F 60287 Form 2011

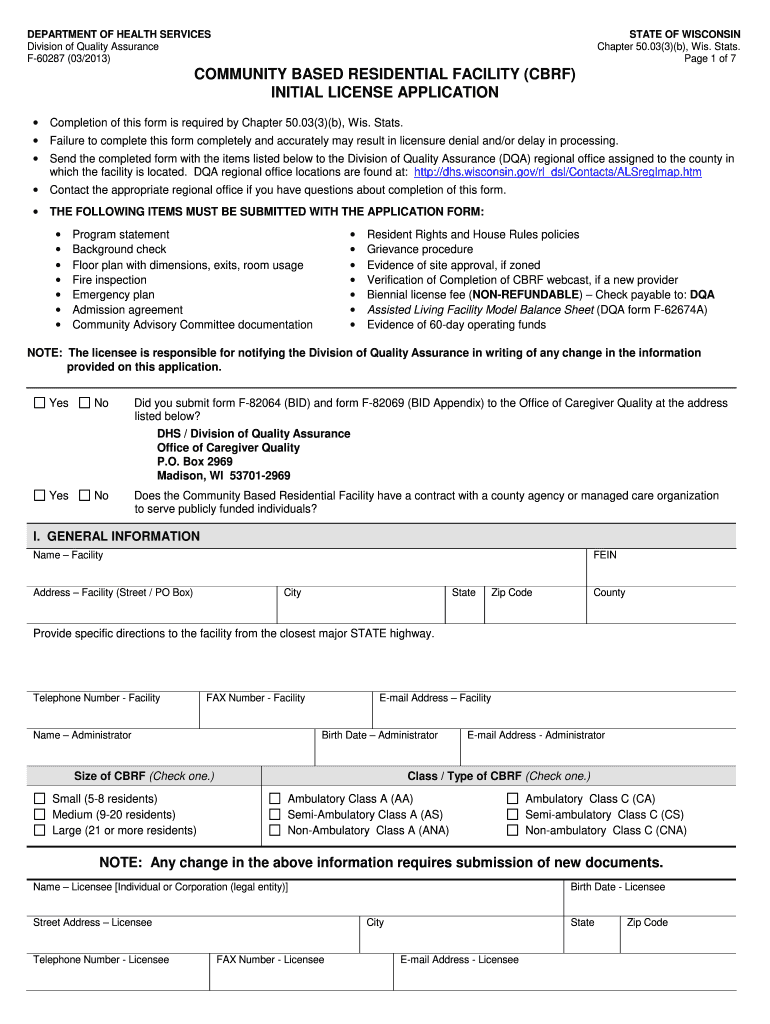

What is the F 60287 Form

The F 60287 Form is a specific document used primarily for tax-related purposes in the United States. It is essential for individuals and businesses to accurately report their income and expenses to the Internal Revenue Service (IRS). This form is designed to capture detailed financial information, ensuring compliance with federal tax laws. Understanding the purpose and requirements of the F 60287 Form is crucial for effective tax management and avoiding potential penalties.

How to use the F 60287 Form

Using the F 60287 Form involves several steps to ensure accurate completion. First, gather all necessary financial documents, including income statements, expense receipts, and any relevant tax records. Next, carefully fill out each section of the form, ensuring that all information is accurate and complete. It is advisable to double-check entries for any errors before submission. Once completed, the form can be submitted electronically or via mail, depending on the specific requirements outlined by the IRS.

Steps to complete the F 60287 Form

Completing the F 60287 Form requires a systematic approach. Follow these steps:

- Collect all relevant financial documents, including W-2s, 1099s, and expense receipts.

- Review the form's instructions to understand each section's requirements.

- Fill out personal identification information accurately at the top of the form.

- Detail your income sources and amounts in the designated sections.

- List all deductible expenses to reduce your taxable income.

- Calculate your total income and deductions to determine your tax liability.

- Review the completed form for accuracy before submission.

Legal use of the F 60287 Form

The legal use of the F 60287 Form is governed by IRS regulations. To ensure that the form is legally binding, it must be filled out accurately and submitted within the specified deadlines. The information provided must be truthful and complete, as any discrepancies can lead to audits or penalties. Utilizing digital tools, such as e-signature solutions, can enhance the form's legal standing, ensuring compliance with electronic signature laws.

Form Submission Methods

The F 60287 Form can be submitted through various methods, providing flexibility for users. Common submission methods include:

- Online: Users can submit the form electronically through the IRS e-filing system, which is often quicker and more efficient.

- Mail: The completed form can be printed and sent to the appropriate IRS address based on the taxpayer's location.

- In-Person: Some individuals may choose to deliver their forms in person at designated IRS offices, although this method is less common.

Filing Deadlines / Important Dates

Filing deadlines for the F 60287 Form are critical to avoid penalties. Typically, the form must be submitted by April fifteenth of the tax year following the income reported. However, if this date falls on a weekend or holiday, the deadline may be extended to the next business day. It is essential to stay informed about any changes to deadlines, as the IRS may announce extensions or modifications based on specific circumstances.

Quick guide on how to complete f 60287 2011 form

Finalize F 60287 Form effortlessly on any device

Web-based document management has become increasingly favored by businesses and individuals alike. It offers an ideal environmentally-friendly alternative to conventional printed and signed documents, allowing you to access the correct form and securely store it online. airSlate SignNow equips you with all the necessary tools to create, edit, and electronically sign your documents quickly without any hold-ups. Manage F 60287 Form on any platform with the airSlate SignNow apps for Android or iOS and streamline any document-related procedure today.

How to edit and electronically sign F 60287 Form with ease

- Find F 60287 Form and click Get Form to begin.

- Utilize the tools available to complete your form.

- Emphasize pertinent areas of your documents or redact sensitive information using tools that airSlate SignNow provides specifically for that purpose.

- Generate your eSignature using the Sign tool, which takes mere seconds and carries the same legal validity as a conventional handwritten signature.

- Review the information and click on the Done button to preserve your modifications.

- Select your preferred method for sharing your form, whether by email, text message (SMS), or invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searching, or errors that necessitate the printing of new document copies. airSlate SignNow satisfies your document management needs with just a few clicks from your chosen device. Edit and electronically sign F 60287 Form and ensure remarkable communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct f 60287 2011 form

Create this form in 5 minutes!

How to create an eSignature for the f 60287 2011 form

The way to create an electronic signature for a PDF document in the online mode

The way to create an electronic signature for a PDF document in Chrome

How to generate an eSignature for putting it on PDFs in Gmail

The way to make an eSignature from your mobile device

The best way to create an eSignature for a PDF document on iOS devices

The way to make an eSignature for a PDF file on Android devices

People also ask

-

What is the F 60287 Form and why is it important?

The F 60287 Form is a vital document used for specific regulatory purposes. Understanding and correctly filling out the F 60287 Form can ensure compliance with various legal requirements, making it essential for businesses and individuals alike.

-

How can airSlate SignNow help with the F 60287 Form?

airSlate SignNow provides a seamless platform to electronically sign and manage the F 60287 Form. This simplifies the signing process, ensuring that your documents are completed quickly and securely, which is crucial for timely submissions.

-

What are the key features of airSlate SignNow for handling the F 60287 Form?

Key features of airSlate SignNow include customizable templates, secure eSignatures, and automated workflows specifically designed to streamline the management of the F 60287 Form. These features enhance efficiency and reduce the likelihood of errors during the signing process.

-

Is there a cost associated with using airSlate SignNow for the F 60287 Form?

Yes, airSlate SignNow offers cost-effective pricing plans to cater to different business needs. You can choose a plan that best suits your requirements for handling the F 60287 Form, ensuring you get the most out of our solutions at a reasonable price.

-

Can I integrate airSlate SignNow with other software for the F 60287 Form?

Absolutely! airSlate SignNow seamlessly integrates with various software solutions, enabling you to incorporate the F 60287 Form into your existing systems. This integration capability allows for a more cohesive workflow and easier management of documents.

-

What benefits does airSlate SignNow provide when managing the F 60287 Form?

Using airSlate SignNow for the F 60287 Form offers multiple benefits, including time savings, enhanced security, and improved organization. This user-friendly tool allows you to manage all your signing needs efficiently while ensuring that your information remains secure.

-

How does airSlate SignNow ensure the security of the F 60287 Form?

airSlate SignNow employs top-notch security protocols, including encryption and authentication measures, to protect the integrity of the F 60287 Form. Your sensitive data is safeguarded throughout the signing process, providing peace of mind.

Get more for F 60287 Form

- Blood donation form

- Direct deposit form payroll network

- Preferred customer enrollment form lifevantage 56084596

- Fish and game az form

- Motion for testimony and attendance of minor children form

- City of springfield treasurer39s stamp commercial delivery permit form

- Sign permit city chicago form

- Uilding permit application form

Find out other F 60287 Form

- Electronic signature Colorado Charity Promissory Note Template Simple

- Electronic signature Alabama Construction Quitclaim Deed Free

- Electronic signature Alaska Construction Lease Agreement Template Simple

- Electronic signature Construction Form Arizona Safe

- Electronic signature Kentucky Charity Living Will Safe

- Electronic signature Construction Form California Fast

- Help Me With Electronic signature Colorado Construction Rental Application

- Electronic signature Connecticut Construction Business Plan Template Fast

- Electronic signature Delaware Construction Business Letter Template Safe

- Electronic signature Oklahoma Business Operations Stock Certificate Mobile

- Electronic signature Pennsylvania Business Operations Promissory Note Template Later

- Help Me With Electronic signature North Dakota Charity Resignation Letter

- Electronic signature Indiana Construction Business Plan Template Simple

- Electronic signature Wisconsin Charity Lease Agreement Mobile

- Can I Electronic signature Wisconsin Charity Lease Agreement

- Electronic signature Utah Business Operations LLC Operating Agreement Later

- How To Electronic signature Michigan Construction Cease And Desist Letter

- Electronic signature Wisconsin Business Operations LLC Operating Agreement Myself

- Electronic signature Colorado Doctors Emergency Contact Form Secure

- How Do I Electronic signature Georgia Doctors Purchase Order Template