Wells Fargo Ira Beneficiary Designation Form 2012

What is the Wells Fargo IRA Beneficiary Designation Form

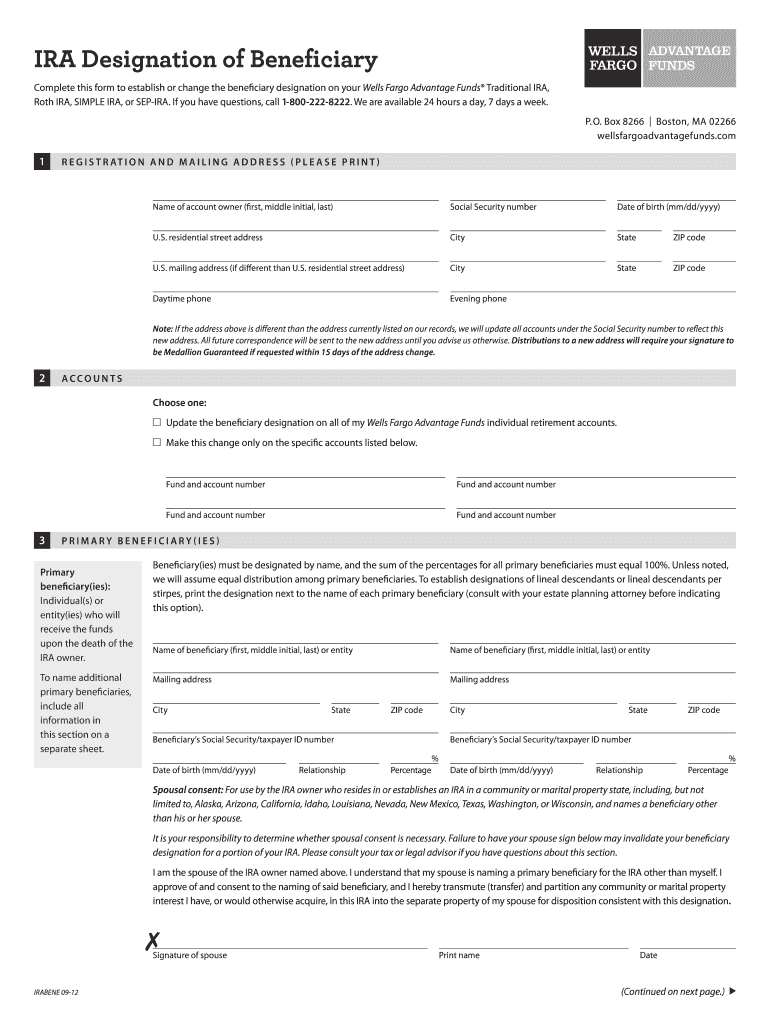

The Wells Fargo IRA Beneficiary Designation Form is a crucial document that allows account holders to specify who will inherit their Individual Retirement Account (IRA) assets upon their passing. This form ensures that the account holder's wishes are clearly documented and legally recognized, providing peace of mind regarding the distribution of assets. It is essential for individuals to complete this form accurately to avoid any potential disputes or complications during the transfer process.

How to use the Wells Fargo IRA Beneficiary Designation Form

Using the Wells Fargo IRA Beneficiary Designation Form involves several straightforward steps. First, account holders must obtain the form, which is typically available through Wells Fargo's website or by contacting customer service. Once the form is in hand, individuals should fill in their personal information, including their account number and details of the beneficiaries they wish to designate. It is important to provide accurate names, relationships, and percentages of the IRA to be distributed to each beneficiary. After completing the form, it must be signed and dated to validate the designations made.

Steps to complete the Wells Fargo IRA Beneficiary Designation Form

Completing the Wells Fargo IRA Beneficiary Designation Form involves the following steps:

- Obtain the form from Wells Fargo.

- Fill in your personal information, including your name and account number.

- Designate your beneficiaries by providing their names, relationships, and the percentage of the IRA each will receive.

- Review the information for accuracy to ensure it reflects your wishes.

- Sign and date the form to finalize your designations.

- Submit the completed form to Wells Fargo, either online or by mail.

Legal use of the Wells Fargo IRA Beneficiary Designation Form

The legal use of the Wells Fargo IRA Beneficiary Designation Form is governed by federal and state laws that dictate how retirement accounts are managed and distributed. To ensure that the form is legally binding, it must be filled out completely and accurately, signed by the account holder, and submitted to Wells Fargo. This form acts as a legal declaration of the account holder's intentions regarding the distribution of their assets, making it essential to keep it updated, especially after major life events such as marriage, divorce, or the birth of a child.

Key elements of the Wells Fargo IRA Beneficiary Designation Form

Several key elements must be included in the Wells Fargo IRA Beneficiary Designation Form to ensure its effectiveness:

- Account Holder Information: Full name, address, and account number.

- Beneficiary Designations: Names, relationships, and percentage shares for each beneficiary.

- Contingent Beneficiaries: Optional designations in case primary beneficiaries are unable to inherit.

- Signature and Date: Required to validate the form.

Form Submission Methods

The Wells Fargo IRA Beneficiary Designation Form can be submitted through various methods to ensure convenience for account holders. The options typically include:

- Online Submission: Completing and submitting the form via Wells Fargo's secure online portal.

- Mail: Sending the completed form to the designated Wells Fargo address.

- In-Person: Visiting a local Wells Fargo branch to submit the form directly.

Quick guide on how to complete wells fargo ira beneficiary designation form

The optimal method to locate and endorse Wells Fargo Ira Beneficiary Designation Form

At the scope of your complete organization, ineffective procedures concerning paper approval can consume a signNow amount of working hours. Signing documents like Wells Fargo Ira Beneficiary Designation Form is an inherent aspect of operations in any field, which is the reason the effectiveness of each agreement’s lifecycle signNowly influences the organization’s overall productivity. With airSlate SignNow, endorsing your Wells Fargo Ira Beneficiary Designation Form can be as straightforward and swift as possible. This platform provides you with the most recent version of essentially any document. Even better, you can sign it instantly without the necessity of installing external applications on your computer or printing any physical copies.

How to obtain and endorse your Wells Fargo Ira Beneficiary Designation Form

- Browse through our repository by category or use the search bar to find the document you require.

- Examine the form preview by clicking on Learn more to ensure it’s the correct one.

- Hit Get form to begin editing immediately.

- Fill out your form and include any essential information using the toolbar.

- When finished, click the Sign tool to endorse your Wells Fargo Ira Beneficiary Designation Form.

- Choose the signature option that is most suitable for you: Draw, Generate initials, or upload an image of your handwritten signature.

- Click Done to conclude editing and proceed to document-sharing options if necessary.

With airSlate SignNow, you possess everything required to handle your documents effectively. You can locate, complete, edit, and even send your Wells Fargo Ira Beneficiary Designation Form in one tab without any trouble. Enhance your procedures with a single, intelligent eSignature solution.

Create this form in 5 minutes or less

Find and fill out the correct wells fargo ira beneficiary designation form

FAQs

-

I need help filling out this IRA form to withdraw money. How do I fill this out?

I am confused on the highlighted part.

-

How do I transfer my IRA from Wells Fargo to another bank?

There are two ways to go about this. The first is the preferred method as there is no chance of you being taxed for early withdrawal.Electronic Transfer from Wells Fargo to your new provider. You can have your new provider initiate or you can have Wells Fargo do so. You will need to have the new account established before the transfer, but it can be established with no money and then funded with the transfer.Have Wells Fargo give you a check for the entire amount, often referred to as a rollover. You the have 60 days to complete the transfer to the new account. If you don’t complete the transfer the entire amount will be taxed and if you are under 59 1/2 you will also get hit with a penalty. Some institutions may ask for the name of the institution you are transfer too and and make the check out in your name “for INSTITUTION NAME.” You would endorse the check and give to the new IRA holder. This is to prevent people from speculating with their savings in hopes of beating the market and then getting the money back into the IRA.

-

I recently opened a Fidelity Roth IRA and it says my account is closed and I need to submit a W-9 form. Can anyone explain how this form relates to an IRA and why I need to fill it out?

Financial institutions are required to obtain tax ID numbers when opening an account, and the fact that it's an IRA doesn't exempt them from that requirement. They shouldn't have opened it without the W-9 in the first place, but apparently they did. So now they had to close it until they get the required documentation.

-

How long does it take to find out your pre-approval home loan from Wells Fargo?

Wells Fargo issues three types of approval letters. These vary by the level of analysis they perform on the file prior to issuing the letter and therefor the level of certainty the letter provides to the borrower and to potential sellers that the loan financing will come through.The types of letters are -Pre-qualificationGives you an option of your home price range and estimated closing costs based on non-verified information you provided. Doesn’t require a full mortgage applicationCan often be issued same-day through a Loan Officer or an Online ApplicationPre-approvalGives you an estimate of your home price range based on an initial review of your application and limited credit information only. It requires a mortgage application. Doesn’t require you to provide actual documentsTypically issued within two or three daysCredit approvalGives you an estimated loan amount based on an initial underwriter review of your credit and the information you provided. This letter is their highest standard of credit approval. Requires copies of financial documents (e.g. paystubs, tax returns, bank statements, etc.)This is the type of letter you want to obtain prior to making offers on homes as it will make your offer more solid and competitiveTypically issued within five days

-

How can I fill out Google's intern host matching form to optimize my chances of receiving a match?

I was selected for a summer internship 2016.I tried to be very open while filling the preference form: I choose many products as my favorite products and I said I'm open about the team I want to join.I even was very open in the location and start date to get host matching interviews (I negotiated the start date in the interview until both me and my host were happy.) You could ask your recruiter to review your form (there are very cool and could help you a lot since they have a bigger experience).Do a search on the potential team.Before the interviews, try to find smart question that you are going to ask for the potential host (do a search on the team to find nice and deep questions to impress your host). Prepare well your resume.You are very likely not going to get algorithm/data structure questions like in the first round. It's going to be just some friendly chat if you are lucky. If your potential team is working on something like machine learning, expect that they are going to ask you questions about machine learning, courses related to machine learning you have and relevant experience (projects, internship). Of course you have to study that before the interview. Take as long time as you need if you feel rusty. It takes some time to get ready for the host matching (it's less than the technical interview) but it's worth it of course.

-

How do I fill out the form of DU CIC? I couldn't find the link to fill out the form.

Just register on the admission portal and during registration you will get an option for the entrance based course. Just register there. There is no separate form for DU CIC.

Create this form in 5 minutes!

How to create an eSignature for the wells fargo ira beneficiary designation form

How to generate an eSignature for the Wells Fargo Ira Beneficiary Designation Form online

How to generate an electronic signature for the Wells Fargo Ira Beneficiary Designation Form in Google Chrome

How to create an eSignature for putting it on the Wells Fargo Ira Beneficiary Designation Form in Gmail

How to make an electronic signature for the Wells Fargo Ira Beneficiary Designation Form from your smartphone

How to generate an eSignature for the Wells Fargo Ira Beneficiary Designation Form on iOS

How to make an electronic signature for the Wells Fargo Ira Beneficiary Designation Form on Android OS

People also ask

-

What is the Wells Fargo Ira Beneficiary Designation Form?

The Wells Fargo Ira Beneficiary Designation Form is a document that allows account holders to specify beneficiaries for their IRA accounts. This form is crucial for ensuring that assets are distributed according to your wishes after your passing. Properly filling out this form can help avoid probate and streamline the transfer process.

-

How do I obtain the Wells Fargo Ira Beneficiary Designation Form?

You can obtain the Wells Fargo Ira Beneficiary Designation Form directly from the Wells Fargo website or through your local branch. Additionally, partnering with an electronic signature service like airSlate SignNow can make the process of filling out and submitting the form easier and more efficient.

-

Can airSlate SignNow assist with completing the Wells Fargo Ira Beneficiary Designation Form?

Yes, airSlate SignNow is designed to help you fill out and eSign the Wells Fargo Ira Beneficiary Designation Form seamlessly. Our platform provides an intuitive interface that simplifies the document completion process, ensuring you can complete the form correctly and efficiently.

-

Is there a cost associated with using airSlate SignNow for the Wells Fargo Ira Beneficiary Designation Form?

AirSlate SignNow offers various pricing plans that are both affordable and designed to suit different business needs. Depending on your usage, you can choose a plan that allows you to eSign documents like the Wells Fargo Ira Beneficiary Designation Form without breaking the bank.

-

What features does airSlate SignNow offer for signing the Wells Fargo Ira Beneficiary Designation Form?

AirSlate SignNow provides features such as secure electronic signatures, document templates, and cloud storage that enhance the completion of the Wells Fargo Ira Beneficiary Designation Form. Our platform prioritizes user-friendliness while ensuring that all transactions are secure and compliant with legal standards.

-

Can I integrate airSlate SignNow with other tools I am using to manage my IRA?

Yes, airSlate SignNow offers integrations with various applications that can help you manage your IRA effectively. By connecting with tools you currently use, you can streamline the process of handling the Wells Fargo Ira Beneficiary Designation Form alongside other financial documentation.

-

What are the benefits of using airSlate SignNow for the Wells Fargo Ira Beneficiary Designation Form?

Using airSlate SignNow for the Wells Fargo Ira Beneficiary Designation Form offers benefits like time savings, enhanced security, and a simplified signing process. Our platform allows you to complete forms quickly and ensures that your documents are securely stored and easily accessible whenever needed.

Get more for Wells Fargo Ira Beneficiary Designation Form

Find out other Wells Fargo Ira Beneficiary Designation Form

- Sign New Jersey Real Estate Limited Power Of Attorney Computer

- Sign New Mexico Real Estate Contract Safe

- How To Sign South Carolina Sports Lease Termination Letter

- How Can I Sign New York Real Estate Memorandum Of Understanding

- Sign Texas Sports Promissory Note Template Online

- Sign Oregon Orthodontists Last Will And Testament Free

- Sign Washington Sports Last Will And Testament Free

- How Can I Sign Ohio Real Estate LLC Operating Agreement

- Sign Ohio Real Estate Quitclaim Deed Later

- How Do I Sign Wisconsin Sports Forbearance Agreement

- How To Sign Oregon Real Estate Resignation Letter

- Can I Sign Oregon Real Estate Forbearance Agreement

- Sign Pennsylvania Real Estate Quitclaim Deed Computer

- How Do I Sign Pennsylvania Real Estate Quitclaim Deed

- How Can I Sign South Dakota Orthodontists Agreement

- Sign Police PPT Alaska Online

- How To Sign Rhode Island Real Estate LLC Operating Agreement

- How Do I Sign Arizona Police Resignation Letter

- Sign Texas Orthodontists Business Plan Template Later

- How Do I Sign Tennessee Real Estate Warranty Deed