Printable Delaware Form 200C Composite Income Tax Return 2020

What is the Printable Delaware Form 200C Composite Income Tax Return

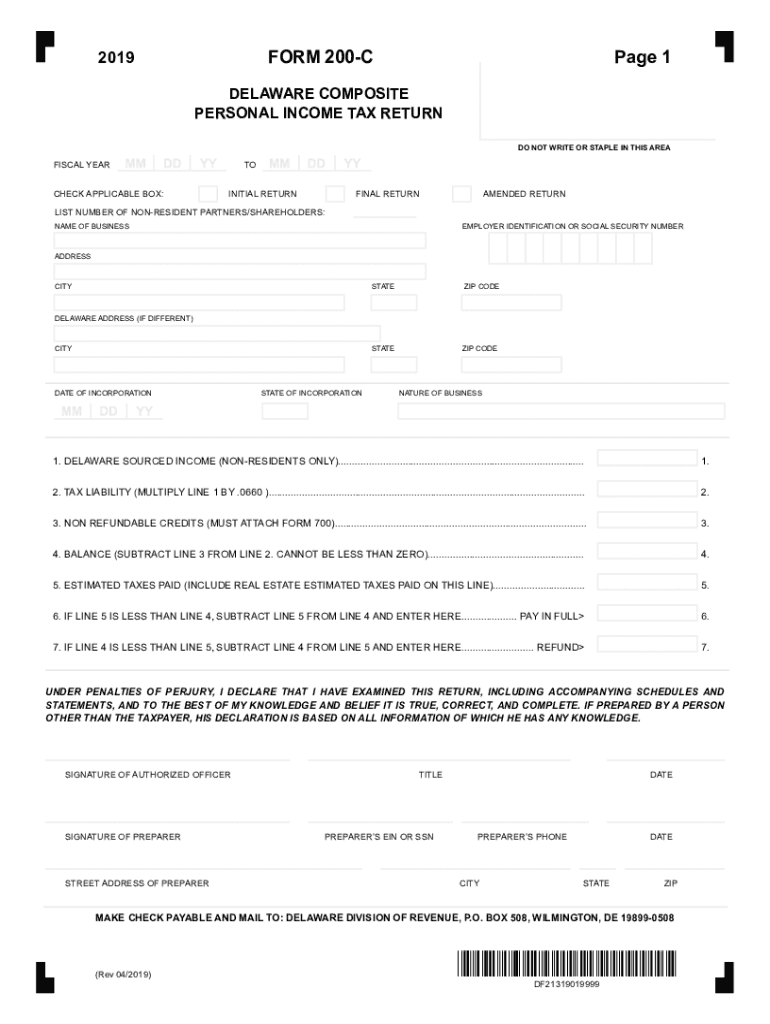

The Printable Delaware Form 200C Composite Income Tax Return is a tax form designed for composite filing by pass-through entities, such as partnerships and S corporations, on behalf of non-resident partners or shareholders. This form allows these entities to report and pay Delaware income tax for individuals who do not reside in the state but have income sourced from Delaware. It simplifies the tax process for both the entity and its non-resident members by consolidating individual tax liabilities into one return.

How to use the Printable Delaware Form 200C Composite Income Tax Return

To effectively use the Printable Delaware Form 200C Composite Income Tax Return, entities must first gather all necessary financial information pertaining to their non-resident members. This includes income earned in Delaware and any applicable deductions. Once the form is filled out with accurate data, it should be reviewed for completeness. After verification, the form can be submitted to the Delaware Division of Revenue, ensuring compliance with state tax regulations.

Steps to complete the Printable Delaware Form 200C Composite Income Tax Return

Completing the Printable Delaware Form 200C involves several key steps:

- Gather all relevant financial documents, including income statements and prior tax returns.

- Fill in the entity's information, including name, address, and federal employer identification number (FEIN).

- Report the total income earned by non-resident members in Delaware.

- Calculate the total tax liability based on the applicable tax rates.

- Ensure all calculations are accurate and complete.

- Sign the form, certifying that the information provided is true and correct.

Legal use of the Printable Delaware Form 200C Composite Income Tax Return

The Printable Delaware Form 200C is legally binding when completed and submitted according to Delaware tax laws. For the form to be valid, it must include proper signatures and accurate financial information. Compliance with the Delaware Division of Revenue’s guidelines is essential to avoid penalties. The form serves as an official record of the tax liabilities for non-resident members, making it important for both the entity and the individuals involved.

Filing Deadlines / Important Dates

Filing deadlines for the Printable Delaware Form 200C Composite Income Tax Return typically coincide with the state’s tax deadlines. Entities must file the form by the due date, which is usually the 15th day of the fourth month following the end of the tax year. It is crucial for entities to stay informed about any changes to these deadlines to ensure timely submission and avoid late fees.

Form Submission Methods (Online / Mail / In-Person)

The Printable Delaware Form 200C can be submitted through various methods. Entities may choose to file electronically via the Delaware Division of Revenue's online portal, which offers a streamlined process. Alternatively, the form can be mailed to the appropriate address provided by the Division of Revenue or submitted in person at designated locations. Each submission method has specific guidelines that should be followed to ensure proper processing.

Quick guide on how to complete printable 2020 delaware form 200c composite income tax return

Complete Printable Delaware Form 200C Composite Income Tax Return effortlessly on any device

Digital document management has become increasingly popular among corporations and individuals. It offers an ideal eco-conscious alternative to conventional printed and signed forms, allowing you to locate the right document and securely store it online. airSlate SignNow equips you with all the tools necessary to create, edit, and eSign your files quickly and without interruptions. Manage Printable Delaware Form 200C Composite Income Tax Return on any device with the airSlate SignNow Android or iOS applications and streamline any document-related task today.

The simplest method to edit and eSign Printable Delaware Form 200C Composite Income Tax Return without hassle

- Obtain Printable Delaware Form 200C Composite Income Tax Return and click on Get Form to begin.

- Make use of the tools we offer to complete your document.

- Emphasize pertinent sections of your documents or redact sensitive information with tools specifically designed for that purpose by airSlate SignNow.

- Generate your eSignature using the Sign feature, which takes mere seconds and holds the same legal validity as a traditional wet ink signature.

- Review all the information and click on the Done button to save your changes.

- Select your preferred method of sending your document, whether by email, SMS, invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, tiring form searches, or errors that necessitate printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device you prefer. Modify and eSign Printable Delaware Form 200C Composite Income Tax Return and ensure outstanding communication at every step of your document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct printable 2020 delaware form 200c composite income tax return

Create this form in 5 minutes!

How to create an eSignature for the printable 2020 delaware form 200c composite income tax return

How to make an electronic signature for a PDF online

How to make an electronic signature for a PDF in Google Chrome

The best way to create an eSignature for signing PDFs in Gmail

How to make an electronic signature from your smartphone

The best way to generate an eSignature for a PDF on iOS

How to make an electronic signature for a PDF file on Android

People also ask

-

What is the Printable Delaware Form 200C Composite Income Tax Return?

The Printable Delaware Form 200C Composite Income Tax Return is a tax form used by eligible partnerships and corporations to report income earned in Delaware. It allows for a collective filing of individual partner or shareholder income, which streamlines the tax process. Ensuring compliance with state tax regulations is crucial for businesses operating in Delaware.

-

How can I access the Printable Delaware Form 200C Composite Income Tax Return?

You can easily access the Printable Delaware Form 200C Composite Income Tax Return through our platform. Simply navigate to the forms section, and you’ll find the option to download or print the form as needed. This ensures you can get your tax filings done efficiently and effectively.

-

Is there a cost associated with obtaining the Printable Delaware Form 200C Composite Income Tax Return?

The Printable Delaware Form 200C Composite Income Tax Return is available for free on our platform. There are no hidden fees or costs associated with downloading the form. Our goal is to provide easy access to essential documents like this income tax return for all users.

-

What are the benefits of using airSlate SignNow for the Printable Delaware Form 200C Composite Income Tax Return?

Using airSlate SignNow allows you to not only access the Printable Delaware Form 200C Composite Income Tax Return but also easily eSign and share it with relevant parties. Our platform enhances workflow efficiency, ensures documents are securely handled, and helps meet filing deadlines without stress. This can signNowly simplify your tax season.

-

Can I integrate airSlate SignNow with other tools for the Printable Delaware Form 200C Composite Income Tax Return?

Yes, airSlate SignNow offers integrations with various tools and platforms. This allows seamless management of your documents, including the Printable Delaware Form 200C Composite Income Tax Return, across different applications. By integrating your workflow, you can enhance productivity and ensure streamlined tax filing processes.

-

What features should I look for in the Printable Delaware Form 200C Composite Income Tax Return?

When considering the Printable Delaware Form 200C Composite Income Tax Return, look for features that enable easy editing, eSignature capabilities, and secure sharing options. Furthermore, an intuitive user interface makes it easier to fill out and submit the form correctly. These features help you efficiently navigate tax reporting requirements.

-

How do I submit the Printable Delaware Form 200C Composite Income Tax Return after filling it out?

Once you have completed the Printable Delaware Form 200C Composite Income Tax Return, you can submit it via mail or electronically, depending on the state's requirements. Ensure that you double-check all entries for accuracy before submission. Using airSlate SignNow makes it easy to keep track of your submissions and their statuses.

Get more for Printable Delaware Form 200C Composite Income Tax Return

- Hc sharps injury form doc

- Lpf 812 form

- Pardot grading worksheet form

- Donation request form bel air cantina

- Exponents product and quotient rule worksheet answers form

- Measuring liquid volume practice pdf form

- Shawnzia thomas form

- Broward county environmental and consumer protection division credit card authorization form broward county environmental and

Find out other Printable Delaware Form 200C Composite Income Tax Return

- How To Integrate Sign in Banking

- How To Use Sign in Banking

- Help Me With Use Sign in Banking

- Can I Use Sign in Banking

- How Do I Install Sign in Banking

- How To Add Sign in Banking

- How Do I Add Sign in Banking

- How Can I Add Sign in Banking

- Can I Add Sign in Banking

- Help Me With Set Up Sign in Government

- How To Integrate eSign in Banking

- How To Use eSign in Banking

- How To Install eSign in Banking

- How To Add eSign in Banking

- How To Set Up eSign in Banking

- How To Save eSign in Banking

- How To Implement eSign in Banking

- How To Set Up eSign in Construction

- How To Integrate eSign in Doctors

- How To Use eSign in Doctors