Forming a Llc in Michigan

What is the Forming A LLC in Michigan

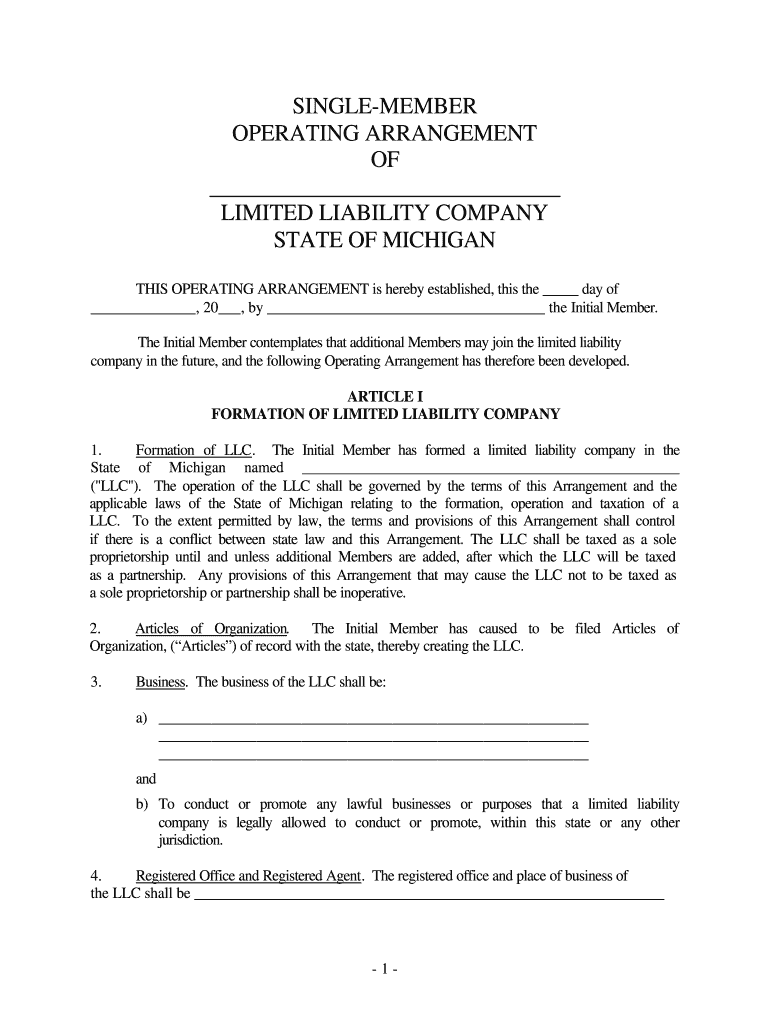

The process of forming a Limited Liability Company (LLC) in Michigan involves creating a distinct legal entity that separates personal assets from business liabilities. This structure provides flexibility in management and tax treatment while protecting personal assets from business debts. An LLC can have one or multiple members, making it suitable for various business types. The Michigan LLC formation requires specific documents, including the Articles of Organization, which must be filed with the state.

Steps to Complete the Forming A LLC in Michigan

To successfully complete the formation of an LLC in Michigan, follow these essential steps:

- Choose a Name: Ensure the name is unique and complies with Michigan naming requirements.

- Designate a Registered Agent: Appoint an individual or business entity responsible for receiving legal documents.

- File Articles of Organization: Submit the necessary form to the Michigan Department of Licensing and Regulatory Affairs (LARA).

- Create an Operating Agreement: Draft a document outlining the management structure and operating procedures of the LLC.

- Obtain an EIN: Apply for an Employer Identification Number from the IRS for tax purposes.

Required Documents

When forming an LLC in Michigan, specific documents must be prepared and submitted:

- Articles of Organization: This is the primary document required to officially establish your LLC.

- Operating Agreement: Although not mandatory, it is highly recommended to outline the management structure.

- Employer Identification Number (EIN): Required for tax identification purposes, especially if the LLC has employees.

Legal Use of the Forming A LLC in Michigan

Forming an LLC in Michigan provides legal protections and benefits. The LLC structure limits personal liability, meaning personal assets are generally protected from business debts and lawsuits. Additionally, Michigan LLCs can elect to be taxed as a corporation or partnership, offering flexibility in tax treatment. Compliance with state regulations is essential to maintain the legal standing of the LLC.

Eligibility Criteria

To form an LLC in Michigan, certain eligibility criteria must be met:

- At least one member is required, who can be an individual or another business entity.

- The chosen name must not be identical or too similar to an existing business entity registered in Michigan.

- The registered agent must have a physical address in Michigan and be available during business hours.

Form Submission Methods (Online / Mail / In-Person)

In Michigan, the Articles of Organization can be submitted through various methods:

- Online: The fastest method is to file electronically through the Michigan LARA website.

- By Mail: Complete the paper form and send it to the appropriate state office.

- In-Person: You may also file the documents in person at the LARA office.

Quick guide on how to complete forming a llc in michigan

Prepare Forming A Llc In Michigan seamlessly on any device

Digital document management has gained traction among companies and individuals. It offers a perfect environmentally friendly alternative to traditional printed and signed documents, as you can access the required form and securely store it online. airSlate SignNow equips you with all the tools necessary to create, modify, and eSign your documents swiftly without any holdups. Manage Forming A Llc In Michigan on any platform with airSlate SignNow Android or iOS applications and simplify any document-related task today.

The easiest way to modify and eSign Forming A Llc In Michigan effortlessly

- Find Forming A Llc In Michigan and then click Get Form to begin.

- Use the tools we provide to fill out your form.

- Highlight important parts of the documents or hide sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Create your eSignature with the Sign tool, which takes seconds and carries the same legal validity as an old-fashioned wet ink signature.

- Review the details and click on the Done button to save your changes.

- Select how you wish to send your form, via email, SMS, or invite link, or download it to your computer.

Eliminate concerns about lost or disordered documents, tedious form searching, or mistakes that require printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device you prefer. Modify and eSign Forming A Llc In Michigan and ensure effective communication at any point of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

FAQs

-

I need to pay an $800 annual LLC tax for my LLC that formed a month ago, so I am looking to apply for an extension. It's a solely owned LLC, so I need to fill out a Form 7004. How do I fill this form out?

ExpressExtension is an IRS-authorized e-file provider for all types of business entities, including C-Corps (Form 1120), S-Corps (Form 1120S), Multi-Member LLC, Partnerships (Form 1065). Trusts, and Estates.File Tax Extension Form 7004 InstructionsStep 1- Begin by creating your free account with ExpressExtensionStep 2- Enter the basic business details including: Business name, EIN, Address, and Primary Contact.Step 3- Select the business entity type and choose the form you would like to file an extension for.Step 4- Select the tax year and select the option if your organization is a Holding CompanyStep 5- Enter and make a payment on the total estimated tax owed to the IRSStep 6- Carefully review your form for errorsStep 7- Pay and transmit your form to the IRSClick here to e-file before the deadline

-

What forms do I need to fill out as a first-year LLC owner? It's a partnership LLC.

A Limited Liability Company (LLC) is business structure that provides the limited liability protection features of a corporation and the tax efficiencies and operational flexibility of a partnership.Unlike shareholders in a corporation, LLCs are not taxed as a separate business entity. Instead, all profits and losses are "passed through" the business to each member of the LLC. LLC members report profits and losses on their personal federal tax returns, just like the owners of a partnership would.The owners of an LLC have no personal liability for the obligations of the LLC. An LLC is the entity of choice for a businesses seeking to flow through losses to its investors because an LLC offers complete liability protection to all its members. The basic requirement for forming an Limited Liability Company are:Search your business name - before you form an LLC, you should check that your proposed business name is not too similar to another LLC registered with your state's Secretary of StateFile Articles of Organization - the first formal paper you will need file with your state's Secretary of State to form an LLC. This is a necessary document for setting up an LLC in many states. Create an Operating Agreement - an agreement among LLC members governing the LLC's business, and member's financial and managerial rights and duties. Think of this as a contract that governs the rules for the people who own the LLC. Get an Employer Identification Number (EIN) - a number assigned by the IRS and used to identify taxpayers that are required to file various business tax returns. You can easily file for an EIN online if you have a social security number. If you do not have a social security number or if you live outsides of United States, ask a business lawyer to help you get one.File Statement of Information - includes fairly basic information about the LLC that you need to file with your state’s Secretary of State every 2 years. Think of it as a company census you must complete every 2 years.Search and Apply for Business Licenses and Permits - once your business is registered, you should look and apply for necessary licenses and permits you will need from the county and city where you will do business. Every business has their own business licenses and permits so either do a Google search of your business along with the words "permits and licenses" or talk to a business lawyer to guide you with this.If you have any other questions, talk to a business lawyer who will clarify and help you with all 6 above steps or answer any other question you may have about starting your business.I am answering from the perspective of a business lawyer who represents businesspersons and entrepreneurs with their new and existing businesses. Feel free to contact me sam@mollaeilaw.com if you need to form your LLC.In my course, How To Incorporate Your Business on Your Own: Quick & Easy, you will learn how to form your own Limited Liability Company (LLC) or Corporation without a lawyer, choose a business name, file a fictitious business name, file Articles of Organization or Articles of Incorporation, create Operating Agreement or Bylaws, apply for an EIN, file Statement of Information, and how to get business licenses and permits.

-

How do I correctly fill out a W9 tax form as a single member LLC?

If your SMLLC is a sole proprietorship/disregarded entity, then you put your name in the name box and not the name of the LLC. You check the box for individual/sole proprietor not LLC.If the SMLLC is an S or C corp then check the box for LLC and write in the appropriate classification. In that case you would put the name of the LLC in the name box.

-

Do I need to fill out Form W-9 (US non-resident alien with an LLC in the US)?

A single-member LLC is by default a disregarded entity. Assuming you have not made a “check-the-box” election to have it treated as a corporation, this means for tax purposes, you are a sole proprietor.As a non-resident alien, you would not complete form W-9. You would likely provide form W-8ECI; possibly W-8BEN.

-

When dissolving an LLC do you need to fill out IRS Form 966?

The answer will be yes or no depending on how your entity is recognized for tax purposes. An LLC is not a recognized entity by the IRS. By default, a single-member LLC is organized for tax purposes as a sole proprietorship and a partnership for tax purposes if there is more than one member. However, you can make an election to be taxed as a C Corporation (i.e., an LLC for legal purposes that is taxed as a C Corporation for tax purposes).You must complete and file form 966 to dissolve your LLC if you have elected to be a C Corporation or a Cooperative (Coop) for tax purposes. S Corporations and tax-exempt non-profits are exempt from filing this form (see here).If you are organized for tax purposes as an S Corporation you would file your taxes via form 1120S for the last time and check the box indicating that your return is a “Final Return.” Same is true for a Partnership, but with form 1065.On a state and local level, best practice is to check with your state and local agencies for requirements.For digestible information and tools for understanding how the tax landscape affects your business, visit Financial Telepathy

-

What tax form do I need to fill out to convert from single member LLC to multi-member LLC?

When you add a member to your previously single member LLC (which you can do structurally by amending your operating agreement and filing an amended report, if required, with your secretary of state), you cease to be a 'disregarded entity' under the applicable Treasury Regulations.Going forward, you will either be a (a) partnership, by default, and will have to file a partnership income tax return on Form 1065, or (b) a corporation, if you so elect, and will have to file a Form 1120 if you are a C corporation or Form 1120S if you elect to be taxed as an S corporation.There can be other tax issues as well, and these need to be addressed with a business CPA.

-

Which W-8 form should I fill out as an LLC company?

How do they know to request a W-8 instead of a W-9? Are you Foreign?Assuming you need to submit a W-8 instead of a W-9, here are the questions to guide your W-8 decision.Do you have other members in your LLC? If you are the only member, a Single Member LLC is a Disregarded Entity taxed on your personal tax return. So you would submit the W-8BEN.If you have other members, are you subject to the default status or have you elected corporate status?If you are subject to the default status, your LLC is taxed as a partnership so submit the W-8IMYIf you elected Corporate status, submit the W-8BEN-E.https://www.irs.gov/pub/irs-pdf/...Other great answers here. Especially good advice from Carl and Mark, get to a CPA.

-

What tax forms would I have to fill out for a single-owner LLC registered in Delaware (generating income in California)?

A2A - LLC are a tax fiction - they do not exist for tax purposes. There are default provisions thus assuming you've done nothing you are a sole proprietor.Sounds to me link you have a Delaware, California, and whatever your state of residence is in addition to federal.You've not provided enough information to answer it properly however.

Create this form in 5 minutes!

How to create an eSignature for the forming a llc in michigan

How to create an electronic signature for the Forming A Llc In Michigan in the online mode

How to create an electronic signature for the Forming A Llc In Michigan in Google Chrome

How to create an eSignature for signing the Forming A Llc In Michigan in Gmail

How to make an electronic signature for the Forming A Llc In Michigan right from your smartphone

How to create an electronic signature for the Forming A Llc In Michigan on iOS devices

How to generate an electronic signature for the Forming A Llc In Michigan on Android

People also ask

-

What is the process to form an LLC in Michigan online?

To form an LLC in Michigan online, you need to complete the Articles of Organization and submit them to the Michigan Department of Licensing and Regulatory Affairs. You can easily do this through an online portal. Once approved, you'll receive a confirmation, and your LLC will be officially registered, making it simple to start your business operations.

-

What are the costs associated with forming an LLC in Michigan online?

The cost to form an LLC in Michigan online typically includes the state filing fee for the Articles of Organization, which is currently $50. Additional costs may occur if you choose expedited processing or if you decide to use professional services for LLC formation. Using airSlate SignNow can save you money by simplifying the document eSigning process.

-

What features does airSlate SignNow provide for managing LLC documents in Michigan?

airSlate SignNow offers a variety of features for managing LLC documents in Michigan, including easy eSigning, document templates, and secure cloud storage. These features make it convenient to organize all your important paperwork associated with your LLC. Plus, you can access your documents from anywhere, ensuring you're always prepared.

-

Are there benefits to forming an LLC in Michigan online compared to other states?

Forming an LLC in Michigan online provides several advantages, including straightforward online filing and faster processing times. This method also allows for easy access to required documents and minimizes the need for physical paperwork. Overall, the process is user-friendly and efficient, especially when supported by airSlate SignNow's features.

-

How does airSlate SignNow integrate with other software for LLC management?

airSlate SignNow seamlessly integrates with various business software tools, enhancing your LLC management. This includes accounting software, CRM systems, and cloud storage platforms. The integrations help streamline your document workflows and ensure that all your LLC-related documents are easily accessible from one location.

-

Can I collaborate with others while forming my LLC in Michigan online?

Yes, airSlate SignNow allows for real-time collaboration with team members or partners while you form your LLC in Michigan online. You can share documents, track changes, and get approvals instantly. This collaborative functionality helps streamline the formation process and keeps everyone on the same page.

-

What is the timeframe for receiving my LLC confirmation in Michigan when filing online?

When you file to form your LLC in Michigan online, you can typically expect to receive confirmation within 5 to 10 business days. If you select expedited processing, it may even be quicker. With airSlate SignNow, you'll also have visibility into your document status, keeping you informed throughout the process.

Get more for Forming A Llc In Michigan

- Payment plan contract city of indianapolis indygov form

- Paycheck protection program loan application mid penn bank form

- Form sra addendum to business organization and justia

- Certificate of formation mississippi

- Professional solicitors in kentucky kentucky attorney general form

- Form 9 nevada resale certificatedoc

- New jersey motor vehicle dealer surety bond ioa bonds form

- Nscb industry bulletin nevada state contractors board form

Find out other Forming A Llc In Michigan

- eSignature California Non-Profit LLC Operating Agreement Fast

- eSignature Delaware Life Sciences Quitclaim Deed Online

- eSignature Non-Profit Form Colorado Free

- eSignature Mississippi Lawers Residential Lease Agreement Later

- How To eSignature Mississippi Lawers Residential Lease Agreement

- Can I eSignature Indiana Life Sciences Rental Application

- eSignature Indiana Life Sciences LLC Operating Agreement Fast

- eSignature Kentucky Life Sciences Quitclaim Deed Fast

- Help Me With eSignature Georgia Non-Profit NDA

- How Can I eSignature Idaho Non-Profit Business Plan Template

- eSignature Mississippi Life Sciences Lease Agreement Myself

- How Can I eSignature Mississippi Life Sciences Last Will And Testament

- How To eSignature Illinois Non-Profit Contract

- eSignature Louisiana Non-Profit Business Plan Template Now

- How Do I eSignature North Dakota Life Sciences Operating Agreement

- eSignature Oregon Life Sciences Job Offer Myself

- eSignature Oregon Life Sciences Job Offer Fast

- eSignature Oregon Life Sciences Warranty Deed Myself

- eSignature Maryland Non-Profit Cease And Desist Letter Fast

- eSignature Pennsylvania Life Sciences Rental Lease Agreement Easy