Florida Final Notice of Default for Past Due Payments in Connection with Contract for Deed Form

What is the Florida Final Notice of Default for Past Due Payments in Connection with Contract for Deed

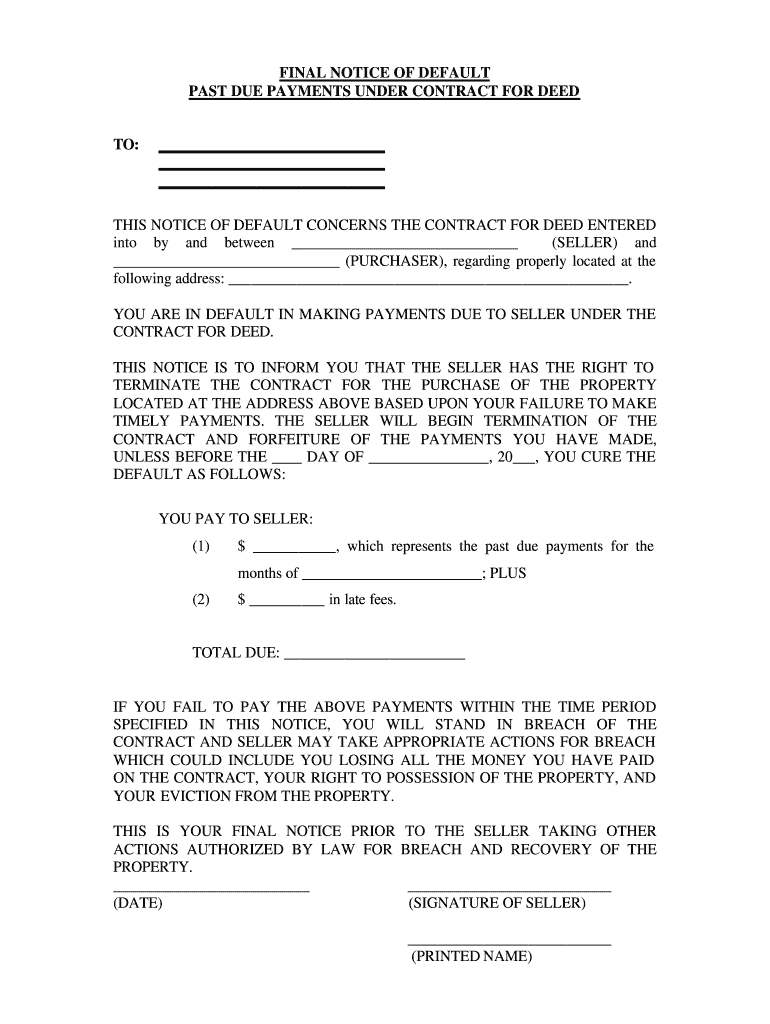

The Florida Final Notice of Default is a formal document issued when a borrower fails to make timely payments as stipulated in a contract for deed. This notice serves as a critical step in the foreclosure process, alerting the borrower to their delinquency and the potential consequences if the default is not remedied. It typically outlines the amount due, the deadline for payment, and the actions that may be taken if the borrower does not respond. Understanding this document is essential for both lenders and borrowers to navigate the complexities of real estate transactions in Florida.

Key Elements of the Florida Final Notice of Default

Several key elements must be included in the Florida Final Notice of Default to ensure its validity and effectiveness. These elements typically include:

- Borrower's Information: Full name and address of the borrower.

- Lender's Information: Name and contact details of the lender or their representative.

- Contract Details: Reference to the specific contract for deed, including dates and terms.

- Payment Information: The total amount past due and any applicable late fees.

- Deadline for Payment: A clear date by which the borrower must make the payment to avoid further action.

- Consequences of Non-Payment: Description of potential actions, such as foreclosure, if the default is not cured.

Steps to Complete the Florida Final Notice of Default

Completing the Florida Final Notice of Default involves several important steps to ensure compliance with state laws and proper communication with the borrower. The steps include:

- Gather Necessary Information: Collect all relevant details about the borrower, the loan, and payment history.

- Draft the Notice: Use clear and concise language to outline the default and required actions.

- Review Legal Requirements: Ensure the notice meets all Florida legal standards for default notifications.

- Send the Notice: Deliver the notice via certified mail or another method that provides proof of delivery.

- Document the Process: Keep records of the notice and any communications with the borrower for future reference.

Legal Use of the Florida Final Notice of Default

The legal use of the Florida Final Notice of Default is governed by state laws that dictate how and when such notices must be issued. It is essential for lenders to adhere to these regulations to ensure the notice is enforceable in court. This includes providing the borrower with adequate notice and the opportunity to remedy the default before proceeding with foreclosure actions. Failure to comply with legal requirements can result in delays or dismissal of foreclosure proceedings.

How to Obtain the Florida Final Notice of Default

Obtaining the Florida Final Notice of Default can be accomplished through several methods. Lenders can create a customized notice using templates available online or consult with a legal professional to ensure compliance with state laws. Additionally, many real estate and legal service providers offer resources and templates specifically designed for Florida's requirements. It is crucial to ensure that any notice used is up-to-date and reflects current legal standards.

Examples of Using the Florida Final Notice of Default

Examples of using the Florida Final Notice of Default can provide valuable insight into its application. For instance, a lender may issue this notice after a borrower misses three consecutive payments on their contract for deed. The notice would detail the total amount due and inform the borrower of their options, such as making a payment plan or facing potential foreclosure. These examples help clarify the importance of timely communication and adherence to legal processes in real estate transactions.

Quick guide on how to complete florida final notice of default for past due payments in connection with contract for deed

Effortlessly Prepare Florida Final Notice Of Default For Past Due Payments In Connection With Contract For Deed on Any Device

Digital document management has gained popularity among businesses and individuals. It serves as an ideal eco-friendly alternative to conventional printed and signed documents, allowing you to locate the needed form and securely save it online. airSlate SignNow provides you with all the tools necessary to swiftly create, modify, and eSign your documents without delays. Manage Florida Final Notice Of Default For Past Due Payments In Connection With Contract For Deed on any platform using the airSlate SignNow apps for Android or iOS and streamline any document-related task today.

How to Modify and eSign Florida Final Notice Of Default For Past Due Payments In Connection With Contract For Deed with Ease

- Find Florida Final Notice Of Default For Past Due Payments In Connection With Contract For Deed and click Get Form to begin.

- Utilize the tools we provide to complete your document.

- Emphasize important sections of your documents or redact sensitive information using tools specifically designed for that by airSlate SignNow.

- Generate your eSignature with the Sign feature, which takes seconds and carries the same legal validity as a traditional wet ink signature.

- Review the details and click the Done button to save your changes.

- Choose your preferred method for sending your form, whether by email, text message (SMS), or invite link, or download it to your computer.

Eliminate concerns about misplaced or lost documents, tedious form searching, or errors that require printing new document copies. airSlate SignNow fulfills your document management needs in just a few clicks from any device you prefer. Edit and eSign Florida Final Notice Of Default For Past Due Payments In Connection With Contract For Deed while ensuring outstanding communication throughout your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

FAQs

-

How long do I have to vacate the property if I am in default on a Contract for Deed in SC? The seller told me verbally that I have 3 weeks to come up with the past due payment, but our contract doesn't outline the repossession process.

The current standing contract is governed by South Carolina contract law, and of course Federal Law, but state law persist first before Fed Law can be looked at per se.The seller can not state new terms after the contract has been signed, but can modify the terms as long as they have your agreement. In instance with what you said about having 3 weeks to come up with past due payment, if certain details are outlined within the contract about payments and when they’re due, you maybe bound by what the seller expressed verbally.Overall, what you owe you will have to pay in a timely manner, 3 weeks or not. Go over the current standing contract for the detailed expressed terms of payment within the contract. That will tell you what kind of leverage you have in regard to your past due payment, that’s if you have any leverage at all.

-

How much my credit score will impact if I do car loan settlement with bank, I have no default in any payments, but I 'm not able to register (commercial) my car for past 1 year and half due to several reasons. I just want to get rid of this burden?

If you financed the vehicle, unless you plan to pay it off, you need to miss certain amount of payments for voluntary repossession to occur, after such they will have to send the vehicle at the auction, the amount they are short on after the sale they will demand for you to pay, if you don't pay it will effect your credit to what degree it depends on how everything will be handled.

Create this form in 5 minutes!

How to create an eSignature for the florida final notice of default for past due payments in connection with contract for deed

How to create an electronic signature for your Florida Final Notice Of Default For Past Due Payments In Connection With Contract For Deed online

How to make an eSignature for the Florida Final Notice Of Default For Past Due Payments In Connection With Contract For Deed in Chrome

How to create an electronic signature for putting it on the Florida Final Notice Of Default For Past Due Payments In Connection With Contract For Deed in Gmail

How to create an eSignature for the Florida Final Notice Of Default For Past Due Payments In Connection With Contract For Deed from your mobile device

How to make an electronic signature for the Florida Final Notice Of Default For Past Due Payments In Connection With Contract For Deed on iOS

How to create an eSignature for the Florida Final Notice Of Default For Past Due Payments In Connection With Contract For Deed on Android devices

People also ask

-

What is a Florida Final Notice Of Default For Past Due Payments In Connection With Contract For Deed?

A Florida Final Notice Of Default For Past Due Payments In Connection With Contract For Deed is a formal document issued to notify a party that they have failed to meet payment obligations under a contract for deed. This notice serves as a crucial step in the foreclosure process, allowing the recipient a chance to rectify the situation before further legal actions are taken.

-

How can airSlate SignNow help with managing a Florida Final Notice Of Default For Past Due Payments In Connection With Contract For Deed?

airSlate SignNow simplifies the process of generating and sending a Florida Final Notice Of Default For Past Due Payments In Connection With Contract For Deed. With our easy-to-use platform, you can quickly create customized notices and eSign them, ensuring compliance and timely delivery to all involved parties.

-

What features does airSlate SignNow offer for creating legal notices like the Florida Final Notice Of Default For Past Due Payments In Connection With Contract For Deed?

airSlate SignNow offers features such as customizable templates, automated workflows, and real-time tracking, which are essential for creating legal notices like the Florida Final Notice Of Default For Past Due Payments In Connection With Contract For Deed. These tools help streamline your documentation process and ensure accuracy in every step.

-

Is airSlate SignNow cost-effective for businesses needing to send a Florida Final Notice Of Default For Past Due Payments In Connection With Contract For Deed?

Yes, airSlate SignNow is a cost-effective solution for businesses looking to manage legal notices like the Florida Final Notice Of Default For Past Due Payments In Connection With Contract For Deed. Our pricing plans are designed to accommodate various business sizes, making it affordable for any organization to maintain compliance without breaking the bank.

-

Can I integrate airSlate SignNow with other software for handling Florida Final Notice Of Default For Past Due Payments In Connection With Contract For Deed?

Absolutely! airSlate SignNow offers seamless integrations with various software platforms, enhancing your ability to manage the Florida Final Notice Of Default For Past Due Payments In Connection With Contract For Deed. Whether it's CRM systems or document management tools, our integrations help you streamline your workflow and improve efficiency.

-

What are the benefits of using airSlate SignNow for legal documents like the Florida Final Notice Of Default For Past Due Payments In Connection With Contract For Deed?

Using airSlate SignNow for legal documents, including the Florida Final Notice Of Default For Past Due Payments In Connection With Contract For Deed, provides numerous benefits. You enjoy enhanced efficiency, reduced paperwork, and the ability to track document status in real time, all while ensuring that your notices are legally compliant and securely stored.

-

How do I get started with airSlate SignNow for my Florida Final Notice Of Default For Past Due Payments In Connection With Contract For Deed?

Getting started with airSlate SignNow is easy! Simply sign up for an account, choose the right plan for your needs, and you can begin creating and sending your Florida Final Notice Of Default For Past Due Payments In Connection With Contract For Deed immediately. Our user-friendly interface makes the transition seamless.

Get more for Florida Final Notice Of Default For Past Due Payments In Connection With Contract For Deed

- Dna test pdf forms

- Palo alto medical foundation form

- Penguin pediatrics pllc patientpop form

- South african journal of science volume 112 issue 34 form

- 1 insuredannuitant information

- 3 2 1 code it second edition pdf free download epdf form

- Request for policy surrender form

- Physical exam checklist template form

Find out other Florida Final Notice Of Default For Past Due Payments In Connection With Contract For Deed

- How To Sign Arizona Courts Residential Lease Agreement

- How Do I Sign Arizona Courts Residential Lease Agreement

- Help Me With Sign Arizona Courts Residential Lease Agreement

- How Can I Sign Arizona Courts Residential Lease Agreement

- Sign Colorado Courts LLC Operating Agreement Mobile

- Sign Connecticut Courts Living Will Computer

- How Do I Sign Connecticut Courts Quitclaim Deed

- eSign Colorado Banking Rental Application Online

- Can I eSign Colorado Banking Medical History

- eSign Connecticut Banking Quitclaim Deed Free

- eSign Connecticut Banking Business Associate Agreement Secure

- Sign Georgia Courts Moving Checklist Simple

- Sign Georgia Courts IOU Mobile

- How Can I Sign Georgia Courts Lease Termination Letter

- eSign Hawaii Banking Agreement Simple

- eSign Hawaii Banking Rental Application Computer

- eSign Hawaii Banking Agreement Easy

- eSign Hawaii Banking LLC Operating Agreement Fast

- eSign Hawaii Banking Permission Slip Online

- eSign Minnesota Banking LLC Operating Agreement Online