Otr Cfo Dc Form

What is the Otr Cfo Dc

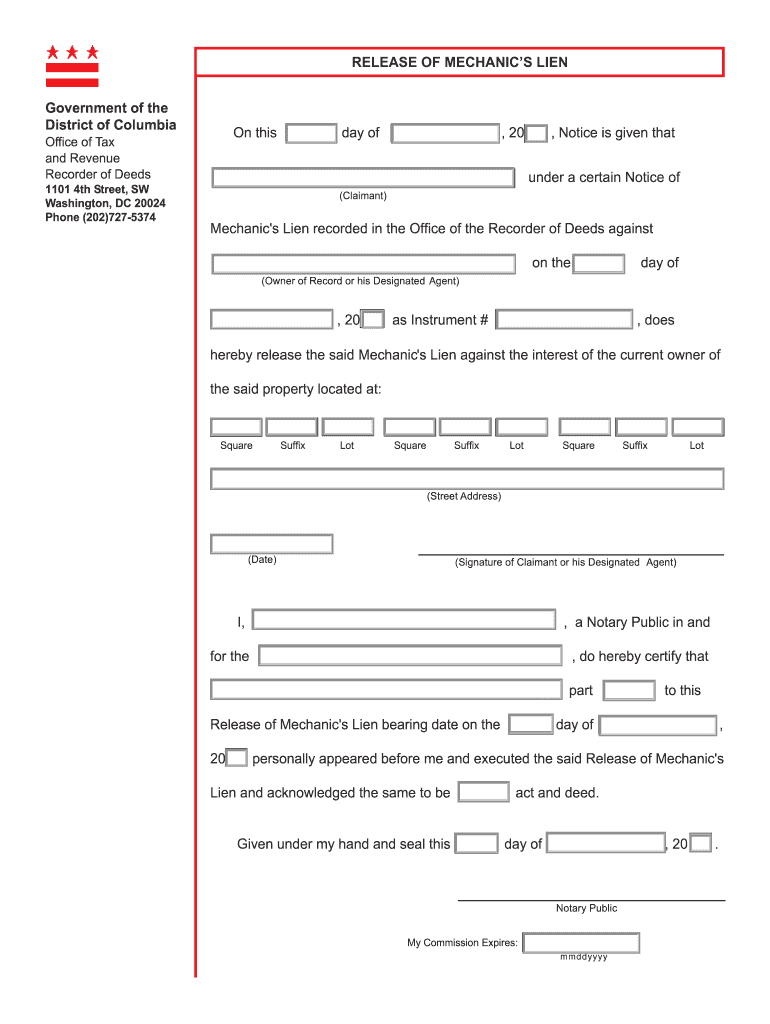

The Otr Cfo Dc form is a crucial document used in the District of Columbia for various financial and tax-related purposes. It is primarily associated with the Office of Tax and Revenue, serving as a means for individuals or businesses to report specific financial information. This form is essential for ensuring compliance with local tax regulations and can impact tax liabilities and financial reporting.

How to use the Otr Cfo Dc

Using the Otr Cfo Dc form involves several key steps. First, gather all necessary financial documents and information required to complete the form accurately. This may include income statements, expense reports, and any other relevant financial records. Once you have the required information, carefully fill out each section of the form, ensuring that all details are accurate and complete. After completing the form, review it for any errors before submission.

Steps to complete the Otr Cfo Dc

Completing the Otr Cfo Dc form can be broken down into a series of straightforward steps:

- Gather all necessary financial documentation.

- Access the Otr Cfo Dc form online or obtain a physical copy.

- Fill out the form with accurate information, ensuring all sections are completed.

- Review the form for accuracy and completeness.

- Submit the form through the appropriate method, whether online, by mail, or in person.

Legal use of the Otr Cfo Dc

The legal use of the Otr Cfo Dc form is governed by local tax laws and regulations. It is essential to ensure that the information provided is truthful and accurate, as any discrepancies may lead to penalties or legal consequences. The form must be used in accordance with the guidelines set forth by the District of Columbia's Office of Tax and Revenue to maintain its validity and ensure compliance.

Key elements of the Otr Cfo Dc

Key elements of the Otr Cfo Dc form include personal identification details, financial reporting sections, and signature lines. Each section is designed to capture specific information that is necessary for tax assessment and compliance. It is important to understand each element to ensure that the form is filled out correctly and meets all legal requirements.

Form Submission Methods

The Otr Cfo Dc form can be submitted through various methods, providing flexibility for users. Options typically include:

- Online submission through the District of Columbia's tax portal.

- Mailing a physical copy to the appropriate tax office.

- In-person submission at designated tax offices.

Who Issues the Form

The Otr Cfo Dc form is issued by the Office of Tax and Revenue in the District of Columbia. This office is responsible for overseeing tax collection and ensuring compliance with local tax laws. They provide the necessary resources and guidance for individuals and businesses to correctly complete and submit the form.

Quick guide on how to complete otr cfo dc

Complete [SKS] seamlessly on any device

Digital document management has become increasingly popular among businesses and individuals. It offers a superb eco-friendly alternative to traditional printed and signed documents, allowing you to access the necessary form and securely store it online. airSlate SignNow provides you with all the tools required to create, modify, and eSign your documents quickly without delays. Handle [SKS] on any device using airSlate SignNow's Android or iOS applications and simplify any document-related operation today.

How to modify and eSign [SKS] effortlessly

- Locate [SKS] and then click Get Form to begin.

- Utilize the tools we provide to fill out your form.

- Emphasize relevant sections of the documents or obscure confidential information using tools specifically designed for that purpose by airSlate SignNow.

- Generate your eSignature with the Sign tool, which takes mere seconds and holds the same legal validity as a conventional handwritten signature.

- Review all the details and then click on the Done button to save your changes.

- Decide how you would like to send your form, via email, text message (SMS), invite link, or download it to your PC.

Say goodbye to lost or misplaced documents, tiring form searches, or errors that require printing new copies. airSlate SignNow fulfills all your document management needs in just a few clicks from any device you prefer. Modify and eSign [SKS] and guarantee excellent communication throughout the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to Otr Cfo Dc

Create this form in 5 minutes!

How to create an eSignature for the otr cfo dc

The way to make an eSignature for your PDF online

The way to make an eSignature for your PDF in Google Chrome

The way to generate an electronic signature for signing PDFs in Gmail

The best way to make an electronic signature from your smartphone

The way to make an electronic signature for a PDF on iOS

The best way to make an electronic signature for a PDF file on Android

People also ask

-

What is Otr Cfo Dc and how can it benefit my business?

Otr Cfo Dc is a comprehensive financial solution designed to streamline your business operations. By using Otr Cfo Dc, you can enhance your financial accuracy and efficiency, ensuring that your documents are processed seamlessly. This service allows you to focus on strategic growth while we manage the intricacies of your financial documentation.

-

How does airSlate SignNow integrate with Otr Cfo Dc?

airSlate SignNow integrates smoothly with Otr Cfo Dc to facilitate electronic document signing and management. This integration ensures that all financial documents are signed and processed promptly, enhancing overall workflow. With this streamlined process, your financial management tasks become less cumbersome.

-

Is there a free trial available for Otr Cfo Dc?

Yes, airSlate SignNow offers a free trial for Otr Cfo Dc, allowing you to explore its features without any commitment. This is a great opportunity to see how it can transform your document management processes. By trying Otr Cfo Dc, you can ensure it meets your business needs effectively.

-

What pricing plans are available for Otr Cfo Dc?

Otr Cfo Dc offers multiple pricing plans tailored to accommodate businesses of all sizes. The plans are designed to provide flexibility and scalability, ensuring that you only pay for the features you need. With transparent pricing, you can choose a plan that best fits your business goals.

-

What features does Otr Cfo Dc offer?

Otr Cfo Dc includes a variety of powerful features, such as electronic signatures, document tracking, and customizable templates. These features help simplify the document workflow, making it more efficient and user-friendly. By utilizing Otr Cfo Dc, your team can save time and reduce errors in documentation.

-

How secure is the Otr Cfo Dc platform?

The Otr Cfo Dc platform prioritizes your security with industry-standard encryption and stringent privacy measures. Your documents are safeguarded, ensuring that sensitive financial information remains confidential. Trusting airSlate SignNow with Otr Cfo Dc guarantees a secure environment for all your eSigning needs.

-

Can Otr Cfo Dc help with compliance and legal requirements?

Absolutely! Otr Cfo Dc is designed to meet various compliance and legal standards, ensuring that your eSigned documents are legally binding. This compliance helps mitigate risks and provides peace of mind for your business transactions. By leveraging Otr Cfo Dc, you can focus on your core operations without worrying about legal issues.

Get more for Otr Cfo Dc

Find out other Otr Cfo Dc

- How To Integrate Sign in Banking

- How To Use Sign in Banking

- Help Me With Use Sign in Banking

- Can I Use Sign in Banking

- How Do I Install Sign in Banking

- How To Add Sign in Banking

- How Do I Add Sign in Banking

- How Can I Add Sign in Banking

- Can I Add Sign in Banking

- Help Me With Set Up Sign in Government

- How To Integrate eSign in Banking

- How To Use eSign in Banking

- How To Install eSign in Banking

- How To Add eSign in Banking

- How To Set Up eSign in Banking

- How To Save eSign in Banking

- How To Implement eSign in Banking

- How To Set Up eSign in Construction

- How To Integrate eSign in Doctors

- How To Use eSign in Doctors