Business Personal Property Rendition of Taxable Property Form

What is the Business Personal Property Rendition of Taxable Property

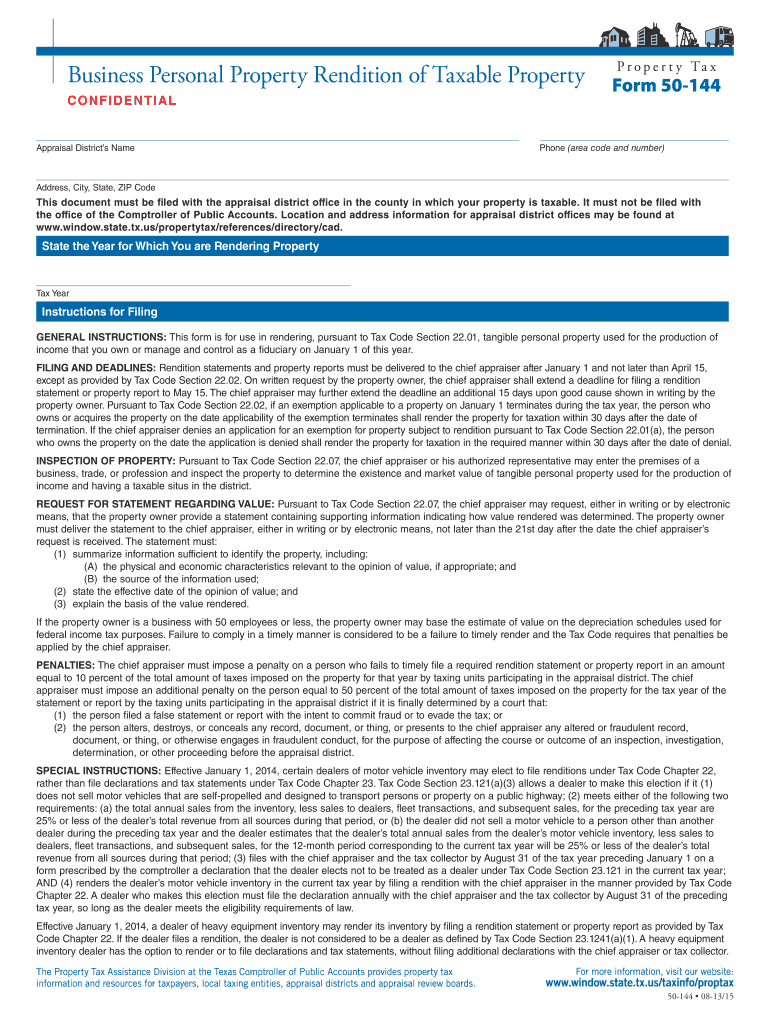

The business personal property rendition of taxable property is a crucial document used by businesses to report their personal property to local tax authorities. This form provides a detailed account of the assets owned by a business, which may include equipment, furniture, and other tangible items used in operations. The information submitted through this form is essential for determining the tax liability of the business, ensuring compliance with local tax laws.

Steps to Complete the Business Personal Property Rendition of Taxable Property

Completing the business personal property rendition involves several key steps to ensure accuracy and compliance. Begin by gathering all necessary information about the personal property owned by the business, including descriptions, purchase dates, and values. Next, accurately fill out the form, providing detailed descriptions and values for each item listed. After completing the form, review it for any errors or omissions. Finally, submit the form to the appropriate local tax authority by the specified deadline.

Legal Use of the Business Personal Property Rendition of Taxable Property

The business personal property rendition serves a legal purpose by providing a formal declaration of a business's taxable assets. This document is essential for tax assessment and helps local authorities determine the appropriate tax rate. Proper completion and timely submission of the form can protect businesses from penalties and ensure compliance with state and local tax regulations.

Filing Deadlines / Important Dates

Filing deadlines for the business personal property rendition vary by state and locality. Typically, businesses must submit their renditions annually, with many jurisdictions requiring submission by April 15. It is crucial for businesses to be aware of their specific deadlines to avoid late fees or penalties. Checking with local tax authorities can provide the most accurate information regarding important dates.

Required Documents

To complete the business personal property rendition, businesses may need to gather several supporting documents. These can include purchase receipts, invoices, and previous tax returns related to personal property. Having these documents on hand can facilitate accurate reporting and help substantiate the values claimed on the rendition.

Form Submission Methods (Online / Mail / In-Person)

The business personal property rendition can typically be submitted through various methods, depending on local regulations. Many jurisdictions now offer online submission options, allowing businesses to file electronically for convenience. Alternatively, forms can often be mailed to the local tax office or submitted in person. It is advisable to confirm the accepted submission methods with the relevant tax authority.

Penalties for Non-Compliance

Failure to file the business personal property rendition on time or providing inaccurate information can result in significant penalties. These may include fines, increased tax assessments, or even legal action in severe cases. Businesses should prioritize compliance to avoid these repercussions and maintain good standing with tax authorities.

Quick guide on how to complete business personal property rendition of taxable property

Effortlessly Prepare Business Personal Property Rendition Of Taxable Property on Any Device

Digital document management has become increasingly popular among businesses and individuals alike. It serves as an excellent eco-friendly substitute for conventional printed and signed documents, allowing you to locate the right form and securely store it online. airSlate SignNow equips you with all the tools required to create, modify, and eSign your documents promptly without interruptions. Manage Business Personal Property Rendition Of Taxable Property from any device with airSlate SignNow's Android or iOS applications and streamline your document-related processes today.

Steps to Modify and eSign Business Personal Property Rendition Of Taxable Property with Ease

- Obtain Business Personal Property Rendition Of Taxable Property and click Get Form to begin.

- Make use of the tools we provide to complete your form.

- Mark important sections of your documents or conceal sensitive information with the tools specifically designed for that purpose by airSlate SignNow.

- Create your signature using the Sign tool, which takes mere seconds and holds the same legal validity as a traditional handwritten signature.

- Review the details and click on the Done button to save your changes.

- Select your preferred method to send your form, whether by email, text message (SMS), invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searches, or mistakes that require printing additional copies. airSlate SignNow meets all your document management needs in just a few clicks from the device of your choice. Adjust and eSign Business Personal Property Rendition Of Taxable Property and ensure exceptional communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

FAQs

-

Why does my property management ask me to fill out a W-9 form?

To collect data on you in case they want to sue you and enforce a judgment.If the management co is required to pay inerest on security deposits then they need to account to ou for that interest income.If you are in a coop or condo they may apportion tax benefits or capital costs to you for tax purposes.

-

If I am a house wife, I put the amount of 500,000 above the fixed deposit in a bank, and I fill out the 15G form, then am I a taxable or non-taxable person?

If you Deposit 5 Lakh than Bank may and IT (IN CASE OF SUSPICION CAN ASK FOR SOURCE of Funds) Assuming you do not have any other income the interest due to this deposit is unlikely to exceed Rs 40000 .Nevertheless you have to calculate other sources to evaluate Total Income .If your income including interest on the fixed deposit is exceeding basic exemption limit ( Rs 2,50,000 for FY 17–18) then you will have to pay tax.Since you have filled Form 15G the Bank will not deduct TDS from the Interest income. So now it is you who will have to calculate the tax amount and then pay it. Otherwise, if you had not filled the form, Bank would have deducted TDS on your Interest income.

-

How should form 26QB be filled in the case of a joint ownership property and multiple sellers?

For each buyer and seller a separate Form 26QB is to be filed.Say A & B buy a property from X & Y for Rs.1 crore in equal proportionate.In that case 4 Form 26QB to be filed.Buyer A - Seller X for sale consideration of Rs.25,00,000Buyer A - Seller Y for sale consideration of Rs.25,00,000Buyer B - Seller X for sale consideration of Rs.25,00,000Buyer B - Seller Y for sale consideration of Rs.25,00,000

-

In partnership form of business organisation, do we have claim on the personal property of secret partners?

Firstly let me get you with who is a Secret Partner.A Secret partner, unlike a silent partner, has a say in the business' operations, but the public is not aware that the secret partner is involved in the business. Her name is not associated with the business in any way. A secret partner may have a tarnished reputation from a previous business failure and doesn't want that reputation to taint the new business, or she simply may prefer to operate anonymously.—————————————————————————————————————Secret Partners share in the liability of the business, unless the business operates under a limited partnership. A limited partnership agreement limits the liability of the partners in the event of debts or lawsuits. If the partnership is not organized as a limited partnership, each partner could incur unlimited liability for damages. Even though secret partners aren't publicly known as partners, they still can incur liability.In unlimited partnership, every partner is liable, jointly with all the other partners and also severally, for all acts of the firm done while he is a partner. You can be held personally responsible for another partner’s negligence or carelessness. This means that if your partnership firm is insufficient to meet its financial obligations, you may have to use your personal assets to pay off debtors, even though you personally may not be at fault.—————————————————————————————————————I would recommend you to form a Limited Liability Partnership( LLP ).A limited partner is a partner in a partnership whose liability is limited to the extent of the partner's share of ownership.LLP has a separate legal entity, liable to the full extent of its assets, the liability of the partners would be limited to their agreed contribution in the LLP. Further, no partner would be liable on account of the independent or un-authorized actions of other partners, thus allowing individual partners to be shielded from joint liability created by another partner’s wrongful business decisions or misconduct.Happy Learning!

-

How can I fill out Google's intern host matching form to optimize my chances of receiving a match?

I was selected for a summer internship 2016.I tried to be very open while filling the preference form: I choose many products as my favorite products and I said I'm open about the team I want to join.I even was very open in the location and start date to get host matching interviews (I negotiated the start date in the interview until both me and my host were happy.) You could ask your recruiter to review your form (there are very cool and could help you a lot since they have a bigger experience).Do a search on the potential team.Before the interviews, try to find smart question that you are going to ask for the potential host (do a search on the team to find nice and deep questions to impress your host). Prepare well your resume.You are very likely not going to get algorithm/data structure questions like in the first round. It's going to be just some friendly chat if you are lucky. If your potential team is working on something like machine learning, expect that they are going to ask you questions about machine learning, courses related to machine learning you have and relevant experience (projects, internship). Of course you have to study that before the interview. Take as long time as you need if you feel rusty. It takes some time to get ready for the host matching (it's less than the technical interview) but it's worth it of course.

-

If a tenant moves out of a rental property leaving behind some of their personal property does the property then belong to the landlord or the next tenant?

If a tenant moves out of a rental property leaving behind some of their personal property does the property then belong to the landlord or the next tenant?The laws vary from state-to-state, but the short answer is: The property belongs to the tenant who left it.The landlord is required by law to remove the items and store them SECURELY. By law, the items must be kept in the same condition as they were left.The landlord is required to keep those items securely stored for a minimum amount of time (usually 30–60 days). During that time, the landlord is required to make a good faith attempt to notify the tenant that the items have been secured, and what the storage fees will cost.The landlord is allowed to charge the tenant for the costs of packing, moving, and storing the items. The tenant must pay those charges BEFORE the items are released to him.At the end of the mandatory storage period, the landlord is required to make one last attempt to notify the tenant that on X (date) the items will be disposed of if the tenant has not claimed them and paid the fees.When that date comes, the landlord may dispose of the items as he sees fit. Any profit made from selling the items must be applied to the unpaid moving/storage fees (at least, that’s the law here in Nevada). “Profit” means money received above the costs of disposing of the items. So, for instance, if the landlord pays for advertising the items, that cost is recouped first, then anything left would be profit.

-

Can someone provide me the property disclosure form which is to be filled out by the employees of the UP government as per the instructions by the new CM?

It will be available in the UP Government website. Further you can email or tweet to the Chief Minister of UP requesting for the particular information. The CM is a committed social worker and leads the life a yogi, so everything is transparent about him and his Government.

Create this form in 5 minutes!

How to create an eSignature for the business personal property rendition of taxable property

How to generate an eSignature for your Business Personal Property Rendition Of Taxable Property in the online mode

How to create an eSignature for the Business Personal Property Rendition Of Taxable Property in Chrome

How to create an eSignature for signing the Business Personal Property Rendition Of Taxable Property in Gmail

How to create an electronic signature for the Business Personal Property Rendition Of Taxable Property straight from your smart phone

How to make an eSignature for the Business Personal Property Rendition Of Taxable Property on iOS

How to create an eSignature for the Business Personal Property Rendition Of Taxable Property on Android devices

People also ask

-

What is a Business Personal Property Rendition Of Taxable Property?

A Business Personal Property Rendition Of Taxable Property is a document that businesses must file with local tax authorities to report the value of their personal property. This filing helps ensure that businesses are accurately taxed based on the property they own. Utilizing tools like airSlate SignNow can streamline this process, making it easier to manage and submit these important documents.

-

How does airSlate SignNow assist with Business Personal Property Rendition Of Taxable Property?

airSlate SignNow simplifies the process of preparing and submitting your Business Personal Property Rendition Of Taxable Property by providing eSigning capabilities and document management features. With our user-friendly platform, businesses can easily create, send, and track their renditions, ensuring timely submissions and compliance with local regulations.

-

What are the pricing options for using airSlate SignNow for Business Personal Property Rendition Of Taxable Property?

airSlate SignNow offers flexible pricing plans tailored to meet the needs of businesses of all sizes. Whether you require basic eSignature functionalities or advanced features for your Business Personal Property Rendition Of Taxable Property, our pricing is designed to be cost-effective and scalable as your business grows. Check our website for detailed pricing information.

-

Can I integrate airSlate SignNow with other software for Business Personal Property Rendition Of Taxable Property?

Yes, airSlate SignNow supports integration with various software solutions to enhance your workflow for Business Personal Property Rendition Of Taxable Property. This allows you to seamlessly connect with accounting, tax preparation, and document management systems, ensuring a smooth process from document creation to submission.

-

What are the benefits of using airSlate SignNow for my Business Personal Property Rendition Of Taxable Property?

Using airSlate SignNow for your Business Personal Property Rendition Of Taxable Property provides numerous benefits, including increased efficiency, reduced paperwork, and enhanced security. Our platform allows multiple users to collaborate on documents in real-time, ensuring all necessary information is accurately captured and submitted on time.

-

Is airSlate SignNow secure for handling Business Personal Property Rendition Of Taxable Property?

Absolutely! airSlate SignNow prioritizes security, utilizing advanced encryption and authentication protocols to safeguard your Business Personal Property Rendition Of Taxable Property. Our platform ensures that all documents are securely stored and only accessible to authorized users, providing peace of mind during the filing process.

-

How can I get started with airSlate SignNow for Business Personal Property Rendition Of Taxable Property?

Getting started with airSlate SignNow for your Business Personal Property Rendition Of Taxable Property is simple. You can sign up for a free trial on our website, explore our features, and begin creating and managing your documents right away. Our intuitive interface makes it easy for anyone to navigate and use the platform effectively.

Get more for Business Personal Property Rendition Of Taxable Property

- Afps form 8

- 1040sr 2019 form

- We sent you a monetary benefit determinations showing the weekly benefits you will receive form

- Form 3131 multistate adjustable rate rider 5 year arm

- Autonomous vehicle technology demonstrationtesting application form

- Form do 21b njgov

- Hsmv 81095 mhrv complaint registration form

- Lp 203 form

Find out other Business Personal Property Rendition Of Taxable Property

- eSign North Carolina Government Notice To Quit Now

- eSign Oregon Government Business Plan Template Easy

- How Do I eSign Oklahoma Government Separation Agreement

- How Do I eSign Tennessee Healthcare / Medical Living Will

- eSign West Virginia Healthcare / Medical Forbearance Agreement Online

- eSign Alabama Insurance LLC Operating Agreement Easy

- How Can I eSign Alabama Insurance LLC Operating Agreement

- eSign Virginia Government POA Simple

- eSign Hawaii Lawers Rental Application Fast

- eSign Hawaii Lawers Cease And Desist Letter Later

- How To eSign Hawaii Lawers Cease And Desist Letter

- How Can I eSign Hawaii Lawers Cease And Desist Letter

- eSign Hawaii Lawers Cease And Desist Letter Free

- eSign Maine Lawers Resignation Letter Easy

- eSign Louisiana Lawers Last Will And Testament Mobile

- eSign Louisiana Lawers Limited Power Of Attorney Online

- eSign Delaware Insurance Work Order Later

- eSign Delaware Insurance Credit Memo Mobile

- eSign Insurance PPT Georgia Computer

- How Do I eSign Hawaii Insurance Operating Agreement