Isp3520 2016-2026

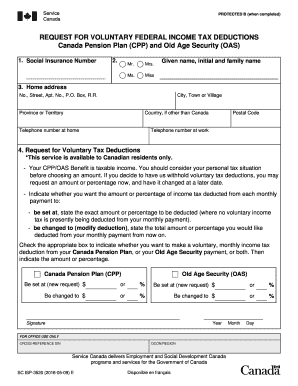

What is the isp3520cpp?

The isp3520cpp is a voluntary income tax deduction form used in the United States for individuals seeking to manage their contributions to the Canada Pension Plan (CPP). This form allows taxpayers to request deductions from their income tax for voluntary contributions made to the CPP. It is essential for individuals who want to ensure their pension contributions are accurately reflected in their tax filings, ultimately impacting their retirement benefits.

Steps to Complete the isp3520cpp

Completing the isp3520cpp involves several key steps to ensure accuracy and compliance. Begin by gathering necessary personal information, including your Social Security number and income details. Next, clearly indicate the amount you wish to contribute voluntarily to the CPP. Ensure that you review the form for any specific instructions related to your state or tax situation. Once completed, sign and date the form to validate your request. It is advisable to keep a copy for your records before submission.

Legal Use of the isp3520cpp

The isp3520cpp is legally binding when filled out correctly and submitted according to IRS guidelines. To ensure its legality, it must meet the requirements set forth by the Electronic Signatures in Global and National Commerce Act (ESIGN) and the Uniform Electronic Transactions Act (UETA). These laws affirm that electronic signatures and documents hold the same legal weight as their paper counterparts, provided proper protocols are followed during the signing process.

Eligibility Criteria for the isp3520cpp

To be eligible to use the isp3520cpp, individuals must meet specific criteria. Primarily, the form is intended for U.S. taxpayers who wish to make voluntary contributions to the CPP. Additionally, individuals should ensure they have a valid Social Security number and are actively employed or have income that qualifies for voluntary deductions. It is important to verify your eligibility to avoid complications during the deduction process.

Form Submission Methods

The isp3520cpp can be submitted through various methods to accommodate different preferences. Taxpayers can choose to submit the form online through secure e-filing systems, ensuring quick processing. Alternatively, the form can be mailed to the appropriate tax authority or submitted in person at designated offices. Each submission method has its own timeline for processing, so it is advisable to choose the method that best suits your needs and deadlines.

Required Documents for isp3520cpp

When completing the isp3520cpp, certain documents may be required to support your application. These typically include proof of income, such as pay stubs or tax returns, and any previous contributions made to the CPP. Having these documents readily available can help expedite the process and ensure that your request is processed smoothly. It is also beneficial to keep copies of all submitted documents for future reference.

Quick guide on how to complete isp3520

Complete Isp3520 effortlessly on any device

Online document management has become increasingly popular among businesses and individuals. It offers an ideal eco-friendly alternative to traditional printed and signed documents, as you can easily find the appropriate form and securely keep it online. airSlate SignNow provides you with all the resources needed to create, modify, and eSign your documents promptly without delays. Manage Isp3520 on any device using the airSlate SignNow Android or iOS applications and simplify any document-related process today.

The simplest way to modify and eSign Isp3520 with ease

- Find Isp3520 and click Get Form to begin.

- Use the tools we offer to complete your form.

- Highlight important sections of your documents or redact sensitive information with tools specifically provided by airSlate SignNow for that purpose.

- Create your eSignature using the Sign feature, which only takes a few seconds and holds the same legal validity as a conventional wet ink signature.

- Review the details and then click on the Done button to save your updates.

- Choose how you want to send your form, whether via email, SMS, invitation link, or download it to your computer.

Forget about lost or mislaid documents, tedious form hunting, or mistakes that require printing new document copies. airSlate SignNow takes care of all your document management needs in just a few clicks from any device you prefer. Modify and eSign Isp3520 to ensure excellent communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct isp3520

Create this form in 5 minutes!

How to create an eSignature for the isp3520

The way to create an eSignature for a PDF document online

The way to create an eSignature for a PDF document in Google Chrome

The best way to generate an eSignature for signing PDFs in Gmail

The way to make an electronic signature straight from your smart phone

The best way to generate an eSignature for a PDF document on iOS

The way to make an electronic signature for a PDF document on Android OS

People also ask

-

What is the request for voluntary federal income tax deductions form ISP 3520?

The request for voluntary federal income tax deductions form ISP 3520 is a document used to request tax deductions for federal income tax. This form allows taxpayers to specify their eligibility and how they wish to implement their deductions. Understanding this form is crucial for effective tax management.

-

How does airSlate SignNow simplify the process of submitting the request for voluntary federal income tax deductions form ISP 3520?

With airSlate SignNow, you can easily fill out and submit the request for voluntary federal income tax deductions form ISP 3520 electronically. Our user-friendly interface streamlines the entire process, allowing you to complete your documentation swiftly and efficiently. This not only saves time but also reduces the likelihood of errors.

-

Is there a cost associated with using airSlate SignNow for the request for voluntary federal income tax deductions form ISP 3520?

Yes, airSlate SignNow offers various pricing plans to accommodate different business needs. Each plan includes access to features that facilitate the electronic signing and submission of the request for voluntary federal income tax deductions form ISP 3520. You can choose a plan that best fits your budget.

-

What features does airSlate SignNow offer for managing the request for voluntary federal income tax deductions form ISP 3520?

airSlate SignNow provides features such as document templates, real-time collaboration, and secure cloud storage, all designed to enhance your experience with the request for voluntary federal income tax deductions form ISP 3520. These tools make it easier to manage forms and share documents with relevant parties.

-

How can I ensure my request for voluntary federal income tax deductions form ISP 3520 is secure with airSlate SignNow?

airSlate SignNow prioritizes security, employing advanced encryption and secure access controls to protect your documents, including the request for voluntary federal income tax deductions form ISP 3520. You can trust that your sensitive information is safe and secure while using our platform.

-

Can airSlate SignNow integrate with other software for handling the request for voluntary federal income tax deductions form ISP 3520?

Yes, airSlate SignNow offers integrations with various software applications that enhance your workflow when handling the request for voluntary federal income tax deductions form ISP 3520. These integrations help streamline tasks and compile necessary data from your existing systems.

-

What are the benefits of using airSlate SignNow over traditional methods for the request for voluntary federal income tax deductions form ISP 3520?

Using airSlate SignNow for the request for voluntary federal income tax deductions form ISP 3520 allows for quick turnaround times, minimizes paperwork, and reduces the risk of document loss. The digital format improves accessibility and organization compared to traditional methods, enabling easier tracking of form submissions.

Get more for Isp3520

Find out other Isp3520

- eSign Louisiana Notice of Rent Increase Mobile

- eSign Washington Notice of Rent Increase Computer

- How To eSign Florida Notice to Quit

- How To eSign Hawaii Notice to Quit

- eSign Montana Pet Addendum to Lease Agreement Online

- How To eSign Florida Tenant Removal

- How To eSign Hawaii Tenant Removal

- eSign Hawaii Tenant Removal Simple

- eSign Arkansas Vacation Rental Short Term Lease Agreement Easy

- Can I eSign North Carolina Vacation Rental Short Term Lease Agreement

- eSign Michigan Escrow Agreement Now

- eSign Hawaii Sales Receipt Template Online

- eSign Utah Sales Receipt Template Free

- eSign Alabama Sales Invoice Template Online

- eSign Vermont Escrow Agreement Easy

- How Can I eSign Wisconsin Escrow Agreement

- How To eSign Nebraska Sales Invoice Template

- eSign Nebraska Sales Invoice Template Simple

- eSign New York Sales Invoice Template Now

- eSign Pennsylvania Sales Invoice Template Computer