Verification of Employment Loss of Income Form

What is the verification of employment loss of income

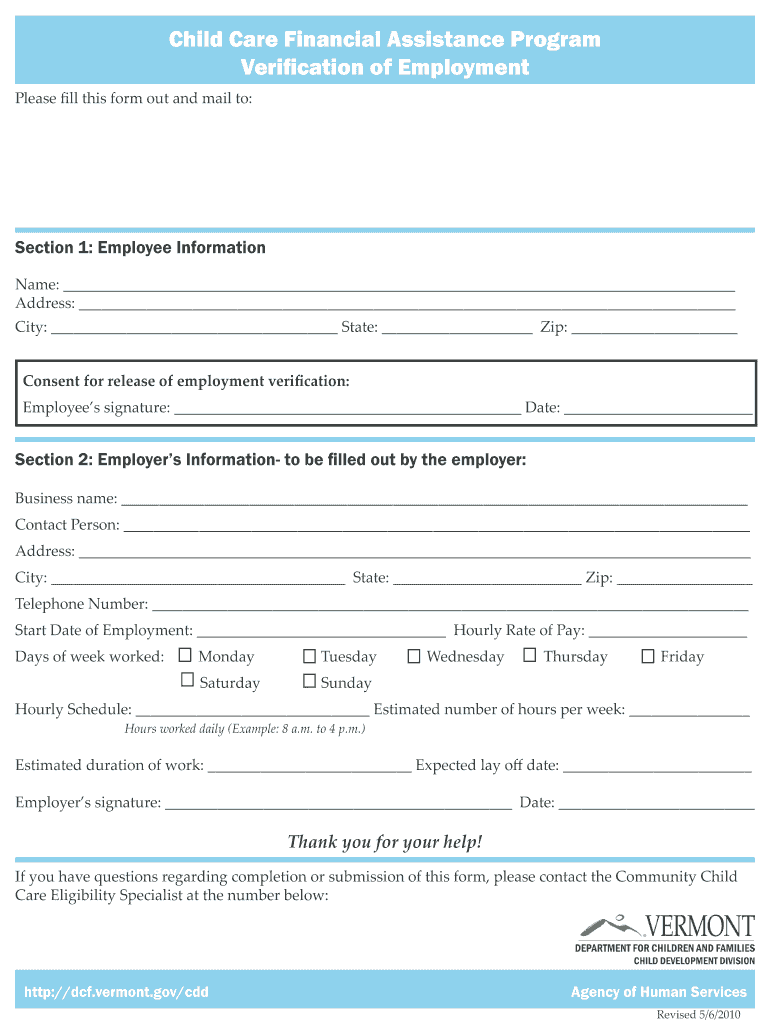

The verification of employment loss of income is a crucial document that provides proof of an individual's employment status and income history. This form is often required by various institutions, such as lenders or government agencies, to assess eligibility for assistance programs or loans. It details the reasons for employment termination, the duration of unemployment, and any income received during that period. The information contained in this form helps organizations determine the financial stability of an individual and their ability to meet obligations.

How to use the verification of employment loss of income

To effectively use the verification of employment loss of income, individuals should first ensure that the form is filled out accurately and completely. This involves gathering necessary information, such as previous employment details, dates of employment, and reasons for job loss. Once the form is completed, it can be submitted to the requesting agency, such as a bank or social services office, either electronically or via mail. It is important to retain a copy of the form for personal records, as it may be needed for future reference or additional applications.

Steps to complete the verification of employment loss of income

Completing the verification of employment loss of income involves several key steps:

- Gather necessary information: Collect details about your previous employment, including employer name, job title, dates of employment, and reasons for leaving.

- Fill out the form: Accurately complete all sections of the form, ensuring that all information is truthful and up to date.

- Review the form: Check for any errors or omissions before submitting the form to ensure accuracy.

- Submit the form: Send the completed form to the requesting agency, either electronically or by mail, according to their submission guidelines.

Legal use of the verification of employment loss of income

The verification of employment loss of income is legally recognized as a valid document when it meets certain criteria. It must be completed accurately and signed by the appropriate parties, typically the former employer or a representative. Adhering to local and federal laws regarding employment verification is essential to ensure that the document is accepted by institutions. Additionally, the form must comply with privacy regulations to protect the sensitive information contained within.

Required documents

When submitting the verification of employment loss of income, certain documents may be required to support the information provided. These can include:

- Pay stubs: Recent pay stubs from the previous employer that reflect income prior to job loss.

- Termination letter: A letter from the employer stating the reason for termination.

- Unemployment benefits documentation: Proof of any unemployment benefits received during the period of job loss.

Form submission methods

The verification of employment loss of income can typically be submitted through various methods, depending on the requirements of the requesting agency. Common submission methods include:

- Online: Many agencies allow for electronic submission through secure portals or email.

- Mail: Physical copies of the form can be sent via postal service to the designated office.

- In-person: Some individuals may choose to deliver the form in person to ensure it is received promptly.

Quick guide on how to complete verification of employment loss of income

Effortlessly Prepare Verification Of Employment Loss Of Income on Any Gadget

Managing documents online has become increasingly prevalent among businesses and individuals. It serves as an ideal environmentally friendly alternative to traditional printed and signed documents, allowing access to the correct form and secure online storage. airSlate SignNow provides all the tools you require to create, edit, and eSign your documents promptly without delays. Manage Verification Of Employment Loss Of Income on any gadget with airSlate SignNow's Android or iOS applications and enhance any document-related procedure today.

The easiest way to edit and eSign Verification Of Employment Loss Of Income effortlessly

- Find Verification Of Employment Loss Of Income and click on Get Form to begin.

- Utilize the tools we offer to complete your document.

- Highlight important sections of your documents or redact sensitive details with tools specifically provided by airSlate SignNow for that purpose.

- Create your signature using the Sign tool, which takes mere seconds and carries the same legal validity as a standard wet ink signature.

- Review all the information and click on the Done button to save your changes.

- Choose your preferred method to send your form, whether by email, SMS, invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced files, tedious form searching, or errors requiring new document copies. airSlate SignNow fulfills all your document management needs in just a few clicks from any device you prefer. Edit and eSign Verification Of Employment Loss Of Income and guarantee excellent communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the verification of employment loss of income

The best way to make an eSignature for a PDF online

The best way to make an eSignature for a PDF in Google Chrome

The way to create an eSignature for signing PDFs in Gmail

The way to generate an eSignature straight from your smartphone

How to make an eSignature for a PDF on iOS

The way to generate an eSignature for a PDF document on Android

People also ask

-

What is a dcf income form and how can it benefit my business?

The dcf income form is a crucial document used in financial and taxation processes. It allows businesses to report their income accurately, ensuring compliance with regulations. By utilizing the dcf income form, companies can streamline their financial reporting and minimize errors, resulting in a more efficient workflow.

-

How does airSlate SignNow simplify the signing process for dcf income forms?

airSlate SignNow provides a user-friendly platform that makes signing dcf income forms effortless. With features like electronic signatures and document templates, businesses can quickly send, sign, and store their forms. This not only saves time but also enhances security and legal compliance.

-

Is there a cost associated with using the dcf income form feature in airSlate SignNow?

Yes, while airSlate SignNow offers competitive pricing, the cost will depend on the chosen subscription plan. Each plan includes access to the dcf income form feature along with other essential tools. You can explore different pricing tiers to find the best fit for your business needs.

-

Can I integrate airSlate SignNow with other software for handling dcf income forms?

Absolutely! airSlate SignNow offers seamless integrations with various software applications, including popular CRMs and accounting tools. By integrating these systems, you can streamline the process of managing dcf income forms and enhance your overall operational efficiency.

-

What security measures are in place for dcf income forms signed through airSlate SignNow?

airSlate SignNow prioritizes security and ensures that all dcf income forms are protected with advanced encryption. Additionally, the platform complies with various data protection regulations, providing users with peace of mind regarding the safety of their sensitive information.

-

Can I track the status of my dcf income forms sent through airSlate SignNow?

Yes, airSlate SignNow allows you to track the status of your sent dcf income forms in real time. You can easily see when a document has been viewed, signed, or completed, enabling you to manage workflows more efficiently and follow up when necessary.

-

Are there templates available for creating dcf income forms in airSlate SignNow?

Yes, airSlate SignNow offers a variety of customizable templates for dcf income forms. These templates can help you save time and ensure that all necessary information is included when preparing the forms for your business needs.

Get more for Verification Of Employment Loss Of Income

- Direct deposit form payroll network

- Preferred customer enrollment form lifevantage 56084596

- Fish and game az form

- Motion for testimony and attendance of minor children form

- Warranty work form

- Mhsaa bowling score sheet form

- City of springfield treasurer39s stamp commercial delivery permit form

- Sign permit city chicago form

Find out other Verification Of Employment Loss Of Income

- How To Integrate Sign in Banking

- How To Use Sign in Banking

- Help Me With Use Sign in Banking

- Can I Use Sign in Banking

- How Do I Install Sign in Banking

- How To Add Sign in Banking

- How Do I Add Sign in Banking

- How Can I Add Sign in Banking

- Can I Add Sign in Banking

- Help Me With Set Up Sign in Government

- How To Integrate eSign in Banking

- How To Use eSign in Banking

- How To Install eSign in Banking

- How To Add eSign in Banking

- How To Set Up eSign in Banking

- How To Save eSign in Banking

- How To Implement eSign in Banking

- How To Set Up eSign in Construction

- How To Integrate eSign in Doctors

- How To Use eSign in Doctors