Form 1099 Div 2009

What is the Form 1099-DIV

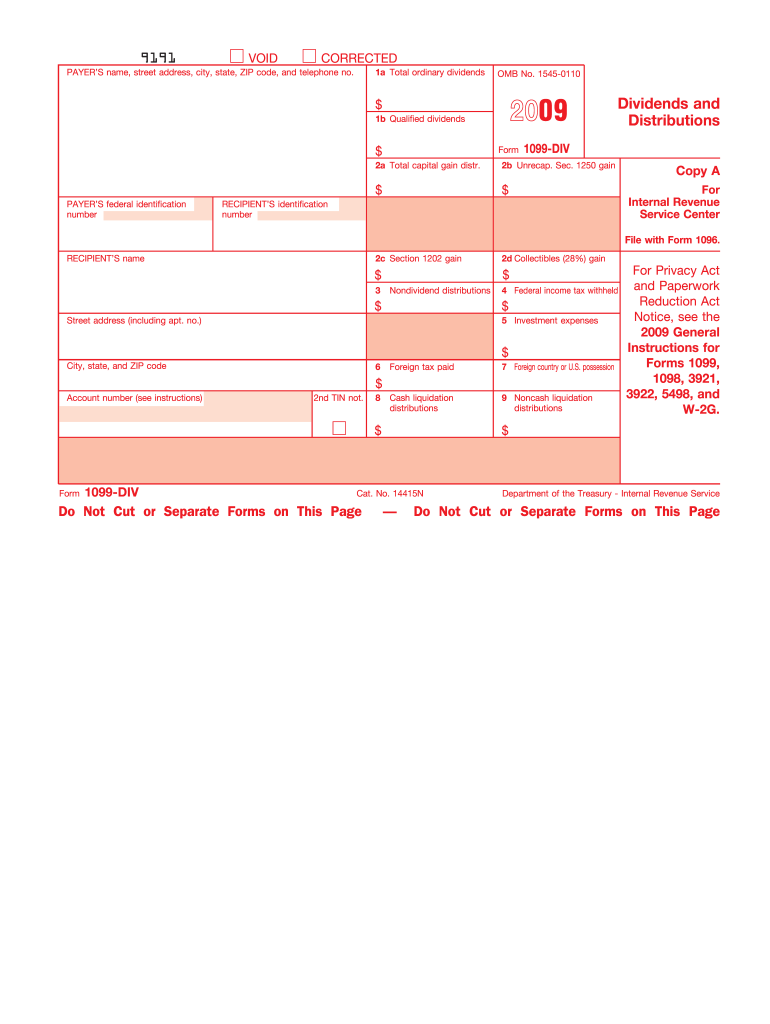

The Form 1099-DIV is a tax document used in the United States to report dividends and distributions to shareholders. It is typically issued by banks, mutual funds, and other financial institutions to individuals who have received dividends during the tax year. This form provides essential information to the taxpayer and the IRS, including the total amount of dividends paid, any capital gains distributions, and any federal income tax withheld. Understanding this form is crucial for accurately reporting income on your tax return.

How to Use the Form 1099-DIV

Using the Form 1099-DIV involves several steps. First, you should receive this form from any financial institution that has paid you dividends. Once you have the form, review the information carefully to ensure accuracy. The amounts reported on the 1099-DIV must be included on your tax return. Depending on your tax situation, you may need to report these amounts on different schedules or forms, such as Schedule B for interest and ordinary dividends. It is important to keep this form on hand for your records and to assist in preparing your tax return.

Steps to Complete the Form 1099-DIV

Completing the Form 1099-DIV involves several straightforward steps. First, gather all relevant financial documents that detail your dividend income. Next, fill out the form by entering your personal information and the total dividends received in the appropriate sections. Ensure that you accurately report any capital gains distributions and federal income tax withheld, if applicable. After completing the form, review it for any errors before submitting it to the IRS and providing copies to any recipients. Keeping a copy for your records is also advisable.

Key Elements of the Form 1099-DIV

The Form 1099-DIV contains several key elements that are essential for both taxpayers and the IRS. These elements include:

- Recipient's Information: This section includes the taxpayer's name, address, and taxpayer identification number (TIN).

- Payer's Information: Details about the financial institution or entity issuing the form.

- Dividends and Distributions: The total amount of ordinary dividends, qualified dividends, and capital gains distributions.

- Federal Tax Withheld: Any federal income tax withheld from the dividends.

Understanding these elements helps ensure that taxpayers accurately report their income and comply with tax regulations.

Filing Deadlines / Important Dates

Filing deadlines for the Form 1099-DIV are crucial for compliance. Typically, the form must be issued to recipients by January 31 of the year following the tax year in which the dividends were paid. Additionally, the IRS requires that the form be filed by February 28 if submitted by mail or by March 31 if filed electronically. It is important to adhere to these deadlines to avoid potential penalties for late filing.

Penalties for Non-Compliance

Failure to comply with the requirements associated with the Form 1099-DIV can result in significant penalties. The IRS imposes fines for late filing, incorrect information, or failure to file altogether. These penalties can vary based on how late the form is submitted and the size of the business. It is essential for taxpayers and businesses to ensure that they accurately complete and file the form on time to avoid these financial repercussions.

Quick guide on how to complete 2009 form 1099 div

Handle Form 1099 Div with ease on any device

Digital document management has become increasingly favored by companies and individuals alike. It serves as an ideal environmentally friendly alternative to traditional printed and signed materials, allowing you to access the necessary forms and securely store them online. airSlate SignNow equips you with all the tools needed to create, modify, and eSign your documents swiftly without any delays. Manage Form 1099 Div on any device using the airSlate SignNow apps for Android or iOS and enhance any document-based task today.

The simplest way to modify and eSign Form 1099 Div without any hassle

- Locate Form 1099 Div and select Get Form to begin.

- Utilize the tools we provide to fill out your document.

- Emphasize important sections of the documents or obscure sensitive information with tools that airSlate SignNow specifically offers for that purpose.

- Generate your signature using the Sign feature, which takes mere seconds and holds the same legal validity as a conventional ink signature.

- Verify all details and click the Done button to save your modifications.

- Decide how you wish to send your form, whether by email, SMS, or invite link, or download it to your computer.

Eliminate concerns about lost or mislaid documents, tedious form searches, or mistakes that necessitate printing new copies. airSlate SignNow meets your document management needs in just a few clicks from any device you choose. Alter and eSign Form 1099 Div and maintain excellent communication at every phase of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 2009 form 1099 div

Create this form in 5 minutes!

How to create an eSignature for the 2009 form 1099 div

How to create an electronic signature for a PDF document online

How to create an electronic signature for a PDF document in Google Chrome

How to generate an eSignature for signing PDFs in Gmail

The best way to create an eSignature from your smart phone

How to create an eSignature for a PDF document on iOS

The best way to create an eSignature for a PDF file on Android OS

People also ask

-

What is Form 1099 Div and why is it important?

Form 1099 Div is a tax form used to report dividends and distributions to taxpayers. Understanding this form is crucial for accurate tax reporting and compliance. Using airSlate SignNow, you can effortlessly eSign your Form 1099 Div, ensuring timely and secure submission.

-

How does airSlate SignNow simplify the process of signing Form 1099 Div?

airSlate SignNow streamlines the signing process for Form 1099 Div by allowing users to electronically sign documents from any device. This reduces paperwork and saves time, making it easy to manage your forms efficiently. Plus, you can track the status of your signed documents in real time.

-

Is there a cost associated with using airSlate SignNow for Form 1099 Div?

Yes, airSlate SignNow offers various pricing plans tailored to fit different business needs. Each plan includes features like eSigning, document management, and templates for Form 1099 Div. With a cost-effective solution, you can focus on your business while handling your tax documents efficiently.

-

Can I integrate airSlate SignNow with other software for processing Form 1099 Div?

Absolutely! airSlate SignNow integrates seamlessly with various accounting and tax software applications to help you manage Form 1099 Div efficiently. This connectivity allows for improved workflow and ensures that all your documents are in sync, enhancing your productivity.

-

What features does airSlate SignNow offer for managing Form 1099 Div?

airSlate SignNow provides features designed specifically for managing Form 1099 Div, including templates, custom workflows, and bulk sending options. These features make it easier to create, send, sign, and store your tax forms securely. Additionally, real-time tracking ensures that you know when your Form 1099 Div has been signed.

-

How secure is airSlate SignNow for signing Form 1099 Div?

Security is a top priority at airSlate SignNow. The platform offers bank-level encryption, ensuring that your Form 1099 Div and other documents are protected during transmission and storage. Your sensitive tax information remains confidential and secure throughout the signing process.

-

Can multiple users sign a Form 1099 Div on airSlate SignNow?

Yes, airSlate SignNow allows multiple users to eSign a Form 1099 Div, making it easy for groups to collaborate on tax documents. You can easily set the signing order and notify users via email, ensuring efficient completion. This feature is particularly beneficial for teams managing multiple tax forms.

Get more for Form 1099 Div

- Letter from landlord to tenant as notice to remove wild animals in premises idaho form

- Letter from landlord to tenant as notice to remove unauthorized pets from premises idaho form

- Letter from tenant to landlord containing notice that premises in uninhabitable in violation of law and demand immediate repair 497305496 form

- Letter from tenant to landlord containing notice that premises leaks during rain and demand for repair idaho form

- Letter from tenant to landlord containing notice that doors are broken and demand repair idaho form

- Letter with demand 497305499 form

- Letter from tenant to landlord with demand that landlord repair plumbing problem idaho form

- Letter from tenant to landlord containing notice that heater is broken unsafe or inadequate and demand for immediate remedy 497305501 form

Find out other Form 1099 Div

- Sign Connecticut Real Estate Business Plan Template Simple

- How To Sign Wisconsin Plumbing Cease And Desist Letter

- Sign Colorado Real Estate LLC Operating Agreement Simple

- How Do I Sign Connecticut Real Estate Operating Agreement

- Sign Delaware Real Estate Quitclaim Deed Secure

- Sign Georgia Real Estate Business Plan Template Computer

- Sign Georgia Real Estate Last Will And Testament Computer

- How To Sign Georgia Real Estate LLC Operating Agreement

- Sign Georgia Real Estate Residential Lease Agreement Simple

- Sign Colorado Sports Lease Agreement Form Simple

- How To Sign Iowa Real Estate LLC Operating Agreement

- Sign Iowa Real Estate Quitclaim Deed Free

- How To Sign Iowa Real Estate Quitclaim Deed

- Sign Mississippi Orthodontists LLC Operating Agreement Safe

- Sign Delaware Sports Letter Of Intent Online

- How Can I Sign Kansas Real Estate Job Offer

- Sign Florida Sports Arbitration Agreement Secure

- How Can I Sign Kansas Real Estate Residential Lease Agreement

- Sign Hawaii Sports LLC Operating Agreement Free

- Sign Georgia Sports Lease Termination Letter Safe