1098 Int Form Editable 2010

What is the 1098 Int Form Editable

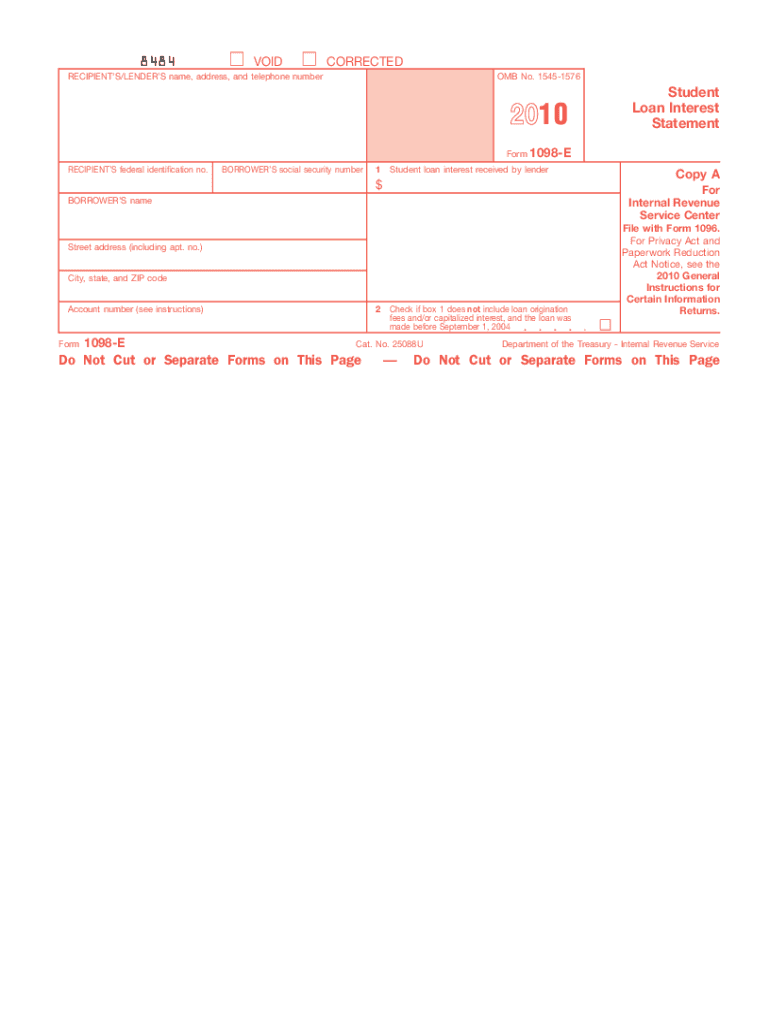

The 1098 Int Form Editable is a tax document used in the United States to report interest payments made by individuals to financial institutions. This form is particularly important for taxpayers who have paid interest on mortgages, student loans, or other types of loans during the tax year. The information provided on the form is essential for accurately reporting income and claiming potential deductions on tax returns. By utilizing an editable version of the 1098 Int Form, users can easily fill in their information digitally, ensuring accuracy and convenience.

How to use the 1098 Int Form Editable

Using the 1098 Int Form Editable involves several straightforward steps. First, access the editable form through a reliable digital platform. Once you have the form open, input the necessary details, including your name, address, and the interest amount paid. Ensure that all information is accurate to avoid issues during tax filing. After completing the form, review it thoroughly for any errors. Finally, save the document in a secure format, such as PDF, to maintain its integrity when submitting it to the IRS or your tax preparer.

Steps to complete the 1098 Int Form Editable

Completing the 1098 Int Form Editable can be done efficiently by following these steps:

- Open the editable form on your device.

- Fill in your personal information, including your name and Social Security number.

- Enter the payer's information, typically your lender or financial institution.

- Input the total interest paid during the tax year.

- Review all entered information for accuracy.

- Save the completed form in a secure format.

Legal use of the 1098 Int Form Editable

The 1098 Int Form Editable is legally recognized for tax reporting purposes in the United States. To ensure its legal validity, it is crucial to adhere to IRS guidelines when filling out the form. This includes providing accurate information and ensuring that the form is signed where required. Electronic signatures are acceptable under the ESIGN Act, provided that the signing process complies with established legal standards. By using a trusted digital platform for completion and submission, you can maintain compliance with applicable laws.

Filing Deadlines / Important Dates

Filing deadlines for the 1098 Int Form Editable align with the standard tax filing schedule in the United States. Typically, the form must be sent to the IRS by January thirty-first of the year following the tax year in question. Additionally, recipients of the form should receive their copies by the same date to ensure they can accurately report their interest payments on their tax returns. Being aware of these deadlines is essential to avoid penalties and ensure timely filing.

Who Issues the Form

The 1098 Int Form Editable is issued by financial institutions, such as banks, credit unions, and mortgage companies. These entities are responsible for reporting the interest payments made by borrowers during the tax year. If you have paid interest on a loan, you should receive this form from your lender, detailing the total amount of interest paid. It is important to keep this form for your records, as it is necessary for accurate tax reporting.

Quick guide on how to complete 1098 int form editable 2010

Effortlessly Prepare 1098 Int Form Editable on Any Device

Online document management has gained traction among businesses and individuals alike. It serves as an ideal environmentally friendly substitute for conventional printed and signed papers, allowing you to locate the right form and securely keep it online. airSlate SignNow equips you with all the necessary tools to quickly create, modify, and eSign your documents without delays. Handle 1098 Int Form Editable on any device with airSlate SignNow's Android or iOS applications and enhance any document-centric workflow today.

The Easiest Way to Modify and eSign 1098 Int Form Editable Effortlessly

- Obtain 1098 Int Form Editable and click on Get Form to begin.

- Utilize the tools we provide to complete your form.

- Emphasize pertinent sections of the documents or obscure sensitive details with tools that airSlate SignNow offers specifically for this purpose.

- Create your signature using the Sign tool, which takes mere seconds and holds the same legal validity as a traditional handwritten signature.

- Review the information and click on the Done button to save your modifications.

- Choose your preferred method of submitting your form, whether by email, text message (SMS), invitation link, or download it to your computer.

Eliminate concerns about lost or mislaid files, tedious form searching, or errors that necessitate printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device you choose. Edit and eSign 1098 Int Form Editable to ensure outstanding communication at every step of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 1098 int form editable 2010

Create this form in 5 minutes!

How to create an eSignature for the 1098 int form editable 2010

The way to make an eSignature for your PDF document online

The way to make an eSignature for your PDF document in Google Chrome

The way to make an electronic signature for signing PDFs in Gmail

How to make an electronic signature straight from your smart phone

The way to make an electronic signature for a PDF document on iOS

How to make an electronic signature for a PDF document on Android OS

People also ask

-

What is the 1098 Int Form Editable feature in airSlate SignNow?

The 1098 Int Form Editable feature allows users to modify and fill out the Internal Revenue Service (IRS) 1098 form efficiently. This functionality ensures that you can customize information pertinent to your financial reporting needs. By using airSlate SignNow, businesses can streamline the process of preparing this signNow tax document.

-

How does airSlate SignNow ensure the security of my 1098 Int Form Editable?

Security is a top priority for airSlate SignNow. Our platform implements advanced encryption protocols to protect sensitive data within your 1098 Int Form Editable. Additionally, we offer secure cloud storage and compliance with industry standards to ensure your documents remain safe and private.

-

Is there a cost associated with using the 1098 Int Form Editable feature?

airSlate SignNow offers competitive pricing plans that include access to the 1098 Int Form Editable feature. You can choose from various subscription options based on your business needs. To find the best plan for you, visit our pricing page for a comprehensive overview.

-

Can I integrate the 1098 Int Form Editable with other software?

Yes, airSlate SignNow provides seamless integrations with various software applications, enhancing the usability of the 1098 Int Form Editable. Whether you are using CRM systems, accounting software, or other business tools, our platform can connect with them to optimize your workflow.

-

How user-friendly is the 1098 Int Form Editable feature?

The 1098 Int Form Editable feature is designed to be intuitive and easy to use. With a user-friendly interface, even those with minimal technical skills can quickly navigate and complete their forms. Our goal is to make the document management process efficient and straightforward for all users.

-

What are the benefits of using airSlate SignNow for the 1098 Int Form Editable?

By using airSlate SignNow for the 1098 Int Form Editable, you can save time and reduce errors in your document preparation. The platform promotes a faster turnaround for signatures and offers convenient access from any device. This enhances productivity and allows you to focus on more critical business activities.

-

Can multiple users collaborate on the 1098 Int Form Editable?

Absolutely! airSlate SignNow allows multiple users to collaborate on the 1098 Int Form Editable simultaneously. This feature facilitates teamwork and enables your team to work together efficiently, ensuring that all necessary information is included and verified before final submission.

Get more for 1098 Int Form Editable

- Idaho deed form

- Affidavit service form

- Warranty deed to child reserving a life estate in the parents idaho form

- Warranty deed husband and wife to two individuals idaho form

- Discovery interrogatories from plaintiff to defendant with production requests idaho form

- Non military form

- Idaho custodial form

- Id custodial form

Find out other 1098 Int Form Editable

- How Do I eSign Hawaii Insurance Operating Agreement

- eSign Hawaii Insurance Stock Certificate Free

- eSign New Hampshire Lawers Promissory Note Template Computer

- Help Me With eSign Iowa Insurance Living Will

- eSign North Dakota Lawers Quitclaim Deed Easy

- eSign Ohio Lawers Agreement Computer

- eSign North Dakota Lawers Separation Agreement Online

- How To eSign North Dakota Lawers Separation Agreement

- eSign Kansas Insurance Moving Checklist Free

- eSign Louisiana Insurance Promissory Note Template Simple

- eSign Texas Lawers Contract Fast

- eSign Texas Lawers Lease Agreement Free

- eSign Maine Insurance Rental Application Free

- How Can I eSign Maryland Insurance IOU

- eSign Washington Lawers Limited Power Of Attorney Computer

- eSign Wisconsin Lawers LLC Operating Agreement Free

- eSign Alabama Legal Quitclaim Deed Online

- eSign Alaska Legal Contract Safe

- How To eSign Alaska Legal Warranty Deed

- eSign Alaska Legal Cease And Desist Letter Simple