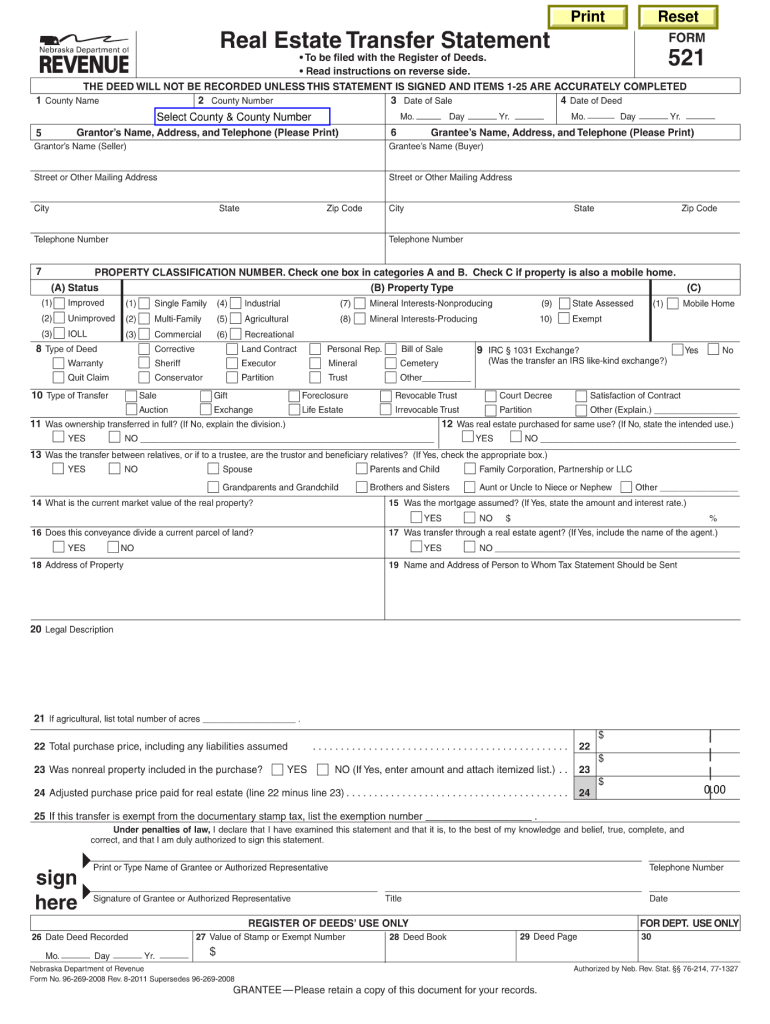

The Nebraska Form 521 is a tax-related document used primarily for reporting property tax exemptions in the state of Nebraska. This form is essential for individuals or entities seeking to claim exemptions on their property taxes, ensuring compliance with state regulations. By accurately completing this form, taxpayers can potentially reduce their tax liabilities, making it a vital tool for financial management.

How to use the Nebraska Form 521

Using the Nebraska Form 521 involves several key steps. First, gather all necessary information regarding the property for which the exemption is being claimed. This includes details such as the property address, ownership information, and the specific exemption type being sought. Next, fill out the form accurately, ensuring that all required fields are completed. After completing the form, review it for any errors before submission. Proper use of this form can lead to significant tax savings.

Steps to complete the Nebraska Form 521

Completing the Nebraska Form 521 requires careful attention to detail. Follow these steps:

- Obtain the latest version of the form from the appropriate state agency.

- Fill in your personal information, including your name and contact details.

- Provide the property information, including its location and description.

- Indicate the specific exemption you are applying for, ensuring it aligns with state guidelines.

- Sign and date the form to validate your submission.

Once completed, ensure that the form is submitted within the designated deadlines to avoid penalties.

Legal use of the Nebraska Form 521

The Nebraska Form 521 is legally binding when completed and submitted according to state laws. To ensure its legal validity, the form must be filled out accurately and submitted on time. Additionally, it must comply with all relevant state regulations governing property tax exemptions. Failure to adhere to these legal requirements may result in denial of the exemption and potential penalties.

Key elements of the Nebraska Form 521

Several key elements must be included in the Nebraska Form 521 for it to be considered complete:

- Taxpayer Information: Full name and contact information of the individual or entity applying for the exemption.

- Property Details: Address, type, and description of the property in question.

- Exemption Type: Specific exemption being claimed, such as homestead or charitable organization exemptions.

- Signature: The form must be signed and dated by the taxpayer or an authorized representative.

Form Submission Methods

The Nebraska Form 521 can be submitted through various methods, ensuring flexibility for taxpayers. Options include:

- Online Submission: Some jurisdictions may allow electronic filing through state tax websites.

- Mail: The completed form can be mailed to the appropriate local tax authority.

- In-Person: Taxpayers may choose to deliver the form directly to their local tax office.

It is important to verify the submission method accepted by your local tax authority to ensure compliance.

Quick guide on how to complete nebraska form 521 2011

Prepare Nebraska Form 521 seamlessly on any device

Digital document management has become increasingly favored by businesses and individuals alike. It offers an ideal eco-friendly substitute for traditional printed and signed papers, allowing you to locate the correct form and securely store it online. airSlate SignNow equips you with all the tools necessary to create, alter, and eSign your documents swiftly without delays. Manage Nebraska Form 521 on any device using airSlate SignNow's Android or iOS applications and simplify your document-related tasks today.

The easiest way to modify and eSign Nebraska Form 521 effortlessly

- Find Nebraska Form 521 and click Get Form to begin.

- Utilize the tools we offer to complete your document.

- Emphasize pertinent sections of your documents or obscure sensitive information using features that airSlate SignNow provides specifically for that purpose.

- Generate your signature with the Sign tool, which takes seconds and holds the same legal standing as a conventional wet ink signature.

- Review the details and click on the Done button to preserve your changes.

- Choose how you would prefer to send your form, via email, text message (SMS), or invitation link, or download it to your computer.

Say goodbye to lost or misfiled documents, time-consuming form searching, or errors that necessitate printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device of your choosing. Modify and eSign Nebraska Form 521 to ensure excellent communication at any stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the nebraska form 521 2011

The way to make an eSignature for a PDF document in the online mode

The way to make an eSignature for a PDF document in Chrome

The way to generate an eSignature for putting it on PDFs in Gmail

The way to make an electronic signature right from your mobile device

The way to make an eSignature for a PDF document on iOS devices

The way to make an electronic signature for a PDF on Android devices

People also ask

-

What is Nebraska Form 521, and how can airSlate SignNow help?

Nebraska Form 521 is a document used for the certification of small business corporations in Nebraska. airSlate SignNow provides an easy-to-use solution that allows businesses to fill out, send, and eSign Nebraska Form 521 efficiently, ensuring compliance with state regulations while saving time.

-

Is airSlate SignNow cost-effective for eSigning Nebraska Form 521?

Yes, airSlate SignNow offers a cost-effective way to eSign Nebraska Form 521 and other documents. With various pricing plans available, businesses can choose options that fit their needs without sacrificing essential features like templates and automation.

-

What features does airSlate SignNow offer for handling Nebraska Form 521?

airSlate SignNow includes features such as customizable templates, real-time collaboration, and automated reminders that enhance the eSigning process for Nebraska Form 521. These tools streamline document management and reduce errors, making your workflow smoother.

-

Can I integrate airSlate SignNow with other applications for Nebraska Form 521?

Absolutely! airSlate SignNow offers robust integrations with various applications and platforms, making it easy to manage your Nebraska Form 521 alongside other business tools. Popular integrations include Google Drive, Salesforce, and Microsoft Office.

-

What are the benefits of using airSlate SignNow for Nebraska Form 521?

Using airSlate SignNow for Nebraska Form 521 offers numerous benefits, including speed, security, and compliance. This solution not only expedites the signing process but also keeps your documents secure with encryption and ensures that you meet legal requirements.

-

How secure is airSlate SignNow when eSigning Nebraska Form 521?

airSlate SignNow prioritizes security, employing advanced encryption protocols to protect your sensitive information while eSigning Nebraska Form 521. Additionally, the platform complies with major regulatory standards to ensure that your electronic signatures are legally binding.

-

Can I access Nebraska Form 521 on mobile devices with airSlate SignNow?

Yes, airSlate SignNow is fully accessible on mobile devices, allowing you to manage and eSign Nebraska Form 521 from anywhere at any time. This flexibility ensures that you can complete your important documents without being tied to a desktop.

Get more for Nebraska Form 521

- Request for member withdrawal www2 gnb form

- Nikah form uk

- Color consent form 240451701

- Tower hamlets pension opt out form

- Fillable online home loan application form pdf 412kb

- Home loan application form anzcom

- Tenant placement agreement gribble real estate services inc form

- Certificate of formation nj pdf 100399158

Find out other Nebraska Form 521

- How Do I Electronic signature Pennsylvania Car Dealer Document

- How To Electronic signature South Carolina Car Dealer Document

- Can I Electronic signature South Carolina Car Dealer Document

- How Can I Electronic signature Texas Car Dealer Document

- How Do I Electronic signature West Virginia Banking Document

- How To Electronic signature Washington Car Dealer Document

- Can I Electronic signature West Virginia Car Dealer Document

- How Do I Electronic signature West Virginia Car Dealer Form

- How Can I Electronic signature Wisconsin Car Dealer PDF

- How Can I Electronic signature Wisconsin Car Dealer Form

- How Do I Electronic signature Montana Business Operations Presentation

- How To Electronic signature Alabama Charity Form

- How To Electronic signature Arkansas Construction Word

- How Do I Electronic signature Arkansas Construction Document

- Can I Electronic signature Delaware Construction PDF

- How Can I Electronic signature Ohio Business Operations Document

- How Do I Electronic signature Iowa Construction Document

- How Can I Electronic signature South Carolina Charity PDF

- How Can I Electronic signature Oklahoma Doctors Document

- How Can I Electronic signature Alabama Finance & Tax Accounting Document