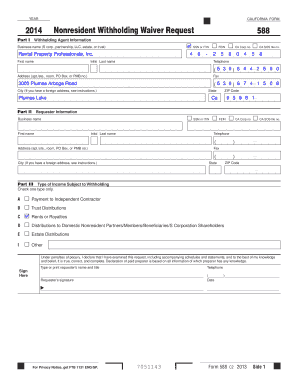

Nonresident Withholding Waiver Request Form

What is the Nonresident Withholding Waiver Request

The nonresident withholding waiver request is a formal document that allows nonresident individuals or entities to seek exemption from withholding taxes on certain types of income. This form is crucial for nonresidents who earn income in the United States but are not subject to tax withholding under specific circumstances. By submitting this request, nonresidents can ensure they are not overtaxed and can receive their income without unnecessary deductions.

How to use the Nonresident Withholding Waiver Request

To utilize the nonresident withholding waiver request effectively, individuals must first determine their eligibility based on the income type and the applicable tax treaties. The process involves completing the form accurately and providing necessary documentation to support the claim for exemption. Once the form is filled out, it should be submitted to the appropriate tax authority, ensuring compliance with all submission guidelines.

Steps to complete the Nonresident Withholding Waiver Request

Completing the nonresident withholding waiver request involves several key steps:

- Gather relevant personal and income information, including tax identification numbers.

- Review the eligibility criteria to ensure that the income qualifies for a waiver.

- Fill out the form carefully, providing accurate details regarding the income and the reason for the waiver request.

- Attach any required documentation that supports the request, such as tax treaty statements or proof of residency.

- Submit the completed form to the designated tax authority, either online or by mail, as specified in the guidelines.

Legal use of the Nonresident Withholding Waiver Request

The legal use of the nonresident withholding waiver request is governed by IRS regulations and applicable tax treaties. It is essential for nonresidents to understand the legal framework surrounding this form to ensure compliance and avoid penalties. The request must be based on valid reasons, such as eligibility under a tax treaty, to be considered legitimate by tax authorities.

IRS Guidelines

The IRS provides specific guidelines regarding the nonresident withholding waiver request, detailing eligibility, required documentation, and submission procedures. Nonresidents should familiarize themselves with these guidelines to ensure that their request is processed smoothly. Adhering to IRS instructions is crucial for avoiding delays or denials in the waiver process.

Required Documents

When submitting the nonresident withholding waiver request, certain documents are typically required to support the claim. These may include:

- Proof of nonresident status, such as a passport or visa.

- Tax identification numbers for both the requester and the income source.

- Documentation demonstrating eligibility for tax treaty benefits, if applicable.

Ensuring that all required documents are included can significantly enhance the chances of a successful waiver request.

Quick guide on how to complete nonresident withholding waiver request

Effortlessly prepare Nonresident Withholding Waiver Request on any device

Online document management has become increasingly popular among businesses and individuals alike. It offers an ideal eco-friendly alternative to traditional printed and signed documents, allowing you to access the necessary form and securely store it online. airSlate SignNow provides all the resources you need to create, edit, and electronically sign your documents quickly and without delays. Handle Nonresident Withholding Waiver Request on any device using the airSlate SignNow Android or iOS applications and enhance any document-based procedure today.

How to edit and electronically sign Nonresident Withholding Waiver Request with ease

- Obtain Nonresident Withholding Waiver Request and click Get Form to begin.

- Utilize the tools we provide to fill out your form.

- Mark important sections of your documents or obscure sensitive information using tools that airSlate SignNow provides specifically for that purpose.

- Create your eSignature with the Sign tool, which takes mere seconds and has the same legal validity as a conventional wet ink signature.

- Review the information and click on the Done button to save your modifications.

- Choose how you wish to send your form, whether by email, SMS, invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searches, and mistakes that require reprinting new document copies. airSlate SignNow caters to your document management needs in just a few clicks from any device you prefer. Modify and electronically sign Nonresident Withholding Waiver Request and ensure excellent communication at any stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the nonresident withholding waiver request

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a nonresident withholding waiver request?

A nonresident withholding waiver request is a formal application submitted to tax authorities that allows nonresident individuals or entities to avoid or reduce tax withholding on certain types of income. By using airSlate SignNow, you can efficiently prepare and eSign your waiver request, streamlining the process.

-

How do I submit a nonresident withholding waiver request with airSlate SignNow?

To submit a nonresident withholding waiver request using airSlate SignNow, start by accessing our platform to create your document. You can then add the necessary details and eSign the form, making it easy to send directly to tax officials securely.

-

Is there a fee for using airSlate SignNow for my waiver request?

airSlate SignNow offers various pricing plans to accommodate different needs, including a cost-effective solution for submitting a nonresident withholding waiver request. You can choose a plan that fits your budget, with no hidden fees.

-

What are the benefits of using airSlate SignNow for my nonresident withholding waiver request?

Using airSlate SignNow for your nonresident withholding waiver request provides several benefits, including simplicity, efficiency, and security. Our platform ensures that your documents are processed quickly and reliably, which saves you valuable time.

-

Can I integrate airSlate SignNow with other platforms for my waiver requests?

Yes, airSlate SignNow offers seamless integrations with various applications, which can enhance your workflow when submitting a nonresident withholding waiver request. You can connect with tools like CRMs and document management systems to streamline your processes.

-

How secure is airSlate SignNow for handling sensitive documents like my waiver request?

airSlate SignNow takes security very seriously. We utilize advanced encryption and compliance measures to ensure that your nonresident withholding waiver request and any sensitive documents are protected throughout the signing process.

-

Can airSlate SignNow help me track the status of my nonresident withholding waiver request?

Absolutely! airSlate SignNow provides tracking features that allow you to monitor the status of your nonresident withholding waiver request. You can receive notifications when your document is viewed or signed, ensuring you stay informed.

Get more for Nonresident Withholding Waiver Request

Find out other Nonresident Withholding Waiver Request

- How To Integrate Sign in Banking

- How To Use Sign in Banking

- Help Me With Use Sign in Banking

- Can I Use Sign in Banking

- How Do I Install Sign in Banking

- How To Add Sign in Banking

- How Do I Add Sign in Banking

- How Can I Add Sign in Banking

- Can I Add Sign in Banking

- Help Me With Set Up Sign in Government

- How To Integrate eSign in Banking

- How To Use eSign in Banking

- How To Install eSign in Banking

- How To Add eSign in Banking

- How To Set Up eSign in Banking

- How To Save eSign in Banking

- How To Implement eSign in Banking

- How To Set Up eSign in Construction

- How To Integrate eSign in Doctors

- How To Use eSign in Doctors