Courts State Co Form

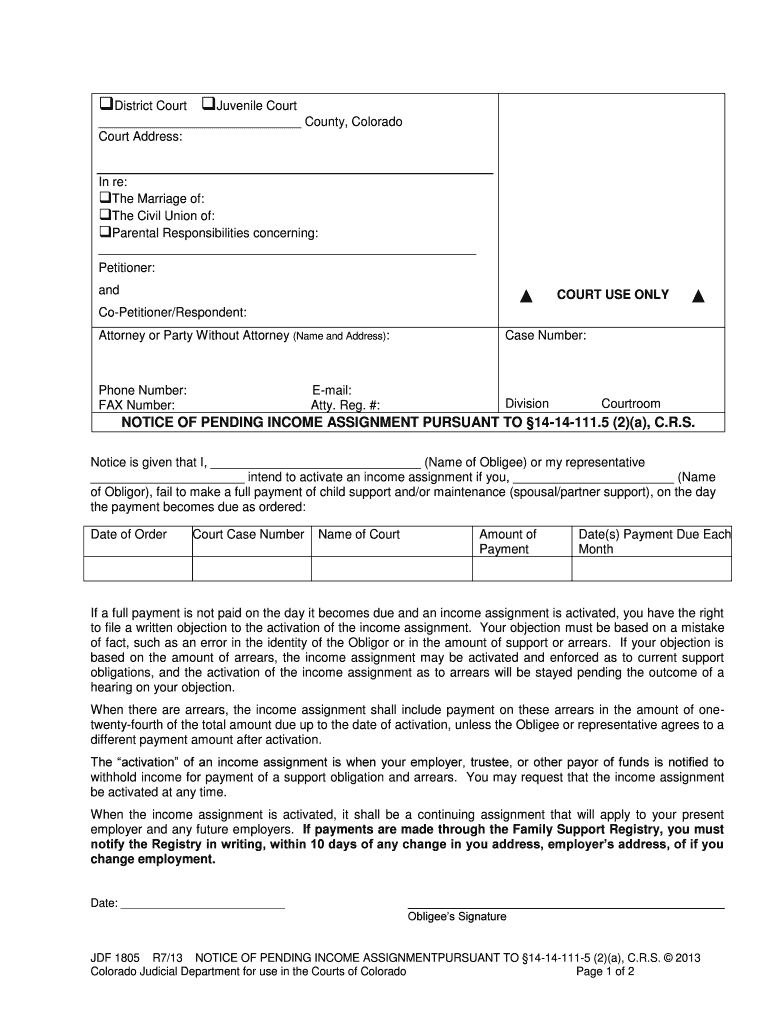

What is the Colorado Pending Income Form?

The Colorado pending income form is a document used to report income that is anticipated but not yet received. This form is particularly relevant for individuals and businesses that expect to receive payments in the near future but have not yet recorded these earnings. It is essential for accurate tax reporting and financial planning.

Steps to Complete the Colorado Pending Income Form

Completing the Colorado pending income form involves several key steps:

- Gather necessary financial information, including expected income sources and amounts.

- Fill out personal identification details, ensuring accuracy to avoid processing delays.

- Detail the anticipated income, including the nature of the income and the expected date of receipt.

- Review the completed form for any errors or omissions before submission.

Legal Use of the Colorado Pending Income Form

The Colorado pending income form serves a legal purpose in tax reporting. It allows individuals and businesses to declare expected income, ensuring compliance with state tax regulations. Proper use of this form can help prevent issues with the Colorado Department of Revenue regarding underreporting of income.

Filing Deadlines / Important Dates

It is crucial to be aware of the filing deadlines associated with the Colorado pending income form. Typically, forms must be submitted by specific dates aligned with tax reporting periods. Missing these deadlines can result in penalties or interest on unpaid taxes.

Required Documents

To complete the Colorado pending income form, several documents may be required:

- Proof of expected income, such as contracts or invoices.

- Personal identification documents, like a driver’s license or Social Security number.

- Previous tax returns for reference, if applicable.

Form Submission Methods

The Colorado pending income form can be submitted through various methods, ensuring flexibility for users:

- Online submission through the Colorado Department of Revenue website.

- Mailing a physical copy to the appropriate tax office.

- In-person submission at designated tax offices across Colorado.

Quick guide on how to complete courts state co 6968356

Effortlessly prepare Courts State Co on any device

Digital document management has become favored by both businesses and individuals. It serves as an excellent eco-friendly alternative to conventional printed and signed paperwork, allowing you to locate the necessary form and securely store it online. airSlate SignNow provides you with all the tools necessary to create, modify, and eSign your documents quickly without delays. Manage Courts State Co across any platform using airSlate SignNow's Android or iOS applications and enhance any document-related process today.

Simplest way to modify and eSign Courts State Co with ease

- Locate Courts State Co and click on Get Form to begin.

- Employ the tools available to complete your document.

- Emphasize essential sections of the documents or hide sensitive information using tools specifically provided by airSlate SignNow for this purpose.

- Create your eSignature with the Sign tool, which takes mere seconds and holds the same legal validity as a traditional handwritten signature.

- Review the details and click on the Done button to save your changes.

- Decide how you wish to send your form—via email, text message (SMS), an invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form hunting, or mistakes that require you to print new document copies. airSlate SignNow addresses your document administration needs in just a few clicks from any device you choose. Modify and eSign Courts State Co and ensure outstanding communication throughout your document preparation journey with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the courts state co 6968356

How to make an eSignature for your PDF online

How to make an eSignature for your PDF in Google Chrome

The way to generate an electronic signature for signing PDFs in Gmail

The best way to create an electronic signature from your smartphone

The best way to make an electronic signature for a PDF on iOS

The best way to create an electronic signature for a PDF file on Android

People also ask

-

What is Colorado pending income and how does it affect my business?

Colorado pending income refers to income that is not yet finalized but affects your financial reporting. Understanding this concept is vital for managing your finances effectively. With airSlate SignNow, you can streamline document processes, ensuring all income declarations are accurate and timely.

-

How can airSlate SignNow help with managing Colorado pending income documentation?

airSlate SignNow simplifies the signing process for documents related to Colorado pending income. Our platform allows you to easily send, sign, and store important financial documents, ensuring that your income-related paperwork is efficiently managed and secure.

-

What are the pricing options for airSlate SignNow related to Colorado pending income?

airSlate SignNow offers various pricing tiers designed to fit your business's needs when managing Colorado pending income. Each plan provides essential features tailored for document management, helping you transact easily and affordably without compromising on quality.

-

Are there features specifically aimed at improving the handling of Colorado pending income?

Yes, airSlate SignNow provides features that enhance the management of Colorado pending income, such as template creation, automated reminders, and secure storage. These tools ensure that you never miss a signNow deadline related to your income documentation.

-

Can I integrate airSlate SignNow with other accounting tools to manage Colorado pending income?

Absolutely! airSlate SignNow seamlessly integrates with popular accounting software, allowing you to synchronize your data related to Colorado pending income. This integration ensures that all documents and transactions are aligned in real-time, streamlining your workflows.

-

What benefits does airSlate SignNow provide for dealing with Colorado pending income?

Using airSlate SignNow to handle Colorado pending income comes with numerous benefits, including increased efficiency, reduced paper clutter, and improved accuracy in your income reports. Our platform helps keep your documentation organized, ensuring compliance and timely filing.

-

Is airSlate SignNow user-friendly for those managing Colorado pending income?

Yes, airSlate SignNow is designed with user-friendliness in mind, making it accessible for all skill levels. Whether you're new to digital document management or an experienced user, our intuitive platform will help you efficiently manage Colorado pending income with ease.

Get more for Courts State Co

- Schev instructor qualification form

- Withdrawal form lfmss

- Netspap standing prior approval form

- Application to buy your home form app2 scottish government scotland gov

- Gym waiver template uk form

- Model job demands checklist fillable form april

- Roommate agreement alberta form

- Independent truck dispatcher agreement template form

Find out other Courts State Co

- How Can I Sign Indiana Government POA

- Sign Maryland Government Quitclaim Deed Safe

- Sign Louisiana Government Warranty Deed Easy

- Sign Government Presentation Massachusetts Secure

- How Can I Sign Louisiana Government Quitclaim Deed

- Help Me With Sign Michigan Government LLC Operating Agreement

- How Do I Sign Minnesota Government Quitclaim Deed

- Sign Minnesota Government Affidavit Of Heirship Simple

- Sign Missouri Government Promissory Note Template Fast

- Can I Sign Missouri Government Promissory Note Template

- Sign Nevada Government Promissory Note Template Simple

- How To Sign New Mexico Government Warranty Deed

- Help Me With Sign North Dakota Government Quitclaim Deed

- Sign Oregon Government Last Will And Testament Mobile

- Sign South Carolina Government Purchase Order Template Simple

- Help Me With Sign Pennsylvania Government Notice To Quit

- Sign Tennessee Government Residential Lease Agreement Fast

- Sign Texas Government Job Offer Free

- Sign Alabama Healthcare / Medical LLC Operating Agreement Online

- Sign Alabama Healthcare / Medical Quitclaim Deed Mobile