Form 1040 V Irs 2006

What is the Form 1040 V Irs

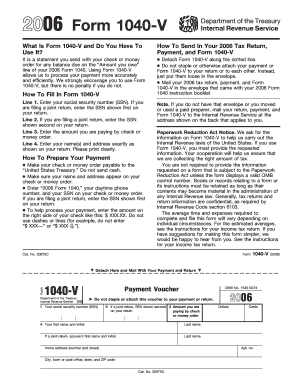

The Form 1040 V is a payment voucher used by taxpayers in the United States to submit payments along with their individual income tax returns. It is typically utilized when taxpayers owe additional taxes and wish to ensure that their payments are properly credited to their accounts. This form helps streamline the payment process, making it easier for the IRS to process payments accurately and efficiently.

How to use the Form 1040 V Irs

To use the Form 1040 V, taxpayers should complete the form by providing their name, address, Social Security number, and the amount of the payment being submitted. After filling out the form, it should be included with the payment and mailed to the appropriate IRS address specified for payments. It is essential to ensure that the payment is sent in a timely manner to avoid penalties and interest on unpaid taxes.

Steps to complete the Form 1040 V Irs

Completing the Form 1040 V involves several straightforward steps:

- Obtain the Form 1040 V from the IRS website or your tax preparation software.

- Fill in your personal information, including your name, address, and Social Security number.

- Indicate the amount you are paying on the form.

- Attach your payment, which can be a check or money order made out to the "United States Treasury."

- Mail the completed form and payment to the designated IRS address based on your location.

Legal use of the Form 1040 V Irs

The Form 1040 V is legally recognized as a valid method for submitting tax payments to the IRS. When completed correctly and submitted on time, it ensures that your payment is processed accurately. It is important to retain a copy of the form and payment for your records, as this documentation may be required for future reference or in the event of an audit.

Filing Deadlines / Important Dates

Taxpayers should be aware of the filing deadlines associated with the Form 1040 V. Typically, individual income tax returns are due on April 15 of each year. If you are submitting a payment with this form, it is crucial to ensure that it is postmarked by this date to avoid any late fees or penalties. In some cases, deadlines may be extended, so checking the IRS website for updates is advisable.

Form Submission Methods (Online / Mail / In-Person)

The Form 1040 V can be submitted by mail along with your payment. Currently, the IRS does not offer an online submission option for this specific form. Taxpayers should ensure that they send their payment to the correct address based on their state of residence. For those who prefer in-person submissions, payments can be made at designated IRS offices, but it is recommended to check ahead for specific procedures and hours of operation.

Quick guide on how to complete 2006 form 1040 v irs

Effortlessly prepare Form 1040 V Irs on any device

Digital document management has gained traction among businesses and individuals alike. It serves as an ideal eco-friendly substitute for traditional printed and signed documents, allowing you to obtain the necessary forms and securely store them online. airSlate SignNow provides you with all the tools you require to create, modify, and eSign your documents swiftly without any holdups. Manage Form 1040 V Irs on any device using the airSlate SignNow Android or iOS applications and enhance any document-related process today.

The simplest method to modify and eSign Form 1040 V Irs effortlessly

- Find Form 1040 V Irs and click on Get Form to initiate the process.

- Use the tools we provide to fill out your form.

- Emphasize important parts of your documents or redact sensitive information with the tools that airSlate SignNow specifically offers for this purpose.

- Generate your eSignature using the Sign tool, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Review all the details and click on the Done button to save your modifications.

- Select your preferred method for sending your form, whether by email, SMS, an invitation link, or download it to your computer.

Eliminate worries about lost or misplaced documents, tedious searching for forms, or errors that necessitate printing new copies. airSlate SignNow addresses your document management needs in just a few clicks from your preferred device. Edit and eSign Form 1040 V Irs and ensure effective communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 2006 form 1040 v irs

Create this form in 5 minutes!

How to create an eSignature for the 2006 form 1040 v irs

The way to make an eSignature for your PDF in the online mode

The way to make an eSignature for your PDF in Chrome

The way to generate an electronic signature for putting it on PDFs in Gmail

The best way to make an electronic signature from your smart phone

The way to make an electronic signature for a PDF on iOS devices

The best way to make an electronic signature for a PDF file on Android OS

People also ask

-

What is the Form 1040 V Irs?

The Form 1040 V Irs is a payment voucher that accompanies your tax return, providing a convenient way to send in your payment if you owe taxes. It helps ensure that the IRS properly credits your account. Using airSlate SignNow can streamline the eSigning of this document.

-

How can airSlate SignNow help with Form 1040 V Irs?

airSlate SignNow allows you to easily eSign your Form 1040 V Irs, making the submission process faster and more efficient. With our platform, you can quickly fill out and send your documents securely online. This eliminates the hassle of printing and mailing.

-

Is there a cost associated with using airSlate SignNow for Form 1040 V Irs?

Yes, airSlate SignNow offers various pricing plans that cater to different business needs. You can choose a plan that best fits your usage for managing documents like Form 1040 V Irs. The cost is often justified by the time and effort saved in document handling.

-

What features of airSlate SignNow are beneficial for Form 1040 V Irs?

airSlate SignNow includes features such as customizable templates, secure document storage, and easy eSigning for Form 1040 V Irs. These features enhance productivity and ensure that your tax documents are handled efficiently and securely.

-

Can I integrate airSlate SignNow with other applications for handling Form 1040 V Irs?

Absolutely! airSlate SignNow integrates seamlessly with other applications like Google Drive, Dropbox, and various CRM systems. This makes it easy to manage and send your Form 1040 V Irs alongside your other documents in one unified platform.

-

What are the benefits of eSigning the Form 1040 V Irs with airSlate SignNow?

eSigning the Form 1040 V Irs with airSlate SignNow offers numerous benefits, including quick turnaround times, enhanced security, and the elimination of paper waste. Additionally, you can track your document's progress in real-time, ensuring you don’t miss any deadlines.

-

How does airSlate SignNow ensure the security of Form 1040 V Irs?

airSlate SignNow implements advanced security measures, including encryption, secure data storage, and compliance with industry standards. Your Form 1040 V Irs and other sensitive documents are protected at every stage of the signing process.

Get more for Form 1040 V Irs

- Kansas contractor 497307306 form

- Electrical contract for contractor kansas form

- Sheetrock drywall contract for contractor kansas form

- Flooring contract for contractor kansas form

- Agreement or contract for deed for sale and purchase of real estate aka land or executory contract kansas form

- Notice of intent to enforce forfeiture provisions of contact for deed kansas form

- Final notice of forfeiture and request to vacate property under contract for deed kansas form

- Buyers request for accounting from seller under contract for deed kansas form

Find out other Form 1040 V Irs

- How To Sign Alabama Legal LLC Operating Agreement

- Sign Alabama Legal Cease And Desist Letter Now

- Sign Alabama Legal Cease And Desist Letter Later

- Sign California Legal Living Will Online

- How Do I Sign Colorado Legal LLC Operating Agreement

- How Can I Sign California Legal Promissory Note Template

- How Do I Sign North Dakota Insurance Quitclaim Deed

- How To Sign Connecticut Legal Quitclaim Deed

- How Do I Sign Delaware Legal Warranty Deed

- Sign Delaware Legal LLC Operating Agreement Mobile

- Sign Florida Legal Job Offer Now

- Sign Insurance Word Ohio Safe

- How Do I Sign Hawaii Legal Business Letter Template

- How To Sign Georgia Legal Cease And Desist Letter

- Sign Georgia Legal Residential Lease Agreement Now

- Sign Idaho Legal Living Will Online

- Sign Oklahoma Insurance Limited Power Of Attorney Now

- Sign Idaho Legal Separation Agreement Online

- Sign Illinois Legal IOU Later

- Sign Illinois Legal Cease And Desist Letter Fast