7202 2020

What is the 7202 self employed form?

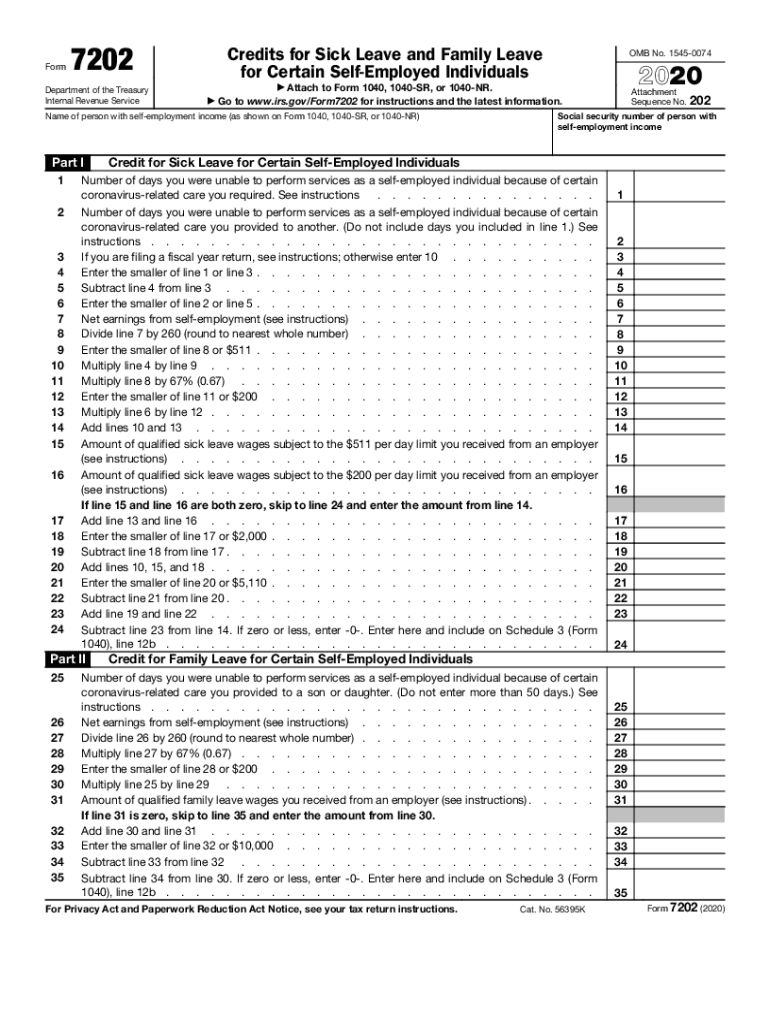

The 7202 self employed form is a tax document used by self-employed individuals to claim credits related to qualified sick and family leave wages. This form is essential for those who have been affected by the COVID-19 pandemic and are eligible for credits under the Families First Coronavirus Response Act (FFCRA). By accurately completing the 7202 form, taxpayers can receive financial relief for wages paid to employees who are unable to work due to specific COVID-19-related reasons.

How to obtain the 7202 form

The 7202 form can be obtained directly from the IRS website in a PDF format. It is advisable to download the most current version of the form to ensure compliance with the latest tax regulations. Additionally, tax preparation software often includes the 7202 form, allowing users to fill it out digitally. It is important to ensure that the version used is for the correct tax year, as forms may vary annually.

Steps to complete the 7202

Completing the 7202 form involves several key steps:

- Begin by entering your personal information, including your name and Social Security number.

- Indicate the number of employees for whom you are claiming credits.

- Calculate the total qualified sick and family leave wages paid, ensuring that you have accurate records to support your claims.

- Complete the calculations for the credits you are eligible to claim based on the wages reported.

- Review the form for accuracy and completeness before submission.

Legal use of the 7202

The legal use of the 7202 form is governed by IRS guidelines, which stipulate that the form must be completed accurately to claim the appropriate credits. It is crucial to maintain supporting documentation for wages paid and reasons for leave, as the IRS may request this information during an audit. Compliance with the guidelines ensures that the form is legally binding and that the credits claimed are valid.

Filing Deadlines / Important Dates

Filing deadlines for the 7202 form align with the standard tax filing deadlines set by the IRS. Typically, self-employed individuals must file their tax returns by April fifteenth of the following year. If you are claiming credits for wages paid during the pandemic, it is essential to stay informed about any extensions or changes to these deadlines, as they may vary based on legislative updates.

IRS Guidelines

The IRS provides specific guidelines for completing and submitting the 7202 form. These guidelines include eligibility criteria for claiming credits, required documentation, and instructions for accurately reporting wages. Familiarizing yourself with these guidelines is critical to ensure compliance and to maximize your potential tax credits. It is advisable to consult the IRS website or a tax professional for the most current information regarding the 7202 form.

Quick guide on how to complete 7202

Complete 7202 effortlessly on any gadget

Managing documents online has gained traction among businesses and individuals. It serves as an ideal eco-friendly alternative to conventional printed and signed documents, allowing you to access the proper form and securely store it in the cloud. airSlate SignNow equips you with all the tools necessary to create, modify, and eSign your paperwork quickly without delays. Handle 7202 on any gadget with the airSlate SignNow Android or iOS applications and streamline any document-related process today.

How to adjust and eSign 7202 with ease

- Find 7202 and click Get Form to begin.

- Utilize the tools we offer to fill out your form.

- Select relevant sections of your documents or redact sensitive information with tools that airSlate SignNow provides specifically for this purpose.

- Create your signature using the Sign tool, which takes mere seconds and carries the same legal authority as a traditional handwritten signature.

- Review the details and click the Done button to save your modifications.

- Choose how you wish to send your form, via email, SMS, or invite link, or download it to your computer.

Eliminate the hassle of lost or misplaced documents, tedious form searching, and errors that require new document copies. airSlate SignNow meets all your document management needs in just a few clicks from any device you choose. Modify and eSign 7202 and guarantee excellent communication at any stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 7202

Create this form in 5 minutes!

How to create an eSignature for the 7202

The way to make an electronic signature for your PDF file online

The way to make an electronic signature for your PDF file in Google Chrome

The best way to make an eSignature for signing PDFs in Gmail

The best way to make an eSignature right from your mobile device

The way to generate an electronic signature for a PDF file on iOS

The best way to make an eSignature for a PDF on Android devices

People also ask

-

What is the 7202 self employed form?

The 7202 self-employed form is a tax document that allows self-employed individuals to claim certain credits related to sick leave and family leave. This form is essential for managing your tax responsibilities effectively. By properly filling out the 7202 self-employed form, you can ensure that you qualify for the relief you are entitled to as a self-employed worker.

-

How does airSlate SignNow help with the 7202 self employed form?

airSlate SignNow streamlines the process of completing and submitting the 7202 self-employed form by offering an easy-to-use electronic signature solution. Our platform ensures your documents are securely signed and can be shared efficiently. With airSlate SignNow, you can manage your tax documents promptly and keep your compliance on track.

-

What are the pricing options for using airSlate SignNow for the 7202 self employed form?

AirSlate SignNow offers various pricing plans to accommodate different needs when handling your 7202 self-employed form. These plans are designed to be cost-effective, ensuring that businesses of all sizes can take advantage of our eSignature capabilities. Visit our website to explore our flexible subscription options and find the one that best suits your budget.

-

Are there any benefits to using airSlate SignNow for the 7202 self employed form?

Using airSlate SignNow for your 7202 self-employed form provides numerous benefits, including enhanced security, faster processing times, and reduced paper waste. Our platform ensures that your documents are encrypted and stored safely. Additionally, you can track the status of your form and get notifications when it's signed, making your workflow more efficient.

-

Can I integrate airSlate SignNow with other tools for managing the 7202 self employed form?

Yes, airSlate SignNow offers integrations with various tools that can help you manage your 7202 self-employed form more effectively. Whether you use accounting software or document management systems, our platform can connect seamlessly, allowing for a streamlined workflow. This integration facilitates easier access to your tax forms and enhances overall productivity.

-

Is airSlate SignNow suitable for freelancers handling the 7202 self employed form?

Absolutely! airSlate SignNow is specifically designed to cater to the needs of freelancers and self-employed individuals dealing with forms like the 7202 self-employed form. Our user-friendly interface allows freelancers to sign and manage important documents effortlessly, ensuring compliance without hassle.

-

How secure is airSlate SignNow when managing the 7202 self employed form?

Security is a top priority at airSlate SignNow when handling sensitive documents like the 7202 self-employed form. Our platform employs advanced encryption and multi-factor authentication to protect your data. You can trust that your information is safe throughout the signing and submission process.

Get more for 7202

- Caregivers supplementary expenditure affidavit form

- Droit de la famille scribd form

- Schedule x drugs list pdf form

- Tuition reimbursement agreement template form

- Special event retailers liquor license nfp form

- Ftb 3536 estimated fee for llcs form

- Termination of lease agreement template form

- General manager contract template form

Find out other 7202

- Sign Colorado Courts LLC Operating Agreement Mobile

- Sign Connecticut Courts Living Will Computer

- How Do I Sign Connecticut Courts Quitclaim Deed

- eSign Colorado Banking Rental Application Online

- Can I eSign Colorado Banking Medical History

- eSign Connecticut Banking Quitclaim Deed Free

- eSign Connecticut Banking Business Associate Agreement Secure

- Sign Georgia Courts Moving Checklist Simple

- Sign Georgia Courts IOU Mobile

- How Can I Sign Georgia Courts Lease Termination Letter

- eSign Hawaii Banking Agreement Simple

- eSign Hawaii Banking Rental Application Computer

- eSign Hawaii Banking Agreement Easy

- eSign Hawaii Banking LLC Operating Agreement Fast

- eSign Hawaii Banking Permission Slip Online

- eSign Minnesota Banking LLC Operating Agreement Online

- How Do I eSign Mississippi Banking Living Will

- eSign New Jersey Banking Claim Mobile

- eSign New York Banking Promissory Note Template Now

- eSign Ohio Banking LLC Operating Agreement Now