Isp 3520 2013

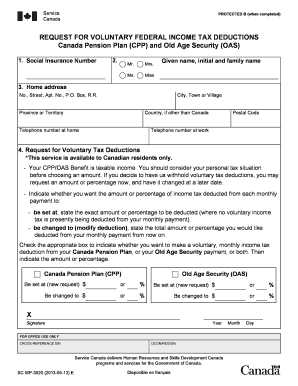

What is the isp 3520?

The isp 3520 is a form used for voluntary income tax deductions for individuals in the United States. This form allows taxpayers to specify how much they wish to have withheld from their income for tax purposes. It plays a crucial role in managing tax liabilities and ensuring that individuals do not face unexpected tax burdens at the end of the fiscal year. Understanding the isp 3520 is essential for effective financial planning and compliance with tax regulations.

How to use the isp 3520

Using the isp 3520 involves filling out the form accurately to reflect your desired withholding amount. Taxpayers should begin by gathering relevant financial information, including income sources and existing deductions. After completing the form, it can be submitted to the appropriate tax authority or employer, depending on specific instructions provided with the form. Regularly reviewing and adjusting the isp 3520 can help align with changing financial circumstances and tax obligations.

Steps to complete the isp 3520

Completing the isp 3520 requires careful attention to detail. Here are the steps to follow:

- Gather necessary financial documents, including previous tax returns and income statements.

- Fill out personal information, including your name, address, and Social Security number.

- Indicate your desired withholding amount based on your financial situation.

- Review the completed form for accuracy, ensuring all information is correct.

- Submit the isp 3520 to your employer or the relevant tax authority as instructed.

Legal use of the isp 3520

The isp 3520 is legally recognized as a valid document for managing tax withholdings in the United States. To ensure its legal standing, taxpayers must fill it out completely and accurately. Compliance with federal and state tax regulations is essential, as improper use of the isp 3520 can lead to penalties or legal issues. It is advisable to keep a copy of the completed form for personal records and future reference.

Filing Deadlines / Important Dates

Staying informed about filing deadlines is crucial when using the isp 3520. Typically, deadlines for submitting the isp 3520 align with the tax year’s end, which is December 31 for most individuals. However, changes in employment or financial circumstances may necessitate updates to the form throughout the year. Taxpayers should consult the IRS guidelines or their tax advisor to ensure compliance with all relevant deadlines.

Required Documents

When filling out the isp 3520, certain documents are essential to ensure accuracy and compliance. Required documents may include:

- Previous tax returns to reference past income and deductions.

- W-2 forms or 1099 forms reflecting current income.

- Any relevant documentation regarding deductions or credits that may impact withholding.

Having these documents on hand will facilitate a smoother completion process and help ensure that the isp 3520 is filled out accurately.

Eligibility Criteria

Eligibility to use the isp 3520 generally includes individuals who receive income subject to withholding. This includes employees, self-employed individuals, and those receiving certain types of government benefits. It is important for taxpayers to assess their financial situation and determine if using the isp 3520 aligns with their tax strategy. Consulting a tax professional may provide additional clarity on eligibility and optimal use of the form.

Quick guide on how to complete isp 3520 100374965

Complete Isp 3520 effortlessly on any device

Digital document handling has become favored by businesses and individuals alike. It serves as an ideal eco-friendly alternative to conventional printed and signed documents, allowing you to access the correct form and securely store it online. airSlate SignNow equips you with all the tools you require to create, modify, and eSign your documents quickly without delays. Manage Isp 3520 on any device using airSlate SignNow's Android or iOS applications and enhance any document-based process today.

How to modify and eSign Isp 3520 with ease

- Obtain Isp 3520 and click on Get Form to begin.

- Use the tools we provide to fill out your document.

- Emphasize relevant sections of the documents or redact sensitive information with the tools that airSlate SignNow offers specifically for that purpose.

- Create your eSignature using the Sign tool, which takes mere seconds and has the same legal validity as a traditional handwritten signature.

- Review the information and click on the Done button to save your modifications.

- Select how you would like to send your form, via email, SMS, invitation link, or download it to your computer.

Forget about lost or misfiled documents, tiring form searches, or mistakes that require printing new document copies. airSlate SignNow addresses all your document management needs in just a few clicks from any device you choose. Edit and eSign Isp 3520 and ensure exceptional communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct isp 3520 100374965

Create this form in 5 minutes!

How to create an eSignature for the isp 3520 100374965

The way to generate an electronic signature for your PDF document in the online mode

The way to generate an electronic signature for your PDF document in Chrome

The way to make an electronic signature for putting it on PDFs in Gmail

The best way to create an electronic signature straight from your mobile device

The best way to make an electronic signature for a PDF document on iOS devices

The best way to create an electronic signature for a PDF document on Android devices

People also ask

-

What is the isp 3520 feature in airSlate SignNow?

The isp 3520 feature in airSlate SignNow enables users to manage and sign documents seamlessly. This functionality is designed to simplify the eSigning process, enhancing efficiency for businesses of all sizes. With isp 3520, you can easily track document statuses and automate workflows.

-

How does pricing for isp 3520 compare to other solutions?

The pricing for isp 3520 within airSlate SignNow is designed to be competitive and cost-effective, making it an attractive option for businesses. With a variety of plans available, you can select the best package that fits your needs without sacrificing quality. This ensures optimal value for your investment in eSignature solutions.

-

What are the key benefits of using isp 3520?

One of the major benefits of using isp 3520 is its user-friendly interface, which simplifies the document signing process. Additionally, it provides robust security measures to protect sensitive information. Businesses can streamline their operations, reducing the time and resources spent on document management.

-

Can I integrate isp 3520 with other software platforms?

Yes, airSlate SignNow's isp 3520 can be easily integrated with various software platforms such as CRM systems and cloud storage solutions. This flexibility allows users to enhance their existing workflows and improve overall productivity. Seamless integration ensures that businesses can scale efficiently while maintaining operational consistency.

-

Is there a free trial for the isp 3520 service?

Yes, airSlate SignNow offers a free trial for its isp 3520 service, allowing potential users to explore its features and benefits without commitment. This trial provides the opportunity to evaluate how isp 3520 can meet your eSigning needs. After the trial, businesses can opt for various plans based on their required features.

-

How secure is my data with isp 3520?

Data security is a top priority for airSlate SignNow, including for isp 3520. The service is built with advanced encryption methods and complies with industry standards to protect sensitive information. You can trust that your documents and data are safe while using isp 3520 for your eSigning needs.

-

What types of documents can I sign using isp 3520?

With isp 3520 from airSlate SignNow, you can sign a wide range of document types, including contracts, agreements, and forms. The platform supports various file formats, making it versatile for different business needs. This capability simplifies the signing process for both parties involved.

Get more for Isp 3520

Find out other Isp 3520

- Electronic signature West Virginia Orthodontists Living Will Online

- Electronic signature Legal PDF Vermont Online

- How Can I Electronic signature Utah Legal Separation Agreement

- Electronic signature Arizona Plumbing Rental Lease Agreement Myself

- Electronic signature Alabama Real Estate Quitclaim Deed Free

- Electronic signature Alabama Real Estate Quitclaim Deed Safe

- Electronic signature Colorado Plumbing Business Plan Template Secure

- Electronic signature Alaska Real Estate Lease Agreement Template Now

- Electronic signature Colorado Plumbing LLC Operating Agreement Simple

- Electronic signature Arizona Real Estate Business Plan Template Free

- Electronic signature Washington Legal Contract Safe

- How To Electronic signature Arkansas Real Estate Contract

- Electronic signature Idaho Plumbing Claim Myself

- Electronic signature Kansas Plumbing Business Plan Template Secure

- Electronic signature Louisiana Plumbing Purchase Order Template Simple

- Can I Electronic signature Wyoming Legal Limited Power Of Attorney

- How Do I Electronic signature Wyoming Legal POA

- How To Electronic signature Florida Real Estate Contract

- Electronic signature Florida Real Estate NDA Secure

- Can I Electronic signature Florida Real Estate Cease And Desist Letter