Sample Form 8809 2013

What is the Sample Form 8809

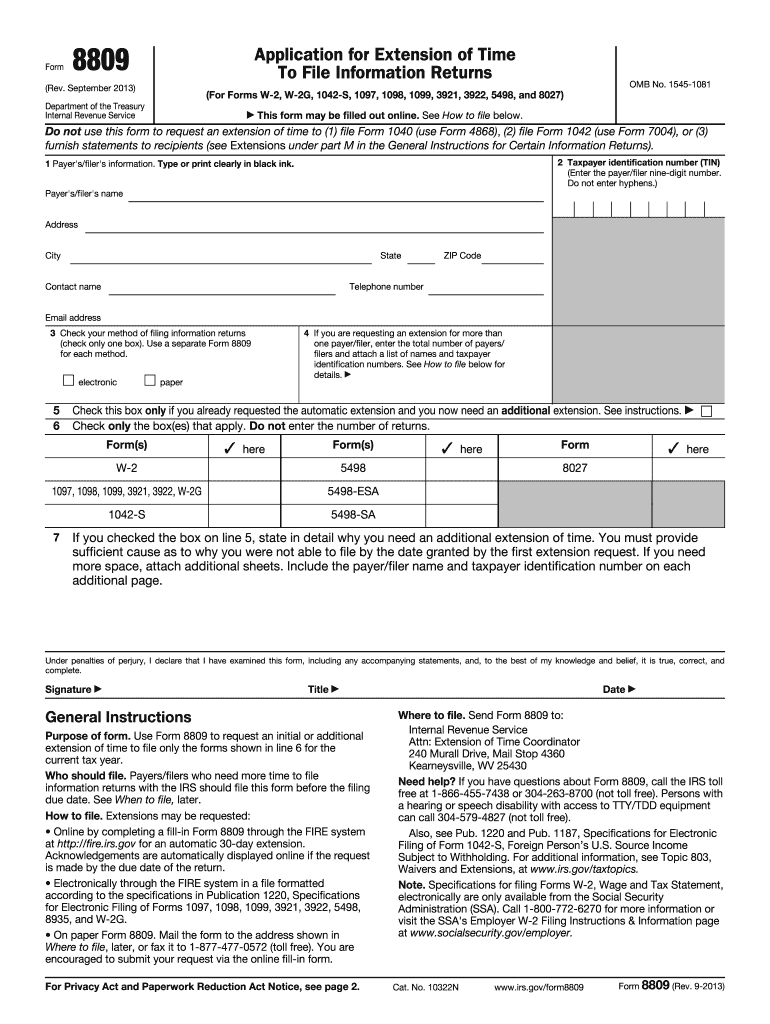

The Sample Form 8809 is an official IRS document used to request an extension of time for filing information returns, such as Forms 1099 and W-2. This form is essential for businesses and organizations that need additional time to prepare their tax documents accurately. By submitting Form 8809, filers can avoid penalties associated with late submissions, ensuring compliance with IRS regulations.

How to use the Sample Form 8809

To use the Sample Form 8809, begin by filling out the required information, including your name, address, and the type of returns for which you are requesting an extension. Ensure that you complete all sections accurately to avoid delays. Once the form is filled out, submit it to the IRS as directed. You can file it electronically or via mail, depending on your preference and the specific instructions provided by the IRS.

Steps to complete the Sample Form 8809

Completing the Sample Form 8809 involves several key steps:

- Gather necessary information, including your taxpayer identification number and details of the returns needing an extension.

- Fill out the form accurately, ensuring all required fields are completed.

- Review the form for any errors or omissions.

- Submit the form electronically through the IRS e-file system or mail it to the appropriate IRS address.

Legal use of the Sample Form 8809

The legal use of the Sample Form 8809 is governed by IRS regulations. When filed correctly, it provides a legitimate extension for filing information returns. It is important to adhere to the guidelines set forth by the IRS to ensure that the extension is recognized and that you remain compliant with federal tax laws. Failure to use the form properly may result in penalties or other legal consequences.

Filing Deadlines / Important Dates

Understanding the filing deadlines associated with the Sample Form 8809 is crucial for compliance. Generally, the form must be submitted by the original due date of the information returns you are extending. This deadline varies depending on the type of return, so it is essential to check the specific due dates for each form. Filing on time can help you avoid penalties and maintain good standing with the IRS.

Form Submission Methods (Online / Mail / In-Person)

The Sample Form 8809 can be submitted through various methods, providing flexibility for filers. You can file the form electronically using the IRS e-file system, which is often the quickest method. Alternatively, you may choose to mail the completed form to the IRS at the designated address for your type of return. In-person submission is typically not an option for this form, as it is primarily processed through electronic or mail channels.

Quick guide on how to complete sample form 8809 2013

Complete Sample Form 8809 effortlessly on any device

Digital document management has become increasingly popular among businesses and individuals. It offers a perfect eco-friendly substitute for traditional printed and signed documents, as you can easily locate the necessary form and securely store it online. airSlate SignNow equips you with all the resources you require to create, modify, and eSign your documents swiftly without delays. Handle Sample Form 8809 on any device with airSlate SignNow Android or iOS applications and enhance any document-based process today.

The simplest way to alter and eSign Sample Form 8809 without hassle

- Locate Sample Form 8809 and click on Get Form to begin.

- Utilize the tools we provide to complete your form.

- Emphasize pertinent sections of your documents or obscure sensitive information with tools that airSlate SignNow offers specifically for this purpose.

- Create your eSignature using the Sign feature, which takes only seconds and holds the same legal validity as a conventional wet ink signature.

- Review all the details and click on the Done button to save your changes.

- Select how you want to send your form, via email, text message (SMS), invitation link, or download it to your PC.

Eliminate worries about lost or misplaced files, tedious form searching, or errors that require printing new document copies. airSlate SignNow meets all your document management requirements in just a few clicks from any device of your choice. Modify and eSign Sample Form 8809 while ensuring excellent communication at any stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct sample form 8809 2013

Create this form in 5 minutes!

How to create an eSignature for the sample form 8809 2013

The way to make an eSignature for a PDF file in the online mode

The way to make an eSignature for a PDF file in Chrome

The way to create an electronic signature for putting it on PDFs in Gmail

The best way to make an electronic signature right from your smartphone

The way to make an eSignature for a PDF file on iOS devices

The best way to make an electronic signature for a PDF on Android

People also ask

-

What is the Sample Form 8809?

The Sample Form 8809 is a request for an extension of time to file information returns with the IRS. It is crucial for businesses needing more time to submit their forms and can be easily managed using airSlate SignNow.

-

How can airSlate SignNow help with the Sample Form 8809?

airSlate SignNow streamlines the process of completing and submitting the Sample Form 8809. With features like electronic signatures and document tracking, you can efficiently manage your filing deadlines and ensure compliance with IRS regulations.

-

Is there a cost to use the Sample Form 8809 with airSlate SignNow?

Yes, there is a subscription fee for using airSlate SignNow, which varies based on the plan you choose. However, investing in our services ensures you can handle your Sample Form 8809 and other documents efficiently, potentially saving you from costly penalties.

-

What features does airSlate SignNow offer for managing the Sample Form 8809?

With airSlate SignNow, you get features like customizable templates, secure e-signatures, and quick document sharing. These tools help simplify the completion and submission of the Sample Form 8809, making your filing process smoother.

-

Can I integrate airSlate SignNow with other applications for the Sample Form 8809?

Yes, airSlate SignNow offers seamless integrations with popular applications like Google Drive, Dropbox, and Zapier. This enables you to manage your Sample Form 8809 alongside other necessary documents, enhancing your workflow.

-

What are the benefits of using airSlate SignNow for the Sample Form 8809?

Using airSlate SignNow for your Sample Form 8809 provides benefits such as improved accuracy, a faster submission process, and enhanced compliance. Our platform makes it easy to track your document status and ensure timely filing.

-

Is the Sample Form 8809 easy to fill out using airSlate SignNow?

Absolutely! airSlate SignNow simplifies the process with a user-friendly interface. You can easily navigate through the Sample Form 8809, filling in the required information without any hassle.

Get more for Sample Form 8809

- Document locator and personal information package including burial information form indiana

- Demand to produce copy of will from heir to executor or person in possession of will indiana form

- Secured promissory note with monthly installment payments kansas form

- Kansas estate contract form

- Commercial mortgage and security agreement kansas form

- Bill of sale of automobile and odometer statement kansas form

- Bill of sale for automobile or vehicle including odometer statement and promissory note kansas form

- Promissory note in connection with sale of vehicle or automobile kansas form

Find out other Sample Form 8809

- Electronic signature Wisconsin Charity Lease Agreement Mobile

- Can I Electronic signature Wisconsin Charity Lease Agreement

- Electronic signature Utah Business Operations LLC Operating Agreement Later

- How To Electronic signature Michigan Construction Cease And Desist Letter

- Electronic signature Wisconsin Business Operations LLC Operating Agreement Myself

- Electronic signature Colorado Doctors Emergency Contact Form Secure

- How Do I Electronic signature Georgia Doctors Purchase Order Template

- Electronic signature Doctors PDF Louisiana Now

- How To Electronic signature Massachusetts Doctors Quitclaim Deed

- Electronic signature Minnesota Doctors Last Will And Testament Later

- How To Electronic signature Michigan Doctors LLC Operating Agreement

- How Do I Electronic signature Oregon Construction Business Plan Template

- How Do I Electronic signature Oregon Construction Living Will

- How Can I Electronic signature Oregon Construction LLC Operating Agreement

- How To Electronic signature Oregon Construction Limited Power Of Attorney

- Electronic signature Montana Doctors Last Will And Testament Safe

- Electronic signature New York Doctors Permission Slip Free

- Electronic signature South Dakota Construction Quitclaim Deed Easy

- Electronic signature Texas Construction Claim Safe

- Electronic signature Texas Construction Promissory Note Template Online