Irs Form 13441 a 2016

What is the IRS Form 13441 A

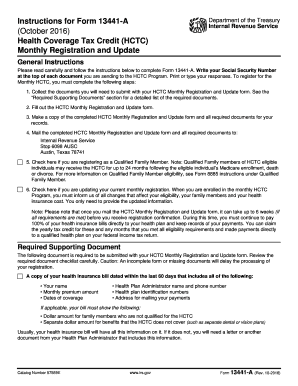

The IRS Form 13441 A, also known as the Application for a Certificate of Status of Beneficial Owner for United States Tax Withholding and Reporting (Entities), is a crucial document for entities seeking to claim a reduced rate of, or exemption from, U.S. tax withholding. This form is primarily utilized by foreign entities that receive income from U.S. sources and need to establish their status to avoid excessive withholding tax. Completing this form accurately is essential for compliance with U.S. tax laws and to ensure that the correct tax rates are applied to the income received.

How to use the IRS Form 13441 A

Using the IRS Form 13441 A involves several steps to ensure that the information provided is accurate and complete. First, gather all necessary information about the entity, including its legal name, address, and taxpayer identification number. Next, fill out the form by providing details about the type of income received and the applicable tax treaty benefits. Once completed, the form must be submitted to the relevant withholding agent or financial institution that requires it. It is important to keep a copy of the submitted form for your records, as it may be needed for future reference or compliance checks.

Steps to complete the IRS Form 13441 A

Completing the IRS Form 13441 A involves a systematic approach to ensure all required information is provided. Follow these steps:

- Begin by downloading the form from the IRS website or obtaining a physical copy.

- Fill in the entity's legal name, address, and taxpayer identification number in the designated fields.

- Indicate the type of income the entity will receive from U.S. sources.

- Provide details on any applicable tax treaty benefits that the entity intends to claim.

- Review the completed form for accuracy and completeness.

- Submit the form to the withholding agent or financial institution as required.

Legal use of the IRS Form 13441 A

The legal use of the IRS Form 13441 A is governed by U.S. tax laws and regulations. This form must be completed and submitted accurately to ensure compliance with the Internal Revenue Code. Entities that fail to provide this form when required may face higher withholding tax rates on their income. Additionally, incorrect or incomplete submissions can lead to penalties and delays in processing. It is advisable for entities to consult with tax professionals to ensure that they meet all legal requirements when using this form.

Key elements of the IRS Form 13441 A

Several key elements are essential for the proper completion of the IRS Form 13441 A. These include:

- Entity Information: Legal name and address of the entity.

- Taxpayer Identification Number: Necessary for tax reporting purposes.

- Type of Income: Clear identification of the income sources from the U.S.

- Tax Treaty Benefits: Information on any applicable tax treaties that may reduce withholding rates.

- Signature and Date: Required to validate the form and confirm the accuracy of the provided information.

Filing Deadlines / Important Dates

Filing deadlines for the IRS Form 13441 A are critical to ensure compliance and avoid penalties. Generally, the form should be submitted before the payment of income subject to withholding. Specific deadlines may vary based on the type of income and the requirements of the withholding agent. It is advisable to check the IRS guidelines or consult a tax professional for the most current deadlines relevant to your situation.

Quick guide on how to complete irs form 13441 a

Effortlessly prepare Irs Form 13441 A on any device

Digital document management has become increasingly favored by businesses and individuals alike. It offers an ideal environmentally-friendly alternative to conventional printed and signed documents, allowing you to access the necessary forms and securely store them online. airSlate SignNow equips you with all the tools required to create, edit, and electronically sign your documents quickly and without delays. Manage Irs Form 13441 A on any device with airSlate SignNow's Android or iOS applications and streamline any document-related process today.

How to modify and eSign Irs Form 13441 A effortlessly

- Locate Irs Form 13441 A and click Get Form to begin.

- Utilize the tools we provide to finalize your document.

- Emphasize important sections of the documents or obscure sensitive details with tools that airSlate SignNow offers for that specific function.

- Generate your signature using the Sign feature, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Review the information and click on the Done button to save your updates.

- Select how you wish to share your form, whether by email, text message (SMS), invitation link, or download it to your computer.

No more concerns about lost or misplaced documents, laborious form searches, or mistakes that necessitate printing new document copies. airSlate SignNow meets all your document management needs in just a few clicks from any device you choose. Modify and eSign Irs Form 13441 A and ensure outstanding communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct irs form 13441 a

Create this form in 5 minutes!

How to create an eSignature for the irs form 13441 a

The best way to create an eSignature for a PDF online

The best way to create an eSignature for a PDF in Google Chrome

The best way to create an eSignature for signing PDFs in Gmail

The way to generate an electronic signature from your smartphone

The way to generate an eSignature for a PDF on iOS

The way to generate an electronic signature for a PDF file on Android

People also ask

-

What is IRS Form 13441 A and why do I need it?

IRS Form 13441 A is a form used for the application for a tax refund. If you are eligible for a refund or need to amend your tax records, completing this form accurately is crucial. Utilizing airSlate SignNow can streamline the signing and submission process, ensuring you meet deadlines.

-

How can airSlate SignNow help me with IRS Form 13441 A?

airSlate SignNow provides an easy-to-use platform where you can fill out and eSign IRS Form 13441 A digitally. This feature allows for quick access and enhances the accuracy of your forms, reducing the chance of errors that could delay your refund.

-

Is there a cost associated with using airSlate SignNow for IRS Form 13441 A?

Yes, airSlate SignNow offers various pricing plans tailored to different business needs. Each plan is designed to be cost-effective, allowing you to choose the best option based on how frequently you need to handle IRS Form 13441 A and other documents.

-

What features does airSlate SignNow offer for managing IRS Form 13441 A?

With airSlate SignNow, you can easily create, fill out, and eSign IRS Form 13441 A. The platform also offers templates, secure storage, and audit trails, ensuring that every form is tracked and compliant with IRS regulations.

-

Can I integrate airSlate SignNow with other software for IRS Form 13441 A?

Yes, airSlate SignNow offers integration options with various software solutions, enhancing your workflow for IRS Form 13441 A. This allows you to seamlessly connect with tools you may already be using for tax and financial management.

-

What benefits does airSlate SignNow provide for completing IRS Form 13441 A?

Using airSlate SignNow to complete IRS Form 13441 A offers numerous benefits, including increased efficiency, reduced paperwork, and enhanced collaboration. These features help ensure that you can focus on getting your tax returns filed accurately and on time.

-

How secure is airSlate SignNow for handling IRS Form 13441 A?

airSlate SignNow prioritizes security with encrypted data transmission and secure storage. When handling sensitive documents like IRS Form 13441 A, you can trust that your information is protected from unauthorized access.

Get more for Irs Form 13441 A

Find out other Irs Form 13441 A

- How Can I Sign Connecticut Legal Document

- How Can I Sign Indiana Legal Form

- Can I Sign Iowa Legal Document

- How Can I Sign Nebraska Legal Document

- How To Sign Nevada Legal Document

- Can I Sign Nevada Legal Form

- How Do I Sign New Jersey Legal Word

- Help Me With Sign New York Legal Document

- How Do I Sign Texas Insurance Document

- How Do I Sign Oregon Legal PDF

- How To Sign Pennsylvania Legal Word

- How Do I Sign Wisconsin Legal Form

- Help Me With Sign Massachusetts Life Sciences Presentation

- How To Sign Georgia Non-Profit Presentation

- Can I Sign Nevada Life Sciences PPT

- Help Me With Sign New Hampshire Non-Profit Presentation

- How To Sign Alaska Orthodontists Presentation

- Can I Sign South Dakota Non-Profit Word

- Can I Sign South Dakota Non-Profit Form

- How To Sign Delaware Orthodontists PPT