Florida Corporate Tax Form 2018

What is the Florida Corporate Tax Form

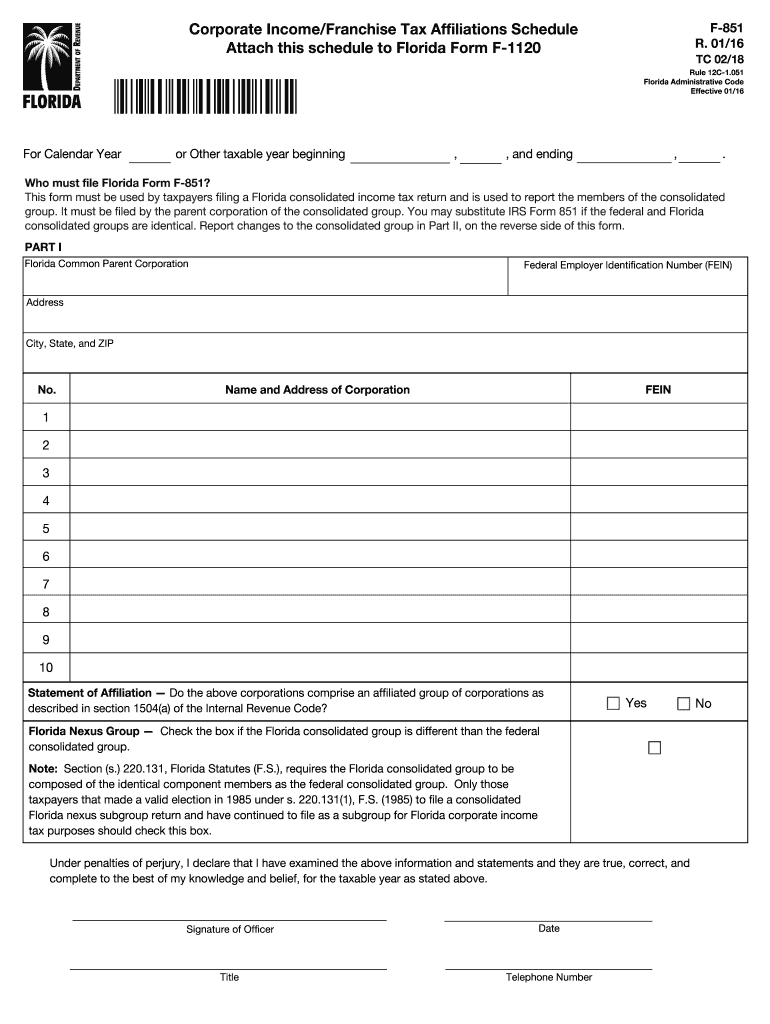

The Florida Corporate Tax Form, commonly referred to as the Florida franchise tax form, is a crucial document for businesses operating within the state. It is used to report corporate income and calculate the tax owed to the state of Florida. This form is essential for corporations, limited liability companies (LLCs), and partnerships that are subject to Florida's corporate income tax regulations. Understanding this form is vital for compliance and ensuring that businesses meet their tax obligations accurately.

Steps to Complete the Florida Corporate Tax Form

Completing the Florida Corporate Tax Form involves several key steps to ensure accuracy and compliance. The process typically includes:

- Gathering Financial Information: Collect all necessary financial documents, including income statements, balance sheets, and any relevant deductions.

- Filling Out the Form: Input the required information into the Florida franchise tax form, ensuring that all data is accurate and complete.

- Reviewing for Errors: Double-check all entries for accuracy, as mistakes can lead to penalties or delays in processing.

- Submitting the Form: Choose your preferred submission method, whether online, by mail, or in person, and ensure it is sent by the deadline.

Legal Use of the Florida Corporate Tax Form

The Florida Corporate Tax Form is legally binding when filled out and submitted according to state regulations. It is essential to comply with all legal requirements to avoid potential penalties. The form serves as an official record of a corporation's income and tax obligations, and it must be filed annually. Adhering to the guidelines set forth by the Florida Department of Revenue ensures that the form is recognized as valid in legal contexts.

Filing Deadlines / Important Dates

Filing deadlines for the Florida Corporate Tax Form are critical for compliance. Generally, the form is due on the first day of the fourth month following the end of the corporation's fiscal year. For corporations operating on a calendar year, this typically means the deadline is April 1. It is important to stay informed about any changes to these dates or extensions that may be available, as timely submission is necessary to avoid penalties.

Required Documents

When completing the Florida Corporate Tax Form, several documents are necessary to ensure accurate reporting. These typically include:

- Financial statements, including income statements and balance sheets.

- Records of any deductions or credits claimed.

- Previous tax returns, if applicable, for reference.

- Documentation of any changes in ownership or business structure.

Form Submission Methods

The Florida Corporate Tax Form can be submitted through various methods to accommodate different preferences. Businesses can choose to file online through the Florida Department of Revenue's website, which often provides a faster processing time. Alternatively, the form can be mailed to the appropriate address or submitted in person at designated locations. Each method has its own considerations regarding processing times and confirmation of receipt.

Quick guide on how to complete florida corporate tax form

Complete Florida Corporate Tax Form effortlessly on any device

Digital document management has become popular among businesses and individuals. It offers an ideal environmentally friendly alternative to traditional printed and signed papers, allowing you to access the correct form and securely store it online. airSlate SignNow equips you with all the necessary tools to create, edit, and eSign your documents swiftly without delays. Handle Florida Corporate Tax Form on any device using airSlate SignNow's Android or iOS applications and optimize any document-related task today.

How to edit and eSign Florida Corporate Tax Form effortlessly

- Locate Florida Corporate Tax Form and then click Get Form to begin.

- Utilize the tools we offer to fill out your document.

- Emphasize important sections of your documents or obscure sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Create your signature using the Sign tool, which takes mere seconds and carries the same legal authority as a conventional wet ink signature.

- Review all details and then click on the Done button to save your changes.

- Choose how you wish to send your form, via email, SMS, or invitation link, or download it to your computer.

Forget about lost or misplaced documents, tedious form searching, or mistakes that require printing new copies. airSlate SignNow caters to all your document management needs with just a few clicks from any device of your choice. Edit and eSign Florida Corporate Tax Form and ensure excellent communication at every stage of the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct florida corporate tax form

Create this form in 5 minutes!

How to create an eSignature for the florida corporate tax form

The way to make an electronic signature for your PDF document online

The way to make an electronic signature for your PDF document in Google Chrome

The best way to make an electronic signature for signing PDFs in Gmail

The best way to make an eSignature from your smart phone

The way to generate an electronic signature for a PDF document on iOS

The best way to make an eSignature for a PDF file on Android OS

People also ask

-

What is the Florida franchise tax form?

The Florida franchise tax form is a document that businesses in Florida must file annually to report their gross receipts and calculate their tax liability. It is essential for maintaining compliance with state regulations and can affect a company's standing. Using the right tools, like airSlate SignNow, can streamline this process.

-

How can airSlate SignNow help with the Florida franchise tax form?

airSlate SignNow provides an easy-to-use platform for creating, sending, and eSigning the Florida franchise tax form. This simplifies the filing process and ensures that you have all necessary signatures collected efficiently. Plus, our system keeps your documents organized and easily accessible.

-

What are the costs associated with using airSlate SignNow for tax forms?

airSlate SignNow offers competitive pricing plans to suit businesses of any size. You can choose from various tiers based on features relevant to managing documents such as the Florida franchise tax form. With such cost-effective solutions, you can save time and money while ensuring compliance.

-

Are there any features specifically for handling tax documents on airSlate SignNow?

Yes, airSlate SignNow includes features like custom templates, automated workflows, and document tracking, which are ideal for handling tax documents such as the Florida franchise tax form. These features help ensure you never miss a deadline and maintain accurate records. This level of efficiency can greatly enhance your tax filing experience.

-

Can I integrate airSlate SignNow with other accounting software for managing my Florida franchise tax form?

Absolutely! airSlate SignNow easily integrates with various accounting and financial software, enabling seamless management of the Florida franchise tax form. This integration allows for automatic data entry and document retrieval, making the filing process much smoother and more efficient.

-

What are the benefits of eSigning the Florida franchise tax form with airSlate SignNow?

eSigning the Florida franchise tax form through airSlate SignNow speeds up the signing process and provides a secure, legally binding signature. This minimizes paperwork and allows for quick turnaround times, which is especially beneficial as tax deadlines approach. You'll also enjoy increased convenience and reduced administrative burden.

-

Is it safe to use airSlate SignNow for my tax documents?

Yes, airSlate SignNow prioritizes the security of your documents, including the Florida franchise tax form. We use advanced encryption technology to assure that your data remains confidential and secure during transmission and storage. You can trust that your sensitive information is protected with us.

Get more for Florida Corporate Tax Form

- Dd2813 24428600 form

- American specialty health ash patient progress po box form

- Im23 form

- Title 4 letter form

- Rem application form

- Cit 0010 f confirmation de la citoyennet canadienne du ou des cic gc form

- Certification of existing sanitary residential suffolk county suffolkcountyny form

- Downloadable form ls 57

Find out other Florida Corporate Tax Form

- eSign Alaska Plumbing Memorandum Of Understanding Safe

- eSign Kansas Orthodontists Contract Online

- eSign Utah Legal Last Will And Testament Secure

- Help Me With eSign California Plumbing Business Associate Agreement

- eSign California Plumbing POA Mobile

- eSign Kentucky Orthodontists Living Will Mobile

- eSign Florida Plumbing Business Plan Template Now

- How To eSign Georgia Plumbing Cease And Desist Letter

- eSign Florida Plumbing Credit Memo Now

- eSign Hawaii Plumbing Contract Mobile

- eSign Florida Plumbing Credit Memo Fast

- eSign Hawaii Plumbing Claim Fast

- eSign Hawaii Plumbing Letter Of Intent Myself

- eSign Hawaii Plumbing Letter Of Intent Fast

- Help Me With eSign Idaho Plumbing Profit And Loss Statement

- eSign Illinois Plumbing Letter Of Intent Now

- eSign Massachusetts Orthodontists Last Will And Testament Now

- eSign Illinois Plumbing Permission Slip Free

- eSign Kansas Plumbing LLC Operating Agreement Secure

- eSign Kentucky Plumbing Quitclaim Deed Free