Form 1048 Irs 2020-2026

What is the Form 1048 IRS?

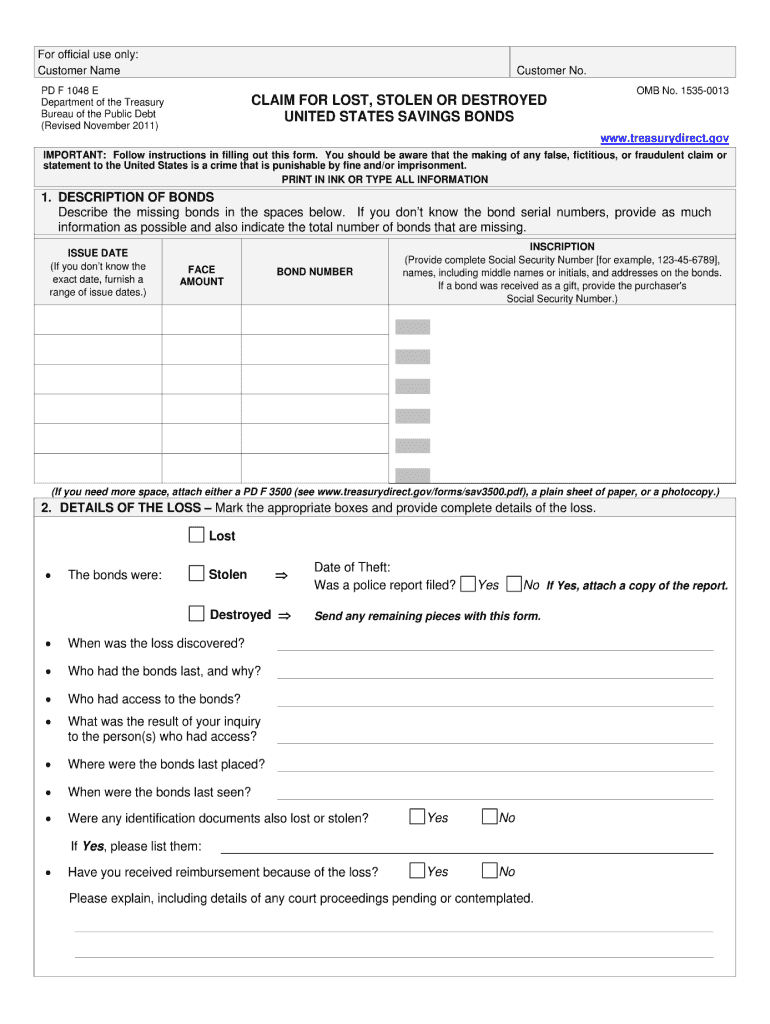

The FS Form 1048, commonly referred to as the 1048 tax form, is a document used by individuals to claim the value of lost savings bonds. This form is issued by the U.S. Department of the Treasury and is essential for those who have misplaced their savings bonds and wish to retrieve their value. The form captures necessary information about the bonds, including their serial numbers and the details of the claimant. Understanding the purpose of the form is crucial for ensuring that individuals can successfully claim their funds.

Steps to Complete the Form 1048 IRS

Completing the FS Form 1048 involves several key steps to ensure accuracy and compliance. First, gather all relevant information regarding the lost savings bonds, including their serial numbers and issue dates. Next, fill out the form with personal details, such as your name, address, and Social Security number. Be sure to provide a detailed description of the lost bonds. Once the form is completed, review it for any errors or omissions. Finally, submit the form as directed, either online or by mail, to the appropriate department for processing.

Legal Use of the Form 1048 IRS

The legal use of the FS Form 1048 is governed by specific regulations set forth by the U.S. Department of the Treasury. When completed correctly, this form serves as a legally binding document that allows individuals to claim the value of their lost savings bonds. It is important to ensure that all information provided is accurate and truthful, as any discrepancies may lead to delays or denial of the claim. Compliance with the legal requirements ensures that the claim is processed smoothly and efficiently.

How to Obtain the Form 1048 IRS

The FS Form 1048 can be obtained through various means. Individuals can access the form online through the U.S. Department of the Treasury's official website, where it is available for download in PDF format. Alternatively, paper copies of the form can be requested by contacting the Treasury Department directly. It is important to ensure that you are using the most current version of the form to avoid any processing issues.

Form Submission Methods

Submitting the FS Form 1048 can be done through multiple methods, ensuring convenience for claimants. The form can be submitted online via the Treasury's designated portal, which allows for quicker processing times. Alternatively, individuals may choose to mail the completed form to the appropriate address provided in the instructions. In-person submissions may also be possible at certain Treasury locations, depending on local guidelines. Each method has its own processing timelines, so it is advisable to choose the one that best fits your needs.

Filing Deadlines / Important Dates

Filing deadlines for the FS Form 1048 are crucial to ensure that claims are processed in a timely manner. While there are no specific deadlines for submitting claims for lost savings bonds, it is recommended to file as soon as the bonds are discovered to be lost. Keeping track of any changes in Treasury regulations or deadlines is important for claimants to avoid missing out on their rightful funds. Regularly checking the U.S. Department of the Treasury's announcements can provide updates on any relevant dates.

Quick guide on how to complete form 1048 irs 2011

Effortlessly prepare Form 1048 Irs on any device

Digital document management has become increasingly favored by businesses and individuals alike. It offers an ideal environmentally-friendly alternative to traditional printed and signed documents, allowing you to access the necessary form and securely store it online. airSlate SignNow equips you with all the tools required to create, modify, and electronically sign your documents swiftly without delays. Manage Form 1048 Irs on any device with airSlate SignNow's Android or iOS applications and enhance any document-centric process today.

How to modify and electronically sign Form 1048 Irs with ease

- Find Form 1048 Irs and click on Get Form to begin.

- Utilize the tools we provide to complete your document.

- Emphasize important sections of the documents or obscure sensitive information with tools specifically designed for this purpose by airSlate SignNow.

- Create your signature using the Sign tool, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review the information and click on the Done button to save your changes.

- Select your preferred method to share your form, via email, text message (SMS), invitation link, or download it to your computer.

Eliminate the hassle of lost or misplaced documents, tedious form searching, or errors that necessitate printing new copies. airSlate SignNow addresses your document management needs in just a few clicks from any device you choose. Alter and electronically sign Form 1048 Irs to ensure effective communication at every stage of your form preparation journey with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct form 1048 irs 2011

Create this form in 5 minutes!

How to create an eSignature for the form 1048 irs 2011

The best way to generate an electronic signature for your PDF file in the online mode

The best way to generate an electronic signature for your PDF file in Chrome

The way to make an eSignature for putting it on PDFs in Gmail

The way to make an electronic signature straight from your smartphone

The way to make an electronic signature for a PDF file on iOS devices

The way to make an electronic signature for a PDF document on Android

People also ask

-

What is the fs form 1048 and why is it important?

The fs form 1048 is a crucial document used for various financial transactions. It helps individuals and businesses manage their finances in a structured manner. Understanding this form ensures that you comply with regulations and maintain accurate records.

-

How does airSlate SignNow support the completion of fs form 1048?

airSlate SignNow simplifies the process of completing the fs form 1048 by allowing users to fill, sign, and send documents electronically. This ensures a streamlined workflow and reduces the risk of errors. The intuitive interface makes it easy for anyone to navigate the form requirements.

-

Is there a cost associated with using airSlate SignNow for fs form 1048?

Yes, airSlate SignNow offers various pricing plans tailored to the needs of different users. Our plans provide cost-effective solutions for businesses of all sizes. Check our pricing page to find the best option that suits your requirements for processing the fs form 1048.

-

Can I integrate airSlate SignNow with other software when handling fs form 1048?

Absolutely! airSlate SignNow supports integrations with numerous applications, enhancing your ability to work efficiently with the fs form 1048. This includes popular tools for project management, customer relationship management, and cloud storage services.

-

What features does airSlate SignNow offer for managing the fs form 1048?

airSlate SignNow provides a range of features tailored for the fs form 1048, including customizable templates, eSignature capabilities, and secure document storage. These features streamline the signing process and ensure that your documents are legally binding and accessible.

-

How can airSlate SignNow benefit my business when dealing with fs form 1048?

Using airSlate SignNow for the fs form 1048 can greatly benefit your business by saving time, reducing costs, and improving accuracy. The electronic signing feature speeds up the approval process, allowing you to focus on your core operations while ensuring compliance.

-

Is airSlate SignNow secure for handling sensitive fs form 1048 data?

Yes, airSlate SignNow prioritizes security with advanced encryption and secure access protocols for handling sensitive information related to the fs form 1048. We ensure compliance with industry standards to protect your data from unauthorized access.

Get more for Form 1048 Irs

Find out other Form 1048 Irs

- Sign Oregon Lawers Limited Power Of Attorney Simple

- Sign Oregon Lawers POA Online

- Sign Mississippi Insurance POA Fast

- How Do I Sign South Carolina Lawers Limited Power Of Attorney

- Sign South Dakota Lawers Quitclaim Deed Fast

- Sign South Dakota Lawers Memorandum Of Understanding Free

- Sign South Dakota Lawers Limited Power Of Attorney Now

- Sign Texas Lawers Limited Power Of Attorney Safe

- Sign Tennessee Lawers Affidavit Of Heirship Free

- Sign Vermont Lawers Quitclaim Deed Simple

- Sign Vermont Lawers Cease And Desist Letter Free

- Sign Nevada Insurance Lease Agreement Mobile

- Can I Sign Washington Lawers Quitclaim Deed

- Sign West Virginia Lawers Arbitration Agreement Secure

- Sign Wyoming Lawers Lease Agreement Now

- How To Sign Alabama Legal LLC Operating Agreement

- Sign Alabama Legal Cease And Desist Letter Now

- Sign Alabama Legal Cease And Desist Letter Later

- Sign California Legal Living Will Online

- How Do I Sign Colorado Legal LLC Operating Agreement