Form 1040 NR Sp U S Nonresident Alien Income Tax Return Spanish Version 2023

What is the Form 1040 NR sp U S Nonresident Alien Income Tax Return Spanish Version

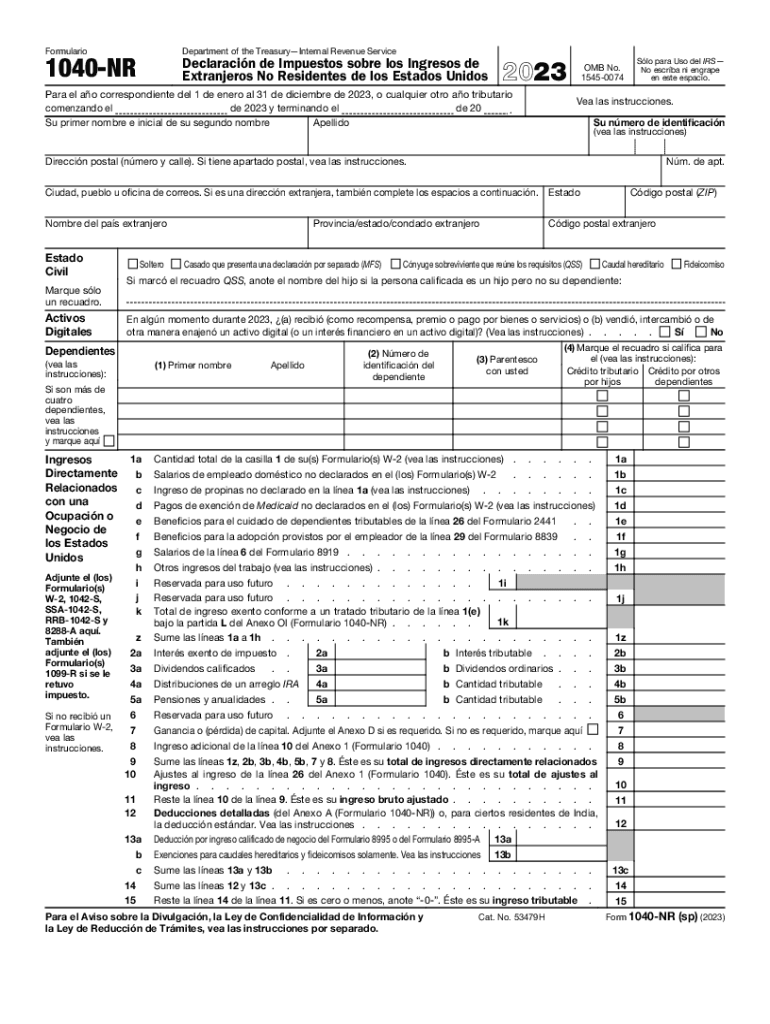

The Form 1040 NR sp U S Nonresident Alien Income Tax Return Spanish Version is a tax form specifically designed for nonresident aliens in the United States. This form allows individuals who do not meet the criteria for residency to report their income and calculate their tax obligations. It is essential for those earning income in the U.S. but who are not considered residents for tax purposes. The Spanish version ensures accessibility for Spanish-speaking taxpayers, facilitating accurate reporting and compliance with U.S. tax laws.

How to use the Form 1040 NR sp U S Nonresident Alien Income Tax Return Spanish Version

Using the Form 1040 NR sp involves several steps. First, gather all necessary documents, including income statements and any applicable deductions. Next, carefully fill out the form, ensuring that all information is accurate and complete. Pay attention to specific sections that pertain to nonresident alien status, as these may differ from standard tax forms. Once completed, review the form to confirm that all entries are correct before submission. It is important to follow the instructions provided with the form to ensure compliance with IRS requirements.

Steps to complete the Form 1040 NR sp U S Nonresident Alien Income Tax Return Spanish Version

Completing the Form 1040 NR sp requires a systematic approach:

- Start by entering your personal information, including your name, address, and taxpayer identification number.

- Report your income from U.S. sources, including wages, salaries, and any other taxable income.

- Identify any deductions or exemptions you may qualify for, such as those related to dependents or specific expenses.

- Calculate your total tax liability based on the income and deductions reported.

- Sign and date the form, confirming that the information provided is true and accurate.

Legal use of the Form 1040 NR sp U S Nonresident Alien Income Tax Return Spanish Version

The Form 1040 NR sp is legally recognized by the IRS as the official document for nonresident aliens to report income. It is crucial for compliance with U.S. tax laws. Filing this form correctly helps avoid penalties and ensures that nonresident aliens fulfill their tax obligations. The form must be submitted by the specified deadlines, and any discrepancies can lead to audits or additional tax liabilities.

Required Documents

To complete the Form 1040 NR sp, several documents are necessary:

- W-2 forms from employers, which report wages and taxes withheld.

- 1099 forms for other income sources, such as freelance work or interest.

- Documentation of any deductions claimed, such as receipts for eligible expenses.

- Identification documents, including a passport or visa, to verify nonresident status.

Filing Deadlines / Important Dates

It is important to be aware of the filing deadlines for the Form 1040 NR sp. Typically, nonresident aliens must file by April 15 of the year following the tax year. However, if you are not required to file a return, you may still want to do so to claim a refund. Extensions may be available, but they must be requested in advance. Keeping track of these dates is essential to avoid penalties for late filing.

Quick guide on how to complete form 1040 nr sp u s nonresident alien income tax return spanish version

Complete Form 1040 NR sp U S Nonresident Alien Income Tax Return Spanish Version effortlessly on any device

Digital document management has gained traction among businesses and individuals. It offers an ideal environmentally friendly alternative to traditional printed and signed documents, allowing you to access the correct form and securely store it online. airSlate SignNow equips you with all the resources necessary to create, modify, and eSign your documents swiftly without delays. Manage Form 1040 NR sp U S Nonresident Alien Income Tax Return Spanish Version on any platform with airSlate SignNow Android or iOS applications and streamline any document-driven task today.

How to alter and eSign Form 1040 NR sp U S Nonresident Alien Income Tax Return Spanish Version effortlessly

- Locate Form 1040 NR sp U S Nonresident Alien Income Tax Return Spanish Version and then click Get Form to begin.

- Utilize the features we provide to complete your form.

- Highlight important sections of the documents or redact sensitive details with tools that airSlate SignNow specifically offers for this purpose.

- Create your signature using the Sign tool, which takes mere seconds and carries the same legal validity as a traditional wet ink signature.

- Verify the information and then click on the Done button to save your modifications.

- Choose how you'd like to send your form, whether by email, text message (SMS), or invitation link, or download it to your computer.

Forget about lost or misplaced documents, tedious form searches, or errors that require printing new document copies. airSlate SignNow meets your needs in document management with just a few clicks from any device you prefer. Edit and eSign Form 1040 NR sp U S Nonresident Alien Income Tax Return Spanish Version and ensure excellent communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct form 1040 nr sp u s nonresident alien income tax return spanish version

Create this form in 5 minutes!

How to create an eSignature for the form 1040 nr sp u s nonresident alien income tax return spanish version

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Form 1040 NR sp U S Nonresident Alien Income Tax Return Spanish Version?

The Form 1040 NR sp U S Nonresident Alien Income Tax Return Spanish Version is a tax form specifically designed for nonresident aliens in the United States. It allows individuals to report their income and calculate their tax obligations in Spanish, making it accessible for Spanish-speaking taxpayers.

-

How can airSlate SignNow help with the Form 1040 NR sp U S Nonresident Alien Income Tax Return Spanish Version?

airSlate SignNow provides an easy-to-use platform for eSigning and sending the Form 1040 NR sp U S Nonresident Alien Income Tax Return Spanish Version. Our solution streamlines the process, ensuring that you can complete your tax return efficiently and securely.

-

Is there a cost associated with using airSlate SignNow for the Form 1040 NR sp U S Nonresident Alien Income Tax Return Spanish Version?

Yes, airSlate SignNow offers various pricing plans to suit different needs. You can choose a plan that fits your budget while gaining access to features that simplify the completion and submission of the Form 1040 NR sp U S Nonresident Alien Income Tax Return Spanish Version.

-

What features does airSlate SignNow offer for the Form 1040 NR sp U S Nonresident Alien Income Tax Return Spanish Version?

airSlate SignNow includes features such as document templates, eSignature capabilities, and secure cloud storage. These tools make it easier to manage the Form 1040 NR sp U S Nonresident Alien Income Tax Return Spanish Version and ensure compliance with tax regulations.

-

Can I integrate airSlate SignNow with other applications for the Form 1040 NR sp U S Nonresident Alien Income Tax Return Spanish Version?

Yes, airSlate SignNow offers integrations with various applications, enhancing your workflow. You can connect it with accounting software and other tools to streamline the process of managing the Form 1040 NR sp U S Nonresident Alien Income Tax Return Spanish Version.

-

What are the benefits of using airSlate SignNow for tax documents like the Form 1040 NR sp U S Nonresident Alien Income Tax Return Spanish Version?

Using airSlate SignNow for tax documents provides convenience, security, and efficiency. You can easily eSign and send the Form 1040 NR sp U S Nonresident Alien Income Tax Return Spanish Version, reducing the time spent on paperwork and ensuring your documents are securely handled.

-

Is airSlate SignNow user-friendly for completing the Form 1040 NR sp U S Nonresident Alien Income Tax Return Spanish Version?

Absolutely! airSlate SignNow is designed with user experience in mind, making it simple for anyone to navigate. Whether you're familiar with tax forms or not, you can easily complete the Form 1040 NR sp U S Nonresident Alien Income Tax Return Spanish Version with our intuitive interface.

Get more for Form 1040 NR sp U S Nonresident Alien Income Tax Return Spanish Version

- Maine notice owner form

- Maine warranty deed 497310751 form

- Notice to owner corporation or llc maine form

- Discharge of lien by individual maine form

- Maine lien form

- Conditional waiver and release upon progress payment individual maine form

- Conditional waiver and release upon progress payment corporation or llc maine form

- Maine waiver form

Find out other Form 1040 NR sp U S Nonresident Alien Income Tax Return Spanish Version

- Help Me With Electronic signature Oklahoma Insurance Contract

- Electronic signature Pennsylvania Insurance Letter Of Intent Later

- Electronic signature Pennsylvania Insurance Quitclaim Deed Now

- Electronic signature Maine High Tech Living Will Later

- Electronic signature Maine High Tech Quitclaim Deed Online

- Can I Electronic signature Maryland High Tech RFP

- Electronic signature Vermont Insurance Arbitration Agreement Safe

- Electronic signature Massachusetts High Tech Quitclaim Deed Fast

- Electronic signature Vermont Insurance Limited Power Of Attorney Easy

- Electronic signature Washington Insurance Last Will And Testament Later

- Electronic signature Washington Insurance Last Will And Testament Secure

- Electronic signature Wyoming Insurance LLC Operating Agreement Computer

- How To Electronic signature Missouri High Tech Lease Termination Letter

- Electronic signature Montana High Tech Warranty Deed Mobile

- Electronic signature Florida Lawers Cease And Desist Letter Fast

- Electronic signature Lawers Form Idaho Fast

- Electronic signature Georgia Lawers Rental Lease Agreement Online

- How Do I Electronic signature Indiana Lawers Quitclaim Deed

- How To Electronic signature Maryland Lawers Month To Month Lease

- Electronic signature North Carolina High Tech IOU Fast