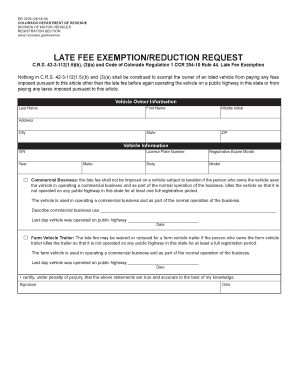

Late Fee Exemption Form

What is the Late Fee Exemption

The Late Fee Exemption is a provision that allows individuals or entities to avoid penalties associated with late payments under specific circumstances. This exemption is particularly relevant for taxpayers in Colorado who may face late fees due to various reasons, such as financial hardship or administrative errors. Understanding the criteria for eligibility is crucial for those seeking to benefit from this exemption.

How to use the Late Fee Exemption

To utilize the Late Fee Exemption, taxpayers must first determine if they meet the eligibility criteria outlined by the Colorado Department of Revenue. Once eligibility is confirmed, the next step involves completing the necessary documentation, which includes the DR2505 form. This form must be filled out accurately and submitted within the designated time frame to ensure that the exemption is processed correctly.

Steps to complete the Late Fee Exemption

Completing the Late Fee Exemption involves several key steps:

- Gather all necessary documentation that supports your claim for exemption.

- Fill out the DR2505 form, ensuring all information is accurate and complete.

- Submit the form either online, by mail, or in person, depending on your preference.

- Keep a copy of the submitted form and any supporting documents for your records.

Legal use of the Late Fee Exemption

The legal use of the Late Fee Exemption requires adherence to state regulations and guidelines. It is essential to ensure that all claims for exemption are legitimate and supported by appropriate documentation. Misuse of the exemption can lead to penalties or legal repercussions, so understanding the legal framework surrounding the exemption is vital for compliance.

Eligibility Criteria

Eligibility for the Late Fee Exemption is determined by specific criteria established by the Colorado Department of Revenue. Generally, individuals must demonstrate valid reasons for late payments, such as unforeseen circumstances or financial difficulties. It is important to review the detailed eligibility requirements to ensure that your situation qualifies for the exemption.

Required Documents

When applying for the Late Fee Exemption using the DR2505 form, certain documents may be required to substantiate your claim. These documents can include:

- Proof of income or financial hardship.

- Documentation of any administrative errors that may have led to late fees.

- Any correspondence with the Colorado Department of Revenue regarding your tax situation.

Form Submission Methods

The DR2505 form can be submitted through various methods, providing flexibility for taxpayers. Options include:

- Online submission through the Colorado Department of Revenue's website.

- Mailing the completed form to the appropriate address.

- In-person submission at designated state offices.

Quick guide on how to complete late fee exemption

Effortlessly prepare Late Fee Exemption on any device

The management of online documents has gained immense traction among businesses and individuals. It offers an ideal environmentally friendly substitute to conventional printed and signed documentation, allowing you to obtain the correct form and securely keep it online. airSlate SignNow provides all the tools necessary to create, modify, and electronically sign your documents quickly and without interruptions. Handle Late Fee Exemption on any device with airSlate SignNow's Android or iOS applications and streamline any document-related process today.

The easiest method to alter and eSign Late Fee Exemption with ease

- Locate Late Fee Exemption and click Get Form to begin.

- Utilize the tools we offer to complete your document.

- Highlight important sections of the documents or obscure sensitive information using tools specifically provided by airSlate SignNow for that purpose.

- Generate your eSignature with the Sign feature, which takes mere seconds and carries the same legal validity as a traditional handwritten signature.

- Review the details and click on the Done button to save your changes.

- Choose your preferred method for sending your form, whether it be via email, text message (SMS), invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced files, tedious form searching, or mistakes that require reprinting new document copies. airSlate SignNow caters to all your document management needs in just a few clicks from any device you choose. Modify and eSign Late Fee Exemption to ensure outstanding communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the late fee exemption

The best way to create an eSignature for a PDF document in the online mode

The best way to create an eSignature for a PDF document in Chrome

The best way to generate an eSignature for putting it on PDFs in Gmail

How to generate an electronic signature straight from your mobile device

The way to generate an eSignature for a PDF document on iOS devices

How to generate an electronic signature for a PDF document on Android devices

People also ask

-

What is the dr2505 feature in airSlate SignNow?

The dr2505 feature in airSlate SignNow allows users to create, send, and manage digital documents effortlessly. This feature streamlines the eSignature process, making it quick and efficient for businesses to handle important paperwork.

-

How much does airSlate SignNow cost with the dr2505 plan?

The dr2505 plan offers a competitive pricing structure ideal for businesses of all sizes. By choosing this plan, you gain access to premium features at an affordable rate, ensuring that your eSigning needs are met without breaking the bank.

-

What are the key benefits of using airSlate SignNow's dr2505 feature?

The dr2505 feature offers multiple benefits, including enhanced security, faster turnaround times for document signing, and improved document tracking. This ensures that your business operates efficiently and securely when handling electronic signatures.

-

Can I integrate airSlate SignNow with other tools using the dr2505?

Yes, the dr2505 feature is designed to seamlessly integrate with various third-party applications, enhancing your workflow signNowly. Whether you're using CRM software or project management tools, airSlate SignNow can connect to keep your processes smooth and efficient.

-

Is training provided with the dr2505 plan of airSlate SignNow?

Absolutely! With the dr2505 plan, airSlate SignNow offers comprehensive training resources and customer support. This ensures that any users can swiftly get up to speed with the platform's features and maximize its potential for their business.

-

How does the dr2505 feature enhance document security?

The dr2505 feature provides top-notch security measures such as encryption, password protection, and audit trails. These safeguards ensure that all documents are protected against unauthorized access, giving users peace of mind during the eSigning process.

-

What types of documents can I sign using airSlate SignNow's dr2505 feature?

The dr2505 feature allows users to sign a wide variety of documents, including contracts, agreements, and forms. This versatility makes airSlate SignNow a go-to solution for businesses needing to sign crucial documents quickly and securely.

Get more for Late Fee Exemption

- Visitor waiver form redlynch equestrian association

- Massachusetts form ct 3t

- Gulf place public beach improvements phase 2 city of gulf shores nj form

- Form w 8ben e form w 8ben e 2 ing emeklilik

- Al form individual revised mar2017

- Cg 5500a 100127540 form

- Faqs 32bj funds form

- Purchase of sale agreement template form

Find out other Late Fee Exemption

- eSignature Washington Insurance Work Order Fast

- eSignature Utah High Tech Warranty Deed Free

- How Do I eSignature Utah High Tech Warranty Deed

- eSignature Arkansas Legal Affidavit Of Heirship Fast

- Help Me With eSignature Colorado Legal Cease And Desist Letter

- How To eSignature Connecticut Legal LLC Operating Agreement

- eSignature Connecticut Legal Residential Lease Agreement Mobile

- eSignature West Virginia High Tech Lease Agreement Template Myself

- How To eSignature Delaware Legal Residential Lease Agreement

- eSignature Florida Legal Letter Of Intent Easy

- Can I eSignature Wyoming High Tech Residential Lease Agreement

- eSignature Connecticut Lawers Promissory Note Template Safe

- eSignature Hawaii Legal Separation Agreement Now

- How To eSignature Indiana Legal Lease Agreement

- eSignature Kansas Legal Separation Agreement Online

- eSignature Georgia Lawers Cease And Desist Letter Now

- eSignature Maryland Legal Quitclaim Deed Free

- eSignature Maryland Legal Lease Agreement Template Simple

- eSignature North Carolina Legal Cease And Desist Letter Safe

- How Can I eSignature Ohio Legal Stock Certificate