P1001 Form 2015-2026

What is the P1001 Form

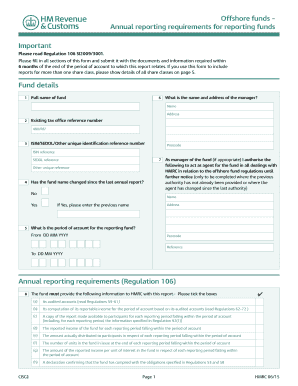

The P1001 form is a crucial document used for reporting specific tax information to the HM Revenue and Customs (HMRC). This form is typically utilized by individuals and businesses to declare certain income and expenses, ensuring compliance with tax regulations. Understanding the purpose and requirements of the P1001 form is essential for accurate tax reporting and avoiding potential penalties.

How to Use the P1001 Form

Using the P1001 form effectively involves several key steps. First, gather all necessary financial documents that support the information you will report. This includes income statements, receipts for deductible expenses, and any other relevant financial records. Next, fill out the form accurately, ensuring that all sections are completed according to HMRC guidelines. After completing the form, review it for any errors or omissions before submission. This careful approach helps prevent delays and ensures that your tax obligations are met.

Steps to Complete the P1001 Form

Completing the P1001 form requires attention to detail. Start by entering your personal information, including your name, address, and tax identification number. Then, move on to report your income, categorizing it appropriately based on the type of income received. Document any allowable expenses in the designated sections, ensuring you have supporting evidence for each claim. Finally, sign and date the form, confirming that the information provided is accurate and complete. This structured approach helps maintain compliance with tax laws.

Legal Use of the P1001 Form

The P1001 form holds legal significance as it serves as an official declaration of income and expenses to the HMRC. When filled out correctly, it can protect taxpayers from legal repercussions associated with tax evasion or inaccuracies. It is important to understand that the information reported on this form must be truthful and substantiated by documentation. Failure to comply with legal standards can result in penalties, including fines or audits by tax authorities.

Filing Deadlines / Important Dates

Timely submission of the P1001 form is critical to avoid penalties. Typically, the filing deadline aligns with the end of the tax year, which is April fifteenth for individual taxpayers. Businesses may have different deadlines depending on their fiscal year. It is advisable to keep track of these important dates and set reminders to ensure that your form is submitted on time. Missing the deadline can lead to interest charges and additional fees, complicating your tax situation.

Form Submission Methods

The P1001 form can be submitted through various methods, providing flexibility for taxpayers. Options include online submission via the HMRC website, mailing a physical copy to the appropriate tax office, or delivering it in person. Each method has its own processing times and requirements, so it is essential to choose the one that best fits your needs. Online submissions are often faster and provide immediate confirmation of receipt, while mailed forms may take longer to process.

Quick guide on how to complete p1001 form

Complete P1001 Form easily on any device

Digital document management has gained popularity among businesses and individuals alike. It serves as an ideal eco-friendly alternative to traditional printed and signed paperwork, allowing you to access the required format and securely store it online. airSlate SignNow equips you with all the necessary tools to create, modify, and eSign your documents promptly without delays. Manage P1001 Form on any device using airSlate SignNow’s Android or iOS applications and enhance any document-centric process today.

How to modify and eSign P1001 Form effortlessly

- Find P1001 Form and then click Get Form to begin.

- Utilize the tools we offer to complete your document.

- Emphasize important sections of your documents or redact sensitive information using tools provided by airSlate SignNow specifically for that purpose.

- Generate your signature with the Sign tool, which takes seconds and holds the same legal validity as a conventional wet ink signature.

- Review the details and then click on the Done button to save your modifications.

- Choose how you want to send your form, via email, text message (SMS), invite link, or download it to your computer.

Wave goodbye to lost or misplaced files, tedious form searching, or mistakes that require printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from your chosen device. Edit and eSign P1001 Form to ensure outstanding communication at any stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct p1001 form

Create this form in 5 minutes!

How to create an eSignature for the p1001 form

How to create an electronic signature for a PDF file in the online mode

How to create an electronic signature for a PDF file in Chrome

How to create an electronic signature for putting it on PDFs in Gmail

The best way to create an eSignature from your smartphone

How to create an eSignature for a PDF file on iOS devices

The best way to create an eSignature for a PDF file on Android

People also ask

-

What is the p1001 HMRC form and why is it important?

The p1001 HMRC form is used for reporting tax and National Insurance contributions for employees in the UK. It is essential for businesses to ensure compliance with tax regulations and avoid penalties. By using airSlate SignNow, you can easily eSign and submit your p1001 HMRC forms, streamlining the process and enhancing accuracy.

-

How can airSlate SignNow help with my p1001 HMRC documentation?

airSlate SignNow offers a user-friendly platform that simplifies the signing and management of your p1001 HMRC documents. With built-in templates and automated workflows, you can easily prepare, send, and track your p1001 HMRC forms, ensuring timely submissions and reducing administrative burdens.

-

What pricing plans does airSlate SignNow offer for eSigning p1001 HMRC forms?

airSlate SignNow offers flexible pricing plans to cater to businesses of all sizes, ranging from basic packages to advanced features. These plans are designed to be cost-effective while providing the necessary tools for managing p1001 HMRC documentation. You can choose a plan based on your volume of eSigning needs for your p1001 HMRC forms.

-

Does airSlate SignNow integrate with accounting software for p1001 HMRC management?

Yes, airSlate SignNow integrates seamlessly with various accounting and payroll software solutions. This integration facilitates efficient management of p1001 HMRC documentation by automatically populating relevant data and allowing for easy eSigning directly from your preferred accounting system.

-

Are electronic signatures on p1001 HMRC forms legally binding?

Absolutely, electronic signatures created with airSlate SignNow are legally binding in accordance with UK law. This means that when you eSign your p1001 HMRC forms using our platform, you can be confident that they meet all legal requirements, ensuring valid submissions to the HMRC.

-

How secure is airSlate SignNow when handling p1001 HMRC documents?

Security is a top priority at airSlate SignNow. Our platform employs advanced encryption and compliance measures to protect your p1001 HMRC documents throughout the signing process. You can trust that your sensitive information remains confidential and secure when using our services.

-

Can I track the status of my p1001 HMRC submissions with airSlate SignNow?

Yes, airSlate SignNow provides tracking features that allow you to monitor the status of your p1001 HMRC submissions in real-time. You’ll receive notifications when documents are viewed and signed, helping you keep tabs on the submission process and deadlines.

Get more for P1001 Form

Find out other P1001 Form

- Can I Electronic signature Kentucky Car Dealer Document

- Can I Electronic signature Louisiana Car Dealer Form

- How Do I Electronic signature Oklahoma Banking Document

- How To Electronic signature Oklahoma Banking Word

- How Can I Electronic signature Massachusetts Car Dealer PDF

- How Can I Electronic signature Michigan Car Dealer Document

- How Do I Electronic signature Minnesota Car Dealer Form

- Can I Electronic signature Missouri Car Dealer Document

- How Do I Electronic signature Nevada Car Dealer PDF

- How To Electronic signature South Carolina Banking Document

- Can I Electronic signature New York Car Dealer Document

- How To Electronic signature North Carolina Car Dealer Word

- How Do I Electronic signature North Carolina Car Dealer Document

- Can I Electronic signature Ohio Car Dealer PPT

- How Can I Electronic signature Texas Banking Form

- How Do I Electronic signature Pennsylvania Car Dealer Document

- How To Electronic signature South Carolina Car Dealer Document

- Can I Electronic signature South Carolina Car Dealer Document

- How Can I Electronic signature Texas Car Dealer Document

- How Do I Electronic signature West Virginia Banking Document