Cw 60 Financial Institution Form

What is the CW 60 Financial Institution?

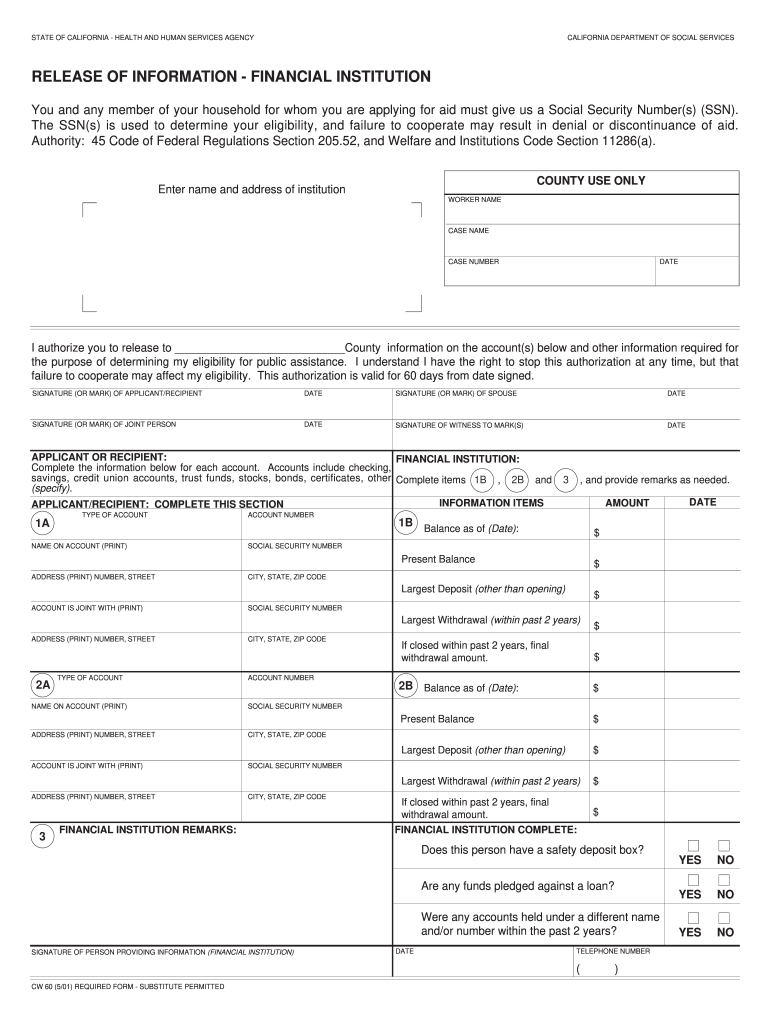

The CW 60 Financial Institution is a specific form used to collect and release financial information pertaining to individuals seeking assistance or benefits from various programs. This form is essential for financial institutions to verify the income and asset details of applicants, ensuring compliance with federal and state guidelines. It serves as a key document in the assessment process for housing assistance and other financial support programs.

Steps to Complete the CW 60 Financial Institution

Completing the CW 60 Financial Institution involves several steps to ensure accuracy and compliance. First, gather all necessary financial documents, including income statements, bank statements, and any other relevant financial information. Next, accurately fill out the form, ensuring that all sections are completed with the correct data. It is crucial to double-check for any errors or omissions before submission. Finally, submit the form through the designated method, whether online, by mail, or in person, as specified by the requesting agency.

Legal Use of the CW 60 Financial Institution

The CW 60 Financial Institution must be used in accordance with applicable laws and regulations. This includes adhering to privacy laws that protect sensitive financial information, such as the Fair Housing Act and the Privacy Act. Proper use of the form ensures that financial institutions can legally collect and process the information required for evaluating applications for assistance. Additionally, maintaining compliance with these regulations helps protect both the institution and the individuals involved.

Key Elements of the CW 60 Financial Institution

Understanding the key elements of the CW 60 Financial Institution is vital for proper completion. The form typically includes sections for personal information, income details, asset disclosures, and any relevant supporting documentation. Each section must be filled out accurately to provide a comprehensive view of the applicant's financial situation. This information is crucial for financial institutions to make informed decisions regarding assistance eligibility.

Required Documents

When completing the CW 60 Financial Institution, several documents may be required to support the information provided. Commonly requested documents include:

- Recent pay stubs or income statements

- Bank statements for the last few months

- Tax returns from the previous year

- Documentation of any other income sources, such as Social Security or unemployment benefits

Having these documents ready can streamline the completion process and ensure that all necessary information is accurately reported.

Form Submission Methods

The CW 60 Financial Institution can typically be submitted through various methods, depending on the requirements of the financial institution or agency involved. Common submission methods include:

- Online submission through a secure portal

- Mailing the completed form to the designated address

- In-person submission at a local office or agency

Choosing the appropriate method for submission is important to ensure timely processing and compliance with any deadlines.

Quick guide on how to complete cw 60 financial institution

Complete Cw 60 Financial Institution effortlessly on any device

Digital document management has surged in popularity among businesses and individuals alike. It serves as an ideal eco-friendly alternative to traditional printed and signed papers, allowing you to find the correct form and securely store it online. airSlate SignNow equips you with all the tools necessary to create, modify, and eSign your documents quickly without delays. Handle Cw 60 Financial Institution on any device with airSlate SignNow Android or iOS applications and elevate any document-focused process today.

How to modify and eSign Cw 60 Financial Institution with ease

- Find Cw 60 Financial Institution and click Get Form to begin.

- Utilize the tools we provide to fill out your document.

- Highlight pertinent sections of your documents or conceal sensitive data with tools that airSlate SignNow offers specifically for this purpose.

- Create your signature using the Sign tool, which takes just seconds and carries the same legal validity as a traditional handwritten signature.

- Review the information and click on the Done button to save your changes.

- Choose how you would like to send your form, via email, SMS, invitation link, or download it to your computer.

Eliminate concerns about lost or misfiled documents, tedious form searches, or errors that require printing new document copies. airSlate SignNow caters to your document management needs in just a few clicks from any device you prefer. Modify and eSign Cw 60 Financial Institution and ensure exceptional communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the cw 60 financial institution

How to create an electronic signature for a PDF document in the online mode

How to create an electronic signature for a PDF document in Chrome

How to generate an eSignature for putting it on PDFs in Gmail

The best way to create an eSignature from your mobile device

How to create an eSignature for a PDF document on iOS devices

The best way to create an eSignature for a PDF file on Android devices

People also ask

-

What is airSlate SignNow and how can it benefit my information financial institution?

airSlate SignNow is a powerful tool designed to help businesses like your information financial institution send and eSign documents easily. By streamlining the document workflow, you can save time and reduce the risk of errors. Its user-friendly interface and robust features enhance productivity and improve customer satisfaction.

-

How does airSlate SignNow ensure the security of documents for an information financial institution?

Security is a top priority for airSlate SignNow, especially for information financial institutions handling sensitive data. The platform uses advanced encryption methods to protect your documents and complies with industry standards such as GDPR and HIPAA. This way, you can be confident that your information remains secure throughout the eSigning process.

-

What are the pricing options for airSlate SignNow suitable for an information financial institution?

airSlate SignNow offers flexible pricing plans that cater to the needs of information financial institutions, starting from affordable options for small teams to comprehensive solutions for larger organizations. Each plan includes essential features and can be customized to suit your specific document needs. Check our website for detailed pricing information and a comparison of features.

-

Can airSlate SignNow integrate with other software commonly used by information financial institutions?

Yes, airSlate SignNow integrates seamlessly with popular applications that many information financial institutions use, including CRM systems, cloud storage, and project management tools. This integration improves workflow efficiency by allowing you to manage documents from a centralized platform. Enhance your processes by leveraging existing tools with airSlate SignNow.

-

What features does airSlate SignNow offer that are specifically useful for information financial institutions?

airSlate SignNow includes features like customizable templates, automated workflows, and real-time tracking, which are particularly beneficial for information financial institutions. These tools help automate repetitive tasks, ensure compliance, and provide an audit trail for accountability. Using these features can greatly enhance operational efficiency within your institution.

-

How can airSlate SignNow improve customer experience for an information financial institution?

By utilizing airSlate SignNow, an information financial institution can provide faster service to clients through quick document turnaround times. The ability to eSign documents from any device also enhances convenience for your clients, leading to higher satisfaction levels. This improved customer experience can contribute to client retention and attract new customers.

-

What kind of support does airSlate SignNow offer for information financial institutions?

airSlate SignNow provides robust customer support, including live chat, email assistance, and an extensive knowledge base tailored for information financial institutions. This support ensures that you can quickly resolve any issues or questions related to the platform. Our dedicated team is here to assist you in making the most of your eSigning experience.

Get more for Cw 60 Financial Institution

Find out other Cw 60 Financial Institution

- Electronic signature Texas Police Lease Termination Letter Safe

- How To Electronic signature Texas Police Stock Certificate

- How Can I Electronic signature Wyoming Real Estate Quitclaim Deed

- Electronic signature Virginia Police Quitclaim Deed Secure

- How Can I Electronic signature West Virginia Police Letter Of Intent

- How Do I Electronic signature Washington Police Promissory Note Template

- Electronic signature Wisconsin Police Permission Slip Free

- Electronic signature Minnesota Sports Limited Power Of Attorney Fast

- Electronic signature Alabama Courts Quitclaim Deed Safe

- How To Electronic signature Alabama Courts Stock Certificate

- Can I Electronic signature Arkansas Courts Operating Agreement

- How Do I Electronic signature Georgia Courts Agreement

- Electronic signature Georgia Courts Rental Application Fast

- How Can I Electronic signature Hawaii Courts Purchase Order Template

- How To Electronic signature Indiana Courts Cease And Desist Letter

- How Can I Electronic signature New Jersey Sports Purchase Order Template

- How Can I Electronic signature Louisiana Courts LLC Operating Agreement

- How To Electronic signature Massachusetts Courts Stock Certificate

- Electronic signature Mississippi Courts Promissory Note Template Online

- Electronic signature Montana Courts Promissory Note Template Now