Philadelphia Bir Tax Form 2019

What is the Philadelphia BIR Tax Form?

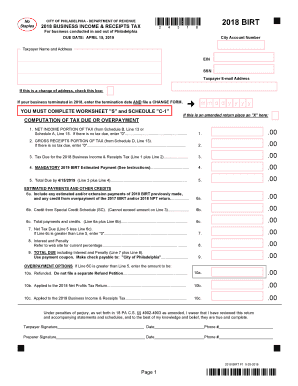

The Philadelphia BIR Tax Form is a crucial document used by businesses operating within the city to report their business income and calculate the Business Income and Receipts Tax (BIRT). This form is essential for ensuring compliance with local tax regulations. The BIRT applies to various business entities, including corporations, partnerships, and sole proprietorships. The form captures essential information such as gross receipts, allowable deductions, and the overall tax liability for the reporting period.

How to Obtain the Philadelphia BIR Tax Form

Obtaining the Philadelphia BIR Tax Form is straightforward. Businesses can access the form through the official Philadelphia Department of Revenue website. It is available for download in PDF format, allowing for easy printing and completion. Additionally, businesses may request a physical copy by contacting the Department of Revenue directly. Ensuring you have the correct version of the form for the specific tax year is vital for accurate reporting.

Steps to Complete the Philadelphia BIR Tax Form

Completing the Philadelphia BIR Tax Form involves several key steps:

- Gather financial records, including income statements and receipts.

- Fill out the form with accurate figures, ensuring all income and deductions are reported.

- Double-check calculations to confirm the accuracy of the reported tax liability.

- Sign and date the form, certifying that the information provided is true and complete.

It is advisable to consult with a tax professional if there are uncertainties regarding any section of the form.

Legal Use of the Philadelphia BIR Tax Form

The Philadelphia BIR Tax Form serves as a legally binding document when properly completed and submitted. It must adhere to local tax laws, and any discrepancies or inaccuracies can lead to penalties. Businesses are required to maintain records that support the information reported on the form, as these may be requested during audits. Understanding the legal implications of the form is critical for compliance and avoiding potential fines.

Filing Deadlines / Important Dates

Filing deadlines for the Philadelphia BIR Tax Form are typically set annually. Businesses should be aware of the specific due dates to avoid late penalties. Generally, the form is due on the fifteenth day of the fourth month following the end of the tax year. For those on a calendar year basis, this means the deadline is April 15. It is essential to stay informed about any changes in deadlines or additional filing requirements that may arise.

Form Submission Methods

The Philadelphia BIR Tax Form can be submitted through various methods, ensuring convenience for businesses. The available submission methods include:

- Online submission via the Philadelphia Department of Revenue's website.

- Mailing a completed paper form to the designated address.

- In-person submission at local Department of Revenue offices.

Choosing the right submission method can help streamline the filing process and ensure timely compliance.

Quick guide on how to complete philadelphia bir tax form 2018

Complete Philadelphia Bir Tax Form effortlessly on any device

Digital document management has gained popularity among businesses and individuals. It offers an ideal eco-friendly substitute for conventional printed and signed documents, allowing you to obtain the appropriate form and securely store it online. airSlate SignNow equips you with all the resources necessary to create, modify, and electronically sign your documents quickly and without interruptions. Handle Philadelphia Bir Tax Form on any device using airSlate SignNow's Android or iOS applications and enhance any document-related process today.

How to update and eSign Philadelphia Bir Tax Form with ease

- Find Philadelphia Bir Tax Form and then click Get Form to begin.

- Utilize the tools we offer to complete your document.

- Emphasize signNow sections of your documents or obscure sensitive details with tools that airSlate SignNow has specifically designed for that purpose.

- Create your eSignature using the Sign tool, which takes just seconds and holds the same legal validity as a traditional wet ink signature.

- Review the information and then click on the Done button to save your changes.

- Select how you wish to share your form, via email, text message (SMS), or invitation link, or download it to your computer.

Eliminate concerns about lost or mislaid files, tedious form searches, or mistakes that necessitate printing new document copies. airSlate SignNow meets your document management needs with just a few clicks from any device you prefer. Modify and eSign Philadelphia Bir Tax Form to ensure exceptional communication at any stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct philadelphia bir tax form 2018

Create this form in 5 minutes!

How to create an eSignature for the philadelphia bir tax form 2018

The best way to create an electronic signature for your PDF file in the online mode

The best way to create an electronic signature for your PDF file in Chrome

How to make an eSignature for putting it on PDFs in Gmail

The best way to generate an electronic signature right from your smartphone

The way to create an electronic signature for a PDF file on iOS devices

The best way to generate an electronic signature for a PDF on Android

People also ask

-

What is the Philadelphia BIR Tax Form 2018?

The Philadelphia BIR Tax Form 2018 is a document that businesses need to file with the Philadelphia Department of Revenue. This form is crucial for reporting business income and ensuring compliance with local tax laws. Understanding this form is essential for businesses operating in Philadelphia.

-

How does airSlate SignNow simplify the process of filling out the Philadelphia BIR Tax Form 2018?

airSlate SignNow simplifies the process of filling out the Philadelphia BIR Tax Form 2018 by providing an intuitive platform for document completion and e-signatures. Users can easily upload, edit, and sign the document without any technical expertise. This streamlines the filing process and helps ensure accuracy.

-

Are there any costs associated with using airSlate SignNow for the Philadelphia BIR Tax Form 2018?

Yes, airSlate SignNow offers a cost-effective solution with various pricing plans to fit different business needs. Users can choose from flexible subscription options that provide full access to features for managing the Philadelphia BIR Tax Form 2018 and other documents. This makes it a budget-friendly choice for small and large businesses alike.

-

Can I integrate airSlate SignNow with other software for filing the Philadelphia BIR Tax Form 2018?

Absolutely! airSlate SignNow seamlessly integrates with various accounting and financial software, allowing users to manage the Philadelphia BIR Tax Form 2018 more efficiently. This integration enhances productivity by centralizing document management with tools you already use.

-

What features does airSlate SignNow offer to enhance compliance for the Philadelphia BIR Tax Form 2018?

airSlate SignNow offers several features designed to enhance compliance when handling the Philadelphia BIR Tax Form 2018. These include secure e-signatures, document tracking, and automated reminders for filing deadlines. This support ensures that users remain compliant with local regulations.

-

Is airSlate SignNow suitable for both small businesses and large enterprises when dealing with the Philadelphia BIR Tax Form 2018?

Yes, airSlate SignNow is suitable for businesses of all sizes. Whether you run a small business or a large enterprise, the features and flexibility of airSlate SignNow help in managing the Philadelphia BIR Tax Form 2018 effectively. Its scalable solutions cater to various user needs.

-

What are the benefits of using airSlate SignNow for the Philadelphia BIR Tax Form 2018?

Using airSlate SignNow for the Philadelphia BIR Tax Form 2018 provides several benefits, including improved efficiency, lower operational costs, and enhanced accuracy. The platform's user-friendly interface allows for quick document preparation and signing, while its compliance features keep your filings on point.

Get more for Philadelphia Bir Tax Form

Find out other Philadelphia Bir Tax Form

- Can I Electronic signature South Carolina Life Sciences PDF

- How Can I Electronic signature Rhode Island Legal Document

- Can I Electronic signature South Carolina Legal Presentation

- How Can I Electronic signature Wyoming Life Sciences Word

- How To Electronic signature Utah Legal PDF

- How Do I Electronic signature Arkansas Real Estate Word

- How Do I Electronic signature Colorado Real Estate Document

- Help Me With Electronic signature Wisconsin Legal Presentation

- Can I Electronic signature Hawaii Real Estate PPT

- How Can I Electronic signature Illinois Real Estate Document

- How Do I Electronic signature Indiana Real Estate Presentation

- How Can I Electronic signature Ohio Plumbing PPT

- Can I Electronic signature Texas Plumbing Document

- How To Electronic signature Michigan Real Estate Form

- How To Electronic signature Arizona Police PDF

- Help Me With Electronic signature New Hampshire Real Estate PDF

- Can I Electronic signature New Hampshire Real Estate Form

- Can I Electronic signature New Mexico Real Estate Form

- How Can I Electronic signature Ohio Real Estate Document

- How To Electronic signature Hawaii Sports Presentation