Withholding Jud Form

What is the Withholding Jud

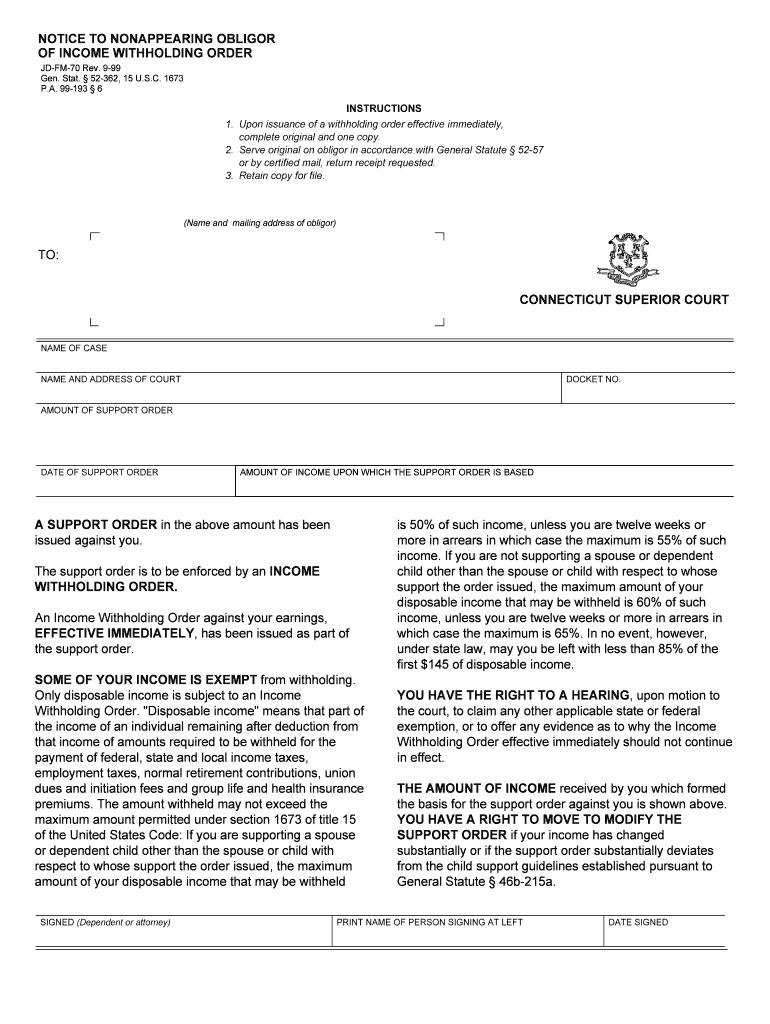

The withholding judgment is a legal mechanism used in Connecticut to collect child support or other financial obligations from an individual’s income. It allows for a portion of an obligor's wages to be withheld directly from their paycheck, ensuring that payments are made consistently and on time. This legal tool is particularly important in cases where the obligor may not voluntarily comply with payment requirements.

How to use the Withholding Jud

To utilize a withholding judgment, the recipient must first obtain a court order that specifies the amount to be withheld from the obligor's income. This order is then submitted to the obligor's employer, who is responsible for deducting the specified amount from the employee's wages. The employer must comply with this order and send the withheld funds directly to the appropriate agency or individual designated in the judgment.

Steps to complete the Withholding Jud

Completing the withholding judgment involves several key steps:

- Obtain a court order for the withholding judgment.

- Prepare the withholding judgment form, ensuring all required information is accurately filled out.

- Submit the completed form to the obligor's employer.

- Monitor the payments to ensure compliance and address any discrepancies promptly.

Legal use of the Withholding Jud

The legal framework governing the withholding judgment is established to protect the rights of both the obligor and the recipient. It is essential for the withholding judgment to be executed in accordance with state laws, ensuring that all parties involved understand their rights and obligations. Compliance with these legal standards helps to prevent disputes and ensures that the process is fair and transparent.

Key elements of the Withholding Jud

Several key elements are critical to the effectiveness of the withholding judgment:

- Amount to be withheld: This should be clearly stated in the court order.

- Duration: The judgment may specify how long the withholding will continue.

- Employer obligations: Employers must act promptly upon receiving the order.

- Notification: The obligor must be informed about the withholding order.

Form Submission Methods

The withholding judgment form can be submitted through various methods, including:

- Online: Many courts offer electronic filing options for convenience.

- Mail: The form can be sent via postal service to the appropriate court or agency.

- In-Person: Submitting the form directly at the court can provide immediate confirmation of receipt.

Penalties for Non-Compliance

Failure to comply with a withholding judgment can result in serious consequences for the obligor. Potential penalties include:

- Legal action to enforce the judgment.

- Additional financial penalties or interest on unpaid amounts.

- Impact on credit ratings and financial standing.

Quick guide on how to complete withholding jud

Complete Withholding Jud seamlessly on any device

Digital document management has gained traction among businesses and individuals. It offers an ideal eco-friendly alternative to conventional printed and signed documents, enabling you to find the right form and securely store it online. airSlate SignNow equips you with all the tools necessary to create, modify, and electronically sign your documents quickly and without delays. Manage Withholding Jud on any device using the airSlate SignNow applications for Android or iOS and simplify any document-related task today.

How to edit and electronically sign Withholding Jud effortlessly

- Find Withholding Jud and select Get Form to begin.

- Utilize the tools we provide to complete your document.

- Emphasize important sections of the documents or redact sensitive information with the tools that airSlate SignNow specifically provides for that purpose.

- Create your electronic signature using the Sign feature, which takes mere seconds and holds the same legal validity as a traditional ink signature.

- Review all the details and click on the Done button to save your modifications.

- Select your preferred method for delivering your form, whether by email, SMS, or invitation link, or download it to your computer.

Say goodbye to lost or misplaced files, tedious form searches, or errors that require the printing of new document copies. airSlate SignNow meets all your document management needs in just a few clicks from your device of choice. Edit and electronically sign Withholding Jud and ensure smooth communication at any point in your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the withholding jud

The best way to generate an electronic signature for your PDF document in the online mode

The best way to generate an electronic signature for your PDF document in Chrome

The way to make an electronic signature for putting it on PDFs in Gmail

The way to make an electronic signature straight from your mobile device

The way to make an electronic signature for a PDF document on iOS devices

The way to make an electronic signature for a PDF document on Android devices

People also ask

-

What is CT income withholding and how does it work?

CT income withholding refers to the process of deducting a specified amount from an employee's paycheck for state taxes and other obligations. It ensures compliance with Connecticut tax laws, helping employers manage their payroll responsibilities efficiently. By automating CT income withholding, airSlate SignNow streamlines the payroll process, saving time and reducing errors.

-

How does airSlate SignNow simplify CT income withholding management?

airSlate SignNow provides a user-friendly platform that automates the documentation and signing process for CT income withholding. This reduces the manual workload on HR departments and ensures that all necessary forms are correctly filled out and signed. By simplifying CT income withholding management, businesses can focus on growth rather than administrative tasks.

-

What features of airSlate SignNow support CT income withholding implementation?

The features of airSlate SignNow that support CT income withholding include customizable templates, electronic signatures, and secure document storage. Users can create and manage CT income withholding forms easily, ensuring compliance with state regulations. These features make the implementation of CT income withholding not only efficient but also secure.

-

Is airSlate SignNow cost-effective for managing CT income withholding?

Yes, airSlate SignNow offers a cost-effective solution for managing CT income withholding. With various pricing plans, businesses can choose a plan that fits their budget while still accessing essential features for payroll management. The savings on administrative costs and the reduction in errors make using airSlate SignNow a smart financial choice for CT income withholding.

-

Can airSlate SignNow be integrated with my existing payroll system for CT income withholding?

Absolutely! airSlate SignNow supports integrations with various payroll systems, making it easy to manage CT income withholding alongside your existing processes. This seamless integration ensures that your business can maintain its current workflow while benefiting from the efficiencies of airSlate SignNow for documentation and eSigning.

-

What benefits can my business expect from using airSlate SignNow for CT income withholding?

By using airSlate SignNow for CT income withholding, businesses can expect increased efficiency, reduced paperwork, and improved compliance with state regulations. The platform allows for quick and easy access to documents, helping businesses stay organized and making tax reporting simpler. Overall, it enhances productivity and minimizes the risk of errors in CT income withholding.

-

How secure is airSlate SignNow for handling documents related to CT income withholding?

Security is a top priority for airSlate SignNow. The platform employs advanced encryption and security protocols to protect documents related to CT income withholding. With secure storage and access controls, businesses can trust airSlate SignNow to safeguard their sensitive payroll information.

Get more for Withholding Jud

Find out other Withholding Jud

- How Can I eSign Kansas Education Word

- How To eSign Kansas Education Document

- How Do I eSign Maine Education PPT

- Can I eSign Maine Education PPT

- How To eSign Massachusetts Education PDF

- How To eSign Minnesota Education PDF

- Can I eSign New Jersey Education Form

- How Can I eSign Oregon Construction Word

- How Do I eSign Rhode Island Construction PPT

- How Do I eSign Idaho Finance & Tax Accounting Form

- Can I eSign Illinois Finance & Tax Accounting Presentation

- How To eSign Wisconsin Education PDF

- Help Me With eSign Nebraska Finance & Tax Accounting PDF

- How To eSign North Carolina Finance & Tax Accounting Presentation

- How To eSign North Dakota Finance & Tax Accounting Presentation

- Help Me With eSign Alabama Healthcare / Medical PDF

- How To eSign Hawaii Government Word

- Can I eSign Hawaii Government Word

- How To eSign Hawaii Government Document

- How To eSign Hawaii Government Document