Www Irs Govnewsroomnew Irs Form Available ForNew IRS Form Available for Self Employed Individuals to Claim 2021-2026

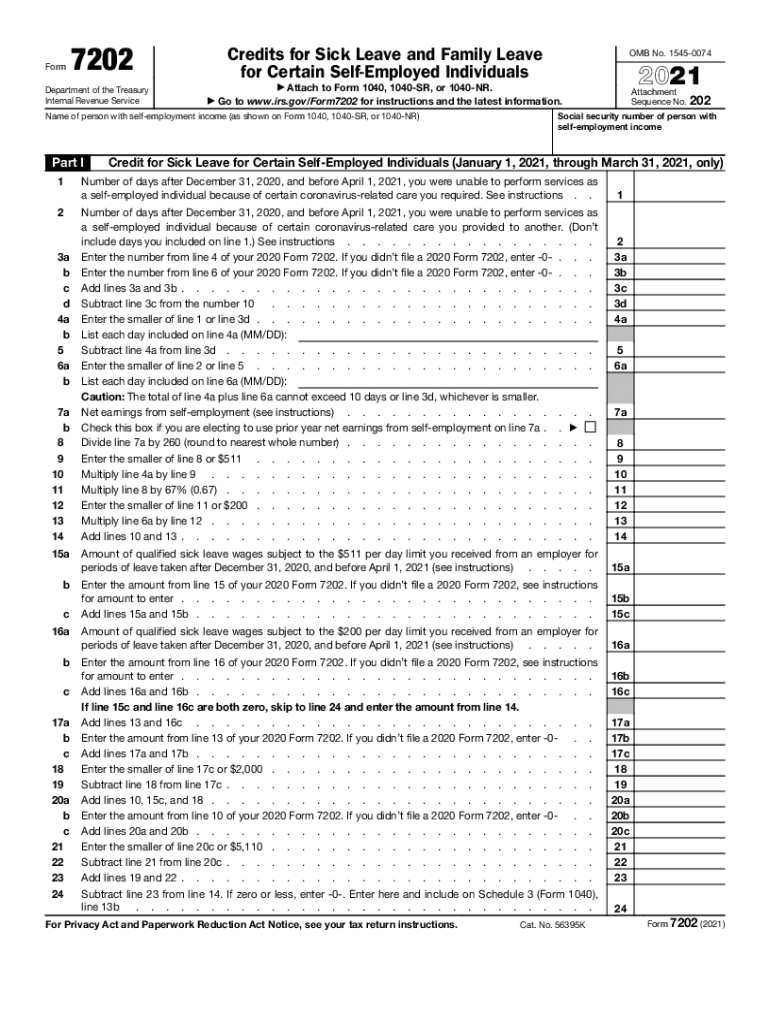

What is IRS Form 7202?

IRS Form 7202 is designed for self-employed individuals to claim additional tax credits related to sick leave and family leave wages. This form allows eligible taxpayers to report their qualified sick and family leave wages under the Families First Coronavirus Response Act (FFCRA). The form serves as a means to provide necessary documentation to the IRS, ensuring that self-employed individuals can receive the credits they are entitled to, thereby supporting their financial stability during challenging times.

Steps to Complete IRS Form 7202

Completing IRS Form 7202 involves several key steps to ensure accuracy and compliance. Begin by gathering all necessary documentation, including records of your sick leave and family leave wages. Next, carefully fill out the form by entering your personal information, including your name, Social Security number, and business details. You will need to report the total number of days you were unable to work due to qualifying reasons, as well as the corresponding wages. Finally, review the form for completeness and accuracy before submitting it with your tax return.

Eligibility Criteria for Using Form 7202

To qualify for IRS Form 7202, you must be a self-employed individual who has been affected by COVID-19. This includes individuals who were unable to work due to their own health issues or due to the need to care for a family member. Specific eligibility criteria include the requirement to have been unable to work for a minimum number of days and to have earned a certain amount in wages during the relevant period. Understanding these criteria is essential to ensure you can successfully claim the credits available to you.

Filing Deadlines for IRS Form 7202

Filing deadlines for IRS Form 7202 align with the standard tax filing deadlines for self-employed individuals. Typically, the deadline for submitting your tax return, including Form 7202, is April 15 of the following year. However, if you require an extension, you may file for an extension, which generally allows you until October 15 to submit your return. It is important to stay informed about any changes to deadlines, especially in light of ongoing legislative updates related to COVID-19 relief measures.

Form Submission Methods for IRS Form 7202

IRS Form 7202 can be submitted using various methods to accommodate different preferences. You may choose to file your form electronically through tax preparation software, which often simplifies the process and reduces the risk of errors. Alternatively, you can print and mail your completed form to the IRS. If you choose to file by mail, ensure that you send it to the correct address as specified by the IRS for your location. Each method has its own advantages, so select the one that best fits your needs.

Key Elements of IRS Form 7202

Understanding the key elements of IRS Form 7202 is crucial for accurate completion. The form includes sections for reporting your total sick leave and family leave wages, as well as the number of days you were unable to work. Additionally, it requires you to provide information on the specific reasons for your leave, such as personal health issues or caregiving responsibilities. Each section must be filled out with precise information to ensure that your claim is valid and accepted by the IRS.

Quick guide on how to complete wwwirsgovnewsroomnew irs form available fornew irs form available for self employed individuals to claim

Complete Www irs govnewsroomnew irs form available forNew IRS Form Available For Self employed Individuals To Claim effortlessly on any device

Online document management has gained popularity among businesses and individuals. It serves as an ideal eco-friendly alternative to traditional printed and signed documents, allowing you to locate the correct form and securely store it online. airSlate SignNow equips you with all the necessary tools to create, modify, and electronically sign your documents quickly without delays. Manage Www irs govnewsroomnew irs form available forNew IRS Form Available For Self employed Individuals To Claim on any device using airSlate SignNow's Android or iOS applications and enhance any document-centric procedure today.

Efficiently modify and eSign Www irs govnewsroomnew irs form available forNew IRS Form Available For Self employed Individuals To Claim with ease

- Locate Www irs govnewsroomnew irs form available forNew IRS Form Available For Self employed Individuals To Claim and click Get Form to begin.

- Utilize the tools we offer to finalize your document.

- Emphasize important sections of the documents or obscure sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Generate your signature using the Sign feature, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review the information and then click on the Done button to save your modifications.

- Select your preferred method to send your form, whether by email, SMS, or invitation link, or download it to the computer.

Eliminate concerns over lost or misplaced files, tedious form navigation, or mistakes that necessitate printing new document copies. airSlate SignNow addresses all your document management needs within a few clicks from any device you prefer. Edit and eSign Www irs govnewsroomnew irs form available forNew IRS Form Available For Self employed Individuals To Claim and ensure smooth communication at every step of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct wwwirsgovnewsroomnew irs form available fornew irs form available for self employed individuals to claim

Create this form in 5 minutes!

How to create an eSignature for the wwwirsgovnewsroomnew irs form available fornew irs form available for self employed individuals to claim

How to create an e-signature for a PDF file in the online mode

How to create an e-signature for a PDF file in Chrome

The best way to create an electronic signature for putting it on PDFs in Gmail

The way to create an electronic signature straight from your smartphone

How to generate an e-signature for a PDF file on iOS devices

The way to create an electronic signature for a PDF document on Android

People also ask

-

What is the form 7202 for 2020 and who needs it?

The form 7202 for 2020 is a tax form used by self-employed individuals and small business owners to claim sick leave and family leave credits under the Families First Coronavirus Response Act. If you faced challenges due to COVID-19 and had to take time off or care for others, this form is essential for claiming your credits.

-

How can airSlate SignNow help with filling out the form 7202 for 2020?

airSlate SignNow provides an intuitive platform to easily fill out and e-sign the form 7202 for 2020. With its user-friendly interface, you can ensure that all necessary information is included efficiently, minimizing errors and streamlining the submission process.

-

What are the pricing options for using airSlate SignNow for the form 7202 for 2020?

airSlate SignNow offers flexible pricing plans catering to various business needs, including a basic plan that allows unlimited document signing. When preparing the form 7202 for 2020, businesses can choose a plan that best fits their budget while benefiting from seamless e-signature capabilities.

-

Is it safe to use airSlate SignNow to submit the form 7202 for 2020?

Yes, airSlate SignNow uses advanced encryption and security measures to protect your documents and personal information. When submitting the form 7202 for 2020, you can trust that your data is secure, allowing you to focus on claiming your eligible credits without worry.

-

Can I integrate airSlate SignNow with my existing accounting software for the form 7202 for 2020?

Absolutely! airSlate SignNow offers integrations with popular accounting software, enabling you to streamline your workflow. By integrating your tools, you can easily access and send the form 7202 for 2020, ensuring that all necessary tax documents are processed without hassle.

-

What features does airSlate SignNow provide that are beneficial for completing the form 7202 for 2020?

airSlate SignNow offers advanced features such as templates, real-time collaboration, and automated reminders. These tools are particularly helpful for completing the form 7202 for 2020, allowing you to share the document with others for quick reviews and signatures while keeping everything organized.

-

Can I track the status of my form 7202 for 2020 once sent through airSlate SignNow?

Yes, airSlate SignNow provides tracking capabilities for all documents sent through its platform. Once you send the form 7202 for 2020, you can easily monitor its status, ensuring you stay informed about when it has been viewed and signed by the recipient.

Get more for Www irs govnewsroomnew irs form available forNew IRS Form Available For Self employed Individuals To Claim

- Bill of sale of automobile and odometer statement for as is sale florida form

- Construction contract cost plus or fixed fee florida form

- Painting contract for contractor florida form

- Trim carpenter contract for contractor florida form

- Fencing contract for contractor florida form

- Hvac contract for contractor florida form

- Landscape contract for contractor florida form

- Florida commercial contract 497302605 form

Find out other Www irs govnewsroomnew irs form available forNew IRS Form Available For Self employed Individuals To Claim

- Sign Ohio Police Promissory Note Template Easy

- Sign Alabama Courts Affidavit Of Heirship Simple

- How To Sign Arizona Courts Residential Lease Agreement

- How Do I Sign Arizona Courts Residential Lease Agreement

- Help Me With Sign Arizona Courts Residential Lease Agreement

- How Can I Sign Arizona Courts Residential Lease Agreement

- Sign Colorado Courts LLC Operating Agreement Mobile

- Sign Connecticut Courts Living Will Computer

- How Do I Sign Connecticut Courts Quitclaim Deed

- eSign Colorado Banking Rental Application Online

- Can I eSign Colorado Banking Medical History

- eSign Connecticut Banking Quitclaim Deed Free

- eSign Connecticut Banking Business Associate Agreement Secure

- Sign Georgia Courts Moving Checklist Simple

- Sign Georgia Courts IOU Mobile

- How Can I Sign Georgia Courts Lease Termination Letter

- eSign Hawaii Banking Agreement Simple

- eSign Hawaii Banking Rental Application Computer

- eSign Hawaii Banking Agreement Easy

- eSign Hawaii Banking LLC Operating Agreement Fast