Florida F1065sk1 Form 2010

What is the Florida F1065sk1 Form

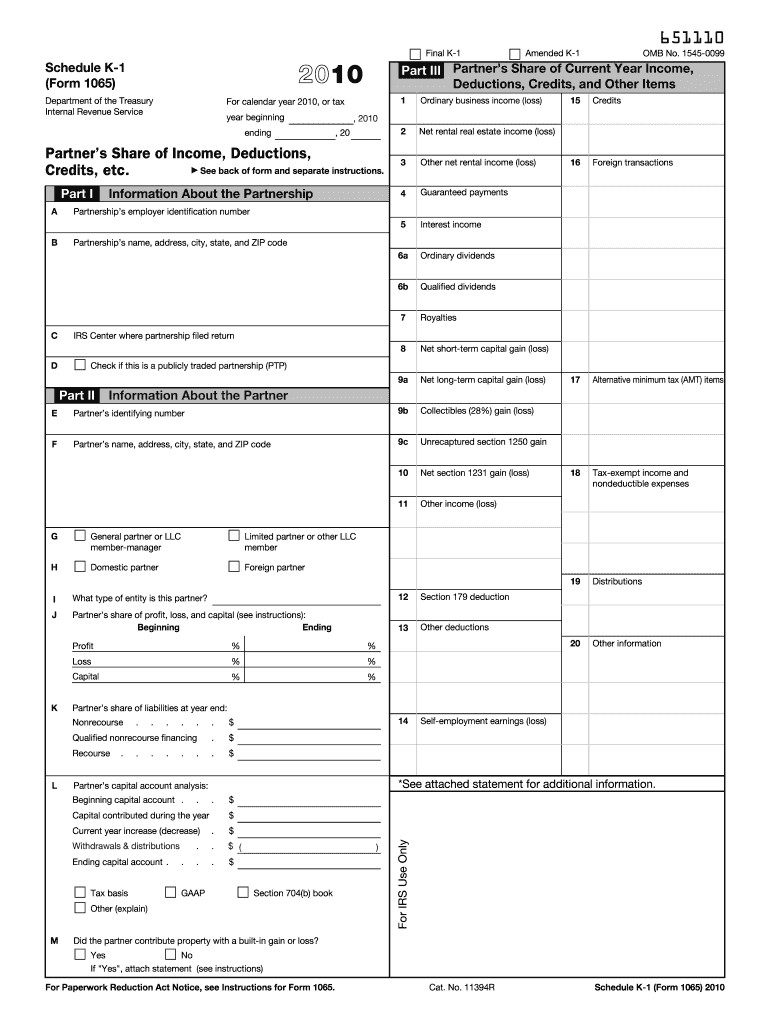

The Florida F1065sk1 Form is a tax document specifically designed for partnerships operating within the state of Florida. This form is used to report the income, deductions, and credits of a partnership to the Florida Department of Revenue. It is essential for ensuring that partnerships comply with state tax regulations and accurately report their financial activities. By filing this form, partnerships can provide the necessary information for tax assessments and maintain transparency with state authorities.

How to use the Florida F1065sk1 Form

To effectively use the Florida F1065sk1 Form, partnerships must gather all relevant financial information, including income, expenses, and any applicable deductions. Once the necessary data is compiled, the form can be filled out electronically or printed for manual completion. It is important to follow the instructions provided with the form to ensure accurate reporting. After completing the form, partnerships must submit it to the Florida Department of Revenue by the specified deadline to avoid penalties.

Steps to complete the Florida F1065sk1 Form

Completing the Florida F1065sk1 Form involves several key steps:

- Gather financial records, including income statements and expense reports.

- Fill out the form, ensuring that all sections are completed accurately.

- Double-check calculations to confirm that all figures are correct.

- Sign and date the form to validate the submission.

- Submit the form electronically or by mail to the Florida Department of Revenue.

Legal use of the Florida F1065sk1 Form

The legal use of the Florida F1065sk1 Form is crucial for partnerships to fulfill their tax obligations. This form must be completed in accordance with Florida tax laws and regulations. It serves as an official record of a partnership's financial activities and is necessary for compliance with state tax requirements. Failure to use this form correctly can result in penalties or legal repercussions, emphasizing the importance of accuracy and adherence to guidelines.

Filing Deadlines / Important Dates

Partnerships must be aware of specific filing deadlines associated with the Florida F1065sk1 Form. Typically, the form is due on the 15th day of the fourth month following the end of the partnership's tax year. For partnerships operating on a calendar year, this means the form is generally due by April 15. It is crucial for partnerships to mark these dates on their calendars to ensure timely submission and avoid late fees.

Required Documents

When preparing to complete the Florida F1065sk1 Form, partnerships should have several key documents on hand, including:

- Income statements detailing all revenue earned.

- Expense reports outlining all costs incurred during the tax year.

- Records of any deductions or credits the partnership intends to claim.

- Previous year’s tax returns for reference and consistency.

Form Submission Methods (Online / Mail / In-Person)

The Florida F1065sk1 Form can be submitted through various methods to accommodate different preferences. Partnerships may choose to file electronically via the Florida Department of Revenue's online portal, which offers a streamlined process. Alternatively, the form can be printed and mailed to the appropriate address. In-person submissions are also accepted at designated state offices. Each method has its own advantages, so partnerships should select the one that best fits their needs.

Quick guide on how to complete florida f1065sk1 2010 form

Effortlessly Prepare Florida F1065sk1 Form on Any Device

Digital document management has become increasingly popular among businesses and individuals. It offers an ideal environmentally friendly option to conventional printed and signed paperwork, as you can locate the appropriate form and securely store it online. airSlate SignNow provides you with all the tools you need to create, modify, and electronically sign your documents quickly without delays. Manage Florida F1065sk1 Form on any device using airSlate SignNow's Android or iOS applications and simplify any document-related processes today.

How to Modify and Electronically Sign Florida F1065sk1 Form with Ease

- Locate Florida F1065sk1 Form and then click Get Form to commence.

- Utilize the tools we offer to fill out your form.

- Mark important sections of the documents or redact sensitive information with tools that airSlate SignNow specifically provides for that purpose.

- Create your signature using the Sign feature, which takes mere seconds and carries the same legal validity as a traditional handwritten signature.

- Review the details and then click on the Done button to finalize your changes.

- Select how you prefer to send your form, whether by email, text message (SMS), or invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searching, or errors that necessitate printing new document copies. airSlate SignNow addresses all your document management needs in just a few clicks from your chosen device. Edit and electronically sign Florida F1065sk1 Form to ensure effective communication at any stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct florida f1065sk1 2010 form

Create this form in 5 minutes!

How to create an eSignature for the florida f1065sk1 2010 form

The way to make an eSignature for your PDF document in the online mode

The way to make an eSignature for your PDF document in Chrome

The way to make an electronic signature for putting it on PDFs in Gmail

How to make an electronic signature straight from your mobile device

The way to make an electronic signature for a PDF document on iOS devices

How to make an electronic signature for a PDF document on Android devices

People also ask

-

What is the Florida F1065sk1 Form?

The Florida F1065sk1 Form is a tax document that partnerships in Florida must file to report their income, deductions, and credits. It includes important details that help determine the tax liability of the partnership. Understanding how to properly complete the Florida F1065sk1 Form is essential for compliance with state tax regulations.

-

How can airSlate SignNow assist with the Florida F1065sk1 Form?

airSlate SignNow provides a seamless platform for sending and eSigning the Florida F1065sk1 Form, making the process more efficient and convenient. Users can easily create, share, and securely sign their documents online, ensuring they comply with filing deadlines. This automation helps eliminate paperwork errors, saving time for businesses.

-

What are the costs associated with using airSlate SignNow for the Florida F1065sk1 Form?

airSlate SignNow offers flexible pricing plans tailored to different business needs, making it an affordable solution for handling the Florida F1065sk1 Form. Users can choose from various subscription options that fit their budget and document handling volume. Cost-effectiveness is a key benefit of using airSlate SignNow, particularly when managing multiple legal documents.

-

What features does airSlate SignNow offer for handling the Florida F1065sk1 Form?

airSlate SignNow includes features like eSigning, document templates, and cloud storage, which streamline the process of managing the Florida F1065sk1 Form. These features allow users to create professional documents quickly, ensure secure electronic signatures, and access their files from anywhere. The platform enhances workflow efficiency and reduces administrative burdens.

-

Is airSlate SignNow compliant with Florida's eSignature laws for the Florida F1065sk1 Form?

Yes, airSlate SignNow complies with Florida's eSignature laws, ensuring that signatures on the Florida F1065sk1 Form are legally valid and enforceable. The platform uses secure technology to protect users' data and maintains compliance with relevant regulations. This compliance gives users peace of mind when sending sensitive documents.

-

Can I integrate airSlate SignNow with other software for managing the Florida F1065sk1 Form?

Absolutely! airSlate SignNow integrates seamlessly with various third-party applications and software, allowing users to enhance their workflow while managing the Florida F1065sk1 Form. This means you can connect airSlate SignNow with CRM systems, accounting software, and more, simplifying document management and improving overall efficiency.

-

What are the benefits of using airSlate SignNow for the Florida F1065sk1 Form?

Using airSlate SignNow for the Florida F1065sk1 Form offers numerous benefits, including faster turnaround times, reduced paperwork, and improved accuracy. The platform simplifies document collaboration, allowing multiple stakeholders to review and sign files without unnecessary delays. Additionally, the user-friendly interface makes it accessible for everyone, regardless of technical skill.

Get more for Florida F1065sk1 Form

- Discovery interrogatories from defendant to plaintiff with production requests idaho form

- Discovery interrogatories divorce form

- Quitclaim deed trust to husband and wife idaho form

- Answer idaho form

- Quitclaim deed individual to four individuals idaho form

- Idaho husband wife 497305441 form

- Small claim form

- Heirship affidavit descent idaho form

Find out other Florida F1065sk1 Form

- eSign Minnesota Construction Purchase Order Template Safe

- Can I eSign South Dakota Doctors Contract

- eSign Mississippi Construction Rental Application Mobile

- How To eSign Missouri Construction Contract

- eSign Missouri Construction Rental Lease Agreement Easy

- How To eSign Washington Doctors Confidentiality Agreement

- Help Me With eSign Kansas Education LLC Operating Agreement

- Help Me With eSign West Virginia Doctors Lease Agreement Template

- eSign Wyoming Doctors Living Will Mobile

- eSign Wyoming Doctors Quitclaim Deed Free

- How To eSign New Hampshire Construction Rental Lease Agreement

- eSign Massachusetts Education Rental Lease Agreement Easy

- eSign New York Construction Lease Agreement Online

- Help Me With eSign North Carolina Construction LLC Operating Agreement

- eSign Education Presentation Montana Easy

- How To eSign Missouri Education Permission Slip

- How To eSign New Mexico Education Promissory Note Template

- eSign New Mexico Education Affidavit Of Heirship Online

- eSign California Finance & Tax Accounting IOU Free

- How To eSign North Dakota Education Rental Application