T3010 Form 2020

What is the T3010 Form

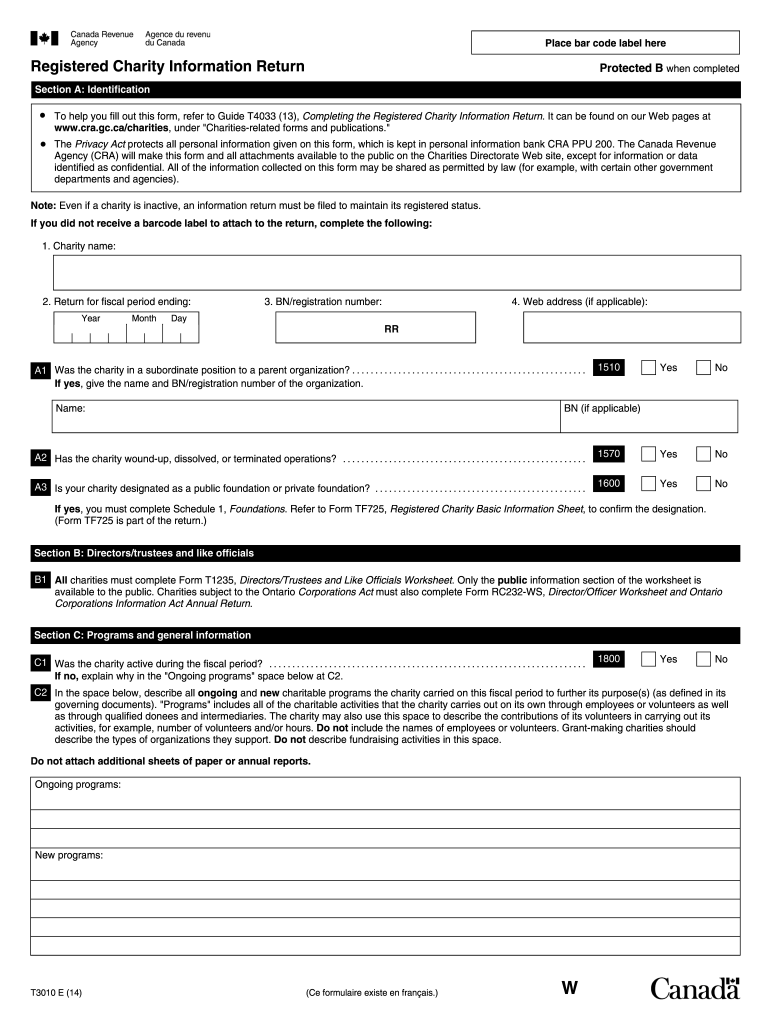

The T3010 form, also known as the Registered Charity Information Return, is a crucial document for registered charities in Canada. It provides the Canada Revenue Agency (CRA) with essential information about a charity's activities, finances, and governance. This form must be filed annually to maintain the charity's registered status and ensure transparency in operations. The T3010 form includes details such as revenue sources, expenditures, and information about the charity's directors and trustees.

How to use the T3010 Form

Using the T3010 form involves several steps to ensure accurate and complete reporting. First, gather all necessary financial records and documentation related to the charity's activities over the past year. This includes income statements, balance sheets, and details about any fundraising events. Next, access the CRA's official website to download the T3010 form or use the CRA's online services for electronic filing. Fill out the form carefully, ensuring that all sections are completed accurately. After completing the form, review it for any errors before submission to avoid delays or penalties.

Steps to complete the T3010 Form

Completing the T3010 form requires a systematic approach. Begin by entering the charity's identification information, including its registration number and contact details. Next, provide a detailed account of the charity's financial activities, including total revenue, expenditures, and any assets held. It's essential to report any fundraising activities and how the funds were utilized. Additionally, include information about the charity's programs and services, as well as the names and positions of the board members. Once all information is accurately filled out, sign and date the form before submitting it to the CRA.

Legal use of the T3010 Form

The T3010 form serves a legal purpose, ensuring that registered charities comply with the regulations set forth by the CRA. Filing this form is not only a legal requirement but also a means of demonstrating accountability to the public and stakeholders. Charities must adhere to the guidelines established by the CRA, including the timely submission of the T3010 form, to avoid penalties or loss of registered status. The information provided in the form is used by the CRA to assess the charity's compliance with tax laws and regulations.

Filing Deadlines / Important Dates

Charities must be aware of specific deadlines associated with the T3010 form to maintain compliance. The T3010 must be filed within six months of the charity's fiscal year-end. For example, if a charity's fiscal year ends on December 31, the T3010 must be submitted by June 30 of the following year. Failure to meet this deadline can result in penalties, including the potential loss of registered status. It is advisable for charities to mark their calendars with these important dates to ensure timely filing.

Form Submission Methods (Online / Mail / In-Person)

The T3010 form can be submitted through various methods, allowing charities flexibility in how they file. Charities can choose to file online using the CRA's electronic services, which is often the quickest method. Alternatively, the completed form can be mailed to the CRA's designated address. Charities may also have the option to submit the form in person at local CRA offices, although this method may vary by location. Regardless of the submission method chosen, it is crucial to keep a copy of the submitted form for record-keeping purposes.

Quick guide on how to complete t3010 2014 form

Complete T3010 Form with ease on any device

Digital document management has gained traction among businesses and individuals alike. It serves as an ideal eco-friendly substitute for traditional printed and physically signed papers, allowing you to access the correct form and securely store it online. airSlate SignNow provides all the necessary tools to create, modify, and electronically sign your documents swiftly without any holdups. Manage T3010 Form on any device using airSlate SignNow apps for Android or iOS and streamline any document-related task today.

How to modify and eSign T3010 Form effortlessly

- Obtain T3010 Form and then click Get Form to begin.

- Utilize the tools we provide to complete your form.

- Emphasize important sections of your documents or obscure sensitive information with tools specifically designed by airSlate SignNow for that purpose.

- Create your signature with the Sign tool, which takes just seconds and carries the same legal validity as a traditional handwritten signature.

- Review all the details and then click on the Done button to save your changes.

- Choose how you want to share your form, whether by email, text message (SMS), or invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searches, or mistakes that necessitate printing new document copies. airSlate SignNow meets all your document management needs in just a few clicks from any device you prefer. Modify and eSign T3010 Form while ensuring excellent communication throughout the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct t3010 2014 form

Create this form in 5 minutes!

How to create an eSignature for the t3010 2014 form

The way to create an eSignature for a PDF in the online mode

The way to create an eSignature for a PDF in Chrome

The best way to create an eSignature for putting it on PDFs in Gmail

The way to make an electronic signature from your smart phone

The best way to generate an eSignature for a PDF on iOS devices

The way to make an electronic signature for a PDF file on Android OS

People also ask

-

What is the t3010 form and why do I need it?

The t3010 form is a required document for registered charities in Canada to report their financial activities to the Canada Revenue Agency. Completing the t3010 form ensures compliance with tax laws and helps maintain your charitable status. Using airSlate SignNow makes it easy to eSign and submit this form electronically, streamlining the process for your organization.

-

How can airSlate SignNow help me with the t3010 form?

airSlate SignNow offers an efficient platform to prepare and eSign the t3010 form quickly and securely. Our user-friendly interface allows users to fill out the form digitally and get it signed by necessary parties without any hassle. Plus, our solution is cost-effective, saving you both time and money in the submission process.

-

What features does airSlate SignNow provide for handling the t3010 form?

airSlate SignNow provides features like customizable templates, bulk sending, and real-time tracking specifically for documents like the t3010 form. Documents can be accessed from any device, ensuring you can manage your forms on the go. These features enhance efficiency, making the process of submitting the t3010 form smoother than ever.

-

Is there a cost associated with using airSlate SignNow for the t3010 form?

Yes, airSlate SignNow offers various pricing plans tailored to different organizational needs. The cost is competitive, especially considering the convenience and efficiency gained when submitting the t3010 form. Additionally, many users find that the savings in paperwork and processing time justify the investment.

-

Can I integrate airSlate SignNow with other applications for managing the t3010 form?

Absolutely! airSlate SignNow supports integrations with numerous applications such as CRMs, document management systems, and cloud storage services. This allows you to manage the t3010 form alongside your other workflows seamlessly. The integration capabilities help you maintain continuity and efficiency in your operations.

-

What are the benefits of using airSlate SignNow for the t3010 form compared to traditional methods?

By using airSlate SignNow for the t3010 form, you eliminate the need for paper, printing, and mailing, drastically saving time and resources. The electronic signature process is secure and legally binding, minimizing the risk of errors. Additionally, the ease of access and tracking provides a more organized approach than traditional methods.

-

How secure is my information when using airSlate SignNow for the t3010 form?

Your security is a top priority at airSlate SignNow. We utilize advanced encryption and security protocols to ensure that all data, including the t3010 form, is protected throughout the signing and storage processes. You can have peace of mind knowing that your sensitive information is in safe hands while using our platform.

Get more for T3010 Form

- Custom crush agreement 1 company address 2 law uoregon form

- Malay chamber of commerce certificate of origin form

- Adventist university of the philippines online application form

- Nozha language school sheets form

- Gap cancellation form protective asset protection

- Impoundment inspection form

- Gid 242 nt form

- Film producer agreement template form

Find out other T3010 Form

- How To Sign Iowa Christmas Bonus Letter

- How To Sign Nevada Christmas Bonus Letter

- Sign New Jersey Promotion Announcement Simple

- Sign Louisiana Company Bonus Letter Safe

- How To Sign Delaware Letter of Appreciation to Employee

- How To Sign Florida Letter of Appreciation to Employee

- How Do I Sign New Jersey Letter of Appreciation to Employee

- How Do I Sign Delaware Direct Deposit Enrollment Form

- How To Sign Alabama Employee Emergency Notification Form

- How To Sign Oklahoma Direct Deposit Enrollment Form

- Sign Wyoming Direct Deposit Enrollment Form Online

- Sign Nebraska Employee Suggestion Form Now

- How Can I Sign New Jersey Employee Suggestion Form

- Can I Sign New York Employee Suggestion Form

- Sign Michigan Overtime Authorization Form Mobile

- How To Sign Alabama Payroll Deduction Authorization

- How To Sign California Payroll Deduction Authorization

- How To Sign Utah Employee Emergency Notification Form

- Sign Maine Payroll Deduction Authorization Simple

- How To Sign Nebraska Payroll Deduction Authorization