Ca Receipts Standard Form

What is the Ca Receipts Standard

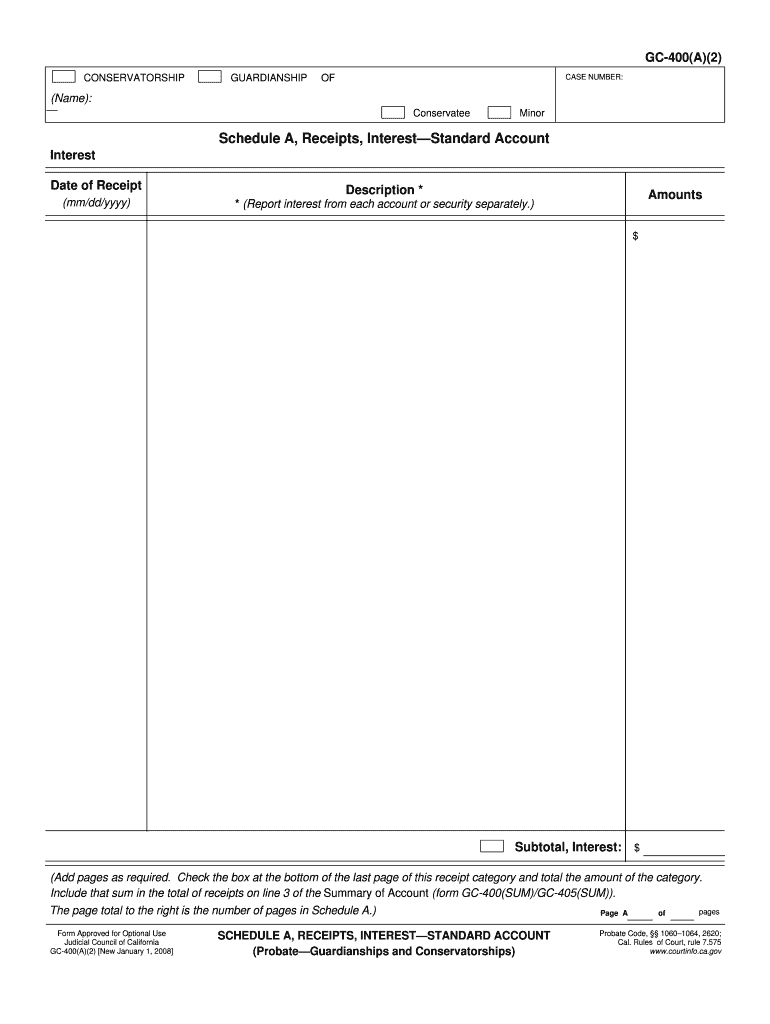

The California Receipts Standard refers to the guidelines established for documenting and tracking receipts related to business expenses. This standard is essential for ensuring accurate reporting and compliance with tax regulations. It outlines the necessary information that must be included on receipts, such as the date of the transaction, the amount spent, and the purpose of the expense. Adhering to these standards helps businesses maintain transparency and accountability in their financial practices.

How to use the Ca Receipts Standard

Utilizing the California Receipts Standard involves several key steps. First, ensure that all receipts collected meet the specified criteria, including clear details of the transaction. Next, categorize the receipts according to the type of expense, such as travel, supplies, or meals. It is also advisable to keep digital copies of all receipts for easy reference and backup. Using a reliable digital document management system can streamline this process, allowing for efficient organization and retrieval of receipts when needed.

Steps to complete the Ca Receipts Standard

Completing the California Receipts Standard requires a systematic approach. Begin by gathering all relevant receipts for the reporting period. Next, verify that each receipt contains the necessary information, including vendor details and transaction amounts. After confirming the accuracy of the receipts, categorize them according to their respective expense types. Finally, compile the receipts into a comprehensive report that aligns with the California tax filing requirements, ensuring that all documentation is readily accessible for review.

Key elements of the Ca Receipts Standard

Key elements of the California Receipts Standard include the following:

- Date: The date of the transaction must be clearly indicated.

- Vendor Information: The name and address of the vendor should be included.

- Transaction Amount: The total amount spent must be documented.

- Purpose of Expense: A brief description of the purpose for the expense is necessary.

- Payment Method: Indicating how the payment was made (credit card, cash, etc.) is also important.

IRS Guidelines

The Internal Revenue Service (IRS) provides specific guidelines on how receipts should be managed for tax purposes. According to IRS regulations, taxpayers must retain receipts for any expense that is claimed as a deduction. This includes maintaining documentation for business-related expenses to substantiate claims during audits. It is advisable to familiarize oneself with IRS guidelines to ensure compliance and avoid potential penalties.

Filing Deadlines / Important Dates

Filing deadlines for the California Receipts Standard align with the overall tax filing schedule. Typically, businesses must submit their annual tax returns by April fifteenth. However, specific deadlines may vary based on the business entity type and any extensions that may be filed. Keeping track of these important dates is crucial for ensuring timely compliance with state and federal regulations.

Quick guide on how to complete ca receipts standard

Prepare Ca Receipts Standard seamlessly on any device

Online document management has gained traction among businesses and individuals. It offers an ideal eco-friendly alternative to traditional printed and signed papers, allowing you to locate the right template and securely save it online. airSlate SignNow equips you with all the tools necessary to create, edit, and electronically sign your documents swiftly without any hold-ups. Manage Ca Receipts Standard on any device with airSlate SignNow's Android or iOS apps and streamline any document-related task today.

How to edit and eSign Ca Receipts Standard with ease

- Locate Ca Receipts Standard and click Get Form to commence.

- Use the tools we offer to fill out your form.

- Highlight pertinent sections of your documents or obscure sensitive details with tools that airSlate SignNow specifically provides for that purpose.

- Create your signature using the Sign tool, which takes mere seconds and holds the same legal validity as a traditional wet ink signature.

- Verify all the details and click on the Done button to save your modifications.

- Select how you want to share your form, whether by email, SMS, invitation link, or download it to your computer.

Forget about lost or misplaced documents, exhausting form searches, or mistakes that necessitate printing new copies. airSlate SignNow meets your document management needs within a few clicks from any device you choose. Edit and eSign Ca Receipts Standard and ensure excellent communication at every phase of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the ca receipts standard

The way to generate an electronic signature for a PDF online

The way to generate an electronic signature for a PDF in Google Chrome

The way to create an eSignature for signing PDFs in Gmail

The best way to create an eSignature straight from your smartphone

The best way to make an eSignature for a PDF on iOS

The best way to create an eSignature for a PDF document on Android

People also ask

-

What is the California schedule for eSigning receipts?

The California schedule for eSigning receipts refers to the timeline and process for electronically signing and sending documents. With airSlate SignNow, businesses can easily manage their eSigning requirements in compliance with California laws, ensuring that all necessary receipts are handled promptly and efficiently.

-

How much does airSlate SignNow cost for handling California schedule a receipts?

airSlate SignNow offers competitive pricing plans that are tailored to meet various business needs, particularly for those needing to manage California schedule a receipts. Pricing starts at an affordable monthly rate, allowing businesses to benefit from a cost-effective solution for their document signing needs.

-

What features does airSlate SignNow offer for managing California schedule a receipts?

airSlate SignNow provides a variety of features to streamline the management of California schedule a receipts, including customizable templates and automated workflows. These tools not only enhance productivity but also ensure that all documents are compliant with California regulations.

-

Can I integrate airSlate SignNow with existing software for California schedule a receipts?

Yes, airSlate SignNow can seamlessly integrate with various applications and software, allowing for easy management of California schedule a receipts. This integration capability ensures that your workflow remains uninterrupted and efficient while using our eSigning solution.

-

What benefits can businesses expect from using airSlate SignNow for California schedule a receipts?

By using airSlate SignNow for California schedule a receipts, businesses can expect improved efficiency, reduced turnaround times, and enhanced compliance with legal requirements. Our platform simplifies the signing process and offers a secure solution for handling sensitive documents.

-

Is airSlate SignNow suitable for small businesses managing California schedule a receipts?

Absolutely! airSlate SignNow is designed to be scalable, making it a perfect fit for small businesses handling California schedule a receipts. Our user-friendly interface and affordable pricing ensure that small enterprises can easily adopt eSigning without overwhelming complexity.

-

How secure is airSlate SignNow when dealing with California schedule a receipts?

Security is a top priority at airSlate SignNow. When managing California schedule a receipts, our platform employs advanced encryption and authentication measures to protect your documents and data, ensuring a secure eSigning process for all users.

Get more for Ca Receipts Standard

- Kym form in nepali

- Student shift hand off communication report s b vital sdnsec form

- Bdca forms

- Ct state green light permit form

- Oaas pf 09 004 form

- Initial podiatry progress note bgotoinsightbbcomb form

- Declaracin de actividad deutsche bank form

- Continuing professional development workshop credit form

Find out other Ca Receipts Standard

- Sign Kentucky Outsourcing Services Contract Simple

- Sign Oklahoma Outsourcing Services Contract Fast

- How Can I Sign Rhode Island Outsourcing Services Contract

- Sign Vermont Outsourcing Services Contract Simple

- Sign Iowa Interview Non-Disclosure (NDA) Secure

- Sign Arkansas Resignation Letter Simple

- Sign California Resignation Letter Simple

- Sign Florida Leave of Absence Agreement Online

- Sign Florida Resignation Letter Easy

- Sign Maine Leave of Absence Agreement Safe

- Sign Massachusetts Leave of Absence Agreement Simple

- Sign Connecticut Acknowledgement of Resignation Fast

- How To Sign Massachusetts Resignation Letter

- Sign New Mexico Resignation Letter Now

- How Do I Sign Oklahoma Junior Employment Offer Letter

- Sign Oklahoma Resignation Letter Simple

- How Do I Sign Oklahoma Acknowledgement of Resignation

- Can I Sign Pennsylvania Resignation Letter

- How To Sign Rhode Island Resignation Letter

- Sign Texas Resignation Letter Easy