Ga Account Form

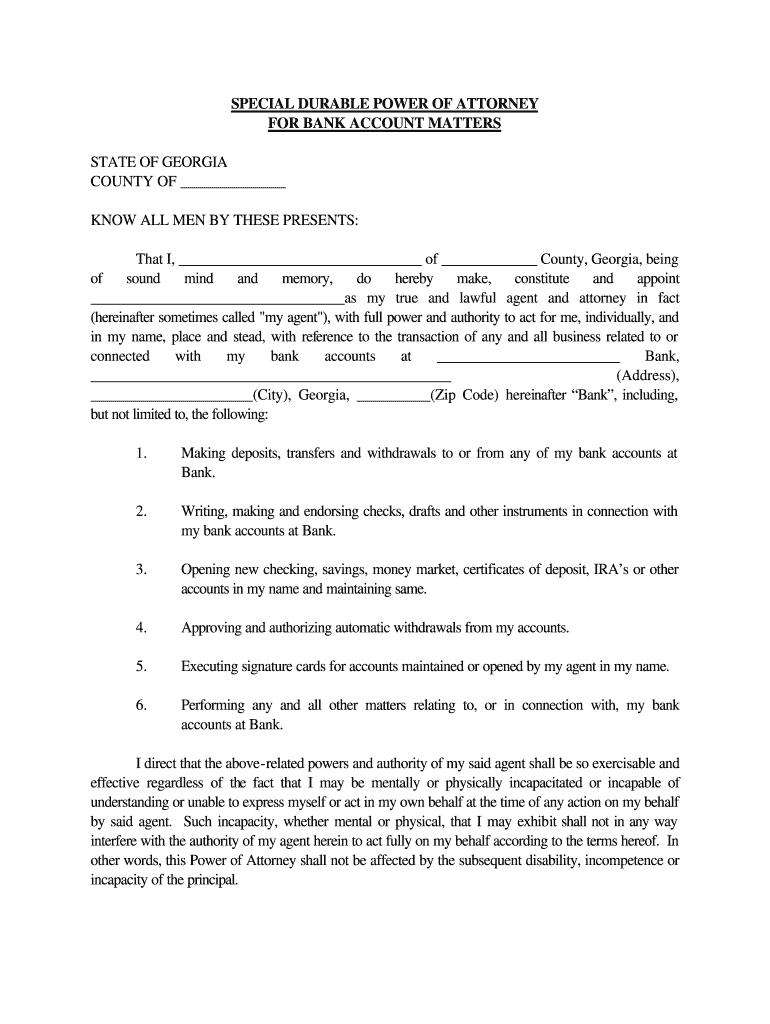

What is the Georgia POA Form?

The Georgia Power of Attorney (POA) form is a legal document that allows an individual (the principal) to designate another person (the agent) to make decisions on their behalf. This form is particularly useful in situations where the principal may be unable to manage their affairs due to health issues, absence, or other circumstances. The Georgia POA form can cover various powers, including financial management, healthcare decisions, and property transactions.

Steps to Complete the Georgia POA Form

Completing the Georgia POA form involves several key steps to ensure it is valid and legally binding:

- Identify the principal and the agent: Clearly state the names and addresses of both parties.

- Specify the powers granted: Detail the specific powers the agent will have, such as managing bank accounts or making medical decisions.

- Include effective dates: Indicate when the powers will begin and whether they are durable (remain effective if the principal becomes incapacitated).

- Sign the document: The principal must sign the form in the presence of a notary public or two witnesses, depending on the type of POA.

Legal Use of the Georgia POA Form

The Georgia POA form is recognized under state law and can be used for various legal purposes. It is essential to ensure that the form complies with Georgia laws, particularly regarding the powers granted and the execution process. A properly executed POA can help avoid complications in managing the principal's affairs and ensure that the agent can act on their behalf without legal hindrance.

Required Documents for the Georgia POA Form

To complete the Georgia POA form, certain documents may be required to verify identities and establish authority:

- Identification: The principal and agent should provide valid government-issued identification, such as a driver's license or passport.

- Proof of residence: Documents that confirm the principal's address may be necessary.

- Previous POA documents: If applicable, any existing power of attorney documents should be reviewed to avoid conflicts.

State-Specific Rules for the Georgia POA Form

Georgia has specific rules governing the execution and use of POA forms, which include:

- The principal must be at least eighteen years old and mentally competent.

- The form must be signed in the presence of a notary public or two witnesses who are not related to the principal or agent.

- Specific language may be required to ensure the form meets legal standards, especially for healthcare decisions.

Examples of Using the Georgia POA Form

The Georgia POA form can be utilized in various scenarios, such as:

- Financial management: Allowing an agent to handle bank transactions, pay bills, and manage investments.

- Healthcare decisions: Granting authority to make medical decisions when the principal is unable to do so.

- Real estate transactions: Authorizing an agent to buy, sell, or manage property on behalf of the principal.

Quick guide on how to complete georgia special form

Execute Ga Account seamlessly on any device

Digital document management has become increasingly favored by companies and individuals alike. It offers an excellent eco-friendly alternative to traditional printed and signed documentation, as you can easily locate the required form and securely store it online. airSlate SignNow equips you with all the necessary tools to create, modify, and eSign your files quickly without waiting. Manage Ga Account on any platform with airSlate SignNow Android or iOS applications and simplify any document-related procedure today.

Steps to modify and eSign Ga Account effortlessly

- Obtain Ga Account and click Get Form to begin.

- Utilize the tools we provide to complete your document.

- Emphasize important sections of your documents or obscure sensitive details with tools that airSlate SignNow offers specifically for this purpose.

- Generate your eSignature using the Sign tool, which takes moments and carries the same legal validity as a conventional wet ink signature.

- Verify the details and hit the Done button to save your changes.

- Choose how you wish to send your form, whether by email, SMS, invitation link, or download it to your PC.

No more concerns about lost or misplaced documents, tedious form searches, or mistakes that necessitate printing new copies. airSlate SignNow meets your document management needs in just a few clicks from any chosen device. Edit and eSign Ga Account and ensure outstanding communication at every phase of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

FAQs

-

What's the best picture taken of you and why do you think it's the best?

Mind the poor quality. Nonetheless, this is one of the many best photographs taken of me. I did mention one of the many but, this was the only one that was taken without me knowing, there were no "Is the lighting alright?" "Am I smiling too much?" or "Angle on point" I love the photograph so much, not probably because it's MY best but, the way it captured the genuine love and affection in the dog's eyes. A little walk down the memory lane wouldn't hurt. It was taken in my University where I had to leave home and face the world on my own. Like what everyone else faced, nothing new just the same old home sick, pain, back stabbing, meeting selfish people, fake friends, yearning to be loved, feeling lonely and than I met this guy. She was stray a dog. I soon discovered a soft spot for her within me and we grew to become real close. She's always there accompanying me through late night strolls around the campus. It was comforting to know that you could trust someone in that super competitive University world where everyone was just trying to outrun you Till one day, the management had gotten rid of her. That too in the most atrocious way possible. The dog catchers had flung chains around her neck and dragged her away from the campus. Tears run down my cheeks even now as I reminisce the last moments of her. Anyway, this picture holds so much love and genuineness that I doubt any other human could have. This picture was taken early in the morning before our hiking program, she hiked with us all the way to the top.

-

How do I fill taxes online?

you can file taxes online by using different online platforms. by using this online platform you can easily submit the income tax returns, optimize your taxes easily.Tachotax provides the most secure, easy and fast way of tax filing.

-

How do I fill out the income tax for online job payment? Are there any special forms to fill it?

I am answering to your question with the UNDERSTANDING that you are liableas per Income Tax Act 1961 of Republic of IndiaIf you have online source of Income as per agreement as an employer -employee, It will be treated SALARY income and you will file ITR 1 for FY 2017–18If you are rendering professional services outside India with an agreement as professional, in that case you need to prepare Financial Statements ie. Profit and loss Account and Balance sheet for FY 2017–18 , finalize your income and pay taxes accordingly, You will file ITR -3 for FY 2017–1831st Dec.2018 is last due date with minimum penalty, grab that opportunity and file income tax return as earliest

-

When is the 1st day to fill out the form for JoSAA’s special round?

First of all special round isn't organised by josaa it is organised by CSAB. And for that registration is going to start from 27th July 2017. For detailed schedule visit CSAB website.

-

Does a girlfriend have to fill out a leave request form for a US Army Soldier in Special Operations in Africa?

Let me guess, you've been contacted via email by somebody you’ve never met. they've told you a story about being a deployed soldier. At some stage in the dialogue they’ve told you about some kind of emotional drama, sick relative/kid etc. They tell you that because they are in a dangerous part of the world with no facilities they need you to fill in a leave application for them. Some part of this process will inevitably involve you having to pay some money on their behalf. The money will need to be paid via ‘Western Union’. Since you havent had much involvement with the military in the past you dont understand and are tempted to help out this poor soldier. they promise to pay you back once they get back from war.if this sounds familiar you are being scammed. There is no soldier just an online criminal trying to steal your money. If you send any money via Western Union it is gone, straight into the pockets of the scammer. you cant get it back, it is not traceable, this is why scammers love Western Union. They aernt going to pay you back, once they have your money you will only hear from them again if they think they can double down and squeeze more money out of you.Leave applications need to be completed by soldiers themselves. They are normally approved by their unit chain of command. If there is a problem the soldier’s commander will summon them internally to resolve the issue. This is all part of the fun of being a unit commander!! If the leave is not urgent they will wait for a convenient time during a rotation etc to work out the problems, if the leave is urgent (dying parent/spouse/kid etc) they will literally get that soldier out of an operational area ASAP. Operational requirements come first but it would need to be something unthinkable to prevent the Army giving immediate emergency leave to somebody to visit their dying kid in hospital etc.The process used by the scammers is known as ‘Advance fee fraud’ and if you want to read about the funny things people do to scam the scammers have a read over on The largest scambaiting community on the planet!

-

Do military members have to pay any fee for leave or fiancee forms?

NOOOOOOO. You are talking to a military romance scammer. I received an email from the US Army that directly answers your question that is pasted below please keep reading.I believe you are the victim of a military Romance Scam whereas the person you are talking to is a foreign national posing as an American Soldier claiming to be stationed overseas on a peacekeeping mission. That's the key to the scam they always claim to be on a peacekeeping mission.Part of their scam is saying that they have no access to their money that their mission is highly dangerous.If your boyfriend girlfriend/future husband/wife is asking you to do the following or has exhibited this behavior, it is a most likely a scam:Moves to private messaging site immediately after meeting you on Facebook or SnapChat or Instagram or some dating or social media site. Often times they delete the site you met them on right after they asked you to move to a more private messaging siteProfesses love to you very quickly & seems to quote poems and song lyrics along with using their own sort of broken language, as they profess their love and devotion quickly. They also showed concern for your health and love for your family.Promises marriage as soon as he/she gets to state for leave that they asked you to pay for.They Requests money (wire transfers) and Amazon, iTune ,Verizon, etc gift cards, for medicine, religious practices, and leaves to come home, internet access, complete job assignments, help sick friend, get him out of trouble, or anything that sounds fishy.The military does provide all the soldier needs including food medical Care and transportation for leave. Trust me, I lived it, you are probably being scammed. I am just trying to show you examples that you are most likely being connned.Below is an email response I received after I sent an inquiry to the US government when I discovered I was scammed. I received this wonderful response back with lots of useful links on how to find and report your scammer. And how to learn more about Romance Scams.Right now you can also copy the picture he gave you and do a google image search and you will hopefully see the pictures of the real person he is impersonating. this doesn't always work and take some digging. if you find the real person you can direct message them and alert them that their image is being used for scamming.Good Luck to you and I'm sorry this may be happening to you. please continue reading the government response I received below it's very informative. You have contacted an email that is monitored by the U.S. Army Criminal Investigation Command. Unfortunately, this is a common concern. We assure you there is never any reason to send money to anyone claiming to be a Soldier online. If you have only spoken with this person online, it is likely they are not a U.S. Soldier at all. If this is a suspected imposter social media profile, we urge you to report it to that platform as soon as possible. Please continue reading for more resources and answers to other frequently asked questions: How to report an imposter Facebook profile: Caution-https://www.facebook.com/help/16... < Caution-https://www.facebook.com/help/16... > Answers to frequently asked questions: - Soldiers and their loved ones are not charged money so that the Soldier can go on leave. - Soldiers are not charged money for secure communications or leave. - Soldiers do not need permission to get married. - Soldiers emails are in this format: john.doe.mil@mail.mil < Caution-mailto: john.doe.mil@mail.mil > anything ending in .us or .com is not an official email account. - Soldiers have medical insurance, which pays for their medical costs when treated at civilian health care facilities worldwide – family and friends do not need to pay their medical expenses. - Military aircraft are not used to transport Privately Owned Vehicles. - Army financial offices are not used to help Soldiers buy or sell items of any kind. - Soldiers deployed to Combat Zones do not need to solicit money from the public to feed or house themselves or their troops. - Deployed Soldiers do not find large unclaimed sums of money and need your help to get that money out of the country. Anyone who tells you one of the above-listed conditions/circumstances is true is likely posing as a Soldier and trying to steal money from you. We would urge you to immediately cease all contact with this individual. For more information on avoiding online scams and to report this crime, please see the following sites and articles: This article may help clarify some of the tricks social media scammers try to use to take advantage of people: Caution-https://www.army.mil/article/61432/< Caution-https://www.army.mil/article/61432/> CID advises vigilance against 'romance scams,' scammers impersonating Soldiers Caution-https://www.army.mil/article/180749 < Caution-https://www.army.mil/article/180749 > FBI Internet Crime Complaint Center: Caution-http://www.ic3.gov/default.aspx< Caution-http://www.ic3.gov/default.aspx> U.S. Army investigators warn public against romance scams: Caution-https://www.army.mil/article/130...< Caution-https://www.army.mil/article/130...> DOD warns troops, families to be cybercrime smart -Caution-http://www.army.mil/article/1450...< Caution-http://www.army.mil/article/1450...> Use caution with social networking Caution-https://www.army.mil/article/146...< Caution-https://www.army.mil/article/146...> Please see our frequently asked questions section under scams and legal issues. Caution-http://www.army.mil/faq/ < Caution-http://www.army.mil/faq/ > or visit Caution-http://www.cid.army.mil/ < Caution-http://www.cid.army.mil/ >. The challenge with most scams is determining if an individual is a legitimate member of the US Army. Based on the Privacy Act of 1974, we cannot provide this information. If concerned about a scam you may contact the Better Business Bureau (if it involves a solicitation for money), or local law enforcement. If you're involved in a Facebook or dating site scam, you are free to contact us direct; (571) 305-4056. If you have a social security number, you can find information about Soldiers online at Caution-https://www.dmdc.osd.mil/appj/sc... < Caution-https://www.dmdc.osd.mil/appj/sc... > . While this is a free search, it does not help you locate a retiree, but it can tell you if the Soldier is active duty or not. If more information is needed such as current duty station or location, you can contact the Commander Soldier's Records Data Center (SRDC) by phone or mail and they will help you locate individuals on active duty only, not retirees. There is a fee of $3.50 for businesses to use this service. The check or money order must be made out to the U.S. Treasury. It is not refundable. The address is: Commander Soldier's Records Data Center (SRDC) 8899 East 56th Street Indianapolis, IN 46249-5301 Phone: 1-866-771-6357 In addition, it is not possible to remove social networking site profiles without legitimate proof of identity theft or a scam. If you suspect fraud on this site, take a screenshot of any advances for money or impersonations and report the account on the social networking platform immediately. Please submit all information you have on this incident to Caution-www.ic3.gov < Caution-http://www.ic3.gov > (FBI website, Internet Criminal Complaint Center), immediately stop contact with the scammer (you are potentially providing them more information which can be used to scam you), and learn how to protect yourself against these scams at Caution-http://www.ftc.gov < Caution-http://www.ftc.gov > (Federal Trade Commission's website)

-

If a marine is on a special mission or secret mission, do they have to pay for a flight home, and what is the form to fill out?

If a real Marine was on a real secret mission, he wouldn’t be telling you that he was.

Create this form in 5 minutes!

How to create an eSignature for the georgia special form

How to generate an eSignature for your Georgia Special Form in the online mode

How to make an eSignature for the Georgia Special Form in Chrome

How to generate an electronic signature for signing the Georgia Special Form in Gmail

How to make an eSignature for the Georgia Special Form straight from your smart phone

How to make an electronic signature for the Georgia Special Form on iOS

How to make an electronic signature for the Georgia Special Form on Android devices

People also ask

-

What is a Ga Account and how does it relate to airSlate SignNow?

A Ga Account is a Google Account that allows you to access various Google services, including Google Drive, which can be integrated with airSlate SignNow. By linking your Ga Account, you can easily manage and store your signed documents directly in Google Drive, streamlining your workflow and document management.

-

How much does airSlate SignNow cost for Ga Account users?

airSlate SignNow offers competitive pricing plans suited for businesses using a Ga Account. The pricing varies depending on the features you need, with options for monthly or annual subscriptions. We recommend checking our pricing page for the latest offers and to find a plan that fits your budget.

-

What are the main features of airSlate SignNow for Ga Account users?

airSlate SignNow provides a range of features for Ga Account users, including document eSigning, templates, and automated workflows. You can customize your documents, track their status, and collaborate with team members seamlessly. These features enhance productivity and simplify the signing process.

-

Can I integrate airSlate SignNow with my existing Ga Account?

Yes, airSlate SignNow can be easily integrated with your Ga Account. This integration allows you to access your Google Drive files, send documents for eSignature directly from your Drive, and save completed documents back to your Drive, making document management more efficient.

-

What benefits does using airSlate SignNow with a Ga Account provide?

Using airSlate SignNow with your Ga Account offers several benefits, including enhanced collaboration, easy access to stored documents, and streamlined signing processes. By leveraging your Ga Account, you can manage all your documents in one place, reducing time spent on manual tasks.

-

Is airSlate SignNow secure for use with my Ga Account?

Absolutely! airSlate SignNow takes security seriously and employs advanced encryption protocols to protect your documents and data. When using your Ga Account, rest assured that your information is stored securely and that you can trust the platform to handle sensitive documents.

-

Can I use airSlate SignNow for free with my Ga Account?

airSlate SignNow offers a free trial that allows Ga Account users to explore the platform's features without any commitment. After the trial, you can choose a subscription plan that meets your needs, but the free version provides a great way to test the service.

Get more for Ga Account

Find out other Ga Account

- How To Electronic signature New York Legal Lease Agreement

- How Can I Electronic signature New York Legal Stock Certificate

- Electronic signature North Carolina Legal Quitclaim Deed Secure

- How Can I Electronic signature North Carolina Legal Permission Slip

- Electronic signature Legal PDF North Dakota Online

- Electronic signature North Carolina Life Sciences Stock Certificate Fast

- Help Me With Electronic signature North Dakota Legal Warranty Deed

- Electronic signature North Dakota Legal Cease And Desist Letter Online

- Electronic signature North Dakota Legal Cease And Desist Letter Free

- Electronic signature Delaware Orthodontists Permission Slip Free

- How Do I Electronic signature Hawaii Orthodontists Lease Agreement Form

- Electronic signature North Dakota Life Sciences Business Plan Template Now

- Electronic signature Oklahoma Legal Bill Of Lading Fast

- Electronic signature Oklahoma Legal Promissory Note Template Safe

- Electronic signature Oregon Legal Last Will And Testament Online

- Electronic signature Life Sciences Document Pennsylvania Simple

- Electronic signature Legal Document Pennsylvania Online

- How Can I Electronic signature Pennsylvania Legal Last Will And Testament

- Electronic signature Rhode Island Legal Last Will And Testament Simple

- Can I Electronic signature Rhode Island Legal Residential Lease Agreement