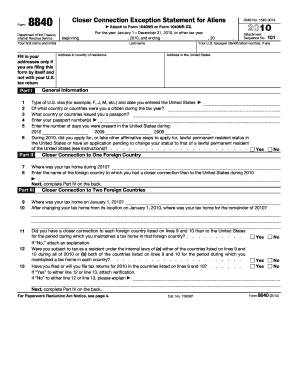

Form 8840 Internal Revenue Service Irs 2022

What is the 8840 form?

The 8840 form, officially known as the Closer Connection Exception Statement for Aliens, is a document issued by the Internal Revenue Service (IRS). This form is primarily used by individuals who are not U.S. citizens but who wish to claim a closer connection to a foreign country for tax purposes. By filing this form, individuals can demonstrate that they meet specific criteria to be considered a non-resident alien for tax purposes, potentially avoiding U.S. tax obligations on certain types of income.

How to use the 8840 form

Using the 8840 form involves several steps to ensure compliance with IRS regulations. Individuals must accurately complete the form, providing detailed information about their residency status, the foreign country to which they claim a closer connection, and the reasons for this claim. It is essential to follow the instructions carefully to avoid errors that could lead to complications with the IRS. Once completed, the form must be submitted to the IRS by the appropriate deadline.

Steps to complete the 8840 form

Completing the 8840 form requires careful attention to detail. Here are the general steps:

- Gather necessary information, including your personal details and residency history.

- Fill out the form, ensuring all sections are completed accurately.

- Provide a clear explanation of your closer connection to the foreign country.

- Review the form for any errors or omissions.

- Submit the completed form to the IRS by the specified deadline.

Legal use of the 8840 form

The legal use of the 8840 form is crucial for individuals seeking to establish their tax status in the United States. Filing this form correctly helps ensure that individuals are not subject to U.S. taxation on income that is not sourced from the U.S. It is important to understand the legal implications of the information provided and to maintain compliance with IRS guidelines to avoid penalties.

Filing Deadlines / Important Dates

Filing deadlines for the 8840 form are critical for compliance. The form is typically due on the same date as the individual’s tax return, which is usually April 15 for most taxpayers. However, extensions may apply in certain situations. It is essential to be aware of these deadlines to avoid late filing penalties and ensure that the form is processed in a timely manner.

Required Documents

When preparing to submit the 8840 form, individuals should have several documents on hand. These may include:

- Proof of residency in the foreign country.

- Documentation supporting the claim of a closer connection.

- Any previous tax returns or forms filed with the IRS, if applicable.

Having these documents ready can facilitate the completion of the form and ensure that all necessary information is provided.

Quick guide on how to complete form 8840 internal revenue service irs

Effortlessly prepare Form 8840 Internal Revenue Service Irs on any device

Digital document management has become increasingly popular among businesses and individuals. It serves as an ideal eco-friendly alternative to conventional printed and signed papers, allowing you to find the appropriate form and securely store it online. airSlate SignNow provides all the tools necessary to create, modify, and electronically sign your documents swiftly without any delays. Manage Form 8840 Internal Revenue Service Irs on any device with airSlate SignNow's Android or iOS applications and streamline any document-driven process today.

The easiest way to modify and eSign Form 8840 Internal Revenue Service Irs with ease

- Find Form 8840 Internal Revenue Service Irs and click Get Form to begin.

- Utilize the tools we offer to finalize your document.

- Emphasize important sections of the documents or obscure sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Create your eSignature using the Sign tool, which takes only seconds and holds the same legal validity as a traditional handwritten signature.

- Review all the details and click on the Done button to save your changes.

- Choose your preferred method to send your form, whether by email, text message (SMS), invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, exhausting form searches, or mistakes that necessitate printing new document copies. airSlate SignNow addresses your document management needs in just a few clicks from any device you prefer. Edit and eSign Form 8840 Internal Revenue Service Irs to ensure effective communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct form 8840 internal revenue service irs

Create this form in 5 minutes!

How to create an eSignature for the form 8840 internal revenue service irs

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the 8840 form and who needs to fill it out?

The 8840 form, also known as the 'Closer Connection Exception Statement for Aliens', is used by certain non-resident aliens to claim that they have a closer connection to a foreign country than the United States. Typically, individuals who are not considered residents but spend signNow time in the U.S. need to fill out this form to avoid being taxed as residents.

-

How can airSlate SignNow help with the 8840 form filing process?

airSlate SignNow simplifies the filing process for the 8840 form by allowing you to create, edit, and electronically sign the document easily. Its user-friendly interface ensures that you can quickly fill out the necessary fields and securely send it to the IRS or relevant parties, all while maintaining compliance.

-

Is there a cost associated with using airSlate SignNow for the 8840 form?

Yes, airSlate SignNow offers various pricing plans that cater to different user needs, ensuring you have the tools necessary to manage documents like the 8840 form effectively. These plans are cost-effective and streamline the signing process, which can save you both time and money.

-

Can I integrate airSlate SignNow with other tools for managing the 8840 form?

Absolutely! airSlate SignNow supports integration with various third-party applications, allowing you to seamlessly manage your documents, including the 8840 form. This means you can easily connect it with tools you already use for enhanced workflow and document management.

-

What are the benefits of using airSlate SignNow for the 8840 form?

Using airSlate SignNow for the 8840 form offers numerous benefits, including ease of use, secure document storage, and the ability to track the status of your filings. The platform also helps ensure that your form is filled out correctly before submission, reducing the risk of errors.

-

Is airSlate SignNow compliant with regulations for the 8840 form?

Yes, airSlate SignNow complies with all relevant electronic signature regulations, including those applicable to forms like the 8840 form. This compliance ensures that your electronically signed documents are valid and legally recognized, giving you peace of mind throughout the process.

-

How long does it take to complete the 8840 form using airSlate SignNow?

Completing the 8840 form using airSlate SignNow is typically a quick process that can be done in just a few minutes, depending on the complexity of your situation. The platform's intuitive interface guides you step-by-step, facilitating quick and efficient completion.

Get more for Form 8840 Internal Revenue Service Irs

- Order following appeal of commitment for michigan courts form

- Family division of circuit court caseload training manual form

- Florida supreme court approved family law form 12981a2

- Lexisnexis automated michigan scao formslexisnexis

- Sample circuit court forms and instructions

- Approved scao jis code dsp state of michigan case no form

- Fillable online probate forms index michigan courts fax email

- Fillable online confirmation of earnings coe form

Find out other Form 8840 Internal Revenue Service Irs

- How To eSignature Hawaii Police RFP

- Can I eSignature Minnesota Real Estate Warranty Deed

- How Do I eSignature Indiana Police Lease Agreement Form

- eSignature Police PPT Kansas Free

- How Can I eSignature Mississippi Real Estate Rental Lease Agreement

- How Do I eSignature Kentucky Police LLC Operating Agreement

- eSignature Kentucky Police Lease Termination Letter Now

- eSignature Montana Real Estate Quitclaim Deed Mobile

- eSignature Montana Real Estate Quitclaim Deed Fast

- eSignature Montana Real Estate Cease And Desist Letter Easy

- How Do I eSignature Nebraska Real Estate Lease Agreement

- eSignature Nebraska Real Estate Living Will Now

- Can I eSignature Michigan Police Credit Memo

- eSignature Kentucky Sports Lease Agreement Template Easy

- eSignature Minnesota Police Purchase Order Template Free

- eSignature Louisiana Sports Rental Application Free

- Help Me With eSignature Nevada Real Estate Business Associate Agreement

- How To eSignature Montana Police Last Will And Testament

- eSignature Maine Sports Contract Safe

- eSignature New York Police NDA Now