Minimum Amount Due Colorado Form

What is the Minimum Amount Due Colorado

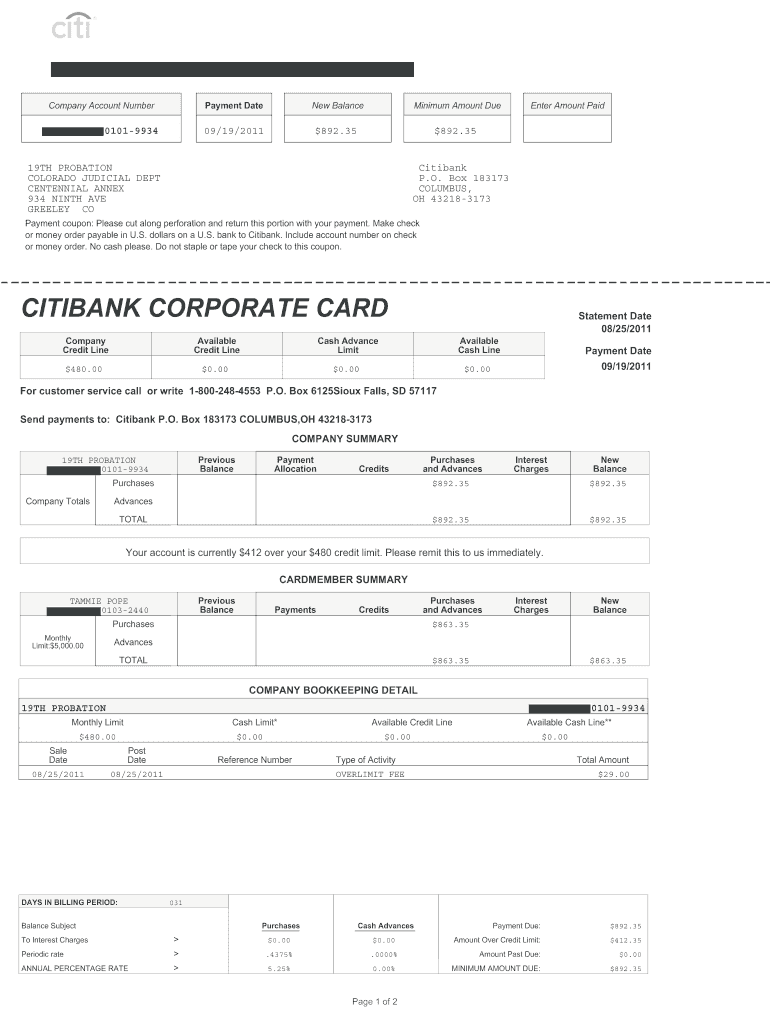

The Minimum Amount Due Colorado refers to the specific amount that an individual or business must pay to meet their financial obligations in the state of Colorado. This figure can vary based on the type of debt or obligation, such as credit card payments, utility bills, or other financial agreements. Understanding this amount is crucial for maintaining good financial standing and avoiding penalties.

How to use the Minimum Amount Due Colorado

Using the Minimum Amount Due Colorado involves calculating the exact amount owed based on your financial agreements. This may include reviewing statements from creditors or service providers. Once the amount is determined, it is essential to ensure timely payment to avoid late fees or additional interest charges. Utilizing digital tools can simplify this process, allowing for easy tracking and management of payments.

Steps to complete the Minimum Amount Due Colorado

Completing the Minimum Amount Due Colorado typically involves several steps:

- Review your financial statements to identify the minimum payment required.

- Gather necessary documentation, such as account numbers and payment methods.

- Choose a payment method, whether online, by mail, or in person.

- Submit your payment by the due date to ensure compliance and avoid penalties.

Legal use of the Minimum Amount Due Colorado

The legal use of the Minimum Amount Due Colorado is governed by state laws and regulations. It is important to adhere to these guidelines to ensure that payments are recognized as valid. This includes understanding the terms outlined in contracts and agreements, as well as any applicable consumer protection laws. Failure to comply with these legal requirements may result in financial penalties or legal action.

Key elements of the Minimum Amount Due Colorado

Key elements of the Minimum Amount Due Colorado include:

- The specific amount required to maintain good standing with creditors.

- The due date by which the payment must be made.

- Any associated fees for late payments.

- Contact information for the creditor or service provider for inquiries.

State-specific rules for the Minimum Amount Due Colorado

Colorado has specific rules regarding the Minimum Amount Due, which may differ from other states. These rules can include regulations on interest rates, late fees, and consumer rights. It is essential to be aware of these state-specific laws to ensure compliance and protect your financial interests.

Examples of using the Minimum Amount Due Colorado

Examples of using the Minimum Amount Due Colorado can include:

- Paying the minimum amount due on a credit card to avoid late fees.

- Making a utility payment to ensure continued service.

- Meeting the minimum payment on a loan to maintain a good credit score.

Quick guide on how to complete minimum amount due colorado

Prepare Minimum Amount Due Colorado effortlessly on any device

Online document management has gained traction among businesses and individuals. It offers a sustainable alternative to traditional printed and signed paperwork, as you can obtain the correct form and securely store it online. airSlate SignNow equips you with all the necessary tools to create, modify, and electronically sign your documents swiftly without delays. Handle Minimum Amount Due Colorado on any device using the airSlate SignNow Android or iOS applications and simplify any document-related tasks today.

The easiest way to edit and electronically sign Minimum Amount Due Colorado with ease

- Obtain Minimum Amount Due Colorado and click Get Form to begin.

- Make use of the tools we offer to complete your document.

- Emphasize important sections of your documents or obscure sensitive information with the tools that airSlate SignNow specifically provides for that purpose.

- Create your signature using the Sign tool, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review all the information and click on the Done button to save your changes.

- Select how you wish to share your form—via email, SMS, or invite link, or download it to your computer.

Forget about lost or misplaced documents, tedious form searching, or mistakes that require printing new document copies. airSlate SignNow meets your document management needs with just a few clicks from any device of your choice. Modify and electronically sign Minimum Amount Due Colorado and ensure effective communication at any stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the minimum amount due colorado

The best way to create an electronic signature for your PDF file online

The best way to create an electronic signature for your PDF file in Google Chrome

How to make an eSignature for signing PDFs in Gmail

How to generate an eSignature straight from your mobile device

The way to create an electronic signature for a PDF file on iOS

How to generate an eSignature for a PDF document on Android devices

People also ask

-

What is the Minimum Amount Due in Colorado for eSigning services?

The Minimum Amount Due in Colorado refers to the smallest payment amount required for eSigning services, ensuring compliance and legality. With airSlate SignNow, businesses can seamlessly handle this requirement as part of their document management process. By leveraging our solution, businesses can save time and money, making compliance easier.

-

How can airSlate SignNow help with understanding the Minimum Amount Due Colorado?

airSlate SignNow provides resources to help businesses navigate the complexities of the Minimum Amount Due in Colorado. Our intuitive platform simplifies the eSigning process, allowing users to comply with financial obligations efficiently. We ensure that you understand your minimum requirements while handling your documentation effortlessly.

-

Are there any hidden fees related to the Minimum Amount Due Colorado when using airSlate SignNow?

No, airSlate SignNow is committed to transparency, with no hidden fees associated with the Minimum Amount Due in Colorado. Our pricing structures are straightforward, allowing you to budget effectively for your document management needs. With our solution, you can focus on your business without worrying about surprise costs.

-

What features does airSlate SignNow offer to comply with the Minimum Amount Due Colorado?

airSlate SignNow offers essential features such as document templates, automatic reminders, and secure eSigning, which help businesses comply with the Minimum Amount Due in Colorado. These features streamline the signing process and reduce the risk of errors, ensuring compliance while enhancing productivity. Our user-friendly interface makes it easy for teams to manage documentation securely.

-

Can airSlate SignNow integrate with other tools to track Minimum Amount Due Colorado?

Yes, airSlate SignNow integrates seamlessly with various tools such as payment processors and CRM systems to help track the Minimum Amount Due in Colorado. These integrations enhance your workflow, allowing for easy documentation, tracking, and management of payments. By using these tools in conjunction with our platform, you can ensure compliance and efficiency.

-

What benefits does airSlate SignNow provide for managing Minimum Amount Due Colorado?

Using airSlate SignNow to manage the Minimum Amount Due in Colorado offers numerous benefits, such as increased efficiency, reduced paperwork, and enhanced compliance. Our platform allows for quick document processing, enabling businesses to meet their financial obligations promptly. Additionally, businesses can enhance their responsiveness and customer satisfaction by streamlining their signing processes.

-

Is airSlate SignNow suitable for small businesses in Colorado managing Minimum Amount Due?

Absolutely! airSlate SignNow is particularly beneficial for small businesses in Colorado managing the Minimum Amount Due. Our cost-effective solution provides all essential features needed for efficient document management without overwhelming small budgets. Plus, with our easy setup and support, small businesses can reap the benefits without complexity.

Get more for Minimum Amount Due Colorado

- Cobb county school districtform jlc 8

- Absenceformbths 03 21 14 brooklyn technical high school bths

- Application for employment remlinger farms form

- Minnesota health care directive printable 100283775 form

- Hart workpermitcom form

- Visual text comprehension worksheets form

- Assets vbt iopublicfilesdivision of surface water no exposure certification for form

- Director service agreement template form

Find out other Minimum Amount Due Colorado

- How To Electronic signature Hawaii Sports Presentation

- How To Electronic signature Massachusetts Police Form

- Can I Electronic signature South Carolina Real Estate Document

- Help Me With Electronic signature Montana Police Word

- How To Electronic signature Tennessee Real Estate Document

- How Do I Electronic signature Utah Real Estate Form

- How To Electronic signature Utah Real Estate PPT

- How Can I Electronic signature Virginia Real Estate PPT

- How Can I Electronic signature Massachusetts Sports Presentation

- How To Electronic signature Colorado Courts PDF

- How To Electronic signature Nebraska Sports Form

- How To Electronic signature Colorado Courts Word

- How To Electronic signature Colorado Courts Form

- How To Electronic signature Colorado Courts Presentation

- Can I Electronic signature Connecticut Courts PPT

- Can I Electronic signature Delaware Courts Document

- How Do I Electronic signature Illinois Courts Document

- How To Electronic signature Missouri Courts Word

- How Can I Electronic signature New Jersey Courts Document

- How Can I Electronic signature New Jersey Courts Document