Fl640 Info Form

What is the FL640 Info

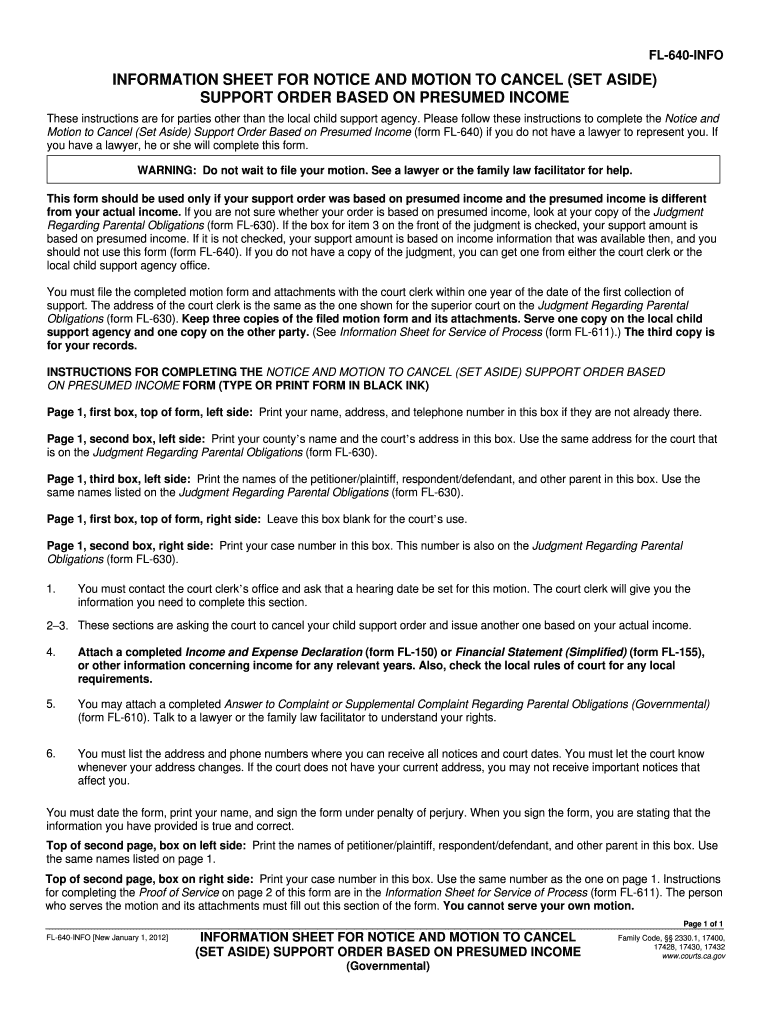

The FL640 Info is a crucial document used in the state of California, primarily concerning presumed income. It serves as a notice for individuals who may be subject to income assessment based on specific criteria set forth by the state. This form is essential for ensuring compliance with California's income reporting regulations, particularly in situations where actual income may not be readily available or verifiable. Understanding the FL640 Info is vital for individuals navigating financial assessments and obligations.

Steps to Complete the FL640 Info

Completing the FL640 Info involves several key steps to ensure accuracy and compliance. First, gather all necessary financial documents, including previous income statements and any relevant tax forms. Next, fill out the form by providing your personal information, including your name, address, and Social Security number. Be sure to indicate your presumed income accurately, based on the guidelines provided by the state. Once completed, review the form for any errors or omissions before submitting it to the appropriate agency.

Legal Use of the FL640 Info

The legal use of the FL640 Info is paramount for individuals facing income assessments in California. This form must be completed and submitted in accordance with state regulations to avoid penalties. It is legally binding and serves as an official record of presumed income, which may be used in various legal and financial contexts. Understanding the legal implications of this form can help individuals ensure they are meeting their obligations and protecting their rights.

Examples of Using the FL640 Info

There are various scenarios in which the FL640 Info is utilized. For instance, individuals applying for public assistance may need to submit this form to establish their income level. Additionally, those involved in legal proceedings related to child support or spousal support may also be required to provide this documentation to determine financial obligations. These examples highlight the importance of the FL640 Info in assessing presumed income across different situations.

Required Documents

When completing the FL640 Info, certain documents are required to support your claims of presumed income. These may include prior year tax returns, pay stubs, bank statements, and any other financial records that can substantiate your income level. Having these documents readily available will facilitate the completion of the form and ensure that all information provided is accurate and verifiable.

Form Submission Methods

The FL640 Info can be submitted through various methods, providing flexibility for individuals. You can choose to submit the form online through designated state portals, which often allow for quicker processing times. Alternatively, you may opt to mail the completed form to the appropriate agency or deliver it in person at designated offices. Understanding these submission methods can help streamline the process and ensure timely compliance with state requirements.

Quick guide on how to complete fl640 info

Complete Fl640 Info effortlessly on any device

Managing documents online has become increasingly popular among businesses and individuals alike. It offers an ideal environmentally friendly option compared to conventional printed and signed documents, allowing you to locate the right form and securely store it online. airSlate SignNow provides all the necessary tools to create, modify, and eSign your documents swiftly without delays. Manage Fl640 Info on any platform using the airSlate SignNow Android or iOS applications and enhance any document-driven workflow today.

The simplest method to modify and eSign Fl640 Info with ease

- Locate Fl640 Info and click Get Form to initiate.

- Utilize the available tools to complete your document.

- Highlight important sections of your documents or obscure sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Create your eSignature using the Sign tool, which takes mere seconds and holds the same legal validity as a traditional handwritten signature.

- Review the information and click on the Done button to save your modifications.

- Choose your delivery method for your form, whether by email, SMS, invitation link, or download to your computer.

Eliminate concerns about lost or misfiled documents, tedious form searches, or errors that necessitate printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device you prefer. Modify and eSign Fl640 Info while ensuring excellent communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the fl640 info

The best way to create an eSignature for a PDF in the online mode

The best way to create an eSignature for a PDF in Chrome

The best way to create an eSignature for putting it on PDFs in Gmail

The way to generate an electronic signature from your smart phone

The way to generate an eSignature for a PDF on iOS devices

The way to generate an electronic signature for a PDF file on Android OS

People also ask

-

What is presumed income and how does airSlate SignNow relate to it?

Presumed income refers to the income a business expects to generate based on contracts and agreements. airSlate SignNow helps streamline the contract signing process, ensuring that documents are signed quickly and accurately, which can positively influence presumed income by speeding up revenue recognition.

-

How can airSlate SignNow help with managing presumed income documentation?

airSlate SignNow provides a secure platform to eSign and manage important documents that directly affect presumed income. By eliminating delays in the signing process, businesses can effectively track and monitor agreements linked to their financial projections, ensuring timely revenue recognition.

-

What pricing plans does airSlate SignNow offer for businesses looking to improve their presumed income management?

airSlate SignNow offers flexible pricing plans designed to cater to businesses of all sizes. Each plan includes features that enhance document workflows, helping to ensure that contracts affecting presumed income are managed efficiently while staying within budget.

-

What features does airSlate SignNow provide to support presumed income tracking?

Features like document templates, real-time tracking, and cloud storage support businesses in managing presumed income-related documents. These tools facilitate efficient document handling and ensure that all agreements are easily accessible for review and compliance.

-

Can airSlate SignNow integrate with other software to help manage presumed income?

Yes, airSlate SignNow integrates seamlessly with various business software, including CRM and accounting tools. These integrations allow businesses to connect their presumed income documentation with workflows, enhancing productivity and accuracy in financial forecasting.

-

How does airSlate SignNow enhance the security of documents affecting presumed income?

Security is a priority at airSlate SignNow, with features like encrypted document storage and secure signing processes. This level of security helps protect sensitive information tied to presumed income, ensuring that all agreements are safely managed and compliant with regulations.

-

What are the benefits of using airSlate SignNow for streamlining presumed income processes?

Utilizing airSlate SignNow helps businesses reduce turnaround time for document completion, which can signNowly enhance presumed income flows. Faster processing of agreements means quicker revenue recognition, positioning businesses for better financial planning.

Get more for Fl640 Info

Find out other Fl640 Info

- How To Electronic signature Indiana Courts Cease And Desist Letter

- How Can I Electronic signature New Jersey Sports Purchase Order Template

- How Can I Electronic signature Louisiana Courts LLC Operating Agreement

- How To Electronic signature Massachusetts Courts Stock Certificate

- Electronic signature Mississippi Courts Promissory Note Template Online

- Electronic signature Montana Courts Promissory Note Template Now

- Electronic signature Montana Courts Limited Power Of Attorney Safe

- Electronic signature Oklahoma Sports Contract Safe

- Electronic signature Oklahoma Sports RFP Fast

- How To Electronic signature New York Courts Stock Certificate

- Electronic signature South Carolina Sports Separation Agreement Easy

- Electronic signature Virginia Courts Business Plan Template Fast

- How To Electronic signature Utah Courts Operating Agreement

- Electronic signature West Virginia Courts Quitclaim Deed Computer

- Electronic signature West Virginia Courts Quitclaim Deed Free

- Electronic signature Virginia Courts Limited Power Of Attorney Computer

- Can I Sign Alabama Banking PPT

- Electronic signature Washington Sports POA Simple

- How To Electronic signature West Virginia Sports Arbitration Agreement

- Electronic signature Wisconsin Sports Residential Lease Agreement Myself