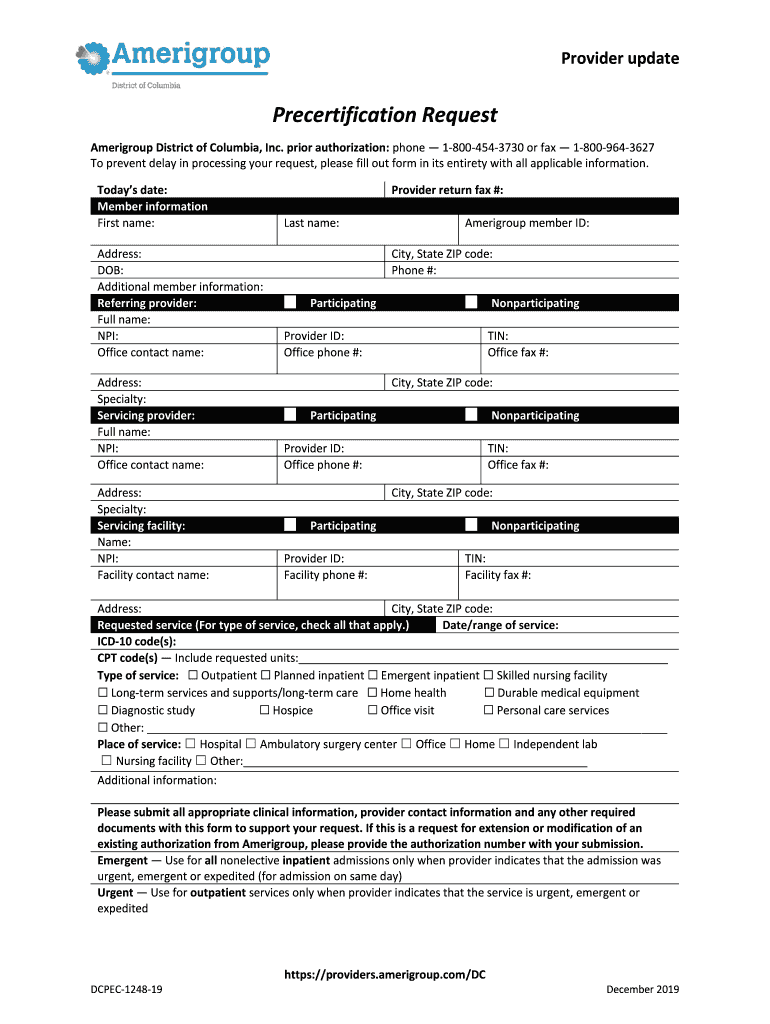

800 964 3627 2019-2026

Understanding the

The is a specific form used for various purposes, primarily related to tax and legal documentation in the United States. It serves as a vital tool for individuals and businesses to report income, claim deductions, or provide necessary information to the IRS. Understanding the purpose and requirements of this form is essential for ensuring compliance with federal regulations.

Steps to Complete the

Completing the involves several key steps to ensure accuracy and compliance. First, gather all necessary information, including personal identification details and financial records. Next, carefully fill out each section of the form, ensuring that all entries are clear and legible. After completing the form, review it for any errors or omissions. Finally, submit the form through the appropriate channels, whether online, by mail, or in person.

Legal Use of the

The legal use of the is governed by specific regulations that ensure its validity. To be considered legally binding, the form must be completed accurately and submitted within the designated time frame. Compliance with IRS guidelines and other relevant legal frameworks is crucial. Utilizing a reliable eSignature platform, such as signNow, can enhance the legal standing of the document by providing a digital certificate and ensuring adherence to eSignature laws.

Obtaining the

To obtain the, individuals can visit the official IRS website or contact their local IRS office for assistance. The form is typically available for download in a PDF format, allowing users to fill it out digitally or print it for manual completion. It is important to ensure that you are using the most current version of the form to avoid any compliance issues.

Examples of Using the

There are various scenarios where the may be utilized. For instance, self-employed individuals may use this form to report their income and expenses accurately. Additionally, businesses may need to complete the form when applying for certain tax credits or deductions. Understanding these examples can help users recognize the form's relevance to their specific situations.

Filing Deadlines and Important Dates

Filing deadlines for the are critical to ensure compliance with IRS regulations. Typically, the form must be submitted by April fifteenth of each year for individual taxpayers. Businesses may have different deadlines based on their fiscal year. Staying informed about these important dates can help avoid penalties and ensure timely processing of the form.

Quick guide on how to complete 800 964 3627

Prepare 800 964 3627 effortlessly on any device

Digital document management has become increasingly favored by businesses and individuals alike. It serves as an ideal environmentally friendly alternative to conventional printed and signed documents, allowing you to find the necessary form and securely store it online. airSlate SignNow provides you with all the resources required to generate, modify, and eSign your documents promptly without obstacles. Handle 800 964 3627 on any device using airSlate SignNow's Android or iOS applications and enhance any document-related task today.

The easiest way to modify and eSign 800 964 3627 with minimal effort

- Locate 800 964 3627 and click Get Form to begin.

- Make use of the tools we offer to complete your form.

- Emphasize important sections of the documents or redact sensitive details with tools that airSlate SignNow specifically provides for this purpose.

- Create your signature using the Sign tool, which only takes a few seconds and carries the same legal validity as a traditional handwritten signature.

- Review all information and click on the Done button to save your modifications.

- Choose how you wish to send your form, via email, text message (SMS), or invitation link, or download it to your computer.

Eliminate the worry of lost or misplaced documents, the hassle of searching for forms, or errors that necessitate reprinting new copies. airSlate SignNow meets your document management needs in just a few clicks from any device you prefer. Modify and eSign 800 964 3627 and ensure outstanding communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 800 964 3627

Create this form in 5 minutes!

How to create an eSignature for the 800 964 3627

The best way to create an eSignature for a PDF file online

The best way to create an eSignature for a PDF file in Google Chrome

The best way to create an electronic signature for signing PDFs in Gmail

The way to generate an electronic signature from your mobile device

The way to generate an eSignature for a PDF file on iOS

The way to generate an electronic signature for a PDF file on Android devices

People also ask

-

What is the purpose of using airSlate SignNow?

airSlate SignNow is designed to empower businesses to efficiently send and eSign documents. With its user-friendly interface and powerful features, it ensures that you can complete your document workflows faster while maintaining security and compliance. For further inquiries, you can signNow us at 8004543730.

-

How much does airSlate SignNow cost?

Pricing for airSlate SignNow is based on flexible plans tailored to fit various business needs. Our plans range from basic options to more advanced features, ensuring you're only paying for what you use. For a detailed pricing breakdown, feel free to contact us at 8004543730.

-

What features does airSlate SignNow offer?

airSlate SignNow includes a range of features such as document templates, customizable workflows, and real-time team collaboration. It also provides secure electronic signatures and audit trails to enhance your document management process. If you have more questions about our features, call us at 8004543730.

-

How does airSlate SignNow enhance document security?

Our platform uses advanced encryption protocols and complies with industry standards to ensure document security. With airSlate SignNow, your signed documents are stored securely and can be tracked to prevent unauthorized access. For more security-related questions, you can signNow out to 8004543730.

-

Can airSlate SignNow integrate with other software?

Yes, airSlate SignNow offers seamless integrations with popular tools like Google Drive, Salesforce, and Zapier. These integrations enhance your productivity by allowing you to manage documents across various platforms effortlessly. For integration-related inquiries, contact us at 8004543730.

-

What are the benefits of using airSlate SignNow for businesses?

By using airSlate SignNow, businesses can streamline their document workflows, reduce turnaround times, and lower operational costs. The platform allows for quick access to documents and simple collaboration, making it a smart choice for modern enterprises. For more benefits, feel free to call us at 8004543730.

-

Is airSlate SignNow suitable for small businesses?

Absolutely! airSlate SignNow is designed to cater to businesses of all sizes, including small businesses. Its cost-effective pricing and user-friendly features empower smaller teams to manage their documents efficiently, making it a valuable tool. If you have specific questions, don't hesitate to ring us at 8004543730.

Get more for 800 964 3627

- B4e form sample 49168

- Teacher recommendation form howard university howard

- Mdtsea student worksheets answer key form

- Aoc cr 281 form

- Environmental inspection checklist form

- Patientparticipantname form

- Masshealth sterilization consent ages 21 and older form

- Personal training introduction amp policies umass form

Find out other 800 964 3627

- How Do I eSign New Mexico Healthcare / Medical Word

- How To eSign Washington High Tech Presentation

- Help Me With eSign Vermont Healthcare / Medical PPT

- How To eSign Arizona Lawers PDF

- How To eSign Utah Government Word

- How Can I eSign Connecticut Lawers Presentation

- Help Me With eSign Hawaii Lawers Word

- How Can I eSign Hawaii Lawers Document

- How To eSign Hawaii Lawers PPT

- Help Me With eSign Hawaii Insurance PPT

- Help Me With eSign Idaho Insurance Presentation

- Can I eSign Indiana Insurance Form

- How To eSign Maryland Insurance PPT

- Can I eSign Arkansas Life Sciences PDF

- How Can I eSign Arkansas Life Sciences PDF

- Can I eSign Connecticut Legal Form

- How Do I eSign Connecticut Legal Form

- How Do I eSign Hawaii Life Sciences Word

- Can I eSign Hawaii Life Sciences Word

- How Do I eSign Hawaii Life Sciences Document