Form 1040a for 2007

What is the Form 1040a For

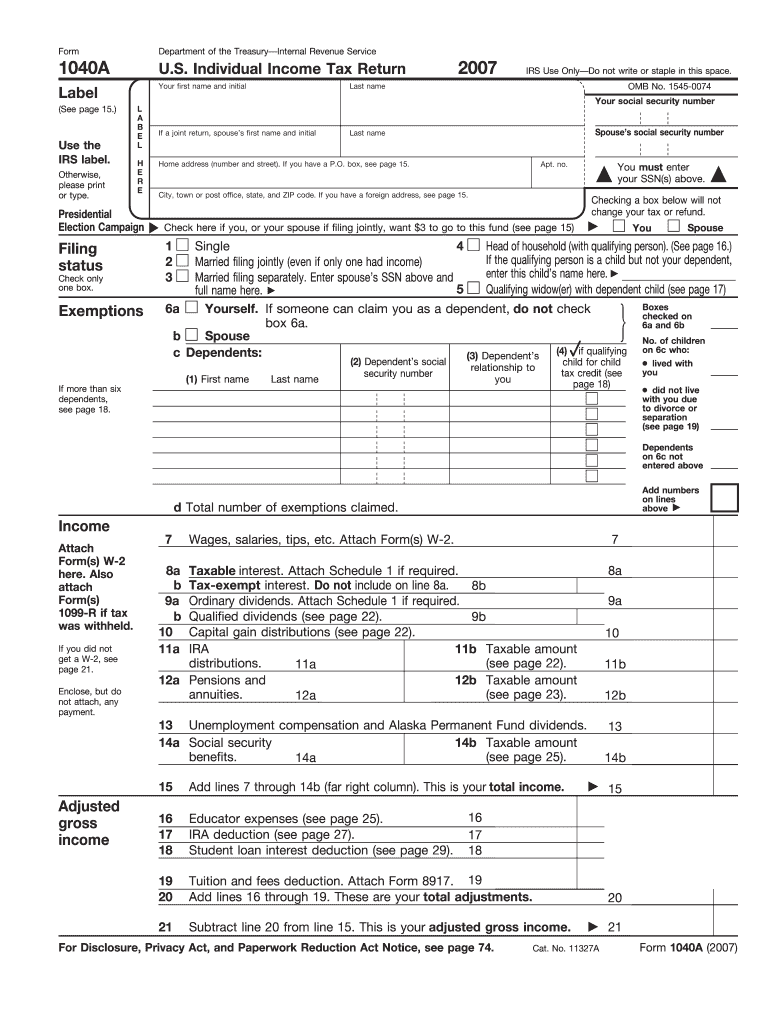

The Form 1040A is a simplified version of the standard Form 1040, designed for individual taxpayers in the United States. It allows for the reporting of income, deductions, and credits in a more straightforward manner. Taxpayers who meet specific criteria, such as having a taxable income below a certain threshold or not itemizing deductions, can use this form. The Form 1040A can accommodate various income sources, including wages, salaries, and certain types of interest and dividends, making it suitable for many individuals and families.

How to use the Form 1040a For

Using the Form 1040A involves several steps to ensure accurate completion. First, gather all necessary financial documents, such as W-2 forms, interest statements, and any other income records. Next, fill out the form by entering personal information, including your name, address, and Social Security number. Report your income in the designated sections, and apply any eligible deductions and credits. Finally, review the completed form for accuracy before submitting it to the IRS. The Form 1040A is designed to streamline the filing process, making it easier for taxpayers to report their financial information.

Steps to complete the Form 1040a For

Completing the Form 1040A involves a series of clear steps:

- Gather all necessary documents, including W-2s, 1099s, and other income statements.

- Fill in your personal details, such as your name, address, and Social Security number.

- Report your income by entering amounts from your documents into the appropriate sections of the form.

- Claim any deductions and credits that apply to your situation, which can help reduce your taxable income.

- Double-check all entries for accuracy and completeness.

- Sign and date the form before submitting it to the IRS.

Legal use of the Form 1040a For

The Form 1040A is legally valid when completed correctly and submitted by the appropriate deadlines. It is essential to ensure that all information is accurate, as discrepancies can lead to penalties or audits. The form must be signed by the taxpayer, and if filing jointly, both spouses must sign. Additionally, e-filing the Form 1040A through an authorized platform ensures compliance with IRS regulations and provides an electronic record of submission.

Filing Deadlines / Important Dates

Taxpayers must be aware of the critical deadlines associated with the Form 1040A. Typically, the deadline for filing individual tax returns is April 15 of each year. If this date falls on a weekend or holiday, the deadline may be extended to the next business day. Taxpayers can also request an extension to file, but it is important to note that any taxes owed must still be paid by the original deadline to avoid penalties and interest.

Form Submission Methods (Online / Mail / In-Person)

The Form 1040A can be submitted through various methods, providing flexibility for taxpayers. The most efficient way is to e-file through an IRS-approved software program, which allows for quick processing and confirmation of receipt. Alternatively, taxpayers can print the completed form and mail it to the appropriate IRS address, depending on their state of residence. In-person submissions are generally not available, but taxpayers can visit local IRS offices for assistance if needed.

Quick guide on how to complete form 1040a for 2007

Complete Form 1040a For effortlessly on any device

Online document management has become increasingly popular among businesses and individuals. It offers an ideal eco-friendly alternative to conventional printed and signed documents, allowing you to obtain the correct form and securely store it online. airSlate SignNow provides all the tools necessary to create, modify, and eSign your documents quickly without delays. Manage Form 1040a For on any device using airSlate SignNow's Android or iOS applications and streamline any document-related processes today.

How to edit and eSign Form 1040a For with ease

- Obtain Form 1040a For and click on Get Form to begin.

- Utilize the tools we provide to complete your document.

- Emphasize important sections of the documents or obscure sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Generate your eSignature using the Sign feature, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review the details and click on the Done button to save your changes.

- Choose how you wish to send your form, via email, SMS, or invite link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searches, or errors that require printing new document copies. airSlate SignNow addresses your document management needs in just a few clicks from any device you prefer. Edit and eSign Form 1040a For and ensure excellent communication at any stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct form 1040a for 2007

Create this form in 5 minutes!

How to create an eSignature for the form 1040a for 2007

The way to make an eSignature for a PDF file online

The way to make an eSignature for a PDF file in Google Chrome

The way to create an electronic signature for signing PDFs in Gmail

The best way to make an eSignature straight from your mobile device

The way to make an eSignature for a PDF file on iOS

The best way to make an eSignature for a PDF document on Android devices

People also ask

-

What is Form 1040a For and how can airSlate SignNow assist with it?

Form 1040a For is a U.S. tax return form that allows taxpayers to report their income and claim certain deductions. airSlate SignNow streamlines the process by enabling users to electronically sign and send Form 1040a For documents securely, making tax season less stressful.

-

What features does airSlate SignNow offer for managing Form 1040a For?

airSlate SignNow offers features like customizable templates, document tracking, and advanced security options specifically tailored for handling Form 1040a For. Users can collaborate in real-time and ensure their tax forms are completed correctly and efficiently.

-

How much does it cost to use airSlate SignNow for Form 1040a For?

The cost of using airSlate SignNow varies based on the chosen plan, with options that cater to individual users and businesses alike. Pricing is designed to be cost-effective, ensuring anyone can afford the tools they need to manage Form 1040a For seamlessly.

-

Can I integrate airSlate SignNow with other software for Form 1040a For?

Yes, airSlate SignNow easily integrates with various software solutions, enhancing the management of Form 1040a For. Whether you use accounting software or document management systems, integration ensures that your tax processes remain streamlined and efficient.

-

What are the benefits of using airSlate SignNow for Form 1040a For?

Using airSlate SignNow for Form 1040a For provides numerous benefits, including time savings, increased security, and reduced paper usage. The platform allows easy tracking and reminders, helping you to manage deadlines and avoid errors during tax filing.

-

Is airSlate SignNow compliant with tax regulations for Form 1040a For?

Absolutely, airSlate SignNow is designed to comply with relevant tax regulations, ensuring that your handling of Form 1040a For meets legal standards. Our solution includes secure electronic signatures, which are recognized by the IRS and other authorities.

-

How does airSlate SignNow enhance collaboration for Form 1040a For?

airSlate SignNow enhances collaboration on Form 1040a For by allowing multiple users to edit and review documents in real time. This feature ensures that all stakeholders can stay updated and contribute to completing the form accurately and efficiently.

Get more for Form 1040a For

- Indiana last will form

- Legal last will and testament form for a widow or widower with adult and minor children indiana

- Legal last will and testament form for divorced and remarried person with mine yours and ours children indiana

- Legal last will and testament form with all property to trust called a pour over will indiana

- Written revocation of will indiana form

- Last will and testament for other persons indiana form

- Notice to beneficiaries of being named in will indiana form

- Estate planning questionnaire and worksheets indiana form

Find out other Form 1040a For

- eSign Rhode Island Landlord tenant lease agreement Later

- How Can I eSign North Carolina lease agreement

- eSign Montana Lease agreement form Computer

- Can I eSign New Hampshire Lease agreement form

- How To eSign West Virginia Lease agreement contract

- Help Me With eSign New Mexico Lease agreement form

- Can I eSign Utah Lease agreement form

- Can I eSign Washington lease agreement

- Can I eSign Alabama Non disclosure agreement sample

- eSign California Non disclosure agreement sample Now

- eSign Pennsylvania Mutual non-disclosure agreement Now

- Help Me With eSign Utah Non disclosure agreement sample

- How Can I eSign Minnesota Partnership agreements

- eSign Pennsylvania Property management lease agreement Secure

- eSign Hawaii Rental agreement for house Fast

- Help Me With eSign Virginia Rental agreement contract

- eSign Alaska Rental lease agreement Now

- How To eSign Colorado Rental lease agreement

- How Can I eSign Colorado Rental lease agreement

- Can I eSign Connecticut Rental lease agreement