Gc 400 C 5 Form

What is the Gc 400 C 5

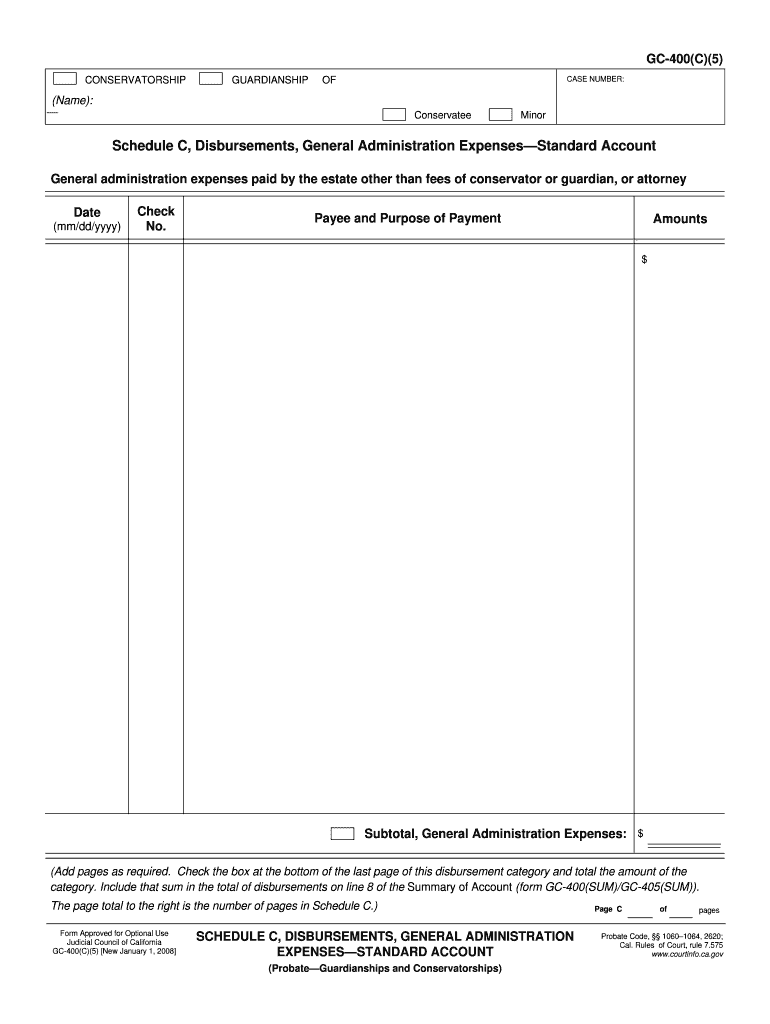

The Gc 400 C 5 is a specific form used for reporting certain financial information, particularly in relation to tax obligations. It is essential for individuals and businesses to accurately complete this form to ensure compliance with IRS regulations. The Gc 400 C 5 is often utilized by self-employed individuals and small business owners to report income and expenses effectively.

How to use the Gc 400 C 5

Using the Gc 400 C 5 involves several steps to ensure that all required information is accurately reported. First, gather all necessary financial documents, including income statements and expense receipts. Next, complete the form by entering your financial details in the appropriate sections. It is crucial to double-check all entries for accuracy before submission. Finally, submit the completed form according to the specified submission methods, which may include online filing or mailing the document to the appropriate IRS office.

Steps to complete the Gc 400 C 5

Completing the Gc 400 C 5 requires careful attention to detail. Follow these steps:

- Gather all relevant financial documents, including income and expense records.

- Fill out the form, ensuring that you provide accurate information in each section.

- Review the completed form for any errors or omissions.

- Submit the form through the designated method, either electronically or by mail.

Legal use of the Gc 400 C 5

The Gc 400 C 5 must be used in accordance with IRS guidelines to ensure its legal validity. This includes adhering to all filing deadlines and accurately reporting financial data. Failure to comply with these regulations may result in penalties or legal repercussions. It is advisable to consult with a tax professional if you have questions about the legal requirements associated with this form.

Required Documents

To complete the Gc 400 C 5, you will need several key documents. These typically include:

- Income statements, such as W-2s or 1099s.

- Receipts for business-related expenses.

- Previous year’s tax return for reference.

Having these documents on hand will facilitate a smoother completion process.

Filing Deadlines / Important Dates

It is crucial to be aware of the filing deadlines associated with the Gc 400 C 5. Generally, the form must be submitted by April fifteenth for the previous tax year. If additional time is needed, taxpayers may file for an extension, but this does not extend the time to pay any taxes owed. Staying informed about these deadlines helps avoid penalties.

Quick guide on how to complete gc 400 c 5

Complete Gc 400 C 5 effortlessly on any device

Digital document management has become increasingly favored by businesses and individuals alike. It offers an ideal eco-friendly alternative to conventional printed and signed documents, allowing you to locate the appropriate form and securely store it online. airSlate SignNow equips you with all the resources necessary to create, modify, and eSign your documents quickly without any holdups. Manage Gc 400 C 5 on any device with airSlate SignNow’s Android or iOS applications and enhance any document-related process today.

The simplest method to modify and eSign Gc 400 C 5 with ease

- Find Gc 400 C 5 and click on Get Form to begin.

- Utilize the features we offer to complete your form.

- Highlight important sections of the documents or obscure confidential information with tools specifically provided by airSlate SignNow for that purpose.

- Generate your eSignature with the Sign tool, which takes mere seconds and holds the same legal value as a traditional wet signature.

- Review all the information and click on the Done button to save your changes.

- Select how you wish to send your form, via email, text message (SMS), or an invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searches, or mistakes that require reprinting new document copies. airSlate SignNow meets all your document management needs in just a few clicks from any device of your preference. Modify and eSign Gc 400 C 5 and ensure excellent communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the gc 400 c 5

The best way to make an electronic signature for a PDF document online

The best way to make an electronic signature for a PDF document in Google Chrome

The best way to generate an eSignature for signing PDFs in Gmail

The way to create an electronic signature straight from your smart phone

How to generate an eSignature for a PDF document on iOS

The way to create an electronic signature for a PDF document on Android OS

People also ask

-

What is the 400 c general form used for?

The 400 c general form is typically used for various administrative and tax-related purposes. It helps in efficiently organizing and submitting necessary documentation, ensuring compliance with applicable regulations. By utilizing the 400 c general form, businesses can streamline their processes and enhance overall operational efficiency.

-

How can I fill out the 400 c general form using airSlate SignNow?

Filling out the 400 c general form using airSlate SignNow is straightforward. You can upload the form, fill in the required fields online, and utilize our eSignature feature for quick approvals. Our platform ensures all your data is securely stored and can be accessed anytime, making the process seamless.

-

What are the benefits of using airSlate SignNow for the 400 c general form?

Using airSlate SignNow for the 400 c general form offers multiple benefits, including increased efficiency and reduced paperwork. The platform allows for easy document sharing and collaboration, enhancing your team's productivity. Additionally, you can track the status of your documents in real-time, ensuring nothing gets overlooked.

-

Is the 400 c general form compliant with industry standards when using airSlate SignNow?

Yes, the 400 c general form processed through airSlate SignNow meets all necessary compliance requirements. Our platform adheres to industry standards and regulations, ensuring that your documents are legally binding and secure. You can trust that all eSignatures and submissions will be compliant with current laws.

-

What pricing plans does airSlate SignNow offer for using the 400 c general form?

airSlate SignNow provides various pricing plans suitable for different business needs, even for those focusing on the 400 c general form. Our pricing is competitive and designed to offer great value for the features included, such as unlimited eSigning and document management capabilities. Check our website for detailed pricing information that caters to your business size and usage.

-

Can I integrate airSlate SignNow with other software for managing the 400 c general form?

Absolutely! airSlate SignNow can be seamlessly integrated with various software applications, facilitating an efficient workflow for managing the 400 c general form. You can connect with platforms like cloud storage services, CRM systems, and project management tools for enhanced functionality and ease of use.

-

How secure is my data when using the 400 c general form with airSlate SignNow?

Data security is a top priority at airSlate SignNow. When using the 400 c general form on our platform, your data is protected with bank-level encryption and multiple layers of security protocols. You can confidently share, eSign, and store your documents, knowing they are safe from unauthorized access.

Get more for Gc 400 C 5

- Joint action routine lesson plan activity snack date daily monday form

- Dba stampin up form

- Agreements for account applications form

- Declaration specimen form

- Fcmg org form

- Disbursement request form planned lifetime assistance planofma ri

- Csc pds form pdf csc pds form pdf personal data sheet pds csc form 212 revised is used when applying for a job in government

- A 6004 784 docx form

Find out other Gc 400 C 5

- Electronic signature Florida Child Support Modification Simple

- Electronic signature North Dakota Child Support Modification Easy

- Electronic signature Oregon Child Support Modification Online

- How Can I Electronic signature Colorado Cohabitation Agreement

- Electronic signature Arkansas Leave of Absence Letter Later

- Electronic signature New Jersey Cohabitation Agreement Fast

- Help Me With Electronic signature Alabama Living Will

- How Do I Electronic signature Louisiana Living Will

- Electronic signature Arizona Moving Checklist Computer

- Electronic signature Tennessee Last Will and Testament Free

- Can I Electronic signature Massachusetts Separation Agreement

- Can I Electronic signature North Carolina Separation Agreement

- How To Electronic signature Wyoming Affidavit of Domicile

- Electronic signature Wisconsin Codicil to Will Later

- Electronic signature Idaho Guaranty Agreement Free

- Electronic signature North Carolina Guaranty Agreement Online

- eSignature Connecticut Outsourcing Services Contract Computer

- eSignature New Hampshire Outsourcing Services Contract Computer

- eSignature New York Outsourcing Services Contract Simple

- Electronic signature Hawaii Revocation of Power of Attorney Computer