Georgia Assignment of Contract for Deed by Seller Form

What is the Georgia Assignment of Contract for Deed by Seller

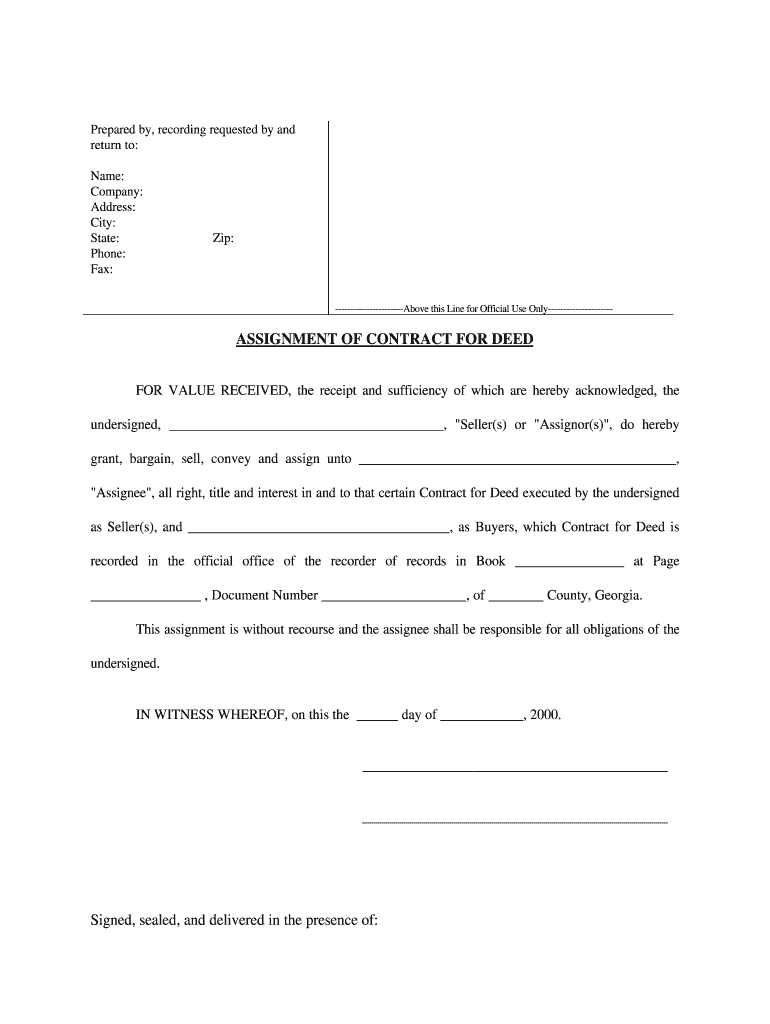

The Georgia Assignment of Contract for Deed by Seller is a legal document that facilitates the transfer of rights and obligations from one party to another in a real estate transaction. This form is particularly relevant when a seller wishes to assign their interest in a property contract to another buyer. The assignment allows the new buyer to step into the shoes of the original seller, maintaining the terms of the existing contract while ensuring that all parties involved are aware of the change. Understanding this form is crucial for ensuring compliance with state laws and protecting the interests of all parties involved.

Key Elements of the Georgia Assignment of Contract for Deed by Seller

Several key elements must be included in the Georgia Assignment of Contract for Deed by Seller to ensure its legality and effectiveness:

- Parties Involved: Clearly identify the original seller and the new buyer who will assume the contract.

- Description of the Property: Include a detailed description of the property being assigned, including the address and any relevant identifiers.

- Terms of the Original Contract: Reference the original contract, outlining any specific terms or conditions that will remain in effect after the assignment.

- Signatures: Both the original seller and the new buyer must sign the document to validate the assignment.

- Date of Assignment: Clearly indicate the date on which the assignment takes effect.

Steps to Complete the Georgia Assignment of Contract for Deed by Seller

Completing the Georgia Assignment of Contract for Deed by Seller involves several important steps:

- Review the Original Contract: Ensure that the original contract allows for assignment and understand its terms.

- Gather Necessary Information: Collect all relevant details about the property, parties involved, and terms of the original contract.

- Draft the Assignment Document: Use a template or create a document that includes all key elements required for the assignment.

- Obtain Signatures: Both the seller and the new buyer must sign the document in the presence of a witness or notary if required.

- Distribute Copies: Provide copies of the signed assignment to all parties involved and retain a copy for personal records.

Legal Use of the Georgia Assignment of Contract for Deed by Seller

The legal use of the Georgia Assignment of Contract for Deed by Seller is governed by state laws that dictate how property contracts can be assigned. It is important for parties to ensure that the assignment complies with any local regulations and that it is properly executed to avoid disputes. Failure to adhere to these legal requirements may result in the assignment being deemed invalid, which could lead to complications in the transaction. Consulting with a legal professional is advisable to navigate any complexities associated with the assignment process.

Examples of Using the Georgia Assignment of Contract for Deed by Seller

There are various scenarios in which the Georgia Assignment of Contract for Deed by Seller may be utilized:

- Investment Opportunities: An investor may wish to assign a property contract to another buyer to capitalize on a lucrative deal.

- Change of Plans: A seller may decide to assign their contract due to personal circumstances, such as relocation or financial changes.

- Joint Ventures: In partnerships, one party may assign their interest in a property to another partner to streamline the transaction process.

State-Specific Rules for the Georgia Assignment of Contract for Deed by Seller

Georgia has specific rules governing the assignment of contracts, including the requirement that assignments must be made in writing and signed by the parties involved. Additionally, it is essential to ensure that the original contract permits assignment, as some contracts may contain clauses that restrict or prohibit this action. Understanding these state-specific rules is vital for ensuring that the assignment is legally binding and enforceable.

Quick guide on how to complete georgia assignment of contract for deed by seller

Complete and submit your Georgia Assignment Of Contract For Deed By Seller swiftly

Effective tools for digital document interchange and validation are essential for optimizing processes and ensuring the continuous growth of your forms. When managing legal documents and signing a Georgia Assignment Of Contract For Deed By Seller, the right signature solution can save you a signNow amount of time and paper with every submission.

Locate, complete, modify, sign, and distribute your legal documents with airSlate SignNow. This platform provides everything necessary to establish efficient document submission workflows. Its vast collection of legal forms and intuitive navigation will assist you in obtaining your Georgia Assignment Of Contract For Deed By Seller promptly, and the editor featuring our signature functionality will enable you to complete and authorize it instantly.

Sign your Georgia Assignment Of Contract For Deed By Seller in a few straightforward steps

- Locate the Georgia Assignment Of Contract For Deed By Seller you require in our library using the search or catalog pages.

- Review the form details and preview it to confirm it meets your needs and state regulations.

- Click Obtain form to access it for modification.

- Complete the form using the all-inclusive toolbar.

- Examine the information you provided and click the Authorize tool to validate your document.

- Select one of three options to add your signature.

- Finalize your edits and save the document in your files, then download it to your device or share it right away.

Simplify every phase of your document preparation and validation with airSlate SignNow. Explore a more effective online solution that has every aspect of managing your paperwork thoroughly addressed.

Create this form in 5 minutes or less

FAQs

-

How do I fill out form 26QB for TDS in case of more than one buyer and seller?

Hi,Please select Yes in the column of Whether more than one Buyer/seller as applicable, and enter the Primary Member details in the Address of Transferee/Transferor & no need of secondary person details.The reason to include this is to know whether the agreement includes more than one buyer/seller, so the option is enabled.Hope it is useful.

-

For the new 2016 W8-BEN-E form to be filled out by companies doing business as a seller on the Amazon USA website, do I fill out a U.S. TIN, a GIIN, or a foreign TIN?

You will need to obtain an EIN for the BC corporation; however, I would imagine a W8-BEN is not appropriate for you, if you are selling through Amazon FBA. The FBA program generally makes Amazon your agent in the US, which means any of your US source income, ie anything sold to a US customer is taxable in the US. W8-BEN is asserting that you either have no US sourced income or that income is exempt under the US/Canadian tax treaty. Based on the limited knowledge I have of your situation, but if you are selling through the FBA program, I would say you don’t qualify to file a W8-BEN, but rather should be completing a W8-ECI and your BC corporation should be filing an 1120F to report your US effectively connected income.

-

How likely is it for me to win a lawsuit where a seller wants to back out of a signed commercial real estate offer/contract?

Obligatory legalese: I’m not a lawyer and you should consult one for legal advice.Generally speaking, if you have performed as specified in the contract, including putting in deposit, removing any applicable contingencies, and informing seller of your intent to close, then I think you have a pretty good case.However, in practical terms, it’s not clear if you should go to court. Lawyers are expensive and, depending on the contract and the state you’re in, you may not be able to get back your expenses, even if you win. And any case, even a winning one, is going to take a long time to complete; is it really worth your time and aggravation?

-

When and how are the assignments for IGNOU CHR to be submitted for the December 2018 TEE? How and when to fill out the examination form? Where do I look for the datasheet?

First download the assignments from IGNOU - The People's University website and write them with A4 size paper then submitted it in your study center.check the above website you will find a link that TEE from fill up for dec 2018 after got the link you will fill your tee from online.Remember while filling your TEE you should put tick mark on the box like this;Are you submitted assignments: yes[ ] No[ ]

-

As one of the cofounders of a multi-member LLC taxed as a partnership, how do I pay myself for work I am doing as a contractor for the company? What forms do I need to fill out?

First, the LLC operates as tax partnership (“TP”) as the default tax status if no election has been made as noted in Treasury Regulation Section 301.7701-3(b)(i). For legal purposes, we have a LLC. For tax purposes we have a tax partnership. Since we are discussing a tax issue here, we will discuss the issue from the perspective of a TP.A partner cannot under any circumstances be an employee of the TP as Revenue Ruling 69-184 dictated such. And, the 2016 preamble to Temporary Treasury Regulation Section 301.7701-2T notes the Treasury still supports this revenue ruling.Though a partner can engage in a transaction with the TP in a non partner capacity (Section 707a(a)).A partner receiving a 707(a) payment from the partnership receives the payment as any stranger receives a payment from the TP for services rendered. This partner gets treated for this transaction as if he/she were not a member of the TP (Treasury Regulation Section 1.707-1(a).As an example, a partner owns and operates a law firm specializing in contract law. The TP requires advice on terms and creation for new contracts the TP uses in its business with clients. This partner provides a bid for this unique job and the TP accepts it. Here, the partner bills the TP as it would any other client, and the partner reports the income from the TP client job as he/she would for any other client. The TP records the job as an expense and pays the partner as it would any other vendor. Here, I am assuming the law contract job represents an expense versus a capital item. Of course, the partner may have a law corporation though the same principle applies.Further, a TP can make fixed payments to a partner for services or capital — called guaranteed payments as noted in subsection (c).A 707(c) guaranteed payment shows up in the membership agreement drawn up by the business attorney. This payment provides a service partner with a guaranteed payment regardless of the TP’s income for the year as noted in Treasury Regulation Section 1.707-1(c).As an example, the TP operates an exclusive restaurant. Several partners contribute capital for the venture. The TP’s key service partner is the chef for the restaurant. And, the whole restaurant concept centers on this chef’s experience and creativity. The TP’s operating agreement provides the chef receives a certain % profit interest but as a minimum receives yearly a fixed $X guaranteed payment regardless of TP’s income level. In the first year of operations the TP has low profits as expected. The chef receives the guaranteed $X payment as provided in the membership agreement.The TP allocates the guaranteed payment to the capital interest partners on their TP k-1s as business expense. And, the TP includes the full $X guaranteed payment as income on the chef’s K-1. Here, the membership agreement demonstrates the chef only shares in profits not losses. So, the TP only allocates the guaranteed expense to those partners responsible for making up losses (the capital partners) as noted in Treasury Regulation Section 707-1(c) Example 3. The chef gets no allocation for the guaranteed expense as he/she does not participate in losses.If we change the situation slightly, we may change the tax results. If the membership agreement says the chef shares in losses, we then allocate a portion of the guaranteed expense back to the chef following the above treasury regulation.As a final note, a TP return requires knowledge of primary tax law if the TP desires filing a completed an accurate partnership tax return.I have completed the above tax analysis based on primary partnership tax law. If the situation changes in any manner, the tax outcome may change considerably. www.rst.tax

-

How can I get a lot of people to fill out my Google form survey for a research paper?

First of all, to get a lot of responses for your survey don't forget to follow main rules of creating a survey. Here are some of them:Create and design an invitation page, sett the information about why it is so important for you to get the answers there; also write the purpose of your survey.Make your survey short. Remember that people spend their time answering questions.Preset your goal, decide what information you want to get in the end. Prepare list of questions, which would be the most important for you.Give your respondents enough time to answer a survey.Don't forget to say "Thank you!", be polite.Besides, if you want to get more responses, you can use these tips:1.The first one is to purchase responses from survey panel. You can use MySurveyLab’s survey panel for it. In this case you will get reliable and useful results. You can read more about it here.2.If you don’t want to spent money for responses, you can use the second solution. The mentioned tool enables sharing the survey via different channels: email (invitations and e-mail embedded surveys, SMS, QR codes, as a link.You can share the link on different social media, like Twitter, Facebook, Facebook groups, different forums could be also useful, Pinterest, LinkedIn, VKontakte and so on… I think that if you use all these channels, you could get planned number of responses.Hope to be helpful! Good luck!

-

A Data Entry Operator has been asked to fill 1000 forms. He fills 50 forms by the end of half-an hour, when he is joined by another steno who fills forms at the rate of 90 an hour. The entire work will be carried out in how many hours?

Work done by 1st person = 100 forms per hourWork done by 2nd person = 90 forms per hourSo, total work in 1 hour would be = 190 forms per hourWork done in 5hours = 190* 5 = 950Now, remaining work is only 50 formsIn 1 hour or 60minutes, 190 forms are filled and 50 forms will be filled in = 60/190 * 50 = 15.7minutes or 16minutes (approximaty)Total time = 5hours 16minutes

Create this form in 5 minutes!

How to create an eSignature for the georgia assignment of contract for deed by seller

How to create an eSignature for your Georgia Assignment Of Contract For Deed By Seller in the online mode

How to create an electronic signature for your Georgia Assignment Of Contract For Deed By Seller in Chrome

How to generate an eSignature for signing the Georgia Assignment Of Contract For Deed By Seller in Gmail

How to make an eSignature for the Georgia Assignment Of Contract For Deed By Seller straight from your mobile device

How to generate an electronic signature for the Georgia Assignment Of Contract For Deed By Seller on iOS devices

How to make an eSignature for the Georgia Assignment Of Contract For Deed By Seller on Android OS

People also ask

-

What is a Georgia Assignment Of Contract For Deed By Seller?

A Georgia Assignment Of Contract For Deed By Seller is a legal document that allows a seller to transfer their rights and obligations under a contract for deed to another party. This assignment can be crucial in real estate transactions, ensuring that the new buyer can fulfill the terms of the original agreement. Understanding this document is essential for smooth property transactions in Georgia.

-

How can airSlate SignNow help with the Georgia Assignment Of Contract For Deed By Seller?

airSlate SignNow simplifies the process of creating and signing a Georgia Assignment Of Contract For Deed By Seller. With our easy-to-use platform, you can quickly generate, send, and eSign documents securely. This streamlines your transactions, saving time and reducing paperwork hassle.

-

What are the key features of airSlate SignNow for managing Georgia Assignment Of Contract For Deed By Seller?

AirSlate SignNow offers features such as customizable templates, secure cloud storage, and real-time tracking for your Georgia Assignment Of Contract For Deed By Seller. These tools enhance efficiency and ensure that your documents are organized and accessible whenever you need them.

-

Is there a cost associated with using airSlate SignNow for Georgia Assignment Of Contract For Deed By Seller?

Yes, airSlate SignNow offers various pricing plans to cater to different business needs, including options for managing Georgia Assignment Of Contract For Deed By Seller. Each plan provides a range of features, allowing you to choose the best fit for your budget and requirements.

-

Can I integrate airSlate SignNow with other software for my Georgia Assignment Of Contract For Deed By Seller?

Absolutely! AirSlate SignNow can seamlessly integrate with various applications to enhance your workflow. This includes CRM systems and document management tools, making it easier to handle your Georgia Assignment Of Contract For Deed By Seller alongside your existing processes.

-

How secure is airSlate SignNow when handling Georgia Assignment Of Contract For Deed By Seller?

AirSlate SignNow prioritizes security by employing advanced encryption protocols to protect your data. When you manage a Georgia Assignment Of Contract For Deed By Seller using our platform, you can trust that your documents are safe and compliant with legal standards.

-

What benefits does eSigning offer for Georgia Assignment Of Contract For Deed By Seller?

eSigning your Georgia Assignment Of Contract For Deed By Seller provides numerous benefits, including speed and convenience. It allows parties to sign documents from anywhere, reducing delays and expediting the closing process, which is vital in real estate transactions.

Get more for Georgia Assignment Of Contract For Deed By Seller

Find out other Georgia Assignment Of Contract For Deed By Seller

- Help Me With eSign Idaho Plumbing Profit And Loss Statement

- eSign Illinois Plumbing Letter Of Intent Now

- eSign Massachusetts Orthodontists Last Will And Testament Now

- eSign Illinois Plumbing Permission Slip Free

- eSign Kansas Plumbing LLC Operating Agreement Secure

- eSign Kentucky Plumbing Quitclaim Deed Free

- eSign Legal Word West Virginia Online

- Can I eSign Wisconsin Legal Warranty Deed

- eSign New Hampshire Orthodontists Medical History Online

- eSign Massachusetts Plumbing Job Offer Mobile

- How To eSign Pennsylvania Orthodontists Letter Of Intent

- eSign Rhode Island Orthodontists Last Will And Testament Secure

- eSign Nevada Plumbing Business Letter Template Later

- eSign Nevada Plumbing Lease Agreement Form Myself

- eSign Plumbing PPT New Jersey Later

- eSign New York Plumbing Rental Lease Agreement Simple

- eSign North Dakota Plumbing Emergency Contact Form Mobile

- How To eSign North Dakota Plumbing Emergency Contact Form

- eSign Utah Orthodontists Credit Memo Easy

- How To eSign Oklahoma Plumbing Business Plan Template