1040sr 2019

What is the 1040SR?

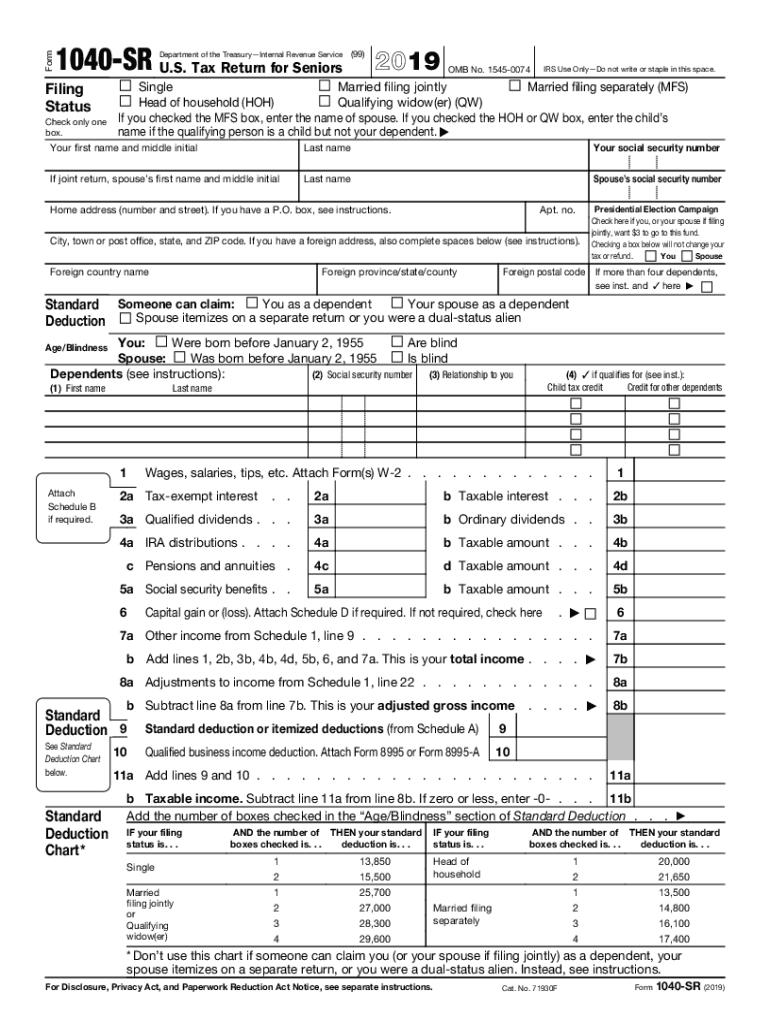

The 2019 IRS 1040 SR form is specifically designed for seniors aged sixty-five and older. This form simplifies the tax filing process by allowing eligible taxpayers to report their income and claim deductions in a straightforward manner. It is similar to the standard 1040 form but includes larger print for easier readability and eliminates the need for certain schedules that are not applicable to many seniors. The 1040 SR is intended to streamline the tax filing experience for older individuals, making it more accessible and user-friendly.

How to Obtain the 1040SR

To obtain the 2019 IRS 1040 SR form, taxpayers can visit the official IRS website, where they can download the form in PDF format. Alternatively, individuals may request a physical copy by contacting the IRS directly or visiting a local IRS office. It is important to ensure that the correct version of the form is used, as tax forms are updated annually. Taxpayers can also find the 1040 SR form at various libraries or community centers that provide tax assistance resources.

Steps to Complete the 1040SR

Completing the 2019 IRS 1040 SR form involves several key steps:

- Gather all necessary documents, including W-2s, 1099s, and any other income statements.

- Fill in personal information, such as name, address, and Social Security number.

- Report income from various sources, including wages, pensions, and Social Security benefits.

- Claim deductions and credits applicable to your situation, such as the standard deduction for seniors.

- Review the completed form for accuracy before signing and dating it.

Once completed, the form can be submitted electronically or via mail, depending on the taxpayer's preference.

Legal Use of the 1040SR

The 2019 IRS 1040 SR form is legally binding once it is signed and submitted to the IRS. To ensure compliance with tax laws, it is vital to provide accurate information and complete all required sections of the form. Electronic signatures are accepted, provided that they meet the standards set forth by the IRS. Taxpayers should retain a copy of their completed form for their records, as it may be needed for future reference or in the event of an audit.

Filing Deadlines / Important Dates

For the 2019 tax year, the deadline for filing the IRS 1040 SR form was April 15, 2020. However, taxpayers could request an extension, which would allow them to file by October 15, 2020. It is essential to adhere to these deadlines to avoid penalties and interest on any unpaid taxes. Taxpayers should also be aware of any changes in deadlines for future tax years, as these can vary.

Required Documents

When completing the 2019 IRS 1040 SR form, taxpayers should prepare the following documents:

- W-2 forms from employers for wage income.

- 1099 forms for other income sources, such as freelance work or interest income.

- Records of any retirement income, including pensions and Social Security benefits.

- Documentation for any deductions or credits claimed, such as medical expenses or property taxes.

Having these documents readily available will facilitate a smoother filing process.

Quick guide on how to complete 1040sr 2019

Complete 1040sr effortlessly on any device

Managing documents online has gained popularity among businesses and individuals. It presents a perfect environmentally-friendly substitute for conventional printed and signed documents, enabling you to obtain the correct form and securely store it online. airSlate SignNow provides you with all the necessary tools to create, modify, and eSign your documents quickly and efficiently. Handle 1040sr on any device using airSlate SignNow Android or iOS applications and enhance any document-driven process today.

The simplest method to alter and eSign 1040sr without hassle

- Locate 1040sr and press Get Form to get started.

- Utilize the tools we provide to complete your document.

- Emphasize important sections of the documents or redact sensitive information with tools that airSlate SignNow has specifically designed for that purpose.

- Generate your signature using the Sign feature, which takes seconds and holds the same legal validity as a conventional wet ink signature.

- Review the information and click on the Done button to save your modifications.

- Choose how you would like to share your form, via email, text message (SMS), invitation link, or download it to your computer.

Forget about lost or misplaced documents, tedious searching for forms, or mistakes that require printing new document copies. airSlate SignNow fulfills all your document management needs in just a few clicks from any device of your choice. Modify and eSign 1040sr and ensure excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 1040sr 2019

Create this form in 5 minutes!

How to create an eSignature for the 1040sr 2019

The best way to create an eSignature for a PDF file online

The best way to create an eSignature for a PDF file in Google Chrome

The best way to create an electronic signature for signing PDFs in Gmail

The best way to generate an electronic signature from your mobile device

The way to generate an eSignature for a PDF file on iOS

The best way to generate an electronic signature for a PDF file on Android devices

People also ask

-

What is the 2019 IRS 1040 SR form?

The 2019 IRS 1040 SR form is a simplified tax return form designed specifically for seniors aged 65 and over. This form allows for a straightforward way to report income, claim deductions, and receive tax credits. It's an ideal option for those who prefer a simpler filing process.

-

How do I eSign the 2019 IRS 1040 SR form using airSlate SignNow?

To eSign the 2019 IRS 1040 SR form using airSlate SignNow, simply upload the form to the platform. You can then add signers, specify signing fields, and send the document for electronic signature. Our user-friendly interface makes it easy to complete the form without hassle.

-

What are the benefits of using airSlate SignNow for the 2019 IRS 1040 SR form?

Using airSlate SignNow for the 2019 IRS 1040 SR form streamlines your tax filing process, saving you time and improving accuracy. With our secure eSignature solution, you can ensure your documents are signed promptly and safely. Plus, logs and notifications keep you informed of each step.

-

Is airSlate SignNow cost-effective for filing the 2019 IRS 1040 SR form?

Yes, airSlate SignNow offers a cost-effective solution for filing the 2019 IRS 1040 SR form. Our pricing plans are designed to suit any budget, ensuring that you can access premium features without overspending. This makes it an ideal choice for individuals and businesses alike.

-

Can I integrate airSlate SignNow with other accounting software for the 2019 IRS 1040 SR form?

Absolutely! airSlate SignNow offers seamless integrations with various accounting software, allowing you to easily manage the 2019 IRS 1040 SR form alongside your other financial documents. This compatibility helps streamline your workflow and keeps everything organized in one place.

-

What features does airSlate SignNow offer for managing the 2019 IRS 1040 SR form?

airSlate SignNow provides essential features such as document templates, audit trails, and customizable signing workflows to manage the 2019 IRS 1040 SR form efficiently. Our platform also includes mobile support, allowing you to complete transactions on-the-go. Experience optimal control over your forms with these advanced tools.

-

How can I ensure my 2019 IRS 1040 SR form is secure with airSlate SignNow?

Security is a priority at airSlate SignNow. We employ advanced encryption protocols and secure cloud storage to protect your 2019 IRS 1040 SR form and other sensitive information. Additionally, we adhere to industry standards, ensuring that your documents are safe throughout the signing process.

Get more for 1040sr

- Truck dispatcher paperwork form

- Lic agent report form 380 pdf

- Land survey report sample pdf form

- Affidavit to authorize proxy who is submitting the form in india

- Clsi guidelines pdf form

- Ea 800 receipt for firearms and firearm parts form

- Stipulated findings of fact conclusions of law order for judgment and judgment and decree form

- Office of the state fire marshal the state vermont division of fire form

Find out other 1040sr

- How To Sign Vermont Legal Executive Summary Template

- How To Sign Vermont Legal POA

- How Do I Sign Hawaii Life Sciences Business Plan Template

- Sign Life Sciences PPT Idaho Online

- Sign Life Sciences PPT Idaho Later

- How Do I Sign Hawaii Life Sciences LLC Operating Agreement

- Sign Idaho Life Sciences Promissory Note Template Secure

- How To Sign Wyoming Legal Quitclaim Deed

- Sign Wisconsin Insurance Living Will Now

- Sign Wyoming Insurance LLC Operating Agreement Simple

- Sign Kentucky Life Sciences Profit And Loss Statement Now

- How To Sign Arizona Non-Profit Cease And Desist Letter

- Can I Sign Arkansas Non-Profit LLC Operating Agreement

- Sign Arkansas Non-Profit LLC Operating Agreement Free

- Sign California Non-Profit Living Will Easy

- Sign California Non-Profit IOU Myself

- Sign California Non-Profit Lease Agreement Template Free

- Sign Maryland Life Sciences Residential Lease Agreement Later

- Sign Delaware Non-Profit Warranty Deed Fast

- Sign Florida Non-Profit LLC Operating Agreement Free