Ct 13 2023

What is the Ct 13

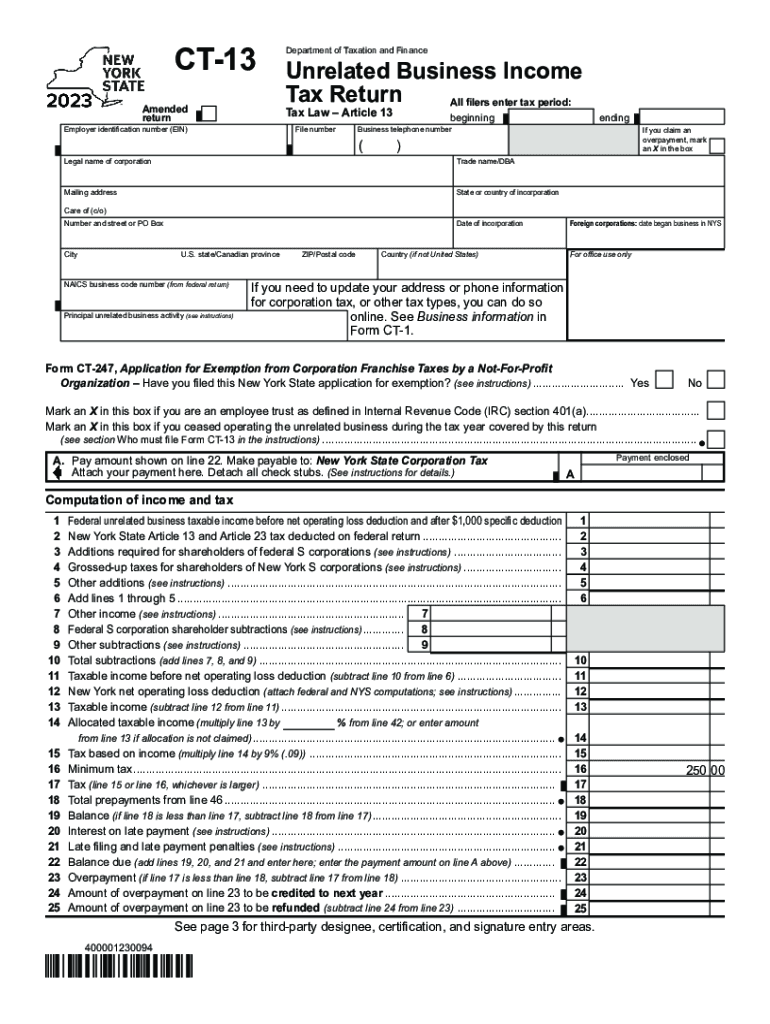

The Ct 13 form, officially known as the Connecticut Unrelated Business Income Tax Return, is a tax form used by organizations that are exempt from federal income tax but engage in unrelated business activities. This form is essential for reporting income generated from activities that are not substantially related to the organization's exempt purpose. Understanding the Ct 13 is crucial for ensuring compliance with state tax regulations in Connecticut.

How to use the Ct 13

To use the Ct 13 effectively, organizations must first determine if their income qualifies as unrelated business income. This includes income from activities that are not directly related to the organization's mission. Once confirmed, the organization must complete the form by providing detailed information about the income, expenses, and any deductions applicable. Properly filling out the Ct 13 ensures that the organization meets its tax obligations while maintaining its tax-exempt status.

Steps to complete the Ct 13

Completing the Ct 13 involves several key steps:

- Gather all necessary financial documents, including income statements and expense records related to the unrelated business activities.

- Fill out the form accurately, detailing all sources of unrelated business income and corresponding expenses.

- Calculate the taxable income by subtracting allowable expenses from gross income.

- Review the completed form for accuracy and completeness before submission.

Filing Deadlines / Important Dates

The filing deadline for the Ct 13 is typically the fifteenth day of the fourth month following the end of the organization’s fiscal year. Organizations must be aware of this deadline to avoid penalties and ensure timely compliance. It is advisable to check for any updates or changes to the filing schedule, as state regulations may vary.

Required Documents

When preparing to file the Ct 13, organizations should have the following documents ready:

- Financial statements detailing income and expenses from unrelated business activities.

- Records of any deductions claimed.

- Previous tax returns, if applicable, for reference and consistency.

Penalties for Non-Compliance

Failure to file the Ct 13 on time or inaccuracies in the form can result in significant penalties. These may include fines and interest on unpaid taxes. Organizations must understand the importance of compliance to avoid these financial repercussions and maintain their tax-exempt status.

Quick guide on how to complete ct 13

Complete Ct 13 effortlessly on any device

Online document management has become increasingly popular among organizations and individuals. It offers an ideal eco-friendly alternative to traditional printed and signed documents, allowing you to find the correct form and securely store it online. airSlate SignNow provides you with all the tools necessary to create, edit, and electronically sign your documents quickly without delays. Manage Ct 13 on any device with airSlate SignNow's Android or iOS applications and enhance any document-centric workflow today.

How to modify and eSign Ct 13 with ease

- Find Ct 13 and click Get Form to begin.

- Use the tools we offer to fill out your document.

- Highlight important sections of the documents or redact sensitive information with tools that airSlate SignNow specifically provides for that purpose.

- Create your electronic signature using the Sign tool, which takes just seconds and carries the same legal validity as a conventional wet ink signature.

- Review the information and then click the Done button to save your modifications.

- Choose how you prefer to send your form: via email, text message (SMS), invite link, or download it to your computer.

Say goodbye to lost or misfiled documents, tedious form searches, or mistakes that necessitate printing new document copies. airSlate SignNow meets all your document management needs in just a few clicks from any device you prefer. Modify and eSign Ct 13 and ensure excellent communication at every stage of your document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct ct 13

Create this form in 5 minutes!

How to create an eSignature for the ct 13

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is ct 13 in relation to airSlate SignNow?

Ct 13 refers to a specific document type or requirement that businesses may encounter when using airSlate SignNow. Our platform ensures compliance with related regulations, allowing you to efficiently manage and eSign documents that fall under ct 13 requirements.

-

How does airSlate SignNow handle ct 13 documents?

AirSlate SignNow provides tools to easily upload, manage, and eSign ct 13 documents. Our intuitive interface allows users to streamline the signing process, ensuring that all necessary information is captured while maintaining compliance with relevant laws.

-

Is there a cost associated with using airSlate SignNow for ct 13 document management?

Yes, airSlate SignNow offers competitive pricing plans designed to meet various business needs, including those requiring ct 13 document management. Our plans are cost-effective, providing valuable features that help businesses manage their documents efficiently.

-

What features does airSlate SignNow offer for ct 13 compliance?

AirSlate SignNow includes features such as customizable templates, secure eSignature options, and audit trails specifically tailored for ct 13 compliance. These functionalities help ensure that your documents are not only properly signed but also traceable for accountability.

-

Can I integrate airSlate SignNow with other applications for ct 13 processes?

Absolutely! AirSlate SignNow offers seamless integrations with various applications that can assist with ct 13 processes, such as CRMs and document management systems. This integration capability enhances your workflow by allowing you to manage everything in one place without compromising efficiency.

-

How does using airSlate SignNow benefit businesses dealing with ct 13 documents?

Utilizing airSlate SignNow provides businesses with a time-saving and efficient method to manage ct 13 documents. Our solution not only streamlines the signing process but also helps improve compliance and reduces the risk of errors that may occur with traditional methods.

-

Are there support resources available for questions related to ct 13?

Yes, airSlate SignNow offers comprehensive support resources for businesses addressing ct 13 topics. Our support team is available to assist you with any questions or challenges, ensuring you have the guidance needed to successfully manage your document signing needs.

Get more for Ct 13

Find out other Ct 13

- How Can I Electronic signature Hawaii Courts Purchase Order Template

- How To Electronic signature Indiana Courts Cease And Desist Letter

- How Can I Electronic signature New Jersey Sports Purchase Order Template

- How Can I Electronic signature Louisiana Courts LLC Operating Agreement

- How To Electronic signature Massachusetts Courts Stock Certificate

- Electronic signature Mississippi Courts Promissory Note Template Online

- Electronic signature Montana Courts Promissory Note Template Now

- Electronic signature Montana Courts Limited Power Of Attorney Safe

- Electronic signature Oklahoma Sports Contract Safe

- Electronic signature Oklahoma Sports RFP Fast

- How To Electronic signature New York Courts Stock Certificate

- Electronic signature South Carolina Sports Separation Agreement Easy

- Electronic signature Virginia Courts Business Plan Template Fast

- How To Electronic signature Utah Courts Operating Agreement

- Electronic signature West Virginia Courts Quitclaim Deed Computer

- Electronic signature West Virginia Courts Quitclaim Deed Free

- Electronic signature Virginia Courts Limited Power Of Attorney Computer

- Can I Sign Alabama Banking PPT

- Electronic signature Washington Sports POA Simple

- How To Electronic signature West Virginia Sports Arbitration Agreement