Indiana Income Withholding 2020-2026

What is the Indiana Income Withholding

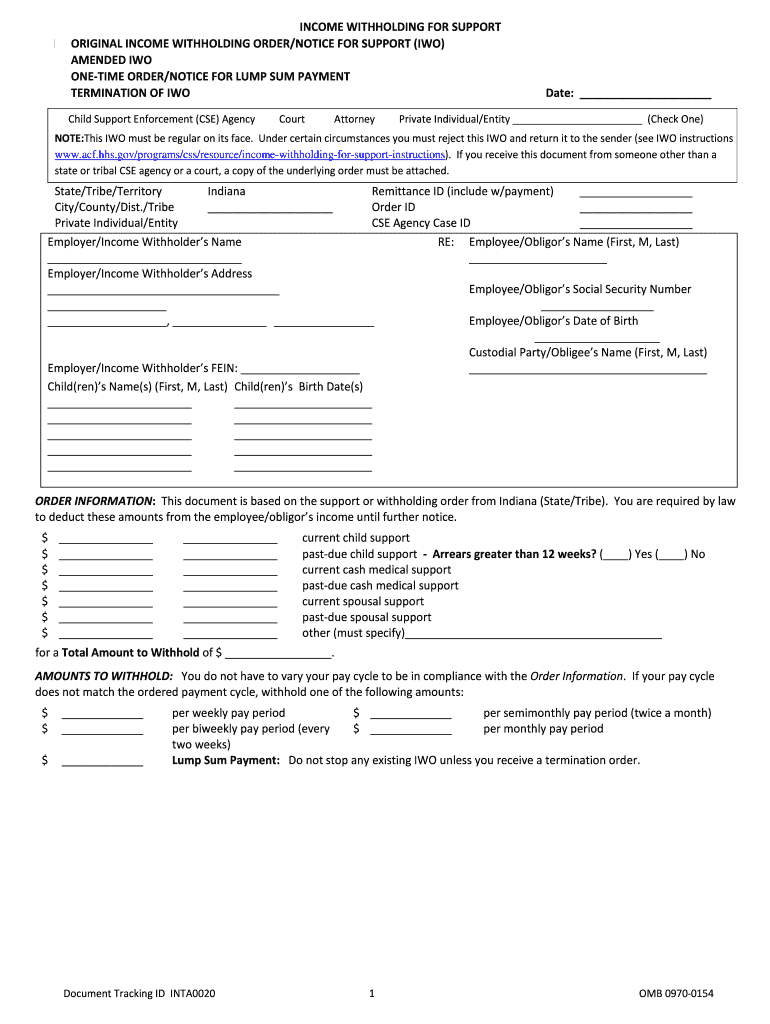

The Indiana income withholding form is a legal document used to facilitate the collection of child support or other court-ordered payments directly from an individual's paycheck. This form is crucial for ensuring that payments are made consistently and on time, thereby supporting the financial needs of dependents. It is often referred to as the Indiana withholding IWO, which stands for Income Withholding Order. The form is designed to comply with state and federal laws regarding child support and is used by employers to deduct the specified amount from an employee's wages before they receive their paycheck.

Steps to Complete the Indiana Income Withholding

Completing the Indiana income withholding form involves several key steps to ensure accuracy and compliance. First, the individual responsible for making payments must provide their personal information, including name, address, and Social Security number. Next, the form requires details about the recipient of the payments, often including their name and address. The amount to be withheld is then specified, which may be a fixed amount or a percentage of the employee's income. It is essential to review the information for accuracy before submitting the form to the employer, as errors can lead to delays in payment processing.

Legal Use of the Indiana Income Withholding

The Indiana income withholding form is legally binding once it is properly completed and submitted. Compliance with the form's requirements ensures that the withholding process adheres to both state and federal laws. Employers are mandated to honor the withholding order, and failure to do so can result in legal consequences. It is important for both the payer and the recipient to understand their rights and responsibilities under the law, ensuring that the payments are made as stipulated in the court order.

How to Obtain the Indiana Income Withholding

The Indiana income withholding form can be obtained through various channels. It is often available online through state government websites, which provide downloadable versions of the form. Additionally, legal aid offices or family law attorneys can assist individuals in acquiring the necessary documentation. Ensuring that the correct and most current version of the form is used is vital for compliance with legal standards.

Form Submission Methods

Submitting the Indiana income withholding form can be done through several methods, depending on the employer's policies. The form can typically be submitted electronically, via email, or through a secure online portal if the employer has such a system in place. Alternatively, individuals may choose to print the completed form and submit it by mail or in person. It is essential to keep a copy of the submitted form for personal records and to confirm receipt with the employer.

Key Elements of the Indiana Income Withholding

Several key elements must be included in the Indiana income withholding form to ensure its validity. These elements include the payer's and recipient's identifying information, the specific amount to be withheld, and the frequency of payments. Additionally, the form should reference the court order or case number associated with the support obligation. Ensuring that all required fields are completed accurately is critical for the form's acceptance and processing by the employer.

Quick guide on how to complete indiana income withholding

Complete Indiana Income Withholding effortlessly on any device

Online document management has gained popularity among businesses and individuals. It serves as a perfect eco-friendly alternative to conventional printed and signed documents, allowing you to find the appropriate form and securely store it online. airSlate SignNow equips you with all the tools required to create, edit, and eSign your documents swiftly without any delays. Manage Indiana Income Withholding on any device using airSlate SignNow's Android or iOS applications and streamline any document-related process today.

The easiest way to modify and eSign Indiana Income Withholding without stress

- Obtain Indiana Income Withholding and click Get Form to begin.

- Utilize the tools we offer to complete your form.

- Mark important sections of the documents or obscure sensitive information with the tools that airSlate SignNow provides specifically for that purpose.

- Generate your eSignature using the Sign feature, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review the information and click on the Done button to save your changes.

- Choose how you want to deliver your form, via email, SMS, invite link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searches, or errors requiring new document copies. airSlate SignNow addresses all your document management needs in just a few clicks from a device of your choice. Modify and eSign Indiana Income Withholding and ensure outstanding communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct indiana income withholding

Create this form in 5 minutes!

How to create an eSignature for the indiana income withholding

How to generate an electronic signature for a PDF document online

How to generate an electronic signature for a PDF document in Google Chrome

The way to generate an eSignature for signing PDFs in Gmail

The best way to generate an electronic signature right from your smart phone

How to make an eSignature for a PDF document on iOS

The best way to generate an electronic signature for a PDF on Android OS

People also ask

-

What is the Indiana income withholding form?

The Indiana income withholding form is a legal document used to instruct employers to withhold a specific amount from an employee's paycheck for child support or other obligations. This form ensures that payments are made directly to the appropriate agency or individual. Utilizing the Indiana income withholding form correctly can help streamline the payment process and ensure compliance with state requirements.

-

How can airSlate SignNow help with the Indiana income withholding form?

airSlate SignNow provides an efficient way to prepare, send, and eSign the Indiana income withholding form. With its user-friendly interface, you can quickly fill out the form and obtain necessary signatures from the parties involved. This not only saves time but also ensures that you meet all legal standards required for processing the form.

-

What are the pricing options for airSlate SignNow?

airSlate SignNow offers several pricing plans tailored to meet various business needs. Each plan includes features that facilitate the easy handling of the Indiana income withholding form and other documents. By choosing the right plan, you can access essential tools while staying within your budget.

-

What features does airSlate SignNow offer for managing the Indiana income withholding form?

airSlate SignNow provides features such as templates, real-time collaboration, and secure cloud storage to simplify the management of the Indiana income withholding form. Additionally, the platform allows you to track document status and send reminders, ensuring that your forms are completed promptly and efficiently. These features enhance productivity and compliance for your business.

-

Are there any integrations available with airSlate SignNow?

Yes, airSlate SignNow integrates seamlessly with various other software and applications, enhancing your workflow. You can easily connect with tools like Google Drive, Salesforce, and Microsoft Teams to automate processes related to the Indiana income withholding form. These integrations enable you to manage documents more effectively and improves overall efficiency.

-

Is airSlate SignNow secure for handling the Indiana income withholding form?

Absolutely! airSlate SignNow prioritizes security and compliance, employing encryption and secure access protocols. When handling the Indiana income withholding form and sensitive information, you can trust that your data is protected. This level of security reassures users that their documents are safe from unauthorized access.

-

How do I get started with airSlate SignNow for the Indiana income withholding form?

Getting started with airSlate SignNow is easy. Simply sign up for an account, and you can create templates for the Indiana income withholding form tailored to your business. Our intuitive platform guides you through each step, making the whole process smooth and efficient.

Get more for Indiana Income Withholding

Find out other Indiana Income Withholding

- How To eSign Rhode Island Legal Lease Agreement

- How Do I eSign Rhode Island Legal Residential Lease Agreement

- How Can I eSign Wisconsin Non-Profit Stock Certificate

- How Do I eSign Wyoming Non-Profit Quitclaim Deed

- eSign Hawaii Orthodontists Last Will And Testament Fast

- eSign South Dakota Legal Letter Of Intent Free

- eSign Alaska Plumbing Memorandum Of Understanding Safe

- eSign Kansas Orthodontists Contract Online

- eSign Utah Legal Last Will And Testament Secure

- Help Me With eSign California Plumbing Business Associate Agreement

- eSign California Plumbing POA Mobile

- eSign Kentucky Orthodontists Living Will Mobile

- eSign Florida Plumbing Business Plan Template Now

- How To eSign Georgia Plumbing Cease And Desist Letter

- eSign Florida Plumbing Credit Memo Now

- eSign Hawaii Plumbing Contract Mobile

- eSign Florida Plumbing Credit Memo Fast

- eSign Hawaii Plumbing Claim Fast

- eSign Hawaii Plumbing Letter Of Intent Myself

- eSign Hawaii Plumbing Letter Of Intent Fast