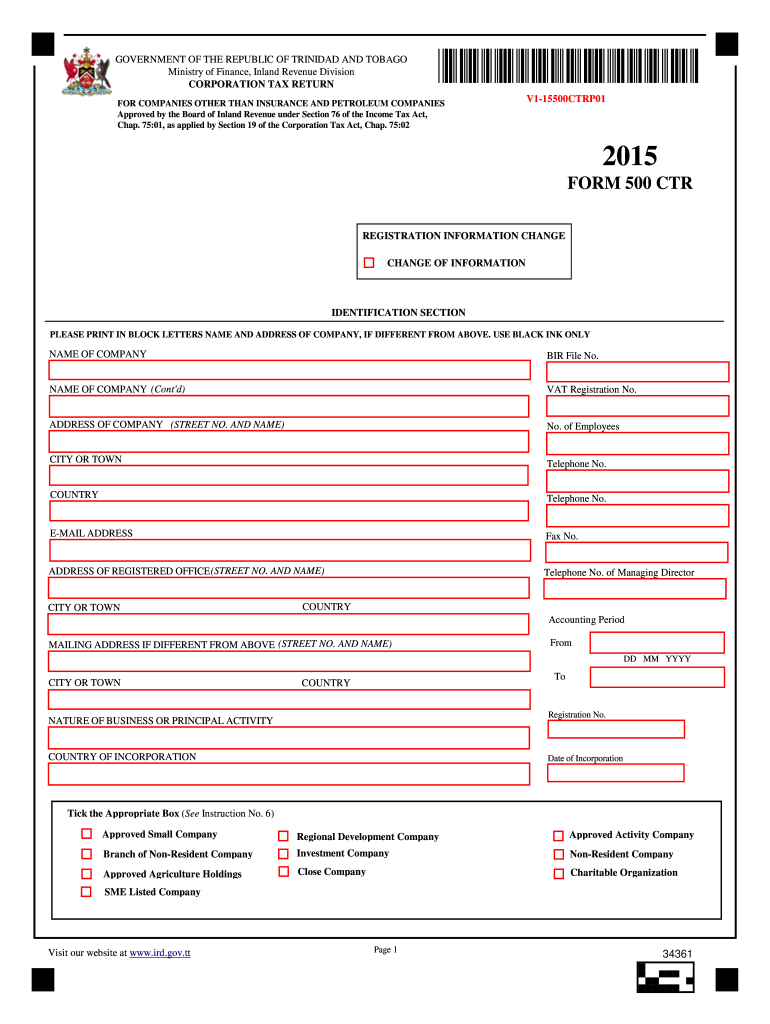

Ministry of Finance, Inland Revenue Division Form

What is the Ministry Of Finance, Inland Revenue Division

The Ministry Of Finance, Inland Revenue Division is a governmental body responsible for managing tax collection and ensuring compliance with tax laws in the United States. This division plays a crucial role in the administration of federal and state tax systems, overseeing various forms and processes that taxpayers must follow. Its primary objective is to facilitate the collection of taxes while providing support and guidance to taxpayers to ensure they meet their obligations.

How to use the Ministry Of Finance, Inland Revenue Division

Using the services of the Ministry Of Finance, Inland Revenue Division involves understanding the specific forms and requirements associated with tax filing. Taxpayers can access necessary forms online, fill them out, and submit them electronically or via mail. It is essential to follow the guidelines provided by the division to ensure that all submissions are accurate and compliant with current tax laws. This includes knowing the deadlines for filing and any specific documentation required for different tax situations.

Steps to complete the Ministry Of Finance, Inland Revenue Division

Completing forms associated with the Ministry Of Finance, Inland Revenue Division typically involves several key steps:

- Identify the correct form based on your tax situation, such as income tax, business tax, or other relevant categories.

- Gather all required documentation, including income statements, deductions, and previous tax filings.

- Fill out the form accurately, ensuring that all information is current and complete.

- Review the completed form for any errors or omissions before submission.

- Submit the form electronically through the division's online portal or by mailing a hard copy to the appropriate address.

Legal use of the Ministry Of Finance, Inland Revenue Division

The legal use of forms from the Ministry Of Finance, Inland Revenue Division is governed by federal and state tax laws. These forms must be filled out in accordance with the guidelines set forth by the division to be considered valid. Electronic signatures are accepted, provided they comply with the Electronic Signatures in Global and National Commerce Act (ESIGN) and other relevant regulations. Ensuring compliance with these laws is crucial for the legal standing of submitted documents.

Required Documents

When dealing with the Ministry Of Finance, Inland Revenue Division, certain documents are typically required to complete tax forms. These may include:

- W-2 forms from employers for income verification.

- 1099 forms for independent contractors or other income sources.

- Receipts for deductible expenses.

- Previous year’s tax return for reference.

- Identification documents, such as Social Security numbers or taxpayer identification numbers.

Filing Deadlines / Important Dates

Filing deadlines for forms associated with the Ministry Of Finance, Inland Revenue Division are critical to avoid penalties. Typically, individual income tax returns are due on April 15 of each year. However, extensions may be available under certain circumstances. It is important to stay informed about specific deadlines for different types of filings, as these can vary based on the form and taxpayer status.

Quick guide on how to complete 2015 ministry of finance inland revenue division

Complete Ministry Of Finance, Inland Revenue Division effortlessly on any device

Online document management has become increasingly popular among businesses and individuals. It serves as an ideal eco-friendly alternative to conventional printed and signed documents, allowing you to find the appropriate form and securely store it online. airSlate SignNow equips you with all the necessary tools to create, edit, and eSign your documents swiftly without any delays. Handle Ministry Of Finance, Inland Revenue Division on any platform using airSlate SignNow's Android or iOS applications and enhance any document-oriented process today.

The easiest way to edit and eSign Ministry Of Finance, Inland Revenue Division without any hassle

- Obtain Ministry Of Finance, Inland Revenue Division and click Get Form to begin.

- Utilize the tools we provide to complete your document.

- Highlight important sections of the documents or obscure sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Create your signature using the Sign tool, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Review the information and click the Done button to save your changes.

- Select how you would like to share your form, whether by email, text message (SMS), or invitation link, or download it to your computer.

Say goodbye to lost or misplaced files, painstaking form searches, or mistakes that require printing new document copies. airSlate SignNow fulfills your document management needs in just a few clicks from any device you prefer. Edit and eSign Ministry Of Finance, Inland Revenue Division and ensure excellent communication at every stage of your form preparation with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the 2015 ministry of finance inland revenue division

How to make an electronic signature for a PDF online

How to make an electronic signature for a PDF in Google Chrome

The best way to create an eSignature for signing PDFs in Gmail

The best way to make an electronic signature from your smartphone

The best way to generate an eSignature for a PDF on iOS

The best way to make an electronic signature for a PDF file on Android

People also ask

-

What is the role of the Ministry Of Finance, Inland Revenue Division in document eSigning?

The Ministry Of Finance, Inland Revenue Division plays a crucial role in regulating financial transactions and ensuring compliance in document eSigning. Their guidelines help businesses adhere to legal standards, ensuring that electronic signatures are recognized as valid and enforceable. airSlate SignNow aligns with these regulations to provide a secure eSigning experience.

-

How can airSlate SignNow benefit my business when dealing with the Ministry Of Finance, Inland Revenue Division?

Using airSlate SignNow allows businesses to streamline their interactions with the Ministry Of Finance, Inland Revenue Division. The platform's eSigning capabilities reduce turnaround times for document approvals, ensuring timely compliance with financial regulations. This efficiency can lead to improved operations and better relationships with government entities.

-

What features does airSlate SignNow offer to comply with the Ministry Of Finance, Inland Revenue Division regulations?

airSlate SignNow offers robust features such as secure document storage, customizable templates, and audit trails that comply with the Ministry Of Finance, Inland Revenue Division standards. These features not only enhance security but also ensure that all signed documents are stored in line with regulatory requirements. This makes it easier to produce records when needed.

-

Is airSlate SignNow cost-effective for businesses dealing with the Ministry Of Finance, Inland Revenue Division?

Yes, airSlate SignNow is a cost-effective solution that meets the needs of businesses engaging with the Ministry Of Finance, Inland Revenue Division. It offers various pricing plans tailored to different business sizes and needs, ensuring that all companies can find an option that fits their budget while remaining compliant with financial regulations.

-

Can airSlate SignNow integrate with other software used for Ministry Of Finance, Inland Revenue Division compliance?

Absolutely! airSlate SignNow seamlessly integrates with various software solutions that many businesses use to ensure compliance with the Ministry Of Finance, Inland Revenue Division. This allows for a smoother workflow by combining eSigning capabilities with existing financial and document management systems, enhancing overall efficiency.

-

What are the security measures taken by airSlate SignNow for documents related to the Ministry Of Finance, Inland Revenue Division?

airSlate SignNow employs advanced security measures, including end-to-end encryption and multi-factor authentication, to protect documents related to the Ministry Of Finance, Inland Revenue Division. These protocols ensure that sensitive financial information is safeguarded during the eSigning process, giving users peace of mind when managing regulated documents.

-

How does airSlate SignNow enhance the user experience for documents associated with the Ministry Of Finance, Inland Revenue Division?

With a user-friendly interface, airSlate SignNow enhances the experience for businesses handling documents with the Ministry Of Finance, Inland Revenue Division. The platform ensures a straightforward process for sending, signing, and tracking documents, making it accessible even for those unfamiliar with digital eSigning solutions.

Get more for Ministry Of Finance, Inland Revenue Division

- Post partum doula intake form

- Form bota uk border agency the home office ukba homeoffice gov

- Delta dental of illinois referral claim form

- Police affidavit template form

- Soccer player application form

- Fiduciary income tax k 41 rev 6 14 form

- Application for employee refund of occupational taxes withheld form

- Property tax or rent rebate claim pa 1000 formspublications 704712625

Find out other Ministry Of Finance, Inland Revenue Division

- Help Me With eSignature Iowa Life Sciences Presentation

- How Can I eSignature Michigan Life Sciences Word

- Can I eSignature New Jersey Life Sciences Presentation

- How Can I eSignature Louisiana Non-Profit PDF

- Can I eSignature Alaska Orthodontists PDF

- How Do I eSignature New York Non-Profit Form

- How To eSignature Iowa Orthodontists Presentation

- Can I eSignature South Dakota Lawers Document

- Can I eSignature Oklahoma Orthodontists Document

- Can I eSignature Oklahoma Orthodontists Word

- How Can I eSignature Wisconsin Orthodontists Word

- How Do I eSignature Arizona Real Estate PDF

- How To eSignature Arkansas Real Estate Document

- How Do I eSignature Oregon Plumbing PPT

- How Do I eSignature Connecticut Real Estate Presentation

- Can I eSignature Arizona Sports PPT

- How Can I eSignature Wisconsin Plumbing Document

- Can I eSignature Massachusetts Real Estate PDF

- How Can I eSignature New Jersey Police Document

- How Can I eSignature New Jersey Real Estate Word