Iowa Form 109

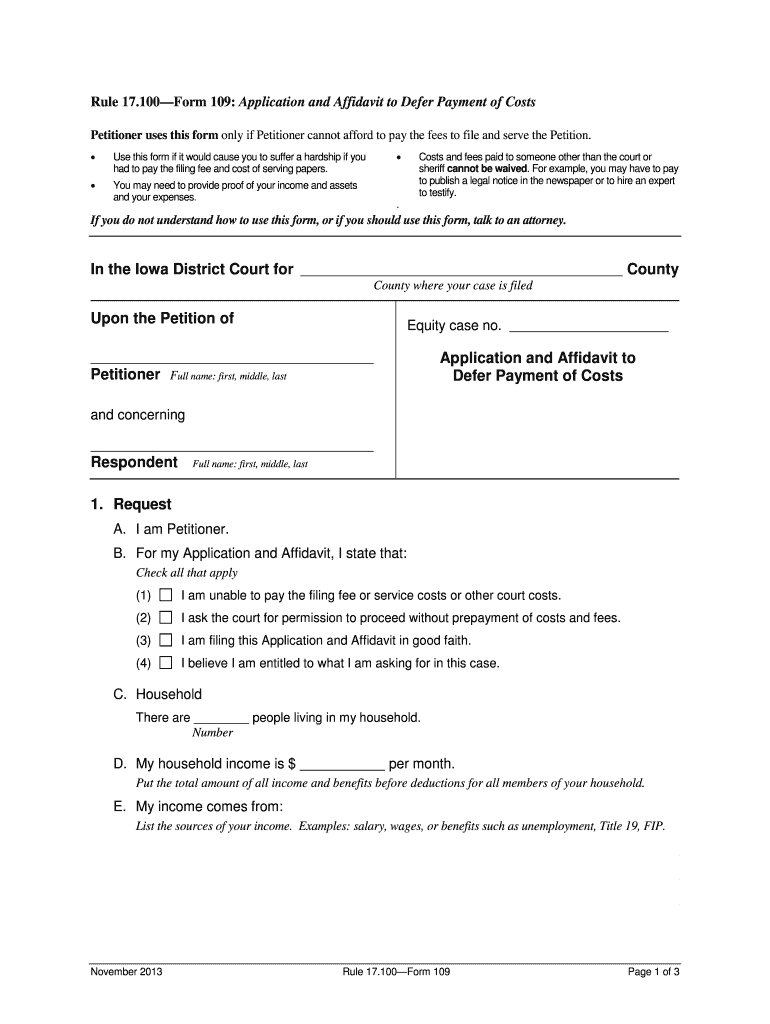

What is the Iowa Form 109

The Iowa Form 109 is a tax document used by residents of Iowa to report specific income and tax information to the state. This form is essential for individuals and businesses that need to comply with state tax regulations. It serves as a means to ensure that all taxable income is accurately reported, allowing the state to assess the proper tax liabilities. Understanding the purpose and requirements of the Iowa Form 109 is crucial for anyone involved in state tax reporting.

Steps to complete the Iowa Form 109

Completing the Iowa Form 109 involves several key steps to ensure accuracy and compliance. Start by gathering all necessary financial documents, including W-2s, 1099s, and any other income statements. Next, follow these steps:

- Enter your personal information, including your name, address, and Social Security number.

- Report your total income as indicated on your financial documents.

- Calculate any deductions or credits you are eligible for to reduce your taxable income.

- Determine your tax liability based on the current Iowa tax rates.

- Review your completed form for accuracy before submission.

Taking the time to carefully complete each section will help avoid issues with the state tax authority.

How to obtain the Iowa Form 109

The Iowa Form 109 can be obtained through several convenient methods. Residents can access the form online via the Iowa Department of Revenue's official website, where it is available for download in PDF format. Additionally, physical copies of the form may be available at local government offices or tax preparation services. Ensure you have the most current version of the form to comply with any recent changes in tax regulations.

Legal use of the Iowa Form 109

The legal use of the Iowa Form 109 is governed by state tax laws. To be considered valid, the form must be filled out completely and accurately, reflecting all required income and deductions. Submitting an incomplete or incorrect form can lead to penalties or legal repercussions. It is important to understand the legal implications of the information provided on the form, as it serves as an official record of your tax obligations to the state.

Filing Deadlines / Important Dates

Filing deadlines for the Iowa Form 109 are crucial for compliance. Typically, the form must be submitted by April 30 of the tax year. However, it is essential to check for any specific changes or extensions announced by the Iowa Department of Revenue. Marking these important dates on your calendar can help ensure timely submission and avoid potential penalties for late filing.

Penalties for Non-Compliance

Failure to comply with the requirements of the Iowa Form 109 can result in various penalties. These may include fines, interest on unpaid taxes, and even legal action in severe cases. It is important to file the form accurately and on time to avoid these consequences. Understanding the potential penalties can motivate individuals and businesses to prioritize their tax responsibilities.

Quick guide on how to complete iowa form 109

Effortlessly complete Iowa Form 109 on any device

Digital document management has become increasingly popular among businesses and individuals. It serves as an ideal eco-friendly alternative to traditional printed and signed documents, allowing you to find the appropriate form and securely save it online. airSlate SignNow provides you with all the tools necessary to create, modify, and eSign your documents quickly and without issues. Handle Iowa Form 109 on any platform using airSlate SignNow's Android or iOS applications and enhance any document-centric process today.

How to edit and eSign Iowa Form 109 with ease

- Obtain Iowa Form 109 and click Get Form to begin.

- Make use of the tools we offer to fill out your form.

- Emphasize important sections of the documents or conceal sensitive information with tools provided by airSlate SignNow specifically for that purpose.

- Create your eSignature using the Sign tool, which takes mere seconds and has the same legal validity as a traditional wet ink signature.

- Review all the details and click on the Done button to save your updates.

- Choose how you wish to share your form, via email, SMS, or invite link, or download it to your computer.

Eliminate concerns about lost or misplaced files, tedious form searching, or mistakes that necessitate printing new document copies. airSlate SignNow addresses your document management needs in just a few clicks from any device you choose. Edit and eSign Iowa Form 109 and ensure outstanding communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the iowa form 109

How to create an electronic signature for your PDF online

How to create an electronic signature for your PDF in Google Chrome

How to generate an electronic signature for signing PDFs in Gmail

The best way to create an eSignature straight from your smartphone

How to create an electronic signature for a PDF on iOS

The best way to create an eSignature for a PDF document on Android

People also ask

-

What is the iowa form 109 and why is it important?

The iowa form 109 is a tax form used for reporting income and withholding information to the Iowa Department of Revenue. It is crucial for taxpayers as it ensures compliance with state tax laws and is necessary for accurate tax filing.

-

How can airSlate SignNow assist with completing the iowa form 109?

airSlate SignNow provides an easy-to-use platform to fill out and eSign the iowa form 109 digitally. This streamlines the process, making it quicker and more efficient for businesses and individuals to complete their tax documentation.

-

Is airSlate SignNow a cost-effective solution for handling the iowa form 109?

Yes, airSlate SignNow is designed to be a cost-effective solution for managing various forms, including the iowa form 109. With competitive pricing plans, it allows users to save both time and money while ensuring compliance with federal and state requirements.

-

What features does airSlate SignNow offer for the iowa form 109?

airSlate SignNow offers features such as electronic signatures, document templates, and secure cloud storage, all tailored for forms like the iowa form 109. These features enhance usability and provide a comprehensive solution for document management.

-

What are the benefits of using airSlate SignNow for the iowa form 109?

Using airSlate SignNow for the iowa form 109 offers benefits such as improved accuracy, reduced processing time, and enhanced security. This platform minimizes errors and helps businesses maintain compliance with state regulations effectively.

-

Can I integrate airSlate SignNow with other applications for processing the iowa form 109?

Yes, airSlate SignNow can seamlessly integrate with various applications, improving workflow efficiency when processing the iowa form 109. This capability allows users to consolidate their operations and enhance productivity.

-

How secure is airSlate SignNow for sending the iowa form 109?

airSlate SignNow prioritizes security with advanced encryption protocols, ensuring that the iowa form 109 and other sensitive documents are protected during transmission. This provides peace of mind to users knowing their data is secure.

Get more for Iowa Form 109

Find out other Iowa Form 109

- eSignature Alabama Business Operations Cease And Desist Letter Now

- How To eSignature Iowa Banking Quitclaim Deed

- How To eSignature Michigan Banking Job Description Template

- eSignature Missouri Banking IOU Simple

- eSignature Banking PDF New Hampshire Secure

- How Do I eSignature Alabama Car Dealer Quitclaim Deed

- eSignature Delaware Business Operations Forbearance Agreement Fast

- How To eSignature Ohio Banking Business Plan Template

- eSignature Georgia Business Operations Limited Power Of Attorney Online

- Help Me With eSignature South Carolina Banking Job Offer

- eSignature Tennessee Banking Affidavit Of Heirship Online

- eSignature Florida Car Dealer Business Plan Template Myself

- Can I eSignature Vermont Banking Rental Application

- eSignature West Virginia Banking Limited Power Of Attorney Fast

- eSignature West Virginia Banking Limited Power Of Attorney Easy

- Can I eSignature Wisconsin Banking Limited Power Of Attorney

- eSignature Kansas Business Operations Promissory Note Template Now

- eSignature Kansas Car Dealer Contract Now

- eSignature Iowa Car Dealer Limited Power Of Attorney Easy

- How Do I eSignature Iowa Car Dealer Limited Power Of Attorney