Alaska Mining License Tax Form 2017

What is the Alaska Mining License Tax Form

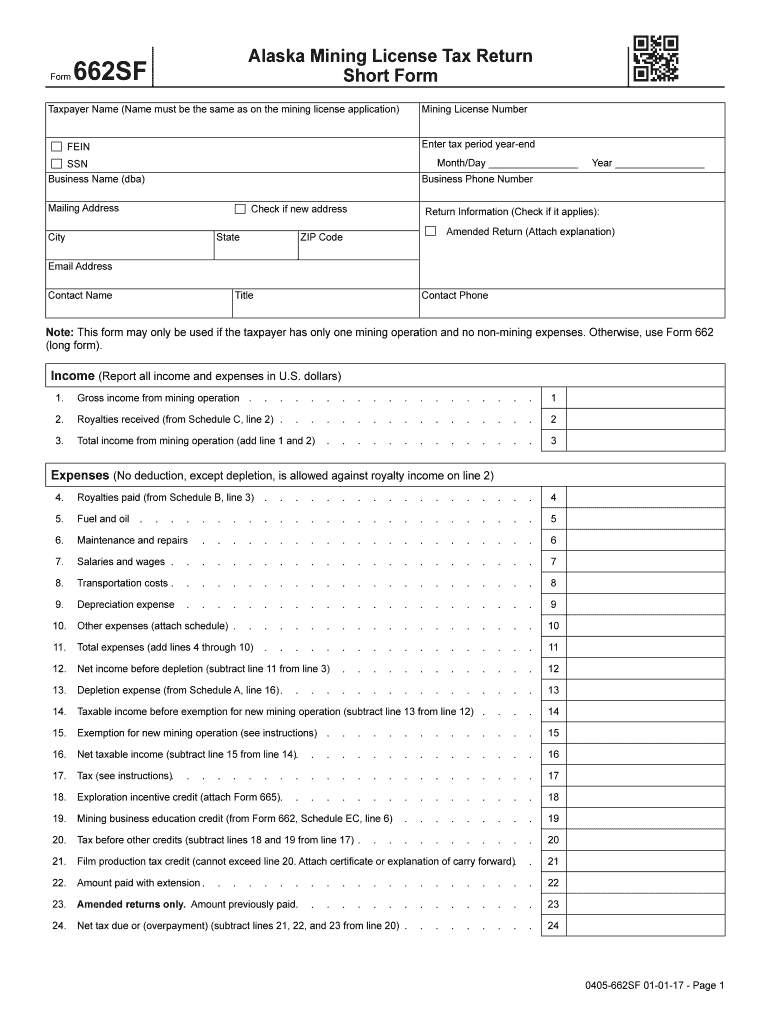

The Alaska Mining License Tax Form is a specialized tax document required for entities engaged in mining activities within the state of Alaska. This form serves to report the taxable income generated from mining operations and calculate the corresponding tax liability. It is essential for compliance with state tax regulations, ensuring that mining businesses contribute to the local economy. The form is officially designated as the Alaska 662SF and is specifically tailored for short-form reporting, making it accessible for smaller mining operations or those with limited activity.

How to use the Alaska Mining License Tax Form

To effectively use the Alaska Mining License Tax Form, businesses must first gather all relevant financial information regarding their mining activities. This includes revenue generated, operational costs, and any applicable deductions. Once the necessary data is compiled, the form should be filled out accurately, ensuring that all figures are correctly reported. After completing the form, it can be submitted electronically or via traditional mail, depending on the preferred submission method. Utilizing digital tools can streamline this process, ensuring compliance and reducing the likelihood of errors.

Steps to complete the Alaska Mining License Tax Form

Completing the Alaska Mining License Tax Form involves several key steps:

- Gather financial records related to mining operations, including income and expenses.

- Obtain the latest version of the Alaska 662SF form from the appropriate state department.

- Fill out the form, ensuring all sections are completed accurately, including income, deductions, and tax calculations.

- Review the form for any errors or omissions before submission.

- Submit the completed form by the specified deadline, either electronically or by mail.

Legal use of the Alaska Mining License Tax Form

The legal use of the Alaska Mining License Tax Form is governed by state tax laws. To be considered valid, the form must be filled out correctly and submitted on time. Additionally, e-signatures are recognized under U.S. law, provided that they comply with the ESIGN and UETA acts. This means that businesses can utilize electronic means to sign and submit the form, ensuring that it meets legal standards for authenticity and integrity.

Filing Deadlines / Important Dates

Filing deadlines for the Alaska Mining License Tax Form are critical for compliance. Typically, the form must be submitted by March 31 of the year following the tax year being reported. It is important for businesses to be aware of any changes to these deadlines, as late submissions can result in penalties. Keeping a calendar of important dates can help ensure timely filing and avoid unnecessary complications.

Required Documents

When completing the Alaska Mining License Tax Form, several documents may be required to support the information reported. These documents include:

- Financial statements detailing income and expenses from mining operations.

- Records of any deductions claimed, such as operational costs or investments.

- Previous tax returns, if applicable, to provide context and continuity.

Having these documents readily available can facilitate a smoother filing process and ensure accuracy in reporting.

Quick guide on how to complete alaska mining license tax form

Prepare Alaska Mining License Tax Form effortlessly on any device

Online document management has gained signNow traction among businesses and individuals. It offers an ideal environmentally friendly substitute for traditional printed and signed papers, as you can obtain the necessary form and securely store it online. airSlate SignNow equips you with all the resources required to create, modify, and eSign your documents rapidly without delays. Handle Alaska Mining License Tax Form on any device using airSlate SignNow Android or iOS applications and enhance any document-related operation today.

How to modify and eSign Alaska Mining License Tax Form with ease

- Locate Alaska Mining License Tax Form and then click Get Form to begin.

- Make use of the tools we offer to fill out your document.

- Highlight pertinent sections of your documents or conceal sensitive data with tools that airSlate SignNow provides specifically for that purpose.

- Produce your eSignature using the Sign feature, which takes mere seconds and carries the same legal authority as a conventional wet ink signature.

- Verify all the information and then click on the Done button to save your modifications.

- Select how you would like to share your form, via email, text message (SMS), or invitation link, or download it to your computer.

Forget about lost or misplaced documents, tedious form searches, or errors that necessitate printing new document copies. airSlate SignNow addresses all your document management needs with just a few clicks from your preferred device. Modify and eSign Alaska Mining License Tax Form and ensure excellent communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct alaska mining license tax form

Create this form in 5 minutes!

How to create an eSignature for the alaska mining license tax form

The way to generate an eSignature for your PDF document in the online mode

The way to generate an eSignature for your PDF document in Chrome

How to make an electronic signature for putting it on PDFs in Gmail

The best way to generate an electronic signature right from your mobile device

The way to create an electronic signature for a PDF document on iOS devices

The best way to generate an electronic signature for a PDF on Android devices

People also ask

-

What is the Alaska mining license tax return?

The Alaska mining license tax return is a tax form that businesses engaged in mining activities must file to report their income and pay taxes to the state. It's crucial for compliance with local regulations and to avoid potential penalties. Understanding this form is essential for any mining operation in Alaska.

-

Why do I need to file an Alaska mining license tax return?

Filing an Alaska mining license tax return is mandatory for any business involved in mining operations in Alaska. It ensures that you are fulfilling state tax obligations and supports public services in the region. Additionally, timely filing helps in maintaining good standing with state authorities.

-

How can airSlate SignNow help with the filing process?

airSlate SignNow simplifies the filing process for the Alaska mining license tax return by allowing you to create, send, and eSign necessary documents effortlessly. Our intuitive platform streamlines the workflow and ensures that your forms are accurately completed and submitted on time. Plus, you can access your documents anytime, anywhere.

-

Is there a fee for using airSlate SignNow for my tax return?

Yes, airSlate SignNow offers various pricing plans to accommodate different business needs, including features that help you manage your Alaska mining license tax return efficiently. Our plans are designed to be cost-effective while delivering excellent value through our suite of eSignature services. Explore our pricing to find the right fit for your business.

-

Can I integrate airSlate SignNow with my existing accounting software?

Absolutely! airSlate SignNow seamlessly integrates with popular accounting software, allowing you to manage your Alaska mining license tax return directly within your existing systems. This integration enhances your workflow by reducing manual data entry and increasing overall efficiency. Check our integration list to see if your software is supported.

-

What features does airSlate SignNow offer for tax document management?

airSlate SignNow provides several features for effective tax document management, including customizable templates, automatic reminders, and secure document storage. These tools help simplify the preparation and filing of your Alaska mining license tax return, ensuring you never miss a deadline. Enjoy the convenience of a digital workspace tailored to your needs.

-

How can I ensure my Alaska mining license tax return is accurate?

To ensure accuracy when filing your Alaska mining license tax return, utilize airSlate SignNow's comprehensive document review features. You can collaborate with team members and check for errors within the platform before submission. This attention to detail helps prevent issues and ensures compliance with Alaska’s tax regulations.

Get more for Alaska Mining License Tax Form

- Supplier classification form

- Concealed handgun permit application statepatrol nebraska form

- Va form 1107 66289291

- Construction change directive template form

- Adot release form

- Parental consent letter for audition form

- Change of address form mail tep barnett usa llc

- Hqrse for overnight delivery to aqha 1600 form

Find out other Alaska Mining License Tax Form

- eSign Iowa Construction Quitclaim Deed Now

- How Do I eSign Iowa Construction Quitclaim Deed

- eSign Louisiana Doctors Letter Of Intent Fast

- eSign Maine Doctors Promissory Note Template Easy

- eSign Kentucky Construction Claim Online

- How Can I eSign Maine Construction Quitclaim Deed

- eSign Colorado Education Promissory Note Template Easy

- eSign North Dakota Doctors Affidavit Of Heirship Now

- eSign Oklahoma Doctors Arbitration Agreement Online

- eSign Oklahoma Doctors Forbearance Agreement Online

- eSign Oregon Doctors LLC Operating Agreement Mobile

- eSign Hawaii Education Claim Myself

- eSign Hawaii Education Claim Simple

- eSign Hawaii Education Contract Simple

- eSign Hawaii Education NDA Later

- How To eSign Hawaii Education NDA

- How Do I eSign Hawaii Education NDA

- eSign Hawaii Education Arbitration Agreement Fast

- eSign Minnesota Construction Purchase Order Template Safe

- Can I eSign South Dakota Doctors Contract