in 2017

What is the In

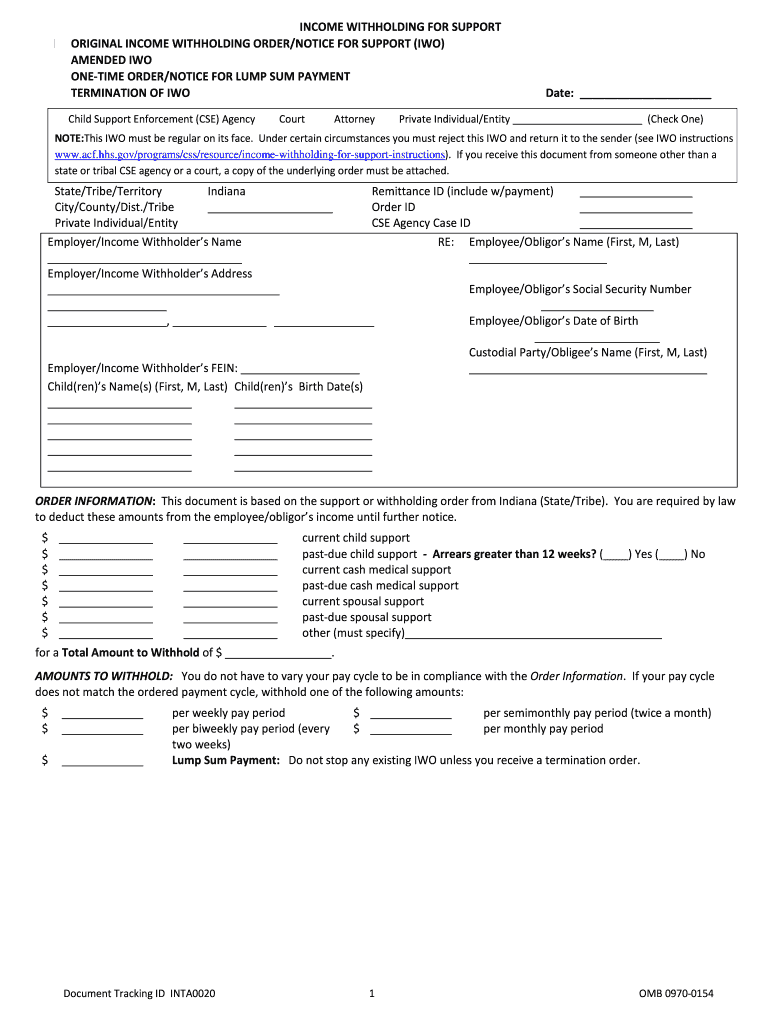

The "In" form is a crucial document used in various administrative and legal processes. It serves as a means for individuals or businesses to provide necessary information to government agencies or organizations. This form is particularly important in contexts such as tax reporting, legal compliance, and formal applications. Understanding the purpose and requirements of the "In" form is essential for ensuring compliance and avoiding potential penalties.

How to use the In

Using the "In" form involves several steps that ensure accurate completion and submission. First, gather all necessary information and documents required to fill out the form. Next, carefully complete each section, paying close attention to detail to avoid errors. Once the form is filled out, review it for accuracy before submission. Depending on the specific requirements, you may need to submit the form electronically, by mail, or in person.

Steps to complete the In

Completing the "In" form involves a systematic approach:

- Gather required documents, such as identification and financial records.

- Fill out the form accurately, ensuring all fields are completed.

- Double-check for any errors or omissions.

- Sign and date the form where required.

- Submit the form according to the specified guidelines.

Following these steps will help ensure that the form is completed correctly and submitted on time.

Legal use of the In

The "In" form must be used in accordance with applicable laws and regulations. It is essential to understand the legal implications of the information provided on the form. For instance, inaccuracies or omissions can lead to penalties or legal issues. Familiarity with relevant laws, such as those governing eSignatures and document submissions, is crucial for ensuring that the form is legally binding and compliant.

IRS Guidelines

The Internal Revenue Service (IRS) provides specific guidelines for completing and submitting the "In" form, particularly when it relates to tax matters. It is important to follow these guidelines closely to avoid issues with tax compliance. This includes understanding filing deadlines, required documentation, and potential deductions or credits associated with the form.

Required Documents

When completing the "In" form, certain documents are typically required. These may include:

- Identification, such as a Social Security number or tax identification number.

- Financial statements or records relevant to the form's purpose.

- Any previous versions of the form if applicable.

Having these documents ready will facilitate a smoother completion process.

Quick guide on how to complete in

Effortlessly prepare In on any device

Online document management has become increasingly popular among companies and individuals. It serves as an ideal eco-friendly substitute for traditional printed and signed documents, as you can access the necessary form and securely store it online. airSlate SignNow equips you with all the tools required to create, modify, and eSign your documents swiftly without delays. Manage In on any device using airSlate SignNow's Android or iOS applications and enhance any document-driven process today.

The simplest way to modify and eSign In with ease

- Obtain In and then click Get Form to initiate.

- Utilize the tools we offer to fill out your form.

- Emphasize relevant sections of your documents or hide sensitive information using tools that airSlate SignNow provides specifically for this purpose.

- Create your eSignature with the Sign feature, which takes only seconds and holds the same legal validity as a traditional handwritten signature.

- Review the details and then click the Done button to save your changes.

- Select your preferred method for sending your form, whether by email, SMS, or invitation link, or download it to your computer.

Eliminate the worry of lost or misplaced documents, tedious form searches, or errors that require printing new copies. airSlate SignNow meets your document management needs in just a few clicks from any device you choose. Modify and eSign In and ensure excellent communication at every stage of your form preparation with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct in

Create this form in 5 minutes!

How to create an eSignature for the in

The best way to create an eSignature for your PDF file online

The best way to create an eSignature for your PDF file in Google Chrome

The best way to make an eSignature for signing PDFs in Gmail

The way to make an eSignature right from your mobile device

The way to generate an electronic signature for a PDF file on iOS

The way to make an eSignature for a PDF on Android devices

People also ask

-

What features does airSlate SignNow provide for eSigning documents?

airSlate SignNow offers a comprehensive suite of features for eSigning documents, including customizable templates, automated workflows, and multi-device accessibility. With these tools, users can easily send and sign documents in minutes, ensuring a streamlined process that enhances productivity.

-

How much does airSlate SignNow cost?

airSlate SignNow offers flexible pricing plans designed to suit various business needs. Depending on the plan chosen, users can benefit from features like unlimited signing, team collaboration tools, and advanced integrations to make their document management experience efficient and cost-effective.

-

Can I integrate airSlate SignNow with other software I already use?

Yes, airSlate SignNow provides seamless integrations with various applications such as Google Drive, Dropbox, and CRM systems like Salesforce. This compatibility helps businesses maintain their current workflows while enhancing their document signing processes in a single platform.

-

Is airSlate SignNow suitable for large organizations?

Absolutely! airSlate SignNow is designed to cater to businesses of all sizes, including large organizations. Its robust features and scalable solutions allow teams to manage high volumes of documents efficiently, providing a powerful tool to improve operational workflows.

-

How secure is the signing process with airSlate SignNow?

The security of the signing process in airSlate SignNow is a top priority. The platform utilizes advanced encryption technologies and complies with strict regulations to ensure that all documents are securely signed, making it a reliable choice for sensitive business communications.

-

What benefits does airSlate SignNow provide for remote teams?

For remote teams, airSlate SignNow offers the convenience of accessing and signing documents from anywhere, at any time. This flexibility improves collaboration and speeds up decision-making processes, allowing team members to focus on their core tasks without delays.

-

Is it easy to use airSlate SignNow for someone who is not tech-savvy?

Yes, airSlate SignNow is designed with user-friendliness in mind. Its intuitive interface and straightforward navigation make it easy for anyone, regardless of their tech background, to send and eSign documents efficiently in just a few clicks.

Get more for In

- Applicant information form

- Dol 671 form

- Redwood falls baseball tournament registration form make checks payable to rayba p

- Da form 5383

- Notice of estate administration form delaware county co delaware pa

- Realtor referral form pdf

- Orioles license plate mva form

- Aquarium maintenance contract template form

Find out other In

- How Do I eSign Maryland Interview Non-Disclosure (NDA)

- Help Me With eSign North Dakota Leave of Absence Agreement

- How To eSign Hawaii Acknowledgement of Resignation

- How Can I eSign New Jersey Resignation Letter

- How Do I eSign Ohio Resignation Letter

- eSign Arkansas Military Leave Policy Myself

- How To eSign Hawaii Time Off Policy

- How Do I eSign Hawaii Time Off Policy

- Help Me With eSign Hawaii Time Off Policy

- How To eSign Hawaii Addressing Harassement

- How To eSign Arkansas Company Bonus Letter

- eSign Hawaii Promotion Announcement Secure

- eSign Alaska Worksheet Strengths and Weaknesses Myself

- How To eSign Rhode Island Overtime Authorization Form

- eSign Florida Payroll Deduction Authorization Safe

- eSign Delaware Termination of Employment Worksheet Safe

- Can I eSign New Jersey Job Description Form

- Can I eSign Hawaii Reference Checking Form

- Help Me With eSign Hawaii Acknowledgement Letter

- eSign Rhode Island Deed of Indemnity Template Secure