Idaho Rs803 Form

What is the Idaho Rs803 Form

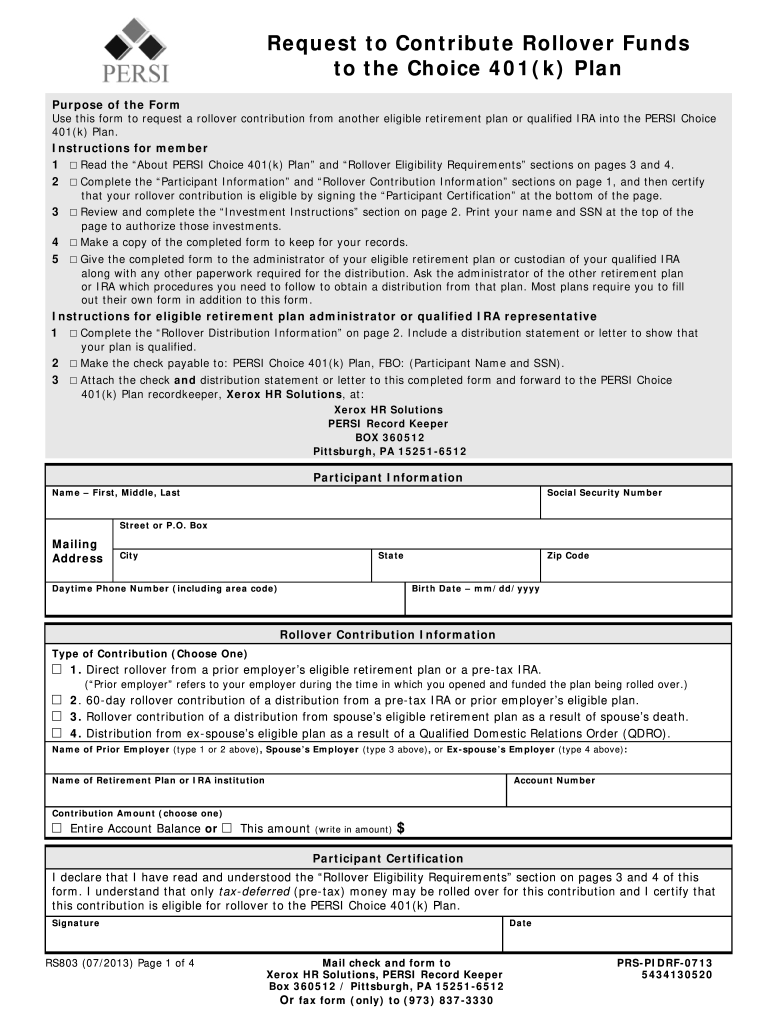

The Idaho Rs803 Form is a document used for reporting contributions to retirement plans within the state of Idaho. This form is essential for individuals who wish to ensure that their retirement contributions comply with state regulations. It provides a structured way to disclose information regarding contributions made to various retirement accounts, including 401(k)s and IRAs. Understanding this form is crucial for maintaining compliance and maximizing retirement benefits.

Steps to complete the Idaho Rs803 Form

Completing the Idaho Rs803 Form involves several key steps to ensure accuracy and compliance. Follow these steps for a successful submission:

- Gather necessary information: Collect details about your retirement contributions, including account numbers and amounts contributed.

- Fill out personal information: Enter your name, address, and Social Security number as required on the form.

- Detail your contributions: Specify the type of retirement plan and the total contributions made during the reporting period.

- Review the form: Double-check all entries for accuracy to prevent delays or issues with processing.

- Submit the form: Choose your preferred submission method, whether online, by mail, or in person.

Legal use of the Idaho Rs803 Form

The Idaho Rs803 Form serves a legal purpose in documenting retirement contributions. It is designed to comply with state laws governing retirement plans and ensures that individuals meet their reporting obligations. Proper use of this form can protect taxpayers from potential penalties associated with non-compliance. It is crucial to maintain accurate records and submit the form within the designated timelines to uphold legal standards.

Form Submission Methods

There are several methods available for submitting the Idaho Rs803 Form, allowing flexibility based on individual preferences:

- Online Submission: Many users prefer to submit the form electronically through the state's online portal, which offers a quick and efficient process.

- Mail: Individuals can print the completed form and send it via postal mail to the designated state office.

- In-Person: For those who prefer face-to-face interactions, submitting the form in person at a local government office is an option.

Eligibility Criteria

To use the Idaho Rs803 Form, individuals must meet specific eligibility criteria. Generally, this form is intended for residents of Idaho who are contributing to retirement plans. Eligibility may also depend on the type of retirement account and the nature of contributions. It is advisable to review the state guidelines to confirm eligibility before completing the form.

Key elements of the Idaho Rs803 Form

The Idaho Rs803 Form includes several key elements that must be accurately completed to ensure compliance. These elements typically consist of:

- Personal Information: Name, address, and Social Security number of the contributor.

- Contribution Details: Types of retirement accounts and amounts contributed during the reporting period.

- Signature: A signature certification that the information provided is accurate and complete.

Quick guide on how to complete idaho rs803 form

Effortlessly Complete Idaho Rs803 Form on Any Device

Managing documents online has become increasingly favored by organizations and individuals alike. It offers an ideal environmentally friendly alternative to conventional printed and signed paperwork, allowing you to locate the correct form and securely store it online. airSlate SignNow equips you with all the necessary tools to swiftly create, modify, and electronically sign your documents without delays. Handle Idaho Rs803 Form on any device using airSlate SignNow's Android or iOS applications and simplify any process involving paperwork today.

The Easiest Way to Modify and eSign Idaho Rs803 Form Without Stress

- Locate Idaho Rs803 Form and click Get Form to begin.

- Make use of the tools available to complete your document.

- Emphasize pertinent sections of your documents or redact sensitive information using the tools that airSlate SignNow specifically offers for such purposes.

- Create your signature using the Sign tool, which takes just seconds and holds the same legal validity as a traditional ink signature.

- Review the information and click on the Done button to save your changes.

- Select your preferred method of delivering your form, whether by email, text message (SMS), invitation link, or download it to your computer.

Eliminate the concern of lost or misplaced documents, laborious searches for forms, or mistakes that necessitate printing new copies. airSlate SignNow meets your document management needs in just a few clicks from any device you choose. Modify and eSign Idaho Rs803 Form and guarantee effective communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the idaho rs803 form

The way to generate an eSignature for your PDF in the online mode

The way to generate an eSignature for your PDF in Chrome

How to generate an electronic signature for putting it on PDFs in Gmail

How to generate an eSignature straight from your smart phone

The way to create an electronic signature for a PDF on iOS devices

How to generate an eSignature for a PDF document on Android OS

People also ask

-

What is contribution retirement and how does it work?

Contribution retirement refers to the approach where individuals allocate a specific amount of their income into retirement savings accounts. These contributions are typically invested in various assets to grow over time. Understanding contribution retirement helps individuals plan effectively for their financial future.

-

How does airSlate SignNow help with contribution retirement documentation?

AirSlate SignNow provides an efficient platform for businesses to manage all their contribution retirement documents electronically. By using our eSigning solutions, users can seamlessly create, send, and sign essential retirement documents, ensuring compliance and reducing processing time.

-

What are the benefits of using airSlate SignNow for contribution retirement plans?

Using airSlate SignNow for contribution retirement plans offers numerous benefits, including faster document turnaround, enhanced security, and ease of access. Our platform streamlines the signing process, making it simpler for employers and employees to manage their retirement contributions securely.

-

Is airSlate SignNow affordable for small businesses managing contribution retirement?

Yes, airSlate SignNow is designed to be cost-effective, making it accessible for small businesses managing contribution retirement plans. With flexible pricing options, businesses can choose a plan that fits their budget while enjoying a robust set of features that simplify their workflow.

-

Can I integrate airSlate SignNow with my existing contribution retirement systems?

Absolutely! AirSlate SignNow is designed to integrate seamlessly with various existing contributions retirement systems and software. This integration allows for a smoother transition and ensures all your vital documents are easily accessible within your preferred platforms.

-

How secure is my data when using airSlate SignNow for contribution retirement?

Security is a top priority at airSlate SignNow. We employ advanced encryption and security protocols to ensure that all your contribution retirement data is protected. Users can rest assured that their sensitive information remains confidential and secure while using our services.

-

What features does airSlate SignNow offer for managing contribution retirement communication?

AirSlate SignNow offers several features for effective communication regarding contribution retirement, including real-time tracking, automated reminders, and customizable templates. These tools facilitate smoother interactions between all parties involved, ensuring everyone stays informed throughout the process.

Get more for Idaho Rs803 Form

- Intake and output record in form

- Transportation security administration tsa claims management form

- Joint account opening form baiduri bank

- Job application coaching speech form

- Sentry v260 manual form

- Adult emergency department general medical evaluation form musc

- Research exempt from full hic review william beaumont hospital beaumont form

- Submit online e mail or fax form

Find out other Idaho Rs803 Form

- Sign Michigan Standard rental agreement Online

- Sign Minnesota Standard residential lease agreement Simple

- How To Sign Minnesota Standard residential lease agreement

- Sign West Virginia Standard residential lease agreement Safe

- Sign Wyoming Standard residential lease agreement Online

- Sign Vermont Apartment lease contract Online

- Sign Rhode Island Tenant lease agreement Myself

- Sign Wyoming Tenant lease agreement Now

- Sign Florida Contract Safe

- Sign Nebraska Contract Safe

- How To Sign North Carolina Contract

- How Can I Sign Alabama Personal loan contract template

- Can I Sign Arizona Personal loan contract template

- How To Sign Arkansas Personal loan contract template

- Sign Colorado Personal loan contract template Mobile

- How Do I Sign Florida Personal loan contract template

- Sign Hawaii Personal loan contract template Safe

- Sign Montana Personal loan contract template Free

- Sign New Mexico Personal loan contract template Myself

- Sign Vermont Real estate contracts Safe