Fiduciary Income Tax K 41 Rev 6 14 2023

What is the Fiduciary Income Tax K-41 Rev 6 14

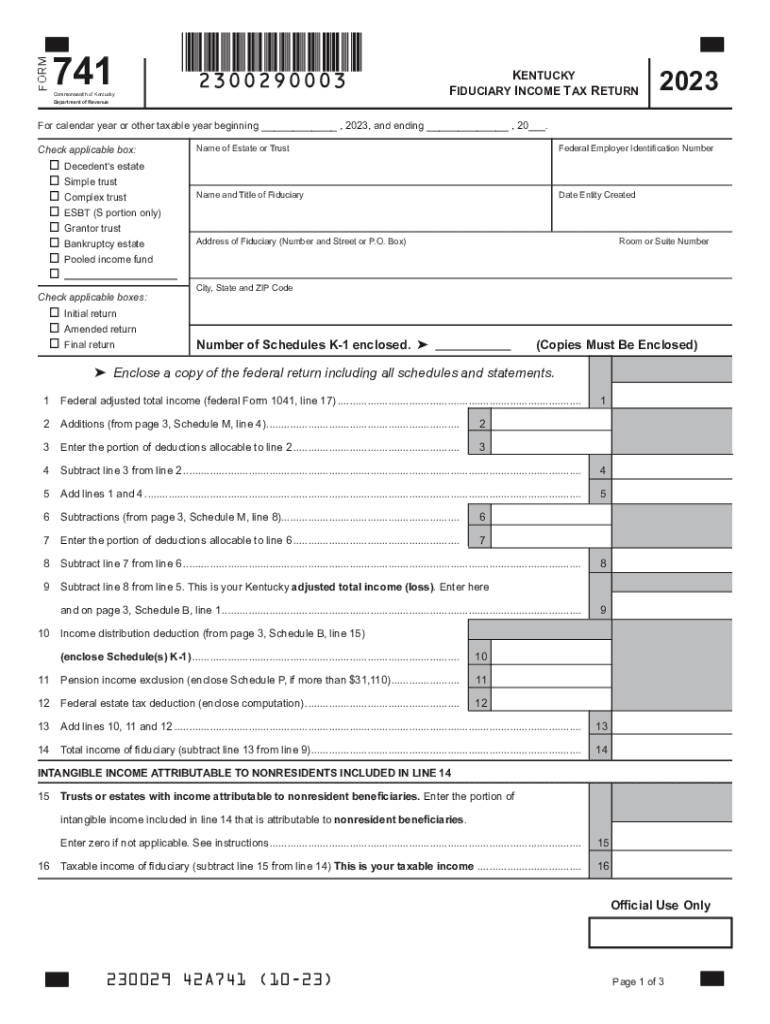

The Fiduciary Income Tax K-41 Rev 6 14 is a specific tax form used in the United States for reporting income earned by estates and trusts. This form is essential for fiduciaries, who are responsible for managing the financial affairs of an estate or trust. The K-41 form allows fiduciaries to report income, deductions, and credits associated with the estate or trust, ensuring compliance with federal and state tax laws. This form is typically filed annually and is crucial for determining the tax liability of the estate or trust, as well as for the beneficiaries who may receive distributions from it.

How to use the Fiduciary Income Tax K-41 Rev 6 14

Using the Fiduciary Income Tax K-41 Rev 6 14 involves several steps to accurately report the income and expenses of an estate or trust. First, gather all necessary documentation, including income statements, expense receipts, and any relevant tax documents. Next, complete the form by entering the income earned by the estate or trust, along with any deductions that can be claimed. It is important to follow the specific instructions provided with the form to ensure all sections are filled out correctly. Once completed, the form should be submitted to the appropriate tax authority by the designated deadline.

Steps to complete the Fiduciary Income Tax K-41 Rev 6 14

Completing the Fiduciary Income Tax K-41 Rev 6 14 requires careful attention to detail. Here are the steps to follow:

- Collect all relevant financial documents related to the estate or trust.

- Fill out the identifying information at the top of the form, including the name and address of the fiduciary.

- Report the total income earned during the tax year in the appropriate sections.

- List any deductions that apply, such as administrative expenses or distributions to beneficiaries.

- Calculate the total tax liability based on the reported income and deductions.

- Sign and date the form to certify its accuracy.

- Submit the completed form to the appropriate tax authority by the filing deadline.

Key elements of the Fiduciary Income Tax K-41 Rev 6 14

The Fiduciary Income Tax K-41 Rev 6 14 includes several key elements that are crucial for accurate reporting. These elements consist of:

- Income Reporting: This section requires detailed reporting of all income generated by the estate or trust.

- Deductions: Fiduciaries can claim deductions for allowable expenses related to the management of the estate or trust.

- Tax Computation: This part involves calculating the tax owed based on the net income after deductions.

- Beneficiary Information: Details about distributions made to beneficiaries must be included, as this affects their individual tax obligations.

Filing Deadlines / Important Dates

Filing deadlines for the Fiduciary Income Tax K-41 Rev 6 14 typically align with the annual tax return deadlines for estates and trusts. Generally, the form must be filed by the fifteenth day of the fourth month following the end of the tax year. For estates and trusts operating on a calendar year, this means the form is due by April 15. It is essential to be aware of any changes to deadlines or extensions that may apply, especially in light of specific circumstances or changes in tax law.

Form Submission Methods

The Fiduciary Income Tax K-41 Rev 6 14 can be submitted through various methods, ensuring flexibility for fiduciaries. The primary submission methods include:

- Online Submission: Many tax authorities provide an online portal for electronic filing, allowing for quicker processing.

- Mail: The form can be printed and mailed to the appropriate tax office, ensuring that it is sent well before the deadline.

- In-Person Submission: Fiduciaries may also choose to submit the form in person at local tax offices, which can provide immediate confirmation of receipt.

Quick guide on how to complete fiduciary income tax k 41 rev 6 14

Complete Fiduciary Income Tax K 41 Rev 6 14 with ease on any device

Digital document management has gained signNow traction among businesses and individuals. It serves as an ideal eco-friendly alternative to traditional printed and signed paperwork, allowing you to access the right form and securely store it online. airSlate SignNow equips you with all the necessary tools to create, edit, and eSign your documents swiftly without interruptions. Manage Fiduciary Income Tax K 41 Rev 6 14 on any platform using airSlate SignNow's Android or iOS applications and streamline any document-related process today.

How to edit and eSign Fiduciary Income Tax K 41 Rev 6 14 effortlessly

- Find Fiduciary Income Tax K 41 Rev 6 14 and click on Get Form to begin.

- Use the tools we provide to complete your document.

- Emphasize pertinent sections of your documents or obscure sensitive information with tools specifically designed for that purpose by airSlate SignNow.

- Generate your signature using the Sign tool, which takes only seconds and carries the same legal validity as a conventional handwritten signature.

- Review the details and click the Done button to preserve your modifications.

- Choose how you wish to share your form, via email, text message (SMS), or an invitation link, or download it to your computer.

Eliminate the hassle of misplaced or lost files, tedious form searches, or mistakes that necessitate printing new copies of documents. airSlate SignNow meets all your document management needs in just a few clicks from any device you prefer. Edit and eSign Fiduciary Income Tax K 41 Rev 6 14 and ensure excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct fiduciary income tax k 41 rev 6 14

Create this form in 5 minutes!

How to create an eSignature for the fiduciary income tax k 41 rev 6 14

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is Fiduciary Income Tax K 41 Rev 6 14?

Fiduciary Income Tax K 41 Rev 6 14 refers to a specific tax form used by fiduciaries to report income, deductions, and credits on behalf of estates and trusts in a streamlined manner. This form ensures compliance with state tax regulations and provides necessary information for beneficiaries.

-

How can airSlate SignNow help with completing Fiduciary Income Tax K 41 Rev 6 14?

AirSlate SignNow simplifies the process of completing Fiduciary Income Tax K 41 Rev 6 14 by providing an easy-to-use platform for document management and eSigning. Users can fill out the necessary forms electronically and securely send them for signatures, minimizing hassle and expediting the filing process.

-

Is there a cost associated with using airSlate SignNow for Fiduciary Income Tax K 41 Rev 6 14?

Yes, there is a cost associated with using airSlate SignNow, but it is an affordable solution for businesses needing to eSign and manage documents like Fiduciary Income Tax K 41 Rev 6 14. Pricing plans are flexible, allowing you to choose one that suits your business needs without breaking the bank.

-

What features does airSlate SignNow offer for handling Fiduciary Income Tax K 41 Rev 6 14?

AirSlate SignNow offers a range of features that benefit users preparing Fiduciary Income Tax K 41 Rev 6 14, including customizable templates, automated workflows, and real-time tracking of document status. These features enhance efficiency, ensuring that all documents are completed accurately and on time.

-

Can airSlate SignNow integrate with other software for managing Fiduciary Income Tax K 41 Rev 6 14?

Absolutely! AirSlate SignNow integrates seamlessly with various accounting and tax software, enabling users to manage Fiduciary Income Tax K 41 Rev 6 14 within their existing workflow. This integration helps streamline the entire process, from preparing the documents to obtaining necessary signatures.

-

What benefits does eSigning provide for Fiduciary Income Tax K 41 Rev 6 14?

eSigning provides numerous benefits when submitting Fiduciary Income Tax K 41 Rev 6 14. These include reduced turnaround times, increased security, and better organization, allowing fiduciaries to manage their tax documents efficiently and effectively without the complications of traditional paper-based methods.

-

Is airSlate SignNow user-friendly for individuals new to Fiduciary Income Tax K 41 Rev 6 14?

Yes, airSlate SignNow is designed to be user-friendly, making it accessible for both seasoned professionals and those new to handling Fiduciary Income Tax K 41 Rev 6 14. The intuitive interface and guided options streamline the process, ensuring that users can navigate through the necessary steps without difficulty.

Get more for Fiduciary Income Tax K 41 Rev 6 14

Find out other Fiduciary Income Tax K 41 Rev 6 14

- Can I eSignature Oregon Orthodontists LLC Operating Agreement

- How To eSignature Rhode Island Orthodontists LLC Operating Agreement

- Can I eSignature West Virginia Lawers Cease And Desist Letter

- eSignature Alabama Plumbing Confidentiality Agreement Later

- How Can I eSignature Wyoming Lawers Quitclaim Deed

- eSignature California Plumbing Profit And Loss Statement Easy

- How To eSignature California Plumbing Business Letter Template

- eSignature Kansas Plumbing Lease Agreement Template Myself

- eSignature Louisiana Plumbing Rental Application Secure

- eSignature Maine Plumbing Business Plan Template Simple

- Can I eSignature Massachusetts Plumbing Business Plan Template

- eSignature Mississippi Plumbing Emergency Contact Form Later

- eSignature Plumbing Form Nebraska Free

- How Do I eSignature Alaska Real Estate Last Will And Testament

- Can I eSignature Alaska Real Estate Rental Lease Agreement

- eSignature New Jersey Plumbing Business Plan Template Fast

- Can I eSignature California Real Estate Contract

- eSignature Oklahoma Plumbing Rental Application Secure

- How Can I eSignature Connecticut Real Estate Quitclaim Deed

- eSignature Pennsylvania Plumbing Business Plan Template Safe