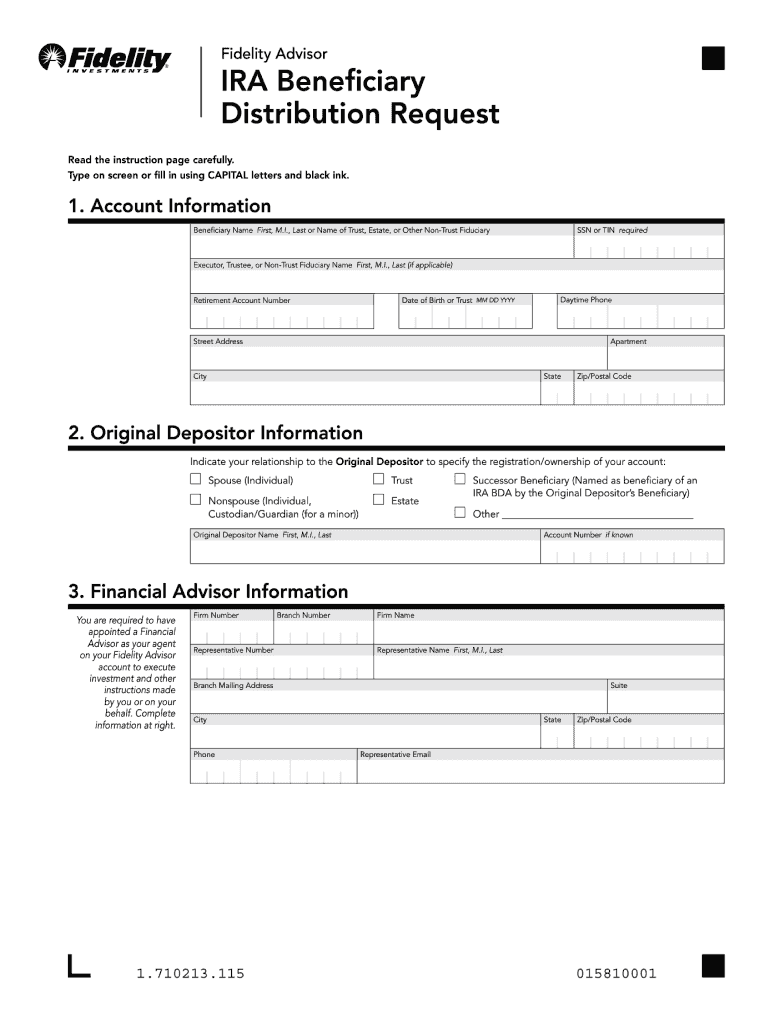

Fidelity Advisor Ira Beneficiary Distribution Request Form 2013

What is the Fidelity beneficiary claim form individual?

The Fidelity beneficiary claim form individual is a crucial document used to initiate the process of claiming benefits from Fidelity Investments. This form is specifically designed for individuals who are listed as beneficiaries on various Fidelity accounts, such as IRAs or 401(k) plans. By completing this form, beneficiaries can request the distribution of funds following the account holder's passing. It is essential to fill out this form accurately to ensure a smooth and timely processing of the claim.

Steps to complete the Fidelity beneficiary claim form individual

Filling out the Fidelity beneficiary claim form individual involves several key steps to ensure that all necessary information is provided. Begin by gathering essential documents, such as the account holder's death certificate and any relevant identification. Next, accurately fill in your personal details, including your name, address, and relationship to the deceased. Clearly indicate the type of account from which you are claiming benefits. Finally, review the form for completeness and accuracy before submitting it. Ensuring that all sections are filled out correctly can help prevent delays in processing your claim.

Legal use of the Fidelity beneficiary claim form individual

The legal use of the Fidelity beneficiary claim form individual is governed by various regulations that ensure its validity. To be considered legally binding, the form must be signed by the beneficiary and may require notarization, depending on state laws. The form serves as a formal request for the distribution of funds and must be submitted to Fidelity Investments for processing. Understanding the legal implications of this form is essential to ensure that your claim is honored and that the distribution of assets occurs without complications.

Required documents for the Fidelity beneficiary claim form individual

When submitting the Fidelity beneficiary claim form individual, certain documents are required to support your claim. These typically include a certified copy of the account holder's death certificate, proof of identity for the beneficiary, and any relevant documentation that verifies your relationship to the deceased. In some cases, additional forms may be necessary, depending on the specific type of account involved. Collecting all required documents beforehand can streamline the process and help prevent delays in receiving your benefits.

Form submission methods for the Fidelity beneficiary claim form individual

The Fidelity beneficiary claim form individual can be submitted through various methods to accommodate different preferences. Beneficiaries may choose to submit the form online through the Fidelity website, ensuring a quick and efficient process. Alternatively, the form can be mailed to Fidelity's designated address or delivered in person at a local Fidelity branch. Each submission method has its advantages, and beneficiaries should select the one that best suits their needs while ensuring that all required documents are included.

Filing deadlines for the Fidelity beneficiary claim form individual

Filing deadlines for the Fidelity beneficiary claim form individual can vary depending on the type of account and state regulations. It is important to submit the form as soon as possible after the account holder's death to avoid potential complications or delays in receiving benefits. Beneficiaries should be aware of any specific timeframes set by Fidelity or applicable state laws to ensure compliance. Understanding these deadlines can help beneficiaries navigate the claims process more effectively.

Quick guide on how to complete fidelity advisor ira beneficiary distribution request form

Effortlessly prepare Fidelity Advisor Ira Beneficiary Distribution Request Form on any device

Digital document management has gained traction among organizations and individuals. It offers an excellent eco-friendly substitute to conventional printed and signed documents, as you can easily find the appropriate form and securely store it online. airSlate SignNow equips you with all the necessary tools to create, edit, and electronically sign your documents quickly without issues. Manage Fidelity Advisor Ira Beneficiary Distribution Request Form on any device using the airSlate SignNow apps for Android or iOS and enhance any document-based activity today.

How to modify and electronically sign Fidelity Advisor Ira Beneficiary Distribution Request Form with ease

- Obtain Fidelity Advisor Ira Beneficiary Distribution Request Form and click Get Form to initiate the process.

- Utilize the tools we provide to submit your document.

- Highlight pertinent sections of the documents or obscure sensitive information with tools specifically designed for that purpose by airSlate SignNow.

- Create your electronic signature using the Sign tool, which takes mere seconds and holds the same legal validity as a traditional handwritten signature.

- Verify the details and click on the Done button to save your modifications.

- Select your preferred method to send your form—via email, text message (SMS), invitation link, or download it to your computer.

Eliminate the hassle of lost or misplaced documents, tedious form searches, or errors that necessitate prints of new document copies. airSlate SignNow addresses all your document management needs with just a few clicks from any device you choose. Edit and electronically sign Fidelity Advisor Ira Beneficiary Distribution Request Form while ensuring exceptional communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct fidelity advisor ira beneficiary distribution request form

FAQs

-

I recently opened a Fidelity Roth IRA and it says my account is closed and I need to submit a W-9 form. Can anyone explain how this form relates to an IRA and why I need to fill it out?

Financial institutions are required to obtain tax ID numbers when opening an account, and the fact that it's an IRA doesn't exempt them from that requirement. They shouldn't have opened it without the W-9 in the first place, but apparently they did. So now they had to close it until they get the required documentation.

-

I need help filling out this IRA form to withdraw money. How do I fill this out?

I am confused on the highlighted part.

-

How do I respond to a request for a restraining order? Do I need to fill out a form?

As asked of me specifically;The others are right, you will likely need a lawyer. But to answer your question, there is a response form to respond to a restraining order or order of protection. Worst case the form is available at the courthouse where your hearing is set to be heard in, typically at the appropriate clerk's window, which may vary, so ask any of the clerk's when you get there.You only have so many days to respond, and it will specify in the paperwork.You will also have to appear in court on the date your hearing is scheduled.Most courts have a department that will help you respond to forms at no cost. I figure you are asking because you can't afford an attorney which is completely understandable.The problem is that if you aren't represented and the other person is successful in getting a temporary restraining order made permanent in the hearing you will not be allowed at any of the places the petitioner goes, without risking arrest.I hope this helps.Not given as legal advice-

-

Startup I am no longer working with is requesting that I fill out a 2014 w9 form. Is this standard, could someone please provide any insight as to why a startup may be doing this and how would I go about handling it?

It appears that the company may be trying to reclassify you as an independent contractor rather than an employee.Based on the information provided, it appears that such reclassification (a) would be a violation of applicable law by the employer and (b) potentially could be disadvantageous for you (e.g., depriving you of unemployment compensation if you are fired without cause).The most prudent approach would be to retain a lawyer who represents employees in employment matters.In any event, it appears that you would be justified in refusing to complete and sign the W-9, telling the company that there is no business or legal reason for you to do so.Edit: After the foregoing answer was written, the OP added Q details concerning restricted stock repurchase being the reason for the W-9 request. As a result, the foregoing answer appears to be irrelevant. However, I will leave it, for now, in case Q details are changed yet again in a way that reestablishes the answer's relevance.

Create this form in 5 minutes!

How to create an eSignature for the fidelity advisor ira beneficiary distribution request form

How to generate an electronic signature for the Fidelity Advisor Ira Beneficiary Distribution Request Form online

How to generate an eSignature for the Fidelity Advisor Ira Beneficiary Distribution Request Form in Google Chrome

How to create an electronic signature for putting it on the Fidelity Advisor Ira Beneficiary Distribution Request Form in Gmail

How to make an electronic signature for the Fidelity Advisor Ira Beneficiary Distribution Request Form from your mobile device

How to make an electronic signature for the Fidelity Advisor Ira Beneficiary Distribution Request Form on iOS devices

How to generate an electronic signature for the Fidelity Advisor Ira Beneficiary Distribution Request Form on Android devices

People also ask

-

What is the fidelity beneficiary claim form individual?

The fidelity beneficiary claim form individual is a specific document used to claim benefits from Fidelity accounts. It ensures that the rightful beneficiary receives their inheritance or funds promptly. Completing this form accurately is crucial for a smooth claims process.

-

How does airSlate SignNow simplify the fidelity beneficiary claim form individual process?

airSlate SignNow streamlines the completion of the fidelity beneficiary claim form individual by providing an easy-to-use electronic signature platform. You can fill out, sign, and send the form remotely, saving time and minimizing errors. With intuitive templates, the process is efficient and user-friendly.

-

What are the costs associated with using airSlate SignNow for the fidelity beneficiary claim form individual?

Using airSlate SignNow comes with flexible pricing plans suitable for various business needs. The costs depend on the features you choose, but the platform is designed to be cost-effective while providing comprehensive eSigning solutions. You can start with a free trial to explore its functionalities for the fidelity beneficiary claim form individual.

-

Are there any specific features for managing the fidelity beneficiary claim form individual?

Yes, airSlate SignNow offers features specifically designed for managing documents like the fidelity beneficiary claim form individual. You can create reusable templates, track document status, and get notifications when forms are signed. These features enhance organization and efficiency in handling your claims.

-

Can I integrate airSlate SignNow with other apps for my fidelity beneficiary claim form individual?

Absolutely, airSlate SignNow supports various integrations with popular applications. You can connect it with CRM systems, cloud storage, and other productivity tools, making it easier to manage the fidelity beneficiary claim form individual and your overall document workflow. This connectivity enhances collaboration and efficiency.

-

What are the benefits of using airSlate SignNow for my fidelity beneficiary claim form individual?

Using airSlate SignNow for your fidelity beneficiary claim form individual provides numerous benefits, including faster processing times and reduced paper usage. The platform ensures that your claims are secure and compliant with legal standards, offering peace of mind. Additionally, the electronic format allows for easy accessibility and tracking.

-

How do I get started with airSlate SignNow for the fidelity beneficiary claim form individual?

Getting started with airSlate SignNow is simple. You can sign up for an account on their website and explore the available features. From there, you can create or upload your fidelity beneficiary claim form individual, add signatures, and send it for completion in just a few clicks.

Get more for Fidelity Advisor Ira Beneficiary Distribution Request Form

- Homeowners recovery fund attorneys north carolina form

- To change the coverage that is listed on your declarations page you may use this form to do so

- Cna form statement

- Acic bail bond forms

- Risceo form

- Pearlinsurancecomrenew form

- Cna application g 142826 a form

- Addendum to eras application texas tech university ttuhsc form

Find out other Fidelity Advisor Ira Beneficiary Distribution Request Form

- eSign Hawaii Police Permission Slip Online

- eSign New Hampshire Sports IOU Safe

- eSign Delaware Courts Operating Agreement Easy

- eSign Georgia Courts Bill Of Lading Online

- eSign Hawaii Courts Contract Mobile

- eSign Hawaii Courts RFP Online

- How To eSign Hawaii Courts RFP

- eSign Hawaii Courts Letter Of Intent Later

- eSign Hawaii Courts IOU Myself

- eSign Hawaii Courts IOU Safe

- Help Me With eSign Hawaii Courts Cease And Desist Letter

- How To eSign Massachusetts Police Letter Of Intent

- eSign Police Document Michigan Secure

- eSign Iowa Courts Emergency Contact Form Online

- eSign Kentucky Courts Quitclaim Deed Easy

- How To eSign Maryland Courts Medical History

- eSign Michigan Courts Lease Agreement Template Online

- eSign Minnesota Courts Cease And Desist Letter Free

- Can I eSign Montana Courts NDA

- eSign Montana Courts LLC Operating Agreement Mobile